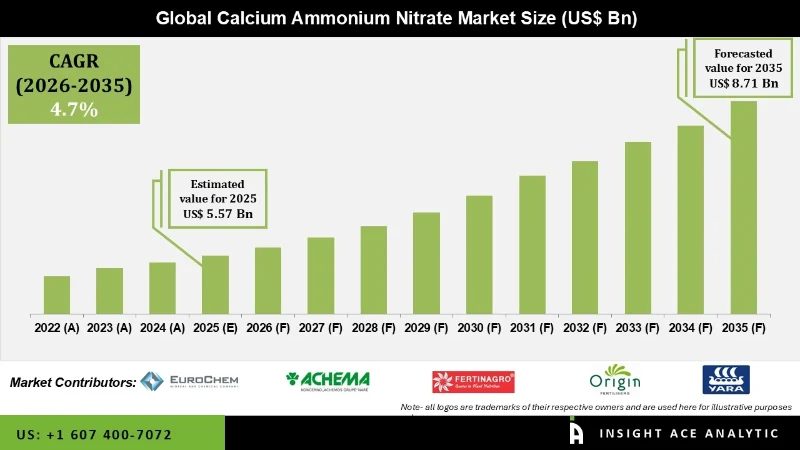

Calcium Ammonium Nitrate Market Size was valued at USD 5.57 Billion in 2025 and is predicted to reach USD 8.71 Billion by 2035 at a 4.7% CAGR during the forecast period for 2026 to 2035.

Calcium Ammonium Nitrate Market Size, Share & Trends Analysis Report, By Application (Fertilizer and Explosive), By Region, Forecasts, 2026 to 2035

CAN, or calcium ammonium nitrate, is a commonly used pesticide. It is highly renowned for possessing a nutritional makeup that is well-balanced. The constitution of this substance contains both ammonium and sodium nitrate. CAN is used to supply crops with all the necessary ingredients needed for normal development and growth. These elements primarily consist of nitrogen and calcium. Because of its extremely special formulation, CAN offers both rapid and continuous nutritional absorption. The industry's proportions have altered due to significant improvements. Enhancing calcium ammonium nitrate's (CAN) durability and effectiveness in farming uses is a priority.

The goal of producers is to improve the kinetics of nitrogen expulsion, which aids in all crops' efficient utilization of nutrients. Minimizing the influence on the planet is also prioritized. Furthermore, the demand for calcium ammonium nitrate is driven by government policies that improve crop production, particularly in emerging economies, as well as encouragement and subsidies from the government. These programs motivate farmers to apply calcium ammonium nitrate fertilizer, increasing the market for goods like this, which is necessary for improving crop productivity in sustainable ways.

However, the barrier to the expansion of the calcium ammonium nitrate (CAN) market is the availability of substitute choices, along with rigorous government laws limiting product consumption. In order to reduce the possibility of ammonium nitrate being misused in terrorist acts, federal departments have put strict regulations in place regulating the manufacturing, preservation, shipment, and application of the substance. Given that the use of substitutes has grown in the explosions and fertilizer application sectors, it is therefore expected that this regulatory framework will limit market expansion.

The global calcium ammonium nitrate market is segmented based on application. Based on application, the market is segmented into fertilizer and explosive.

Explosive in the global calcium ammonium nitrate market is expected to hold a major global market share in 2023. Because of its intrinsic qualities and adaptability, calcium ammonium nitrate (CAN) is in great need in the explosives industry. It is an essential component of explosive preparations because it acts as an antioxidant, releasing oxygen upon explosion to facilitate the combustibility of additional aggressive ingredients.

Fertilizer factors use acrylic acid esters mainly because they are easily soluble in water, guaranteeing quick plant absorption and encouraging effective digestion of nutrients. Furthermore, this sector will develop even more as a result of the agricultural industry's rapid expansion and technological advancements, especially in countries like the US, Germany, the UK, China, and India.

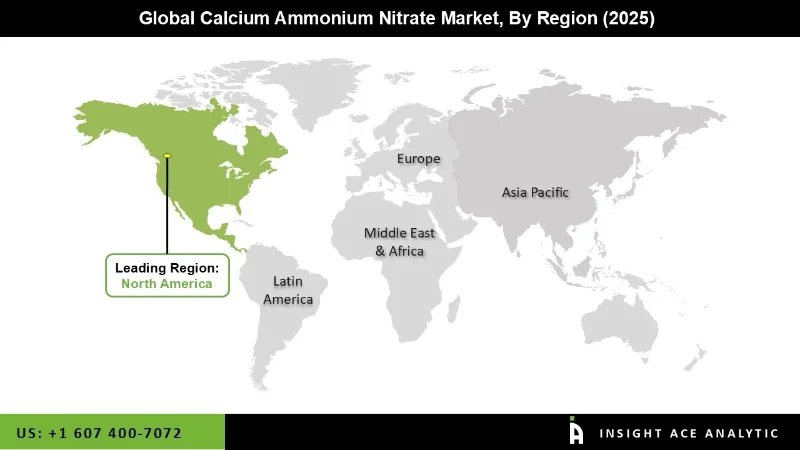

The North American global calcium ammonium nitrate market is expected to register the highest market share in revenue in the near future. This is explained by the rising need for ammonia nitrate energy and increasing curiosity about security explosives. The boom in agricultural operations spurred on by the region's greater usage of pesticides is another of the causes propelling this area's expansion.

In addition, Asia Pacific is projected to grow rapidly in the global calcium ammonium nitrate market because of increased consumption and growing end-use industries, which include water treatment, manufacturing, agricultural chemicals, drugs, and agribusiness. The economy is growing as a result of the rising demand, which is supported by a wide range of applications in different sectors.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 5.57 Billion |

| Revenue Forecast In 2035 | USD 8.71 Billion |

| Growth Rate CAGR | CAGR of 4.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Application and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Yara International ASA, EuroChem Group, Achema AB, Origin Fertilizers (UK) Limited, Fertinagro India Pvt. Ltd., and others. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Calcium Ammonium Nitrate Market - By Application

Calcium Ammonium Nitrate Market - By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.