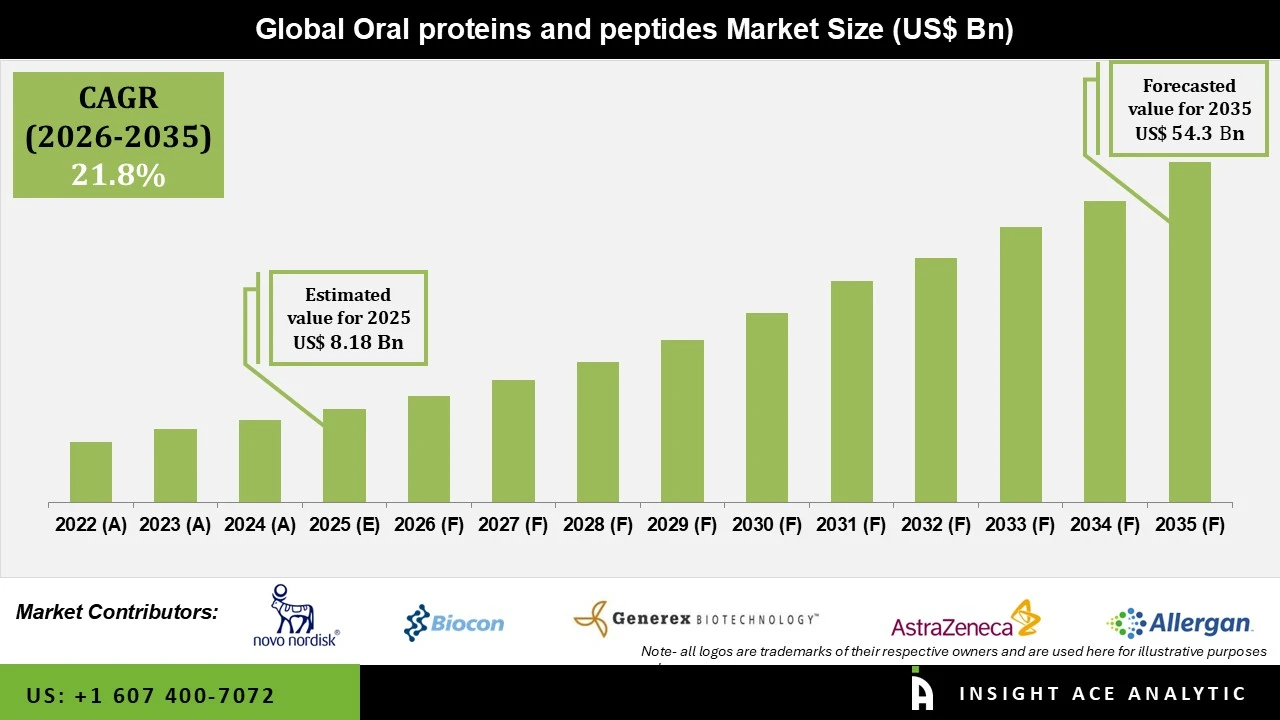

Oral Proteins and Peptides Market Size is valued at USD 8.18 Bn in 2025 and is predicted to reach USD 54.3 Bn by the year 2035 at an 21.80% CAGR during the forecast period for 2026 to 2035.

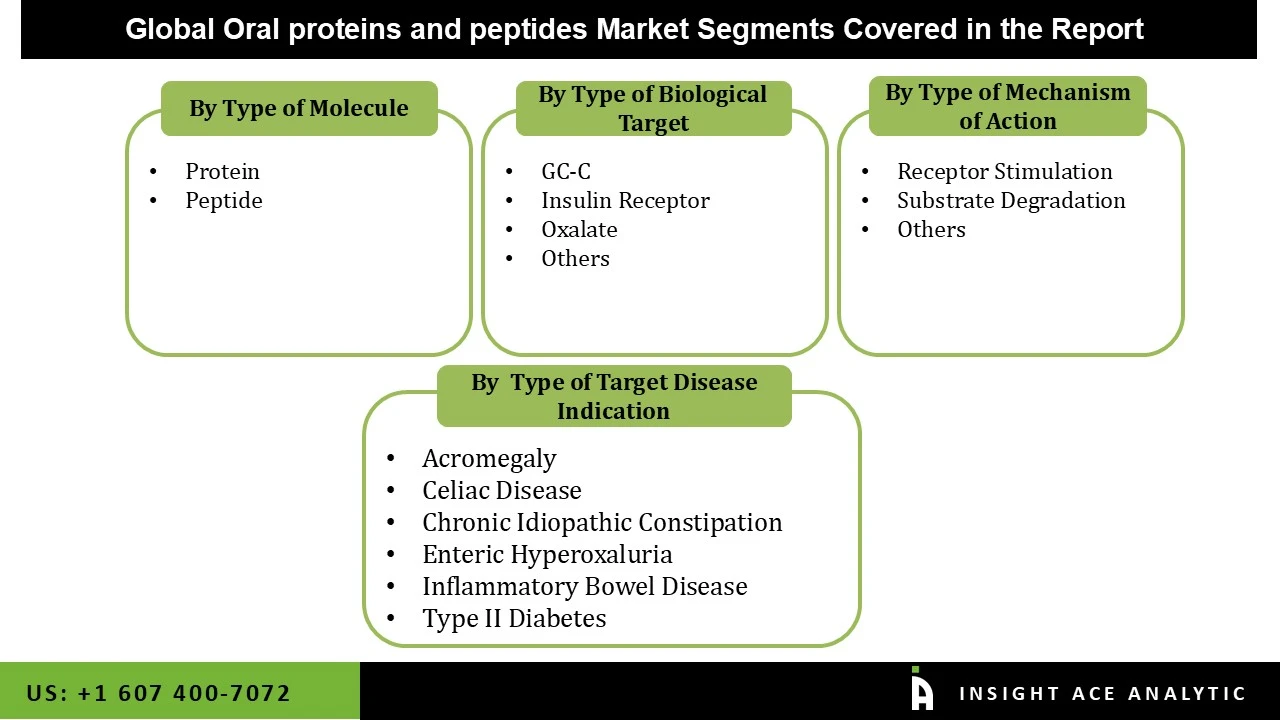

Oral Proteins and Peptides Market Share & Trends Analysis Report, By Type of Target Disease Indication (Acromegaly, Celiac Disease, Chronic Idiopathic Constipation, Enteric Hyperoxaluria, Inflammatory Bowel Disease, and Type II Diabetes), Type of Molecule (Protein and Peptide), Type of Biological Target, Type of Mechanism of Action, By Region, and Segment Forecasts, 2026 to 2035

Oral proteins and peptides are therapeutic medicines made from short chains of amino acids, designed for oral administration to leverage their biological properties in treating various ailments. However, their bioavailability is limited due to degradation by digestive enzymes like proteases in the stomach and small intestine. Despite these challenges, the FDA's approval of several novel oral protein and peptide drugs demonstrates the industry's commitment to overcoming these obstacles. These innovative treatments provide a more convenient and comfortable alternative to injections or intravenous administration and hold the potential to revolutionize the treatment of diseases like diabetes and hormone deficiencies. As a result, the oral proteins and peptides market is rapidly evolving, driven by the ability to address unmet medical needs, improve patient compliance, and enhance bioavailability.

The U.S. Food and Drug Administration (FDA) implemented the 21st Century Cures Act to expedite the approval process for innovative drug delivery systems, including oral formulations of proteins and peptides. In 2023, the FDA recognized the potential of Oramed Pharmaceuticals' oral insulin capsule to address unmet needs in diabetes care and awarded it Fast Track Designation, allowing for faster development and more frequent interactions with regulatory reviewers. Such regulatory advancements are crucial in improving patient care and accelerating the availability of oral protein and peptide products, supporting market growth. Additionally, ongoing research in biotechnology is driving the discovery of new therapeutic proteins and peptides, expanding the pipeline of potential oral treatments. The rising prevalence of chronic conditions like diabetes, cancer, and hormonal disorders further increases the demand for effective and patient-friendly therapeutic options.

The oral proteins and peptides market is segmented based on the type of target disease indication, type of molecule, type of biological target, and type of mechanism of action. Based on the type of target disease indication, the market is divided into acromegaly, celiac disease, chronic idiopathic constipation, enteric hyperoxaluria, inflammatory bowel disease, and type II diabetes. Based on the type of molecule, the market is divided into protein and peptide. Based on the type of biological target, the market is divided into GC-C, insulin receptor, oxalate, and others. Based on the type of mechanism of action, the market is divided into receptor stimulation, substrate degradation, and others.

Based on the type of target disease indication, the market is divided into acromegaly, celiac disease, chronic idiopathic constipation, enteric hyperoxaluria, inflammatory bowel disease, and type II diabetes. Among these, the type II diabetes segment is expected to have the highest growth rate during the forecast period. Traditional diabetes treatments, like insulin injections, can be uncomfortable and inconvenient for patients, especially those requiring daily doses.

Oral formulations of proteins and peptides, such as oral insulin, offer a more patient-friendly alternative, significantly improving treatment compliance. Given the chronic nature of Type II Diabetes, the long-term use of medications creates a large and continuous demand for treatment options. Oral protein and peptide therapies for diabetes, especially insulin, cater to this extensive and growing patient population. With a rapidly increasing global prevalence, Type II Diabetes is one of the most common chronic diseases. According to the International Diabetes Federation, hundreds of millions of people are affected worldwide, driving the demand for effective and manageable treatments.

Based on the type of molecule, the market is divided into protein and peptide. Among these, the peptides segment dominates the market. Peptides are smaller than proteins, making them easier to formulate for oral delivery. Their smaller size allows them to more readily navigate the challenges of the gastrointestinal (GI) tract, such as enzyme degradation and absorption barriers. Peptide-based therapies tend to have shorter development timelines compared to protein-based drugs due to their simpler structure. This leads to faster regulatory approval and market entry.

Peptides have diverse biological activities and can be used to treat a variety of diseases, including metabolic disorders (like Type II Diabetes), gastrointestinal issues, and cancer. Their versatility and effectiveness make them attractive candidates for oral formulations. Compared to proteins, peptides generally have better stability in the GI tract and can be engineered to enhance bioavailability. New technologies, such as peptide modification and protective delivery systems, help improve their effectiveness in oral delivery.

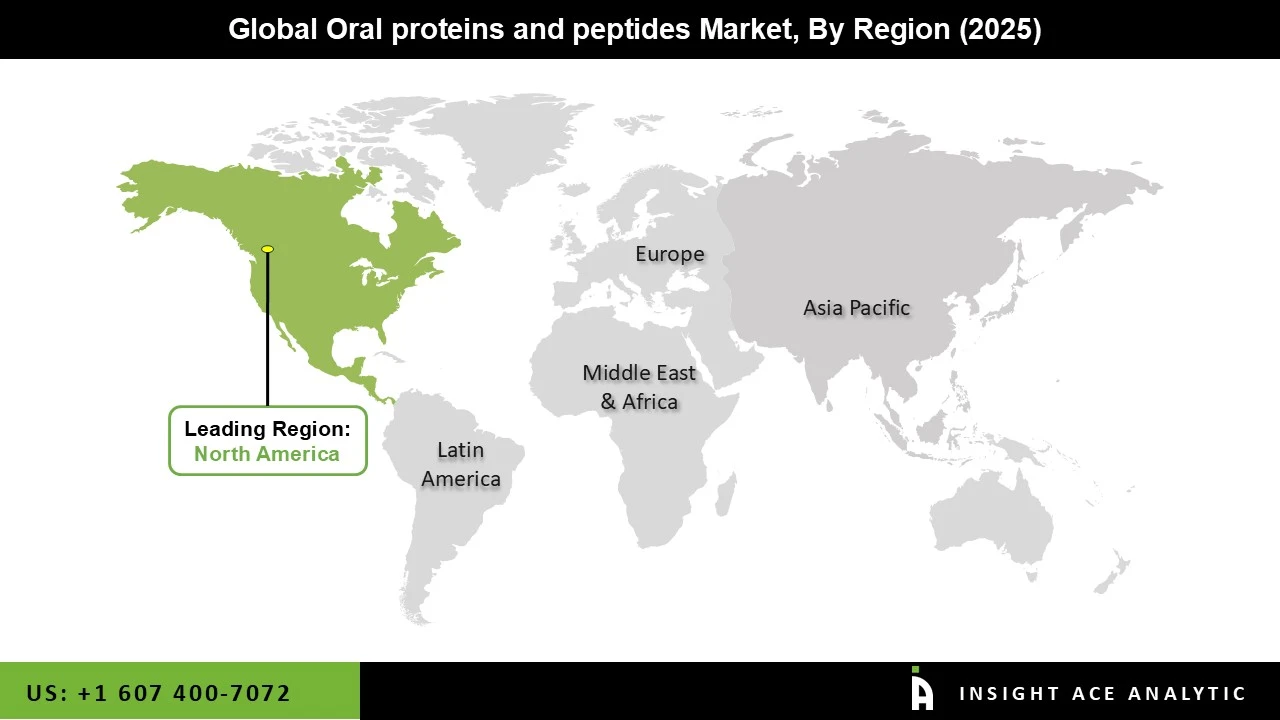

The region’s well-established healthcare system and access to cutting-edge medical technologies support the development and adoption of novel therapeutic products, including oral proteins and peptides. This infrastructure also facilitates clinical trials and regulatory approvals, accelerating the market's growth. The U.S. Food and Drug Administration (FDA) provides clear regulatory pathways and programs, such as Fast Track and Breakthrough Therapy Designations, that encourage the development of innovative treatments, including oral proteins and peptides. These regulatory initiatives speed up the approval process, which positively impacts market growth. The aging population in North America is more prone to chronic diseases, increasing the need for convenient and effective treatments. Oral protein and peptide therapies, which offer non-invasive alternatives to injections, are well-suited to this demographic, further driving market growth.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 8.18 Bn |

| Revenue Forecast In 2035 | USD 54.3 Bn |

| Growth Rate CAGR | CAGR of 21.80% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2036 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type of Target Disease Indication, Type of Molecule, Type of Biological Target, and Type of Mechanism of Action |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | AstraZeneca, Biocon Chiasma, Generex Biotechnology, Novo Nordisk A/S, Allergan, Oramed Pharmaceuticals, Proxima Concepts, Synergy Pharmaceuticals, Tarsa Therapeutics, Sanofi, F. Hoffmann-La Roche Ltd, Novo Nordisk A/S, Abbvie Inc., Pfizer Inc., Bausch Health Companies Inc., Chiesi Farmaceutici S.P.A., Acadia Pharmaceuticals Inc., Aurinia Pharmaceuticals Inc., Merck & Co., Inc., Johnson & Johnson Services, Inc., Swk Holdings, R-Pharm Jsc, Entera Bio Ltd., Proxima Concepts, Astrazeneca Plc, Regor Therapeutics Group, Terns Pharmaceuticals, Inc., Structure Therapeutics, Viking Therapeutics, Protagonist Therapeutics Inc., Rani Therapeutics, Carmot Therapeutics, Inc., Zealand Pharma, Sciwind Biosciences Co., Ltd., Jiangsu Hengrui Pharmaceuticals Co., Ltd |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.