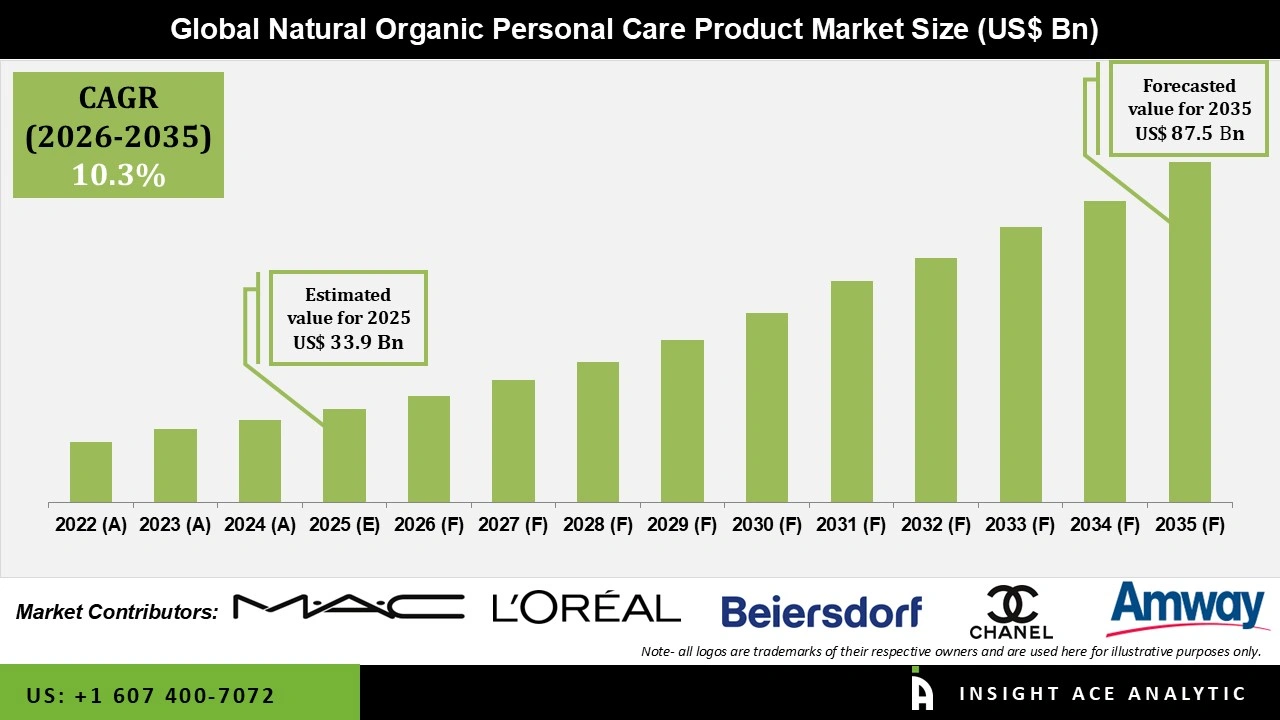

Global Natural and Organic Personal Care Product Market Size is valued at USD 33.9 Bn in 2025 and is predicted to reach USD 87.5 Bn by the year 2035 at a 10.3% CAGR during the forecast period for 2026 to 2035.

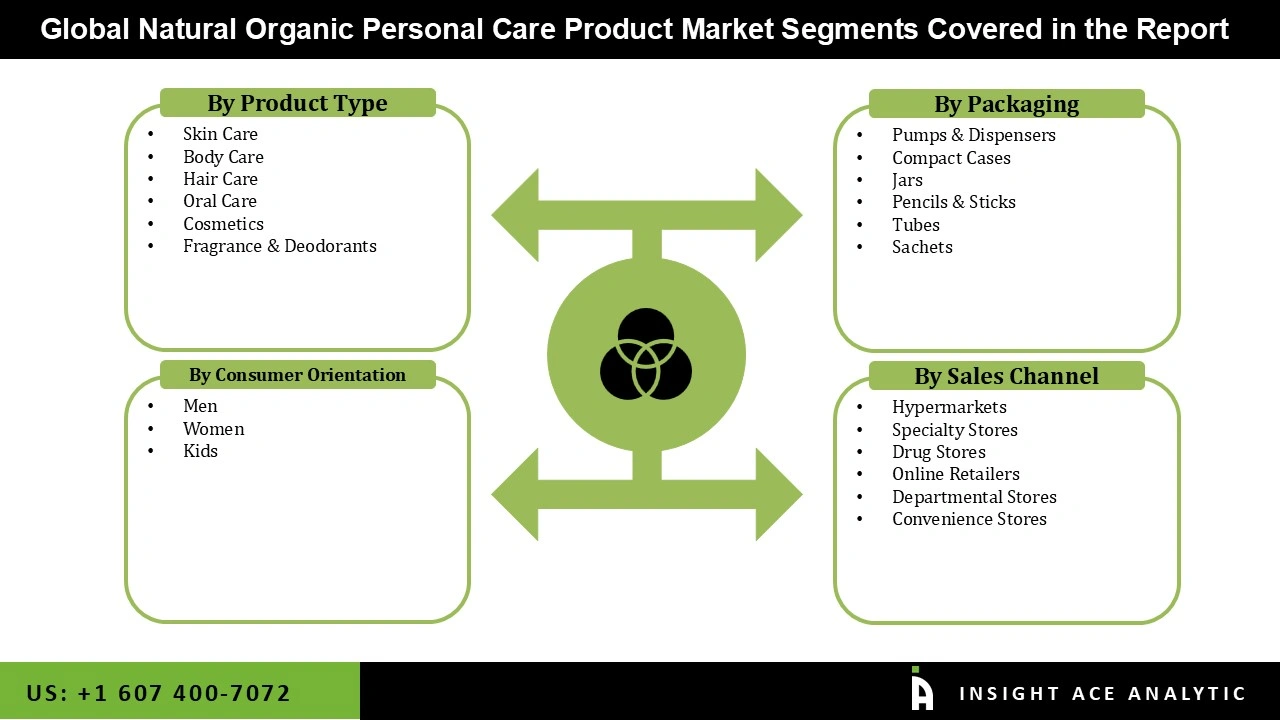

Natural and Organic Personal Care Product Market Size, Share & Trends Analysis Distribution by Type (Skin Care, Hair Care, Body Care, Oral Care, Fragrance & Deodorants, and Cosmetics), Consumer Orientation (Women, Men, and Kids), Packaging (Pumps & Dispensers, Sachets, Pencils & Sticks, Jars, Compact Cases, and Tubes), Distribution Channel (Hypermarkets, Online Retailers, Specialty Stores, Drug Stores, Convenience Stores, and Departmental Stores), and Segment Forecasts, 2026 to 2035.

Natural organic personal care products are grooming and hygiene products that are mostly created from naturally occurring, mineral-based, and plant-based materials that are grown without the use of toxic additives, chemical fertilizers, synthetic pesticides, or genetically modified organisms (GMOs). These products tend to focus on substances like essential oils, herbal extracts, cold-pressed plant oils, and natural butters rather than parabens, sulfates, synthetic perfumes, artificial colors, and petrochemicals. The growing consumer awareness of the advantages of natural and organic products over their synthetic counterparts has contributed to the notable expansion of the natural organic personal care product market. Environmental concerns, the expanding trend of sustainable living, and increased health consciousness all contribute to the demand.

The natural organic personal care product market is expanding primarily due to growing consumer awareness of the negative effects of synthetic chemicals in traditional personal care products. The possible health hazards linked to prolonged exposure to artificial compounds like phthalates, sulfates, and parabens are becoming more well known to consumers. A shift toward natural and organic substitutes, which are thought to be safer and better for general health and wellbeing, is being fueled by this awareness. Furthermore, the demand for natural, organic personal care products is driven by the expanding Clean Beauty movement, which emphasizes transparency in ingredient sourcing and product formulations.

In addition, the growing demand for eco-friendly and sustainable products is another important growth driver boosting the natural organic personal care product market growth. Customers are looking for products that reflect their ideals of sustainability and environmental responsibility, as they become increasingly concerned about how their purchases may affect the environment. The demand for personal care products that use sustainable sourcing methods, recyclable packaging, and biodegradable ingredients has increased as a result. Additionally, the natural organic personal care product market is expanding due to the increase in distribution channels, especially online retail platforms. Customers may easily browse and buy a variety of products from the comfort of their homes due to e-commerce platforms.

Driver

Growing Preference among Consumers for Chemical-Free and Clean Label Skincare Products

The natural organic personal care products are in high demand due to consumers' increased preference for clean label and chemical-free skincare products. As consumers grow more aware of the potential drawbacks of synthetic materials, they are selecting products with natural formulations and clear chemical labels. Additionally, the natural organic personal care product market is growing as a result of growing awareness of environmentally friendly and cruelty-free manufacturing practices. Customers' admiration for businesses that use biodegradable materials and avoid animal research, among other ethical production methods, increases brand loyalty. Furthermore, rising disposable incomes enable more people to buy high-end organic cosmetics. In urban regions, where customers place a larger emphasis on safe and high-quality personal care products, this transition is particularly apparent.

Restrain/Challenge

Short Natural Formulations' Shelf Life and Product Stability

The natural organic personal care product market is facing difficulties because of its short shelf life and unstable products, despite its increasing popularity. These items can break down more quickly because they frequently don't contain artificial preservatives, which raises expenses and causes problems for businesses with inventory control. The absence of globally defined certification and regulatory systems is another significant barrier. The terms "natural" and "organic" are defined differently in different nations, which confuses producers and customers alike. It is challenging for brands to gain widespread exposure because of this discrepancy. Another factor impeding market expansion is consumer skepticism. Consumer trust has been damaged by deceptive marketing tactics where companies mislabel products as organic. They are growing more wary and favoring companies that offer transparent sources and verifiable certifications.

The skin care category held the largest share in the Natural Organic Personal Care Product market in 2025. The skin care industry is known for its high degree of innovation, as producers are always creating new product offers and formulations to satisfy changing consumer demands and preferences. Brands are providing individualized solutions based on variables like skin type, age, and lifestyle, contributing to the growing trend of personalized skin care, which involves products that are targeted to certain skin types and concerns. The creation of sophisticated formulas that combine natural and organic substances with cutting-edge technology like probiotics and plant stem cells is being fueled by this trend in order to provide specific benefits and improve the overall effectiveness of skin care products.

In 2025, the women category dominated the natural organic personal care product market due to the high demand for plant-based skincare, toxin-free hair products, and clean beauty products. Higher understanding of ingredient safety and growing interest in eco-friendly practices led to a faster adoption rate of natural and organic products among female consumers. Women looking for safer everyday items were drawn to brands that increased their cruelty-free and botanical compositions. With the rise of sulfate-free cleansers, natural deodorants, and tailored grooming lines, men and unisex groups saw consistent growth, but women continued to lead due to their greater product selection and frequency of purchases. To further support women's preference for cruelty-free, plant-based care, The Body Shop International Limited, for example, formally declared that by January 2024, its entire worldwide portfolio which includes over 1,000 products and over 4,000 ingredients would be 100% vegan.

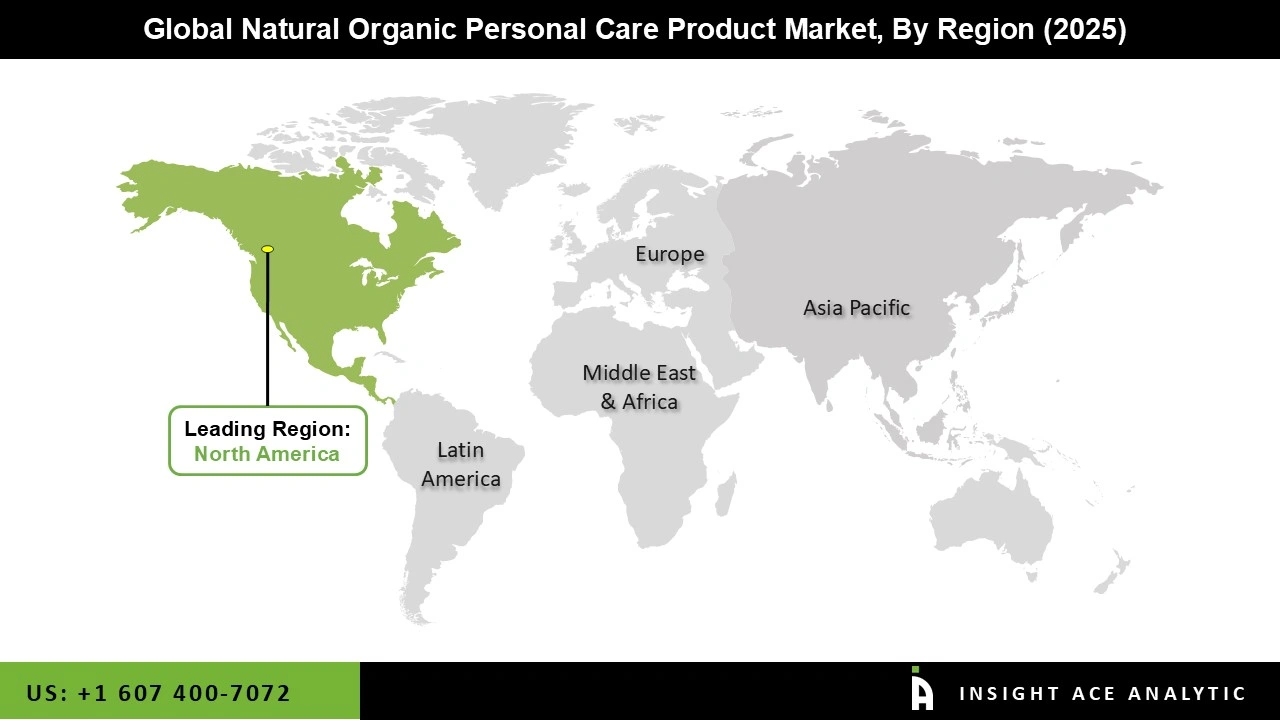

The natural organic personal care product market was dominated by North America region in 2025 due to the substantial presence of important market participants and the high level of consumer knowledge regarding the advantages of natural and organic products. Customers are willing to spend more for premium, luxury natural and organic products in North America, and the market is distinguished by a strong desire for ingredients that are obtained ethically.

The region's growth trajectory is anticipated to continue due to the growing demand for eco-friendly and sustainable products as well as the expansion of distribution channels, especially online retail platforms. Additionally, the region is seeing a sharp increase in the demand for individualized and customized personal care goods as customers look for solutions that are specific to their own requirements and tastes.

• January 2025: At CES 2025 in Las Vegas, L'Oréal Groupe unveiled cutting-edge skin analysis technology. The portable device uses sophisticated proteomics analysis to provide a personalized skin assessment in five minutes.

• January 2024: At the Consumer Electronics Show (CES) in Las Vegas, L'Oréal, a leading worldwide cosmetics company, announced the debut of a new organic skincare range called "Seed Phytonutrients". Using only plant-based ingredients, this collection of shampoos, conditioners, body washes, and face cleansers is USDA certified organic.

• May 2024: With a focus on a 100% natural, vegan, and cruelty-free product, Wildcraft (Canada) introduced its "Pure Radiance Vitamin C Eye Cream" on May 28. Wildcraft's dedication to clean beauty trends and its growth in the high-end skincare market in North America are highlighted by the launch.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 33.9 Bn |

| Revenue forecast in 2035 | USD 87.5 Bn |

| Growth Rate CAGR | CAGR of 10.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Consumer Orientation, Packaging, Distribution Channel, and Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | L'Oréal S.A., Beiersdorf, Amway Corporation, Benefit Cosmetics LLC, LVMH (Moet Hennessy Louis Vuitton), Chanel S.A., Estee Lauder Companies Inc., Mary Kay Cosmetics, Johnson & Johnson, Kao Corporation, Laverana GmbH & Co. KG, Clarins Group, Coty Inc., MAC Cosmetics, and Shiseido Co., Ltd. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.