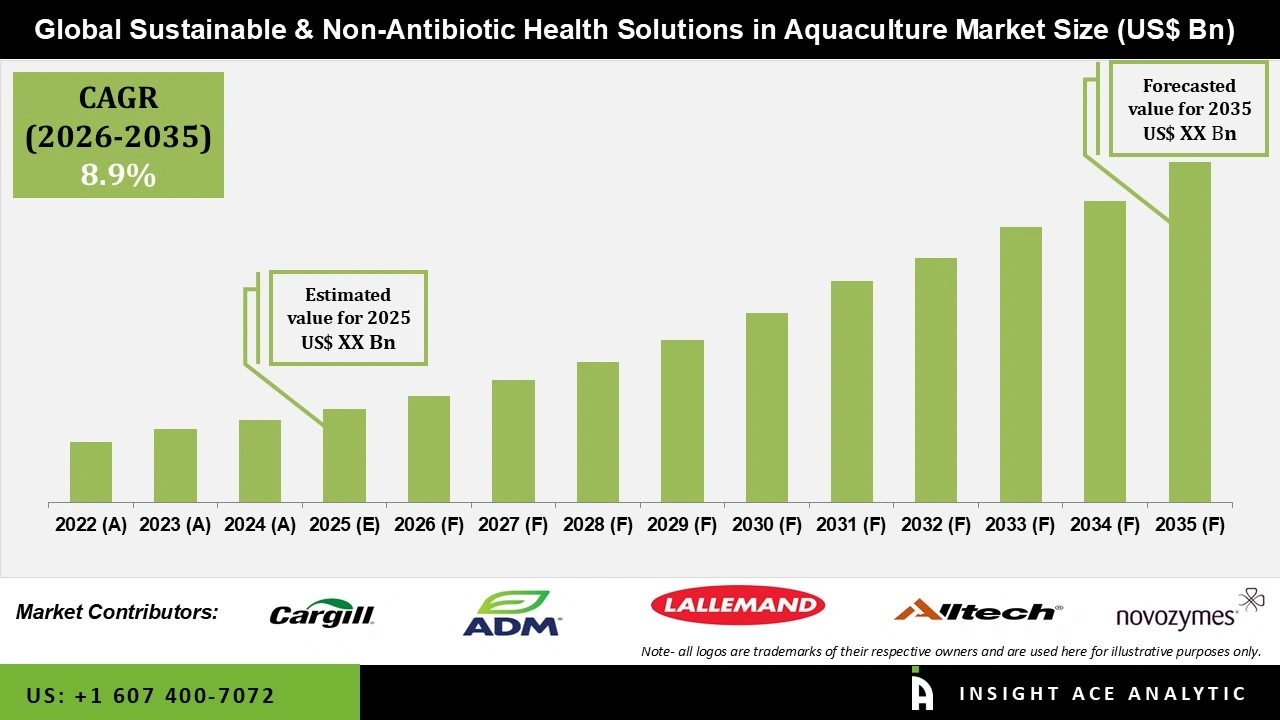

Global Sustainable and Non-Antibiotic Health Solutions in Aquaculture Market Size is predicted to grow at a 8.9% CAGR during the forecast period for 2026 to 2035.

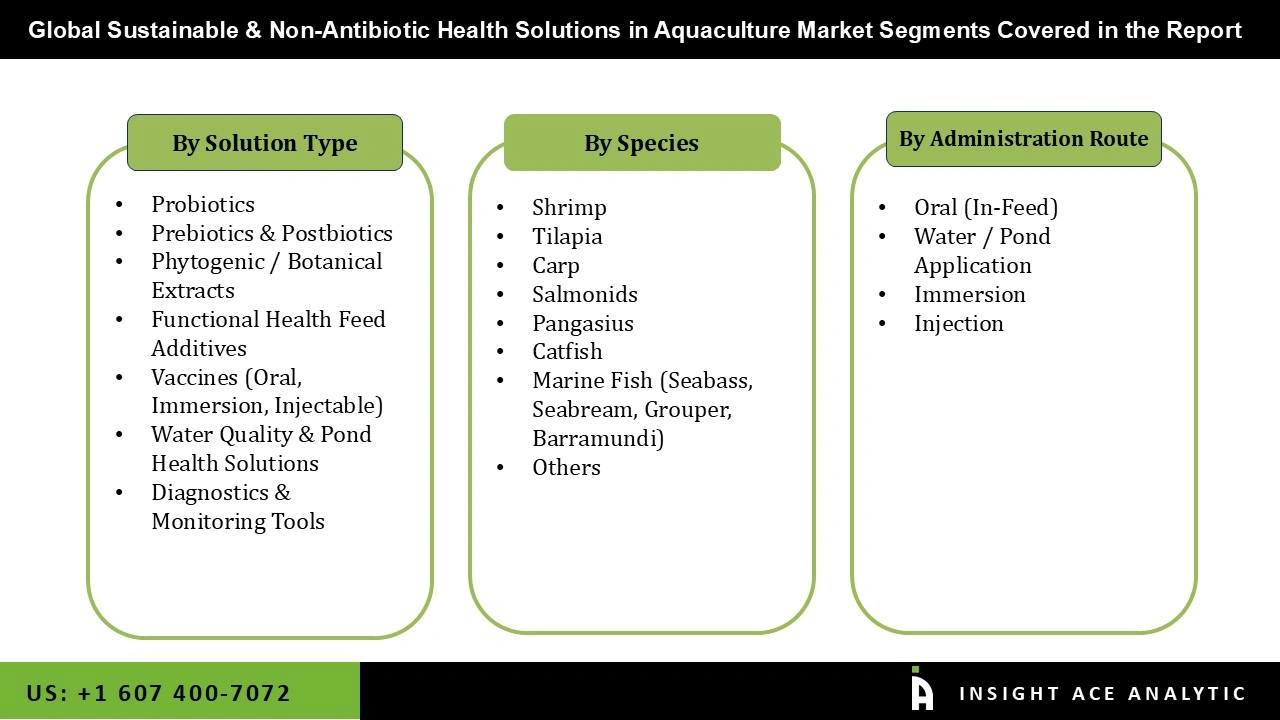

Sustainable & Non-Antibiotic Health Solutions in Aquaculture Market Size, Share & Trends Analysis Distribution by Solution Type (Probiotics, Prebiotics & Postbiotics, Phytogenic / Botanical Extracts, Functional Health Feed Additives, Vaccines(Oral, Immersion, Injectable), Water Quality & Pond Health Solutions, Diagnostics & Monitoring Tools), by Species (Shrimp, Tilapia, Carp, Salmonids, Pangasius, Catfish, Marine Fish (Seabass, Seabream, Grouper, Barramundi), Others), By Administration Type (Oral (In-Feed), Water / Pond Application, Immersion, Injection), By Region and Segment Forecasts, 2026 to 2035

Sustainable and non-antibiotic health solutions are methods and products that support aquaculture and disease prevention without relying on antibiotics, while reducing environmental impact. Sustainable and non-antibiotic health solutions are becoming a cornerstone of modern aquaculture as farmers seek safer, more responsible ways to protect aquatic health. With increasing global demand for seafood and growing awareness of food safety, producers are shifting away from routine antibiotic use toward natural, preventive approaches. Solutions such as probiotics, prebiotics, phytogenic additives, vaccines, and water quality enhancers help strengthen immunity, improve gut health, and reduce disease outbreaks without leaving harmful residues. This transition supports healthier aquaculture, better survival rates, and improved farm productivity while aligning with global sustainability goals

The market for sustainable and non-antibiotic health solutions in aquaculture is driven by concerns over antibiotic resistance and food safety, as well as stricter government regulations and international trade standards. Growing consumer and export market demand for sustainably farmed, antibiotic-free seafood encourages farmers to adopt more responsible health practices. Frequent disease outbreaks and higher production risks are also accelerating the adoption of preventive solutions. Advances in probiotics, vaccines, diagnostics, and precision aquaculture technology are enabling more effective and sustainable farm management.

Despite growing interest, several challenges hinder the adoption of sustainable and non-antibiotic health solutions. Higher costs compared to traditional antibiotics can be a barrier for small and medium-sized farmers. In some regions, limited knowledge or training may prevent effective use, leading to inconsistent results and reduced confidence. However, rising global demand for certified, antibiotic-free seafood presents a significant opportunity. Solution providers can address this by offering affordable, user-friendly, and region-specific products that help farmers increase productivity and meet export and sustainability standards.

Driver

Antibiotic Resistance and Food Safety Driving Sustainable Aquaculture Market.

Growing concerns over antibiotic resistance and food safety are driving the aquaculture industry toward non-antibiotic solutions. Farmers are adopting probiotics, vaccines, and phytogenic feed additives to prevent diseases, support natural immunity, and produce safe, antibiotic-free seafood. Regulatory measures and international standards are reinforcing this shift, while advanced diagnostics, water quality management, and precision aquaculture tools help optimize farm conditions and reduce disease risks. Together, these efforts are not only creating safer and higher-quality seafood for consumers but also enhancing the long-term sustainability, profitability, and global competitiveness of the aquaculture industry.

Restrain/Challenge

High Cost Associated with Sustainable & Non-Antibiotic Health Solutions in Aquaculture Market.

The main challenges in adopting sustainable and non-antibiotic health solutions in aquaculture is their higher cost compared to conventional antibiotics. For small and medium-scale farmers, these costs can be a significant concern, making it difficult to switch to more sustainable practices despite their long-term benefits. While these solutions help improve aquaculture health, prevent disease, and produce safer, antibiotic-free seafood, initial investment requirements may slow adoption. Addressing this challenge through affordable products, farmer education, and supportive policies can help drive wider acceptance and long-term sustainability in the aquaculture industry.

The sustainable & non-antibiotic health solutions in aquaculture market is segmented by solution type, species, and administration route, reflecting a holistic approach to improving aquatic health without antibiotics. By solution type, the market includes probiotics, prebiotics and postbiotics, phytogenic and botanical extracts, functional health feed additives, vaccines, water quality and pond health solutions, and diagnostics and monitoring tools, all aimed at disease prevention, immunity enhancement, and farm sustainability. Based on species, these solutions are widely adopted across shrimp, tilapia, carp, salmonids, pangasius, catfish, and marine fish such as seabass, seabream, grouper, and barramundi, as well as other cultured species. By administration route, products are delivered through oral in-feed methods, water or pond application, immersion, and injection, enabling flexible and species-specific health management throughout the aquaculture production cycle.

Probiotics, vaccines, and water quality solutions are key drivers of the sustainable, non-antibiotic health solutions market because they directly address the most critical challenges in aquaculture: disease prevention, immune support, and optimal pond conditions. Probiotics improve gut health and enhance the natural immunity of aquatic animals, reducing dependence on antibiotics. Vaccines protect fish and shrimp against common infectious diseases, improving survival rates and ensuring consistent production. Meanwhile, water quality solutions maintain healthy pond conditions, preventing stress and disease outbreaks that can severely impact productivity. Together, these solutions provide measurable benefits for farmers, improving aquatic health, farm efficiency, and the overall sustainability of aquaculture operations, which is why they are widely adopted and market leaders.

Oral (in-feed) administration is the most common method for sustainable, non-antibiotic health solutions because it is simple, cost-effective, and works well for large farms. By adding probiotics, vaccines, and other health products directly to feed, farmers make sure all animals get the treatment, which helps with growth, immunity, and disease prevention. This method causes less stress than injections or immersion, saves labor, and fits easily into daily routines. Because it is practical and effective, oral administration is a main factor driving market growth in sustainable aquaculture.

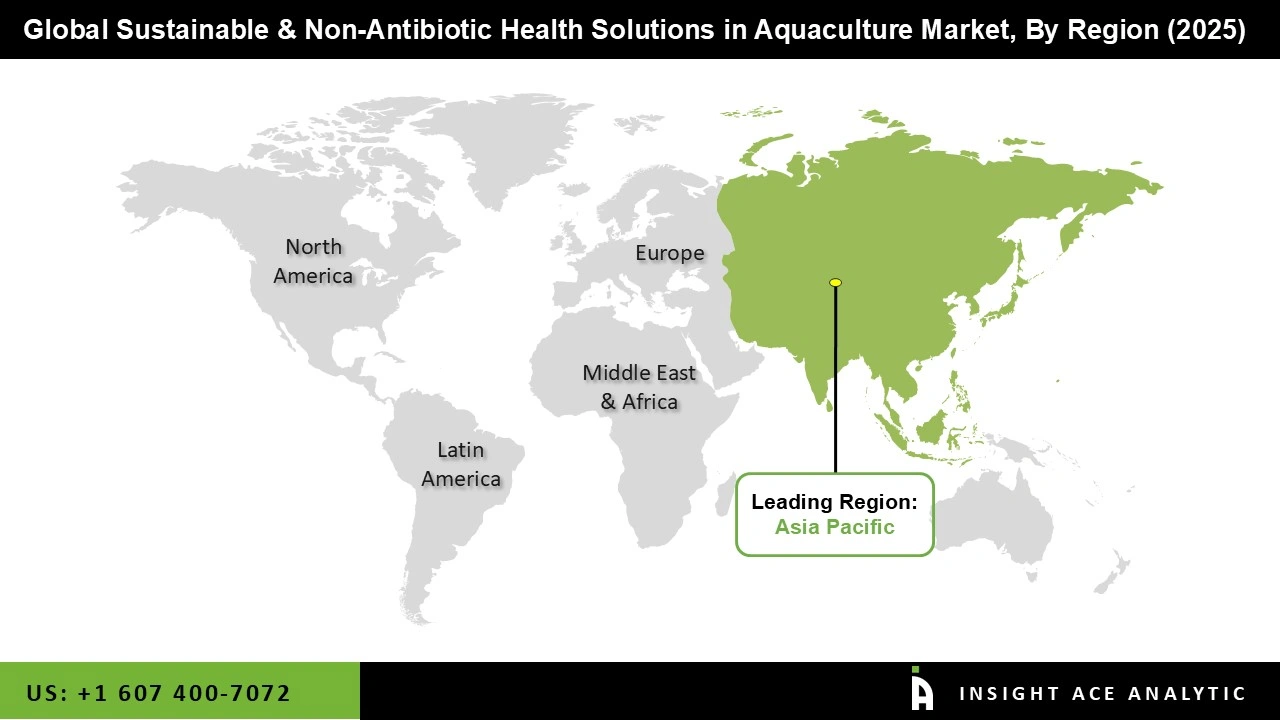

Asia Pacific leads the market for sustainable, non-antibiotic health solutions in aquaculture because of its large seafood production. Countries like China, India, Vietnam, Thailand, and Indonesia are major producers of fish and shrimp.

Farmers in the region face frequent problems like disease outbreaks, water quality issues, and crowded ponds, so they have turned to safer options such as probiotics, vaccines, and plant-based feed additives. More consumers want antibiotic-free, sustainably farmed seafood, and government rules and export standards support this shift. With new technology for diagnostics, monitoring, and precision farming, Asia Pacific continues to set the standard for innovative and effective aquaculture health management.

Feb 2025: Grieg Seafood opened a new post-smolt facility in Hjelmeland, Norway, which allowed salmon to grow to 1 kg before sea transfer, lowered mortality and sea lice issues, reduced antibiotic needs, and improved biosecurity and sustainability.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 8.9% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Solution Type, Species, Administration Route |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Cargill, ADM Animal Nutrition, Lallemand Animal Nutrition, Alltech, Evonik Industries AG, Novozymes, Chr. Hansen, Biorigin, Angel Yeast Co., Ltd., Delacon Biotechnik GmbH, Kemin Industries, Phytobiotics Futterzusatzstoffe GmbH, Igusol Advance S.L., Nor-Feed SAS, Natural Remedies Pvt. Ltd., Skretting (Nutreco), BioMar Group, Mowi Feed, Ridley Corporation, Adisseo, Nutriad, PHARMAQ (Zoetis), Elanco Animal Health, Merck Animal Health (MSD), HIPRA, Virbac, Ceva Santé Animale, Vaxxinova, INVE Aquaculture (Benchmark Holdings), Qingdao Vland Biotech Group, BiOWiSH Technologies, Novus International, AquaBioTech Group, Aquafix, XpertSea, Pentair Aquatic Eco-Systems, YSI / Xylem, Ace Aquatec, eFishery, Aquaconnect, Scoot Science, Aqualabo, Benchmark Genetics, Hendrix Genetics Aquaculture. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.