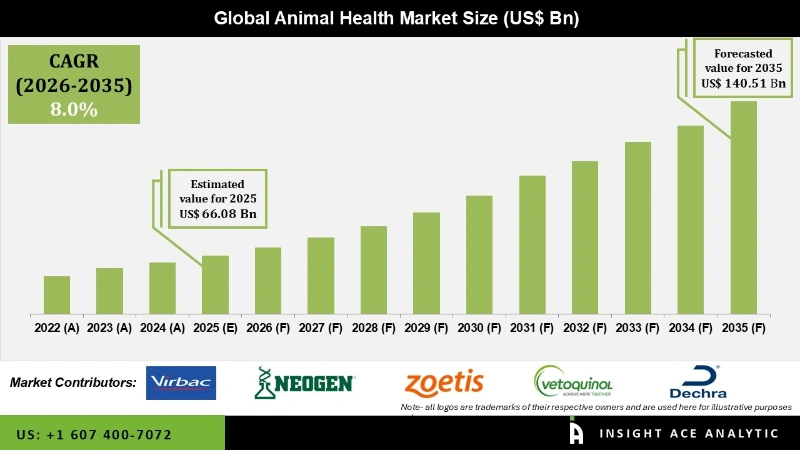

Animal Health Market Size is valued at USD 66.08 Bn in 2025 and is predicted to reach USD 140.51 Bn by the year 2035 at an 8.0% CAGR during the forecast period for 2026 to 2035.

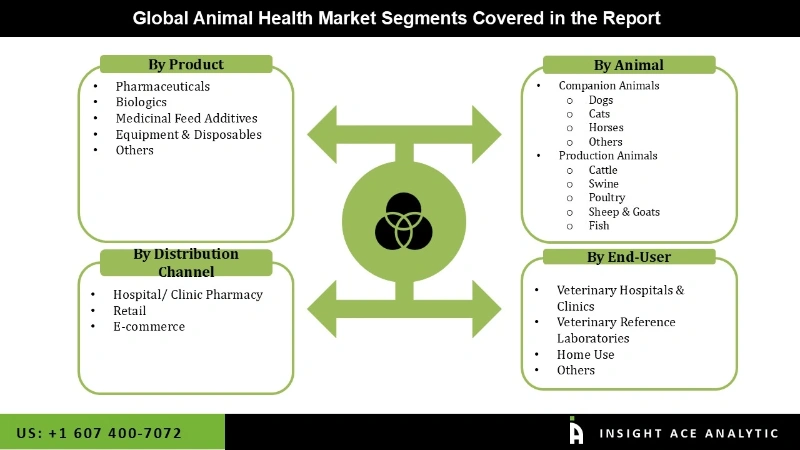

Animal Health Market Share & Trends Analysis Report, By Product (Pharmaceuticals, Biologics, Medicinal Feed Additives, Diagnostics, Equipment & Disposables, Others) By Animal (Companion Animals, Production Animals), By Distribution Channel, By End User, By Region, and Segment Forecasts, 2026 to 2035.

Animal health encompasses the overall well-being and medical treatment of animals, including companion animals, exotic species, wildlife, aquatic creatures, and livestock. It covers various aspects such as biosecurity, nutrition, welfare, disease prevention, and treatment. The rising number of zoonotic infection outbreaks is driving significant investments in antimicrobial treatments, diagnostics, and vaccinations to control disease spread. Governments are implementing stricter regulations and surveillance initiatives to monitor and prevent zoonotic diseases, while public awareness campaigns promote responsible pet ownership and vaccination to reduce community health risks. The livestock industry is adopting biosecurity measures to prevent outbreaks and ensure compliance with food safety standards.

Moreover, the animal health industry is shifting toward preventive care for both companion animals and livestock, driven by growing awareness of early disease detection and proactive management. Animal health is critical for farmers to prevent financial losses, minimize environmental impact, and protect public health by addressing zoonotic diseases and food safety concerns. Innovations in veterinary healthcare have successfully contained diseases like avian flu and are paving the way for eradicating other illnesses. Animals also play a crucial role in human life by providing companionship, food, and protection and contributing to biological research. The growing global pet population, including 113 million cats and 92 million dogs in the EU, 67 million cats and 74 million dogs in China, and 65 million cats and 85 million dogs in the USA, has driven increased demand for veterinary services, medications, advanced treatments, and preventive care, further boosting the animal health industry.

• Virbac S.A.

• NEOGEN Corporation

• Zoetis Inc.

• Vetoquinol S.A.

• Dechra Pharmaceuticals plc

• Mars Inc.

• Animalcare Group plc

• Bimeda

• Biognesis Bag

• Bioveta

• China Animal Husbandry Industry Company

• Chanelle

• ImmuCell Corporation

• Laboratorios CALIER, S.A

• HIPRA, S.A.

• Norbrook Laboratories

• Alembic Animal Health

• Boehringer Ingelheim GmbH

• Elanco

• IDEXX Laboratories, Inc.

• Ceva Santé Animale

• Merck & Co Inc.

• Other Prominent Players

The Animal Health Market is segmented based on the by-product, pharmaceuticals, and, animal, distribution channel, end user. Based on the product, the market is divided into pharmaceuticals, biologics, medicinal feed additives, diagnostics, equipment & disposables, and others. Based on the Animal, the market is divided into companion animals and production animals. Based on the distribution channel, the market is divided into hospital/ clinic pharmacy, retail, and e-commerce. Based on the end user, the market is divided into veterinary hospitals & clinics, veterinary reference laboratories, home use, others.The Diagnostics Segment is Expected to Have the Highest Growth Rate During the Forecast Period

The diagnostics are divided into consumables and instruments. Early diagnosis enables timely intervention, reducing disease spread and mortality, while the growing pet ownership and humanization of pets are driving demand for preventive health check-ups. Wellness diagnostics for allergies, metabolic disorders, and genetic diseases are becoming increasingly popular as pet owners prioritize proactive healthcare. Technological advancements such as next-generation sequencing (NGS) and AI-powered diagnostics enhance early disease identification, improving treatment outcomes. Additionally, IoT-based wearable devices allow real-time monitoring of animal health, ensuring continuous tracking and early detection of potential health issues.

Based on the end user, the market is divided into veterinary hospitals & clinics, veterinary reference laboratories, home use, and others. Among these, the veterinary hospitals & clinics segment dominates the market. The segment's expansion was aided by the rise in pet clinics and hospitals as well as public awareness of the spread of zoonotic illnesses. Because more people are becoming aware of the importance of taking preventative care of their pets and their well-being, the diagnostic centers segment is expected to expand quickly for the forecast period. Additionally, the market is being driven by the development of molecular diagnostic procedures like PCR and ELISA, which now make up a significant portion of the animal healthcare center.

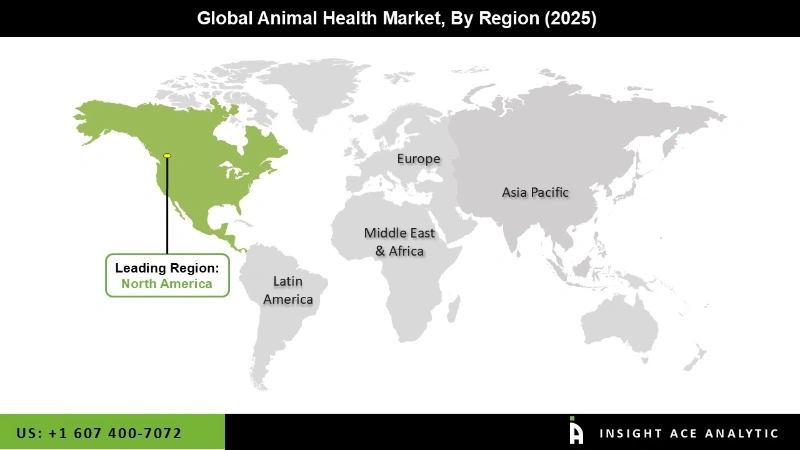

North America having large-scale animal mortality due to zoonotic and livestock diseases is the main causes of the dominant share. Furthermore, the substantial share can be attributed to many variables, including the existence of major market competitors, sophisticated healthcare infrastructure, and high healthcare spending. Additionally, it is thought that the existence of healthcare services and activities to support animal health expands this region's potential for growth. For example, to solve the issues impacting the animal health sector, the North American Pet Health Insurance Association is raising awareness of pet health insurance coverage and creating and investigating collaborations. Effective actions performed by animal welfare groups in the case of an emergency or sudden outbreak of disease are also believed to be important factors contributing to the expansion of this region.

• In Jan 2025, Ceva Animal Health declared that it has acquired the rights to use Touchlight's dbDNA technology in the animal health industry to develop and market products in the future. Ceva and Torchlight hope to work together to develop a program to manufacture novel DNA vaccines for animal health under the direction of Dr. Ian Thompson, a world authority on vaccinations.

• In Nov 2024, MSD Animal Health, which is a part of Merck & Co., announced that BRAVECTO® TriUNO, a novel chewable tablet for dogs, has received approval from the European Commission. Targeting both internal and external parasites, this medicine is a formulation of BRAVECTO (fluralaner).

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 66.08 Bn |

| Revenue Forecast In 2035 | USD 140.51 Bn |

| Growth Rate CAGR | CAGR of 8.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, Pharmaceuticals, And, Animal, Distribution Channel, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; Japan; South Korea; Southeast Asia |

| Competitive Landscape | Virbac S.A., NEOGEN Corporation, Zoetis Inc., Vetoquinol S.A., Dechra Pharmaceuticals plc, Mars Inc., Animalcare Group plc, Bimeda, Biognesis Bag, Bioveta, China Animal Husbandry Industry Company, Chanelle, ImmuCell Corporation, Laboratorios CALIER, S.A, HIPRA, S.A., Norbrook Laboratories, Alembic Animal Health, Boehringer Ingelheim GmbH, Elanco, IDEXX Laboratories, Inc., Ceva Santé Animale, Merck & Co Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Animal Health Market—By Product

• Pharmaceuticals

o Parasiticides

o Anti-infectives

o Anti-inflammatory

o Analgesic

o Others

• Biologics

o Vaccines

? Modified/ Attenuated Live

? Inactivated (Killed)

? Others

o Other Biologics

• Medicinal Feed Additives

• Diagnostics

o Consumables

o Instruments

• Equipment & Disposables

o Critical Care Consumables

o Anesthesia Equipment

o Fluid Management Equipment

o Temperature Management Equipment

o Rescue & Resuscitation Equipment

o Research Equipment

o Patient Monitoring Equipment

• Others

o Veterinary Software

o Veterinary Telehealth

o Livestock Monitoring

Global Animal Health Market – By Animal

• Companion Animals

o Dogs

o Cats

o Horses

o Others

• Production Animals

o Cattle

o Swine

o Poultry

o Sheep & Goats

o Fish

Global Animal Health Market – By Distribution Channel

• Hospital/ Clinic Pharmacy

• Retail

• E-commerce

Global Animal Health Market – By End User

• Veterinary Hospitals & Clinics

• Veterinary Reference Laboratories

• Home Use

• Others

Global Animal Health Market – By Region

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.