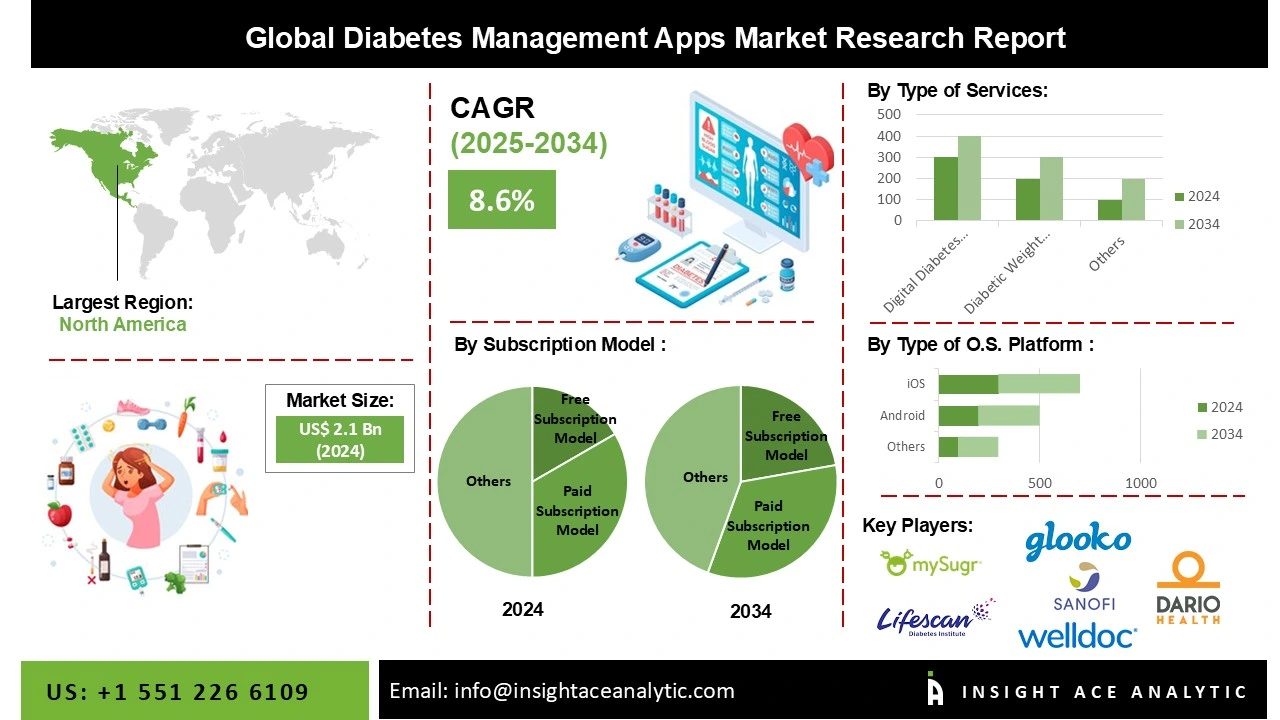

The Diabetes Management Apps Market is expected to grow at a 8.6% CAGR during the forecast period for 2025-2034.

Diabetes is a chronic disease that affects the body's glucose levels. This disorder is caused primarily by the pancreas' failure to make insulin or the body's inability to maintain glucose levels. Diabetes can lead to a variety of health issues, including chronic renal disease, cardiovascular disease, and even death. Diabetes management entails the use of gadgets and software to control blood glucose levels in the body. Effectively tracking diabetes using these devices aids in the effective treatment of patients as well as the tracking and maintenance of data. The primary factors driving market expansion are the increased adoption of smartphones and tablets, as well as healthcare apps, and the global rise in the diabetes population. The need for better diabetes care solutions has become more critical as diabetes prevalence has increased. Additionally, technological developments have made it possible for the industry to receive incredibly versatile solutions. Other significant market expansion drivers include the rising use of connected devices and apps and the growing adoption of cloud-based enterprise solutions.

However, during the anticipated period, expansion in this market is anticipated to be constrained by elements like high device costs, a lack of funding in underdeveloped nations, and a higher acceptance of conventional diabetes treatment technologies. Lack of understanding of digital diabetes management in underdeveloped nations and patient data privacy issues are impeding market expansion.

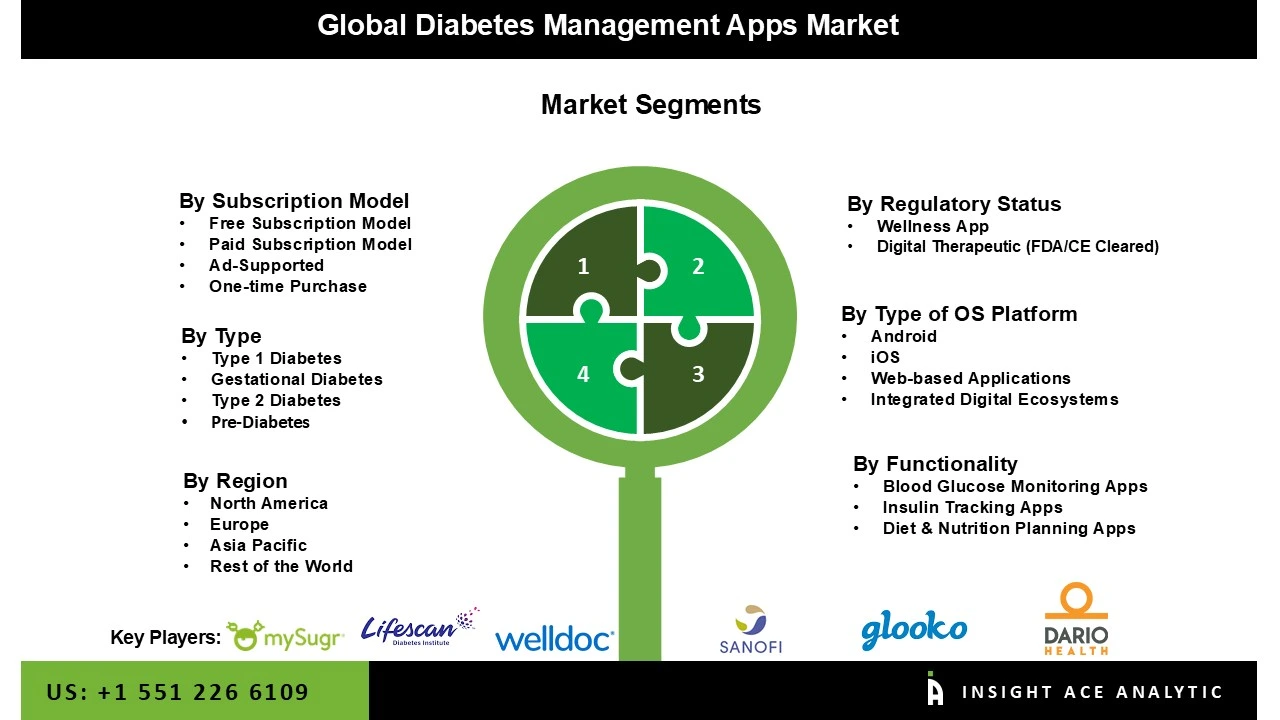

The Diabetes Management Apps market is segmented on the basis of the subscription model, type of services and O.S. platform. Based on the subscription model, the market is segmented as Free Subscription Model and Paid Subscription Model. By type of services, the market is segmented into Digital Diabetes Management and Diabetic Weight & Diet Management. Based on the O.S. segment, the market is segmented into Android and iOS.

On the basis of subscription mode, the market is segmented into Free Subscription Model and Paid Subscription Model. The free subscription model segment is expected to grow at a significant rate over the forecast period. Diabetes tracking apps on smartphones or smart technology-enabled insulin pens and pumps have assisted patients in tracking nutrition and exercise in order to maintain a stable glucose range. Furthermore, new start-ups are entering the market with powerful digital platforms. The availability of telehealth platforms, as well as government measures encouraging the free subscription model sector.

On the basis of the type of services, the market is segmented into Digital Diabetes Management and Diabetic Weight & Diet Management. Diabetes' expanding prevalence has raised the emphasis on developing and accepting better diabetes care solutions, resulting in greater use of digital diabetes management. Furthermore, technological improvements have enabled the market launch of highly adaptable solutions. Other vital drivers boosting market expansion are the increased usage of cloud-based enterprise solutions and the growing use of linked devices and apps.

The North America Diabetes Management Apps market is likely to register a significant revenue share and develop at a rapid CAGR in the near future. The region's robust healthcare sector, which provides medical case management services, is expected to drive demand for diabetes management software. The prevalence of type 1 diabetes has steadily increased in North American countries. Blood sugar and insulin levels must be regularly checked in order for these people to remain in the best possible health. Furthermore, favorable reimbursement policies for patients with chronic illnesses such as diabetes, hypertension, and cardiovascular disorders are expected to boost demand in the North American market for diabetes management. The market is growing as a result of factors such as a robust supply-side infrastructure, rapid adoption of breakthrough technology, and reasonable reimbursements.

· Abbott

· Dexcom, Inc.

· Medtronic

· Insulet Corporation

· F. Hoffmann-La Roche (mySugr)

· Glooko, Inc.

· DarioHealth

· Livongo (Teladoc Health)

· Omada Health

· Noom

· BlueStar (Welldoc)

· Diabeloop

· Tidepool

· Tandem Diabetes Care

· Senseonics (Eversense)

· Glytec

· Onduo (Verily / Sanofi JV)

· Hedia

· BeatO

· HealthifyMe

· SugarFit

· OneDrop

· Ascensia Diabetes Care

· GlucoMe

· Diabetes:M

· Dario (DarioHealth brand)

Other players

| Report Attribute | Specifications | |

| Growth rate CAGR | CAGR of 8.6% from 2025 to 2034 | |

| Quantitative units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 | |

| Historic Year | 2019 to 2022 | |

| Forecast Year | 2025-2034 | |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends | |

| Segments covered | By Subscription Model, By Type, By End Use, By Platform, By Functionality, By Regulatory Status, By Integration Level |

|

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa | |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia | |

| Competitive Landscape | DarioHealth, LifeScan, Welldoc, Glooko, Inc., Fooducate, Diabetes: M, Beat Diabetes, One Drop Tactio Health Group, AgaMatrix, MySugr, Medisana, Medtronic, BioTelemetry, Inc., ContourNextOne, Azumio, Sanofi-Aventis, Abbott, Distal Thoughts, BHI Technologies, and Maxwell Software. | |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. | |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Type (User Population)

· Type 1 Diabetes

· Type 2 Diabetes

· Gestational Diabetes

· Pre-Diabetes

By Subscription Model (Revenue Model)

· Freemium

· Subscription-Based

· One-time Purchase

· Ad-Supported

· Insurance Reimbursement-Based

By O.S. Platform

· iOS

· Android

· Web-based Applications

· Integrated Digital Ecosystems

By Functionality

· Blood Glucose Monitoring Apps

· Insulin Tracking Apps

· Diet & Nutrition Planning Apps

· Physical Activity Tracking Apps

By Regulatory Status

· Wellness App

· Digital Therapeutic (FDA/CE Cleared)

By Integration Level

· Standalone App

· Device-Integrated App

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.