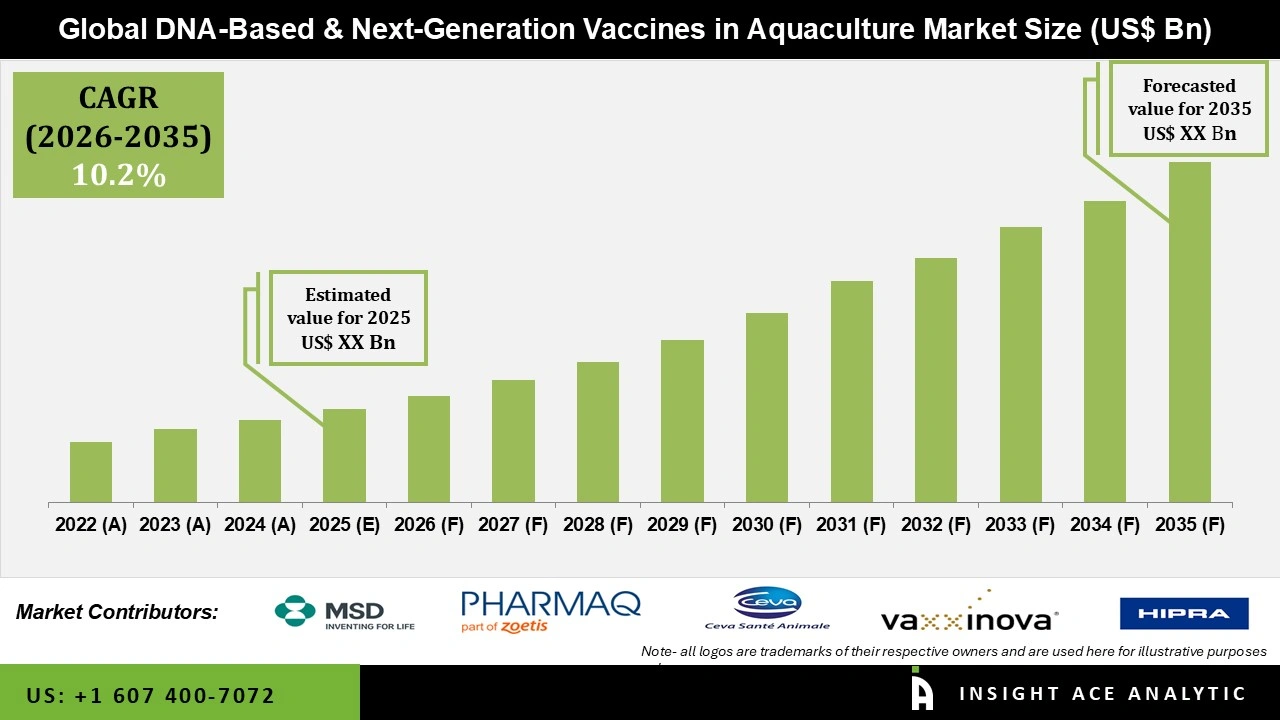

Global DNA Based and Next-Generation Vaccines in Aquaculture Market is likely to witness the growth at a 10.2% CAGR during the forecast period for 2026 to 2035.

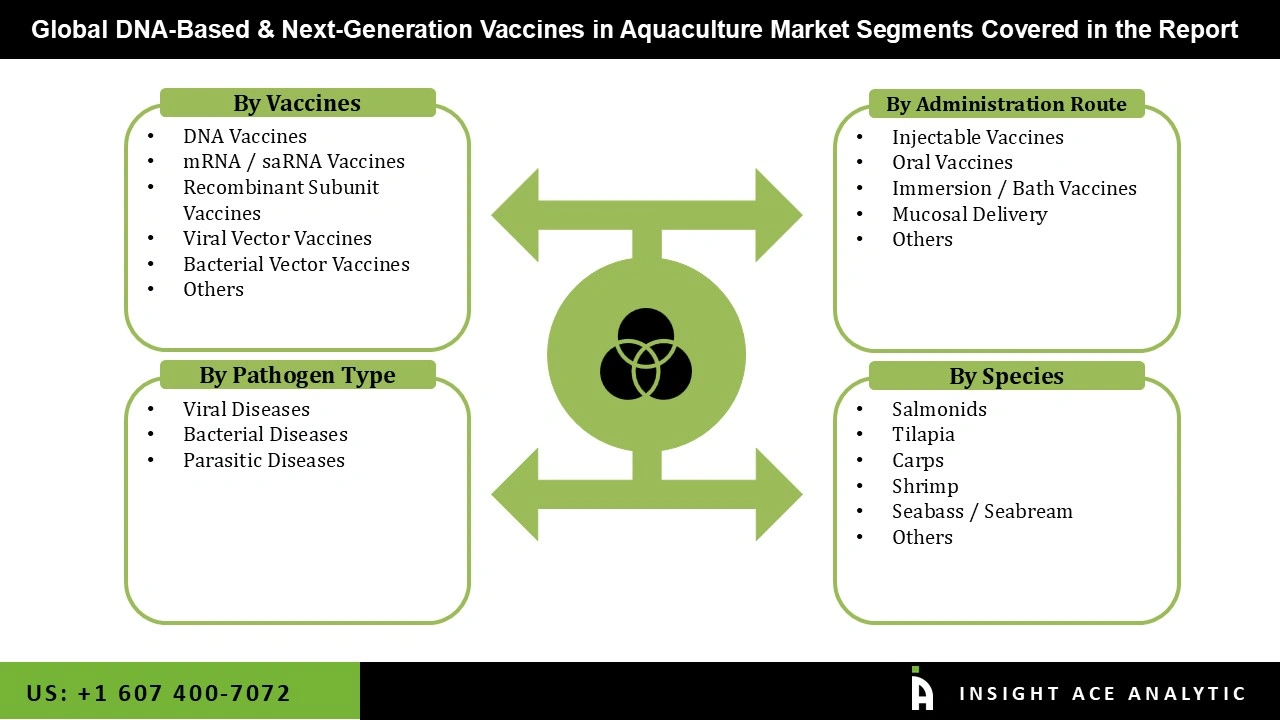

DNA-Based & Next-Generation Vaccines in Aquaculture Market Size, Share & Trends Analysis Distribution by Vaccines (DNA Vaccines, mRNA / saRNA Vaccines, Recombinant Subunit Vaccines, Viral Vector Vaccines, Bacterial Vector Vaccines, Others), by Pathogen Type(Viral Diseases, Bacterial Diseases, Parasitic Diseases) by Administration Route (Injectable Vaccines, Oral Vaccines, Immersion / Bath Vaccines, Mucosal Delivery, Others) by Species (Salmonids, Tilapia, Carps, Shrimp, Seabass / Seabream, Others), By Region and Segment Forecasts, 2026 to 2035

At the intersection of biotechnology and global food security, DNA-based and next-generation vaccines are emerging as transformative tools in aquaculture, offering a sophisticated defense against the infectious diseases that threaten sustainable fish farming. By leveraging cutting-edge platforms—from precisely coded DNA plasmids and self-amplifying RNA to recombinant protein subunits and viral vectors—these advanced immunization strategies provoke potent, targeted immune responses while eliminating the risks associated with traditional live-attenuated or killed pathogen vaccines. As aquaculture intensifies to meet rising seafood demand, these innovations are proving indispensable; they not only enhance survival rates and stock health but also drastically reduce reliance on antibiotics, thereby safeguarding animal welfare, environmental integrity, and the long-term viability of one of the world's most vital food-production sectors.

The growth of the DNA-based and next-generation vaccines market in aquaculture is being driven by a combination of biological, economic, and regulatory factors.

One of the primary drivers is the rising incidence of viral, bacterial, and parasitic diseases, which continues to threaten farmed fish and shrimp populations and directly impacts productivity and profitability. At the same time, there is a strong and growing focus on sustainable aquaculture practices, encouraging the adoption of vaccines that reduce dependence on antibiotics and chemical treatments. Concerns surrounding antimicrobial resistance are further accelerating the shift toward preventive health solutions such as advanced vaccines. In parallel, continuous technological advancements in DNA, mRNA/saRNA, and vector-based vaccine platforms are improving vaccine effectiveness, safety, and scalability. The rapid expansion of global aquaculture production to meet increasing seafood demand is also driving higher investment in fish health management. Additionally, supportive regulatory frameworks and increased R&D funding are enabling faster development and commercialization of next-generation aquaculture vaccines.

Despite their strong potential, DNA-based and next-generation vaccines in aquaculture face several challenges that can impact market adoption. Regulatory and approval processes are often complex and vary across regions, leading to longer timelines for commercialization. In addition, the high costs associated with research and development, advanced manufacturing, and cold-chain logistics can limit accessibility, particularly for small- and medium-scale aquaculture producers. Large-scale administration of vaccines also remains a practical challenge, as vaccinating high volumes of fish or shellfish can be labour-intensive and technically demanding. At the same time, the market presents a significant opportunity driven by the growing demand for sustainable and antibiotic-free aquaculture practices. As regulators, producers, and consumers increasingly prioritize environmental responsibility and animal health, DNA-based and next-generation vaccines are well positioned to gain wider adoption as effective preventive solutions for long-term disease management.

Driver

Rising Disease Incidence Drives Demand for DNA Based and Next-Generation Vaccines in Aquaculture

The rising occurrence of viral, bacterial, and parasitic diseases is a major factor driving the DNA-based and next-generation vaccines market in aquaculture because these outbreaks significantly threaten farmed fish and shrimp populations. Disease outbreaks can cause high mortality rates, reduce growth performance, and lead to substantial economic losses for farmers. Traditional disease control methods, such as antibiotics and chemical treatments, are often less effective and raise concerns about antimicrobial resistance and environmental impact. As a result, there is an urgent need for advanced, targeted, and long-lasting vaccines that can protect aquatic species, enhance survival rates, maintain productivity, and support sustainable and profitable aquaculture operations worldwide.

Restrain/Challenge

Regulatory Challenges: A Key Barrier to the Growth of DNA-Based and Next-Generation Vaccines in Aquaculture

The main challenges affecting the growth of DNA-based and next-generation vaccines in aquaculture are the complexity of regulatory and approval processes. Different countries and regions have varying requirements for vaccine testing, safety evaluation, and market authorization, which can lead to lengthy approval timelines. These regulatory hurdles often slow down the introduction of innovative vaccines to the market, limiting their availability to farmers and aquaculture producers. Overcoming these challenges requires close coordination with regulatory authorities, rigorous safety and efficacy testing, and streamlined approval pathways. Addressing these issues is essential to ensure that advanced vaccines reach the market efficiently and contribute to healthier, more sustainable aquaculture operations worldwide.

The DNA based and next-generation vaccines in the aquaculture market are segmented across four primary dimensions: vaccine type, pathogen type, route of administration, and target species. By vaccine type, the market includes DNA vaccines, mRNA/saRNA vaccines, recombinant subunit vaccines, viral vector vaccines, bacterial vector vaccines, and other emerging vaccine technologies, reflecting ongoing innovation in advanced immunization platforms for aquatic species. Segmentation by pathogen type highlights the key disease challenges addressed by these vaccines, including viral diseases, bacterial diseases, and parasitic diseases, which collectively represent the major causes of morbidity and economic loss in aquaculture. By route of administration, the market comprises injectable vaccines, oral vaccines, immersion or bath vaccines, mucosal delivery systems, and other novel delivery approaches, indicating diverse strategies to improve vaccine efficacy, ease of administration, and scalability in aquaculture operations. Finally, segmentation by species captures the primary farmed organisms targeted by these vaccines, including salmonids, tilapia, carps, shrimp, seabass/seabream, and other commercially important aquatic species, demonstrating the broad applicability of DNA-based and next-generation vaccines across global aquaculture production systems.

Vaccines targeting viral diseases are currently the most in-demand segment of the DNA-based and next-generation vaccines market in aquaculture. Viral outbreaks can lead to high mortality rates and severe economic losses, particularly in high-value species like salmon, shrimp, and tilapia. As a result, aquaculture producers are increasingly adopting advanced vaccines to prevent viral infections and ensure the health and productivity of their stock. By providing targeted and long-lasting immunity, these vaccines help reduce disease-related losses and improve overall farm efficiency, making them a key focus area for both producers and vaccine manufacturers.

Injectable vaccines currently dominate the market due to their high effectiveness in providing strong and consistent immune protection. However, oral and immersion (bath) vaccines are rapidly gaining popularity because they allow easier administration, especially for large-scale aquaculture operations. These non-invasive methods reduce labour requirements and stress on the fish, making them more practical for mass vaccination. The growing adoption of these administration routes highlights the industry’s focus on efficiency, animal welfare, and scalable disease prevention strategies in modern aquaculture systems.

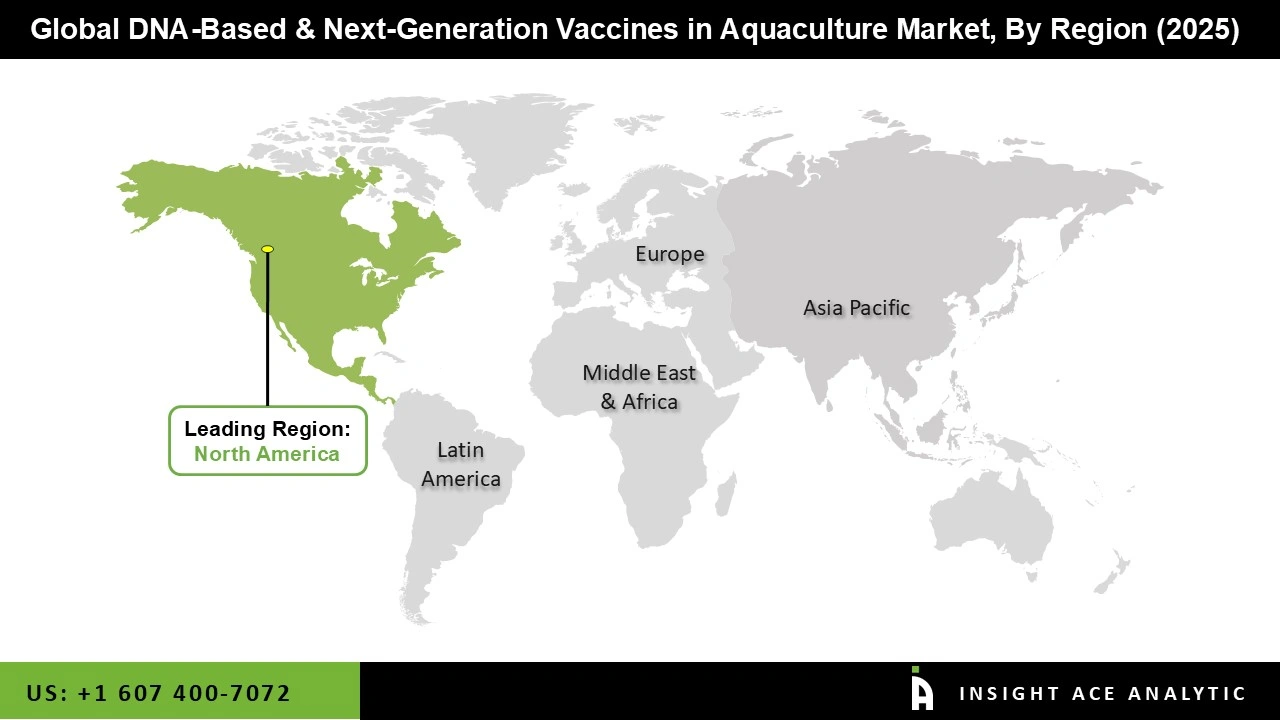

Asia Pacific dominates the DNA-based and next-generation vaccines market in aquaculture due to its favourable environmental conditions and extensive coastal areas, which support large-scale fish and shrimp farming. The region benefits from a well-established aquaculture infrastructure, including advanced hatcheries, feed supply chains, and distribution networks, which facilitates vaccine deployment.

Growing awareness among farmers about the economic losses caused by infectious diseases has also increased the adoption of preventive health measures. Furthermore, collaborations between biotech companies, research institutions, and government bodies in the region are accelerating the development and commercialization of innovative vaccines, positioning Asia Pacific as a key hub for advanced aquaculture health solutions.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 10.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Pathogen Type, Vaccines, Administration Route, Species and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | MSD / Merck & Co., Inc., Zoetis / PHARMAQ, Ceva Animal Health, Touchlight + Stonehaven (Touchlight Aquaculture), Vaxxinova, HIPRA, Virbac / Centrovet, Benchmark Animal Health, ViAqua Therapeutics, Tecnovax (NEW), Nofima, UVAXX. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.