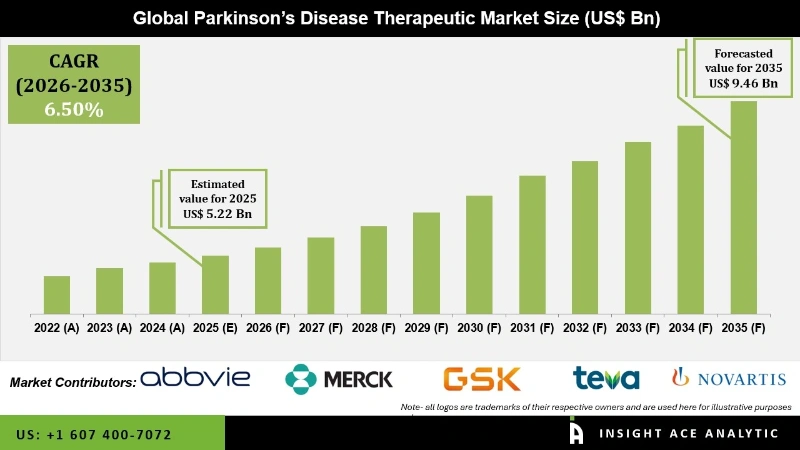

The Parkinson’s Disease Therapeutic Market Size is valued at USD 5.22 billion in 2025 and is predicted to reach USD 9.46 billion by the year 2035 at a 6.5% CAGR during the forecast period for 2026 to 2035.

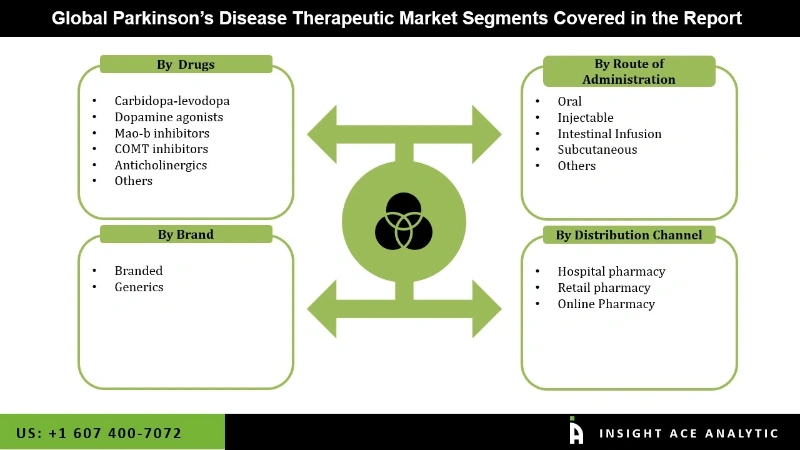

Parkinson's Disease Therapeutic Market Size, Share & Trends Analysis Report By Drugs (Carbidopa-levodopa, Dopamine agonists, Mao-b inhibitors, COMT inhibitors, Anticholinergics), By Distribution Channel (Hospital pharmacy, Retail pharmacy, Online pharmacy), By Brand, By Route of Administration, By Region, And By Segment Forecasts, 2026 to 2035.

Parkinson's disease is attributed to the loss of neurons in the part of the brain responsible for motor control. The exact etiology of nerve cell degeneration remains unknown; however, it is hypothesized that exposure to environmental risk factors and genetic predisposition may play a significant role. The Parkinson's disease Therapeutic Market is witnessing robust growth, propelled by numerous key drivers and emerging opportunities.

The Parkinson's disease therapeutic market is a dynamic sector focused on developing treatments to manage the symptoms and progression of this neurodegenerative disorder. It encompasses a range of pharmaceuticals, medical devices, and therapies aimed at quality improvement of life for individuals with Parkinson's disease. Supportive care, including counselling and educational resources, is essential for both patients and caregivers. Although there is presently no remedy for Parkinson's disease, implementing these comprehensive techniques can greatly improve quality of life and effectively manage symptoms.

The overall market players consist of pharmaceutical companies, research institutions, and healthcare providers. Advances in research and technology drive innovation in treatment options, with a growing emphasis on personalized medicine and holistic approaches to care. Despite challenges such as regulatory hurdles and limited treatment options, the market continues to evolve to meet the needs of patients worldwide.

Some Major Key Players In The Parkinson’s Disease Therapeutic Market:

The Parkinson's disease therapeutic market is categorized on the basis of drug class, distribution channel, brand and route of administration. According to the drug class, the market is segmented into carbidopa-levodopa, dopamine agonists, Mao-b inhibitors, COMT inhibitors, anticholinergics, and others. As per the distribution channel, the market is divided into hospital pharmacy, retail pharmacy, and online pharmacy.

The dopamine agonists segment in the Parkinson's disease therapeutic market comprises a class of medications that mimic the action of dopamine in the brain to alleviate motor symptoms of the disease. These drugs stimulate dopamine receptors, helping to improve movement control and reduce tremors and rigidity in patients with Parkinson's disease. Common dopamine agonists include pramipexole and ropinirole. While effective in managing symptoms, these medications may also be associated with side effects such as nausea, dizziness, and hallucinations. Despite challenges, dopamine agonists play a crucial role in the treatment regimen for many individuals living with Parkinson's disease.

The hospital pharmacy segment of the Parkinson's disease therapeutic market focuses on providing medications and pharmaceutical services within hospital settings to manage the complex treatment needs of patients with Parkinson's disease. Hospital pharmacies play a important role in ensuring the availability, proper dosing, and administration of medications such as levodopa, dopamine agonists, and other therapies used to alleviate symptoms & improve the quality of life for individuals with Parkinson's disease. These pharmacies also collaborate with healthcare teams to monitor drug interactions, adjust treatment regimens, and optimize medication adherence to enhance patient outcomes and safety during hospitalization and post-discharge care.

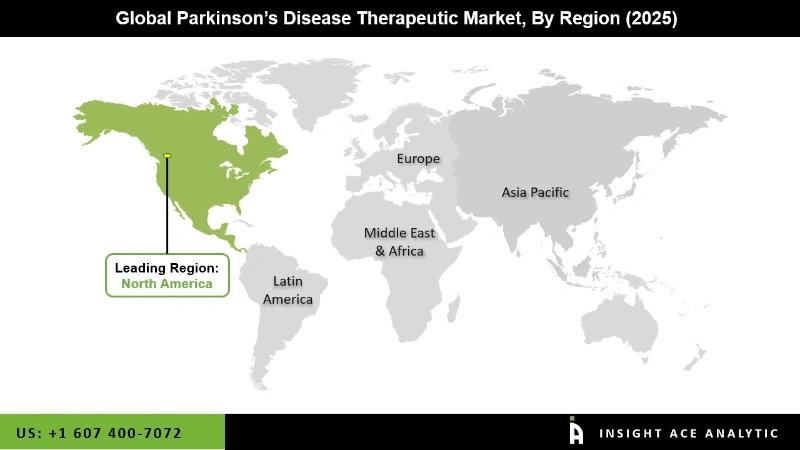

The North American Parkinson's disease therapeutic market is a significant sector characterized by a high prevalence of the disease and a strong focus on research, innovation, and healthcare infrastructure. The region comprises leading pharmaceutical companies, research institutions, and healthcare providers dedicated to developing and delivering advanced treatments for Parkinson's disease. With a growing ageing population and increasing awareness of neurological disorders, the market in North America continues to expand, offering various medications, therapies, and support services to direct the complex needs of patients. Ongoing advancements in treatment options and patient care contribute to shaping the landscape of Parkinson's disease management in North America. Asia Pacific is counted to grow at a rapid rate in the global Parkinson's disease Therapeutic Market due to growing concerns about rapid industrialization, government initiatives, and increasing funding in various industries.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 5.22 Bn |

| Revenue Forecast In 2035 | USD 9.46 Bn |

| Growth Rate CAGR | CAGR of 6.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Drug Class, Distribution Channel, Brand And Route Of Administration |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | Teva Pharmaceutical Industries Ltd., Novartis AG, GlaxoSmithKline Plc., AbbVie Inc., Merck & Co., Inc., Zydus Cadila, Dr. Reddy's, Sun Pharmaceutical Industries Ltd., Cipla Inc., Boehringer Ingelheim International GmbH, Denali Therapeutics Inc., Biogen Inc., Prevail Therapeutics and Others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Parkinson's Disease Therapeutic Market By Drugs

Parkinson's Disease Therapeutic Market By Distribution Channel-

Parkinson's Disease Therapeutic Market By Brand

Parkinson's Disease Therapeutic Market By Route of Administration

Parkinson's Disease Therapeutic Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.