Pet Insurance Market Size is valued at USD 15.08 Billion in 2025 and is predicted to reach USD 77.32 Billion by the year 2035 at a 18.2% CAGR during the forecast period for 2026 to 2035.

Pet Insurance Market Size, Share & Trends Analysis Report by Coverage Type (Accident & Illness, Accident Only), By Animal Type (Dogs, Cats), By Sales Channel (Agency, Broker, Direct, Bancassurance), Region And Segment Forecasts, 2026 to 2035

Pet Insurance Market Key Takeaways:

|

Pet insurance is a coverage that assists pet owners in managing the cost of their pets' veterinarian treatment. It works similarly to human health insurance, except it especially covers medical expenses for pets. In recent years, the pet insurance market has seen tremendous expansion and dramatic changes.

Technology has influenced the pet insurance business by making it easier for pet owners to research, compare, and buy insurance coverage online. Some firms have also developed mobile apps to help with claim submission and access to pet-related services. With the introduction of new players and the expansion of current insurance companies into the pet insurance sector, the market for pet insurance has grown increasingly competitive. This rivalry has resulted in a wider spectrum.

However, pet owners, veterinarians, veterinary hospitals, and animal health companies all faced issues as a result of the COVID-19 pandemic. In contrast, the industry was quick to respond to the epidemic by deploying supportive measures to give access to veterinarian treatment and other services. The pandemic's issues also raised awareness among pet parents to prevent financial risk by purchasing pet insurance coverage.

The Pet Insurance Market is segmented into animal type, coverage type, and sales. The coverage type segment includes accident only, accident & illness, and others. The animal type segment includes dogs, cats, and others. By sales channel, the market is segmented on the basis of agency, broker, direct, bancassurance, and others.

The accident & illness category is expected to hold a major share of the global Pet Insurance Market in 2022. High veterinarian care and diagnostic expenses, an increase in the companion animal population, and increased knowledge of pet insurance are all factors contributing to this trend. Pet insurance providers most typically provide accident and illness covers. These encompass a wide range of disorders, including acute and chronic diseases, treatments, diagnostic tests, and more. Because accident and illness insurance covers pet owners comprehensively, this market is likely to grow the quickest in the coming years.

The dogs' segment is anticipated to grow at a rapid rate in the global Pet Insurance Market. Over the projected period, the category containing horses, small mammals, and so on is expected to develop at the quickest CAGR of more than 18%. Growing pet adoption, insurance companies expanding their service offerings, and rising disposable income in important regions are all factors contributing to this share. Trupanion, Inc., Petplan, Nationwide Mutual Insurance Company, PetFirst Healthcare LLC, and Embrace Pet Insurance Agency, LLC are some of the key market players.

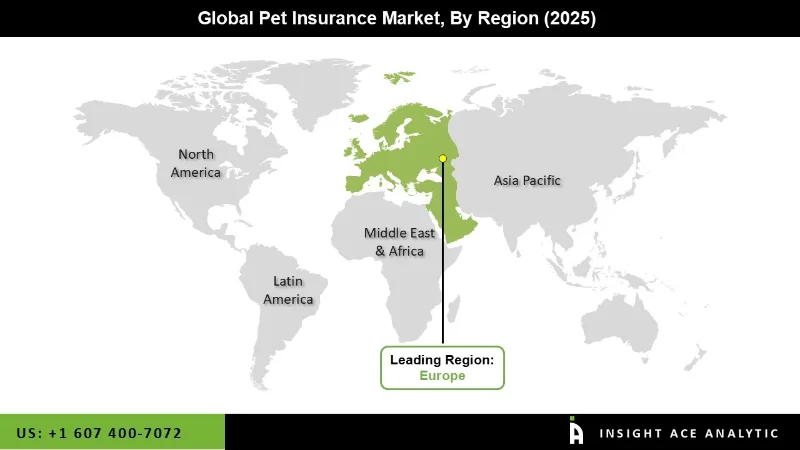

Europe's Pet Insurance Market is expected to register the biggest market share in terms of revenue in the near future, owing to the rising use of pet insurance, increased pet ownership, and the existence of major companies. Petplanare, for example, is headquartered in the U.K., whilst DFV is located in Germany. These businesses are constantly implementing numerous strategic efforts to improve their market share and hence contribute to regional growth.

The market in Asia Pacific is predicted to grow at a significant rate. The rapid development can be attributed to owners' growing worry about their pets' health. As a result, rising worries, along with rising disposable income in these countries, are boosting the Asia Pacific market. Furthermore, the increasing number of multinational corporations entering the developing market in the Asia Pacific area will boost the rise of the pet insurance market.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 15.08 Billion |

| Revenue forecast in 2035 | USD 77.32 Billion |

| Growth rate CAGR | CAGR of 18.2% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Animal Type, Coverage Type, And Sales Channel |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; Japan; Brazil; Mexico; The UK; France; Italy; Spain; Japan; India; South Korea; Southeast Asia |

| Competitive Landscape | Trupanion, Inc.; Deutsche Familienversicherung AG (DFV); Petplan (Allianz); Animal Friends Insurance Services Limited; Figo Pet Insurance, LLC; Direct Line; Nationwide Mutual Insurance Company; Embrace Pet Insurance Agency, LLC; AnicomInsurance; ipet Insurance Co., Ltd.; MetLife Services and Solutions, LLC; Pumpkin Insurance Services Inc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Pet Insurance Market By Coverage Type-

Pet Insurance Market By Animal Type-

Pet Insurance Market By Scale Channel-

Pet Insurance Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.