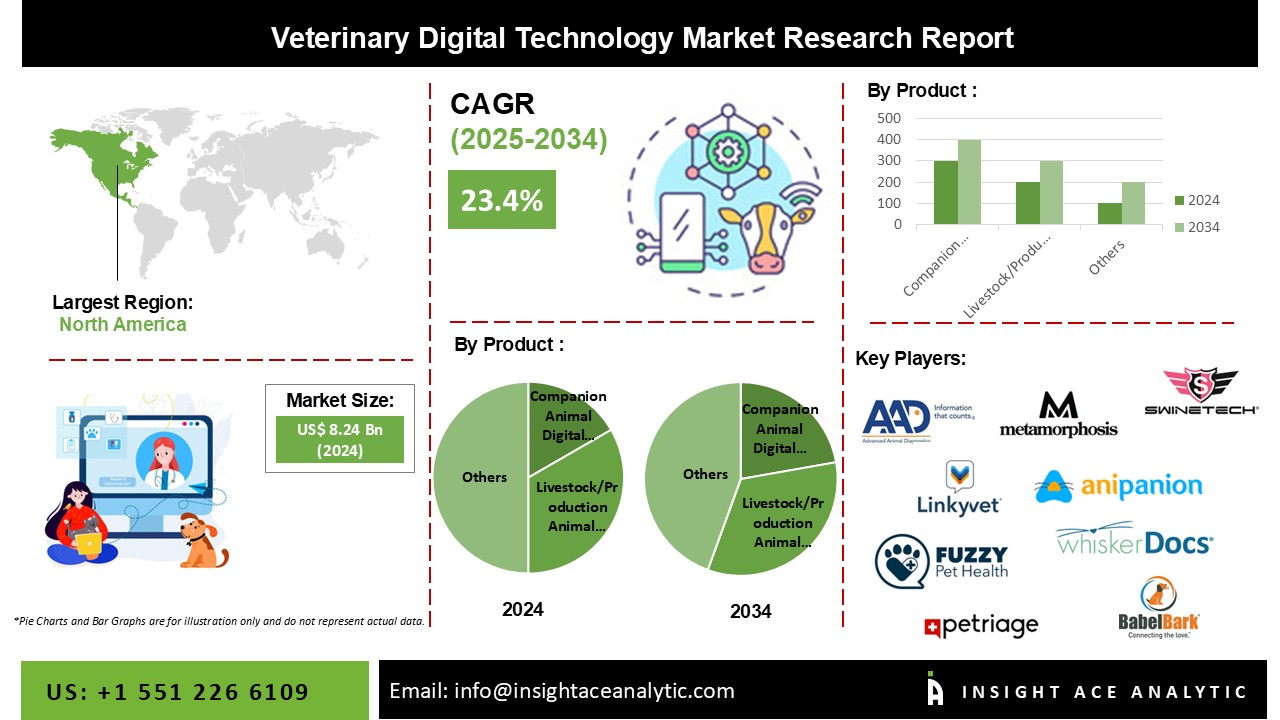

Veterinary Digital Technology Market Size is valued at USD 8.24 Mn in 2024 and is predicted to reach USD 66.35 Mn by the year 2034 at an 23.4% CAGR during the forecast period for 2025-2034.

The rapid development of digital technology, in past few years, allowed a revolution in overall veterinary industry, including development of Telemedicine, Telehealth, monitoring devices, digital cameras and animal production field’s involvement. Digital technology in the veterinary industry offers a comprehensive system for different types of care settings along with custom features such as tracking and identification, behavior monitoring, and veterinary diagnosis. In the veterinary industry, technological improvement continues to develop the level of care, affordability and accessibility have allowed more widespread integration into smaller practices, including diagnostic imaging.

The growth is driven by the increasing application of Veterinary Digital Technology in growing animal health expenditure along with a rising number of veterinary practitioners in developed regions and development in the companion animal sector. Rapidly increasing demand for ensuring animal safety, security & medical diagnosis, and treatment in livestock is further likely to boost the market growth. Integration of digital technology is also projected to have a momentous impact on the animal healthcare industry during the forecast period. The market is growing rapidly, driven by the rising application of Veterinary digital technology in tracking and identifying, monitoring behavior, diagnosing medical concerns.

The Global Veterinary Digital Technology market is categorized on the basis of product, end-user, and region. On the basis of product type, the market is segmented into Companion Animal Digital Technology and Livestock/Production Animal Digital Technology. Companion Animal Digital Technology is further categorized into Telemedicine, Telehealth, reminder applications, trackers, wearables, and platform marketplaces. Livestock/Production Animal Digital Technology is further categorized into monitoring devices, identification devices, trackers, wearables, remote sensors, digital cameras, microphones, and environmental sensors. Based on region, the market is studied across North America, Asia-Pacific, Europe, and LAMEA. Among all, North America is expected to dominate the market during the analysis of the forecast period.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 8.24 Bn |

| Revenue Forecast In 2034 | USD 66.35 Bn |

| Growth Rate CAGR | CAGR of 23.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Metamorphosis Partners, Advanced Animal Diagnostics, Inc., Babel Bark, Inc., SwineTech, Inc., inulogica, whiskerDocs, LLC, Fuzzy Pet Health, Quantified Ag, Pathway Vet Alliance, Anipanion, Linkyvet, TeleVet, Petriage, Inc., TeleTails, VetNOW, Airvet, Pawz Limited, Oncura Partners, PetPro Connect, VETOCLOCK, and VetCT., and others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Veterinary Digital Technology Market Based on Product

Global Veterinary Digital Technology Market Based on Region

Europe Veterinary Digital Technology Market by Country

North America Veterinary Digital Technology Market by Country

Asia Pacific Veterinary Digital Technology Market by Country

Latin America Veterinary Digital Technology Market by Country

Middle East & Africa Veterinary Digital Technology Market by Country

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.