Global Pharmacy Automation Market Size is valued at USD 6.7 Bn in 2024 and is predicted to reach USD 15.86 Bn by the year 2034 at an 9.1% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the report:

The advantages of pharmacy automation technology include increased patient safety, decreased reliance on pharmaceutical shortages, reduced medicine waste and decreased cost per dosage. The market is anticipated that total efficiency will increase due to pharmacies utilizing RFID, barcode scanning, smart dashboards, and data security for a more fluid workflow. Businesses are under increased external pressure to increase transparency and use cutting-edge technology as a result of the challenging and unprecedented problem of managing corporate compliance in a digital environment.

Recent technology developments in pharmacy automation have made various automated solutions possible. The benefits over the forecast period include quicker prescription processing, fewer pharmaceutical errors and inventory issues, and lower pharmacy costs. Additionally, enhancements to the most significant rising healthcare infrastructure will probably create new opportunities for market growth. On the other hand, significant capital costs and rigid informal standards are substantial roadblocks to market expansion in the coming years.

Additionally, in quest of new prospects over the future years, pharmacy automation companies are expanding their footprint throughout emerging regions. The pharmacy automation market will also be driven by the rising need for specialized drug prescription filling solutions, the aim to lower medication errors, and the decentralization of pharmacies. However, constraints such as a reluctance to accept pharmacy automation systems due to the high cost of the pharmacy automation system are expected to hinder pharmacy automation system adoption, limiting the market's growth during the forecast period.

The requirement to reduce medication errors, manual drug dispensing, and the advancement of advanced parts innovation is driving the pharmacy automation system market. In addition, the rise in work costs and an increase in the geriatric population have fueled the expansion of the pharmacy automation market over the upcoming years.

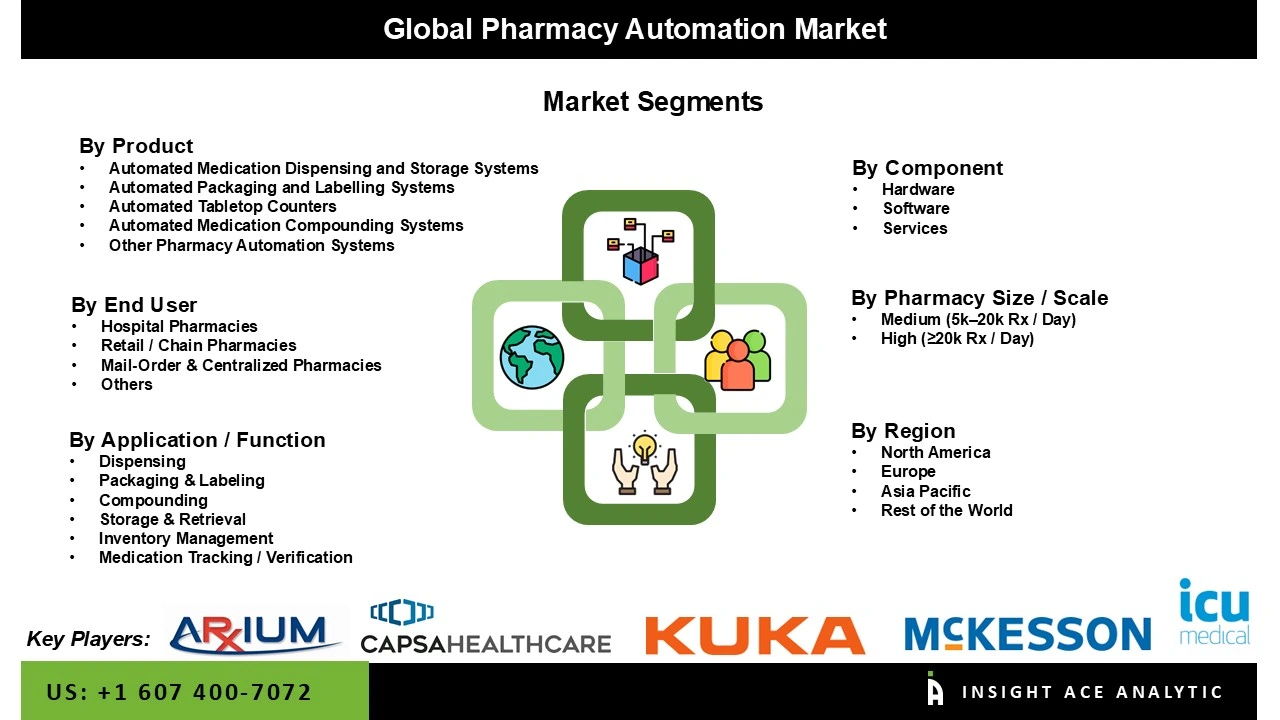

The pharmacy automation market is segmented on product and end users. Based on product type, the market is segmented as automated medication dispensing and storage systems, automated packaging and labeling systems, automated tabletop counters, automated medication compounding systems and other pharmacy automation systems. Based on application, the market is divided into automated packaging and labeling systems, tabletop counters, medication compounding systems, and other pharmacy automation systems. Based on end users, the market is divided into inpatient pharmacies, outpatient pharmacies, retail pharmacies, hospital settings, pharmacy benefit management organizations, and mail-order pharmacies.

The automated medication dispensing and storage systems segment is anticipated to grow at the most significant rate during the forecast period. The recycled content packaging provides better use of eco-friendly resources and techniques, driving the segment's growth during the forecast period. Recycled content packaging uses plastic, metal, paper, and glass, which manufacturers reuse as raw materials to make new packaging products.

Retail pharmacies hold the largest share of the market during the forecast period. Retail pharmacies include supermarkets, chains, mass merchandisers, and independent pharmacies. The expanding need to prevent dispensing errors, the expansion in retail pharmacies and the increased pressure on pharmacists contribute to the segment's growth. Furthermore, key technological companies like Microsoft, IBM, and Google are working on automation and cloud solutions for the pharmaceutical and healthcare industries to overcome security gaps and secure healthcare and pharmaceutical manufacturing networks from outside threats.

North America region is growing at the highest CAGR during the forecast period. The increased number of drug prescriptions at pharmacies because of the aging population is related to the rise of North America's pharmacy automation system market. Additionally, the markets for pharmacy automation equipment in North America are expected to rise because of technological advances in drug administration in hospitals and pharmacies. Increased concerns about insufficient inventory management may encourage the development of high-volume dispensing cabinets in the region, as this will increase the cost of maintaining items, putting merchants under financial hardship.

The market for pharmacy automation equipment in North America is projected to be driven by technological developments in drug administration in hospitals and pharmacies. In addition, during the forecast period, Asia Pacific is expected to grow the fastest. The increased need to reduce pharmaceutical errors, pharmacy decentralization, player technical improvements, and the rapidly growing geriatric population are expected to drive market expansion.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 6.7 Bn |

| Revenue Forecast In 2034 | USD 15.86 Bn |

| Growth Rate CAGR | CAGR of 9.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product, End User, Component, Application / Function and Pharmacy Size / Scale |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; Japan; South Korea; South East Asia |

| Competitive Landscape | Omnicell, Inc., Becton, Dickinson and Company (BD), Capsa Healthcare, Parata Systems LLC – operating under BD, ScriptPro LLC, RxSafe, LLC, ARxIUM, Inc., McKesson Corporation, Swisslog Healthcare, Yuyama Co., Ltd., Willach Pharmacy Solutions, Rowa Automatisierungssysteme GmbH, ICU Medical, Inc., TouchPoint Medical, Inc., Deenova S.R.L., Innovation Associates / iA, NewIcon Oy, Noritsu-RX Corporation, MedAvail Technologies, Inc., Asteres, Inc., JVM Co., Ltd., Tension Packaging & Automation, Inc., Meditech Pharmacy Management / Meditech Pharma Robotics, Cencora, Inc. (formerly AmerisourceBergen) and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Pharmacy Automation Market By Product-

Pharmacy Automation Market By End User

Pharmacy Automation Market By Component-

Pharmacy Automation Market By Application / Function-

Pharmacy Automation Market By Pharmacy Size / Scale-

Pharmacy Automation Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.