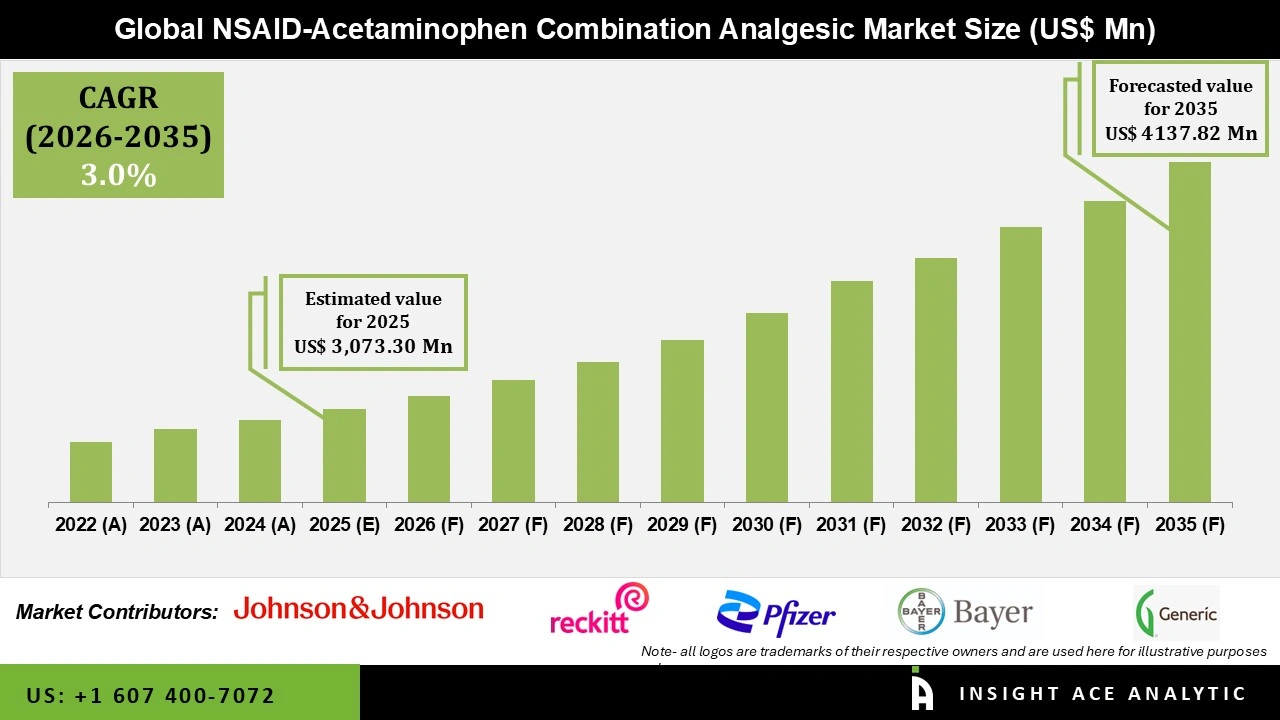

Global NSAID-Acetaminophen Combination Analgesic Market Size is valued at USD 3,073.30 Mn in 2025 and is predicted to reach USD 4,137.82 Mn by the year 2035 at a 3.0% CAGR during the forecast period for 2026 to 2035.

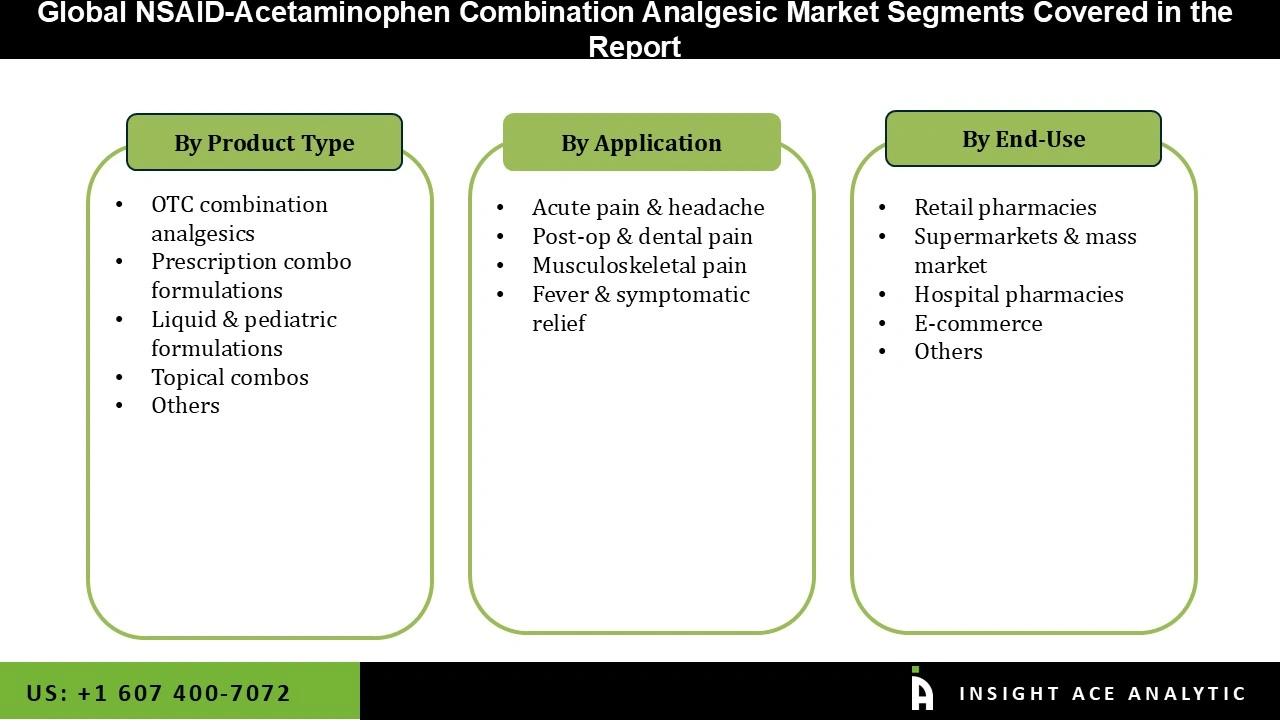

NSAID-Acetaminophen Combination Analgesic Market Size, Share & Trends Analysis Distribution by Type (OTC Combination Analgesics, Topical Combos, Liquid & Pediatric Formulations, Prescription Combo Formulations, and Others), Application (Acute Pain & Headache, Fever & Symptomatic Relief, Musculoskeletal Pain, and Post-op & Dental Pain), End-user (Retail Pharmacies, E-commerce, Hospital Pharmacies, Supermarkets & Mass Market, and Others), By Region and Segment Forecasts, 2026 to 2035.

NSAID–acetaminophen combination analgesics are pain-relieving medicines that contain both acetaminophen (paracetamol) and a non-steroidal anti-inflammatory drug (NSAID) in a single tablet or capsule (or taken together). Acetaminophen mainly works in the brain to reduce pain and fever but has little anti-inflammatory effect. NSAIDs block cyclooxygenase enzymes, which lowers production of prostaglandins that cause pain, inflammation, and swelling. Together, they provide stronger and faster relief than either medicine alone for mild to moderate acute pain, including headaches, muscle aches, dental pain, menstrual cramps, back pain, minor injuries, and post-operative discomfort. These combinations are widely used because they target pain through two different pathways, often giving better results with lower doses of each drug.

The use of NSAID-acetaminophen combination analgesics has been largely affected by the increased demands from both consumers and healthcare providers for a fast-acting, safe, and effective pain management strategy. Combination regimens offering improved analgesia at reduced dosages of individual medicines have recorded increased uptake owing to the rising cost of treatment, the drive to reduce opioid use, or the rising prevalence of acute pain conditions such as headache, dental pain, and post-operative pain. Moreover, given the improved analgesia offered by the combination while possibly overcoming dosage-related adverse effects associated with single-agent treatment, there has been increased demand for the combination owing to improved understanding related to multimodal pain strategies and synergistic pharmacologic principles.

In addition, the NSAID–acetaminophen combination analgesic market has been steadily developing as a result of the increased focus on patient-centric, non-opioid pain management techniques and self-care routines. Customers are actively looking for over-the-counter combo products that offer dependable and prompt relief as awareness of pharmaceutical safety and responsible pain management grows. Pharmaceutical developments in enhanced safety labelling, extended-release dosage, and better formulations provide additional market support. Furthermore, increased healthcare access and urbanization in emerging nations continue to create new growth opportunities for the NSAID–acetaminophen combination analgesic market, while broader retail availability, a strong brand presence, and favorable regulatory frameworks for over-the-counter analgesics in developed regions are facilitating the market penetration.

Driver

Rising Prevalence of Chronic Illnesses

The NSAID–acetaminophen combination analgesic market has been greatly influenced by the rising prevalence of chronic illnesses, such as musculoskeletal disorders, migraines, fever, and arthritis. The need for safe, efficient, and well-tolerated drugs has increased due to the millions of people who suffer from chronic pain problems. For instance, this drug is frequently advised as a first-line pain relief medication in the United States, where 54 million people suffer from arthritis. Additionally, because older persons are more prone to joint discomfort and inflammation-related illnesses, the ageing population also contributes to higher consumption. Its position in the global pain management sector is growing due to this increasing demand, making it a major factor behind the NSAID–acetaminophen combination analgesic market expansion.

Restrain/Challenge

Stringent Regulations and Compliance Issues

The NSAID–acetaminophen combination analgesic market is strictly regulated because of worries about possible abuse and the health dangers of overdosing. Strict regulations about dose limitations, labelling specifications, and manufacturing standards have been put in place by regulatory organisations like the World Health Organisation (WHO), the European Medicines Agency (EMA), and the U.S. FDA. Although these rules contribute to the protection of public health, they make it more expensive for pharmaceutical companies to comply with them since they must update product labels, carry out thorough safety investigations, and deal with difficult approval procedures. Moreover, the companies must devote substantial resources to satisfy regulatory requirements, which delays the release of new products and raises production costs.

The OTC Combination Analgesics category held the largest share in the NSAID-Acetaminophen Combination Analgesic market in 2025, driven by a growing need among consumers for easily accessible and efficient prescription-free self-care pain treatment choices. Because they are more effective than single-ingredient analgesics, over-the-counter combination products that combine an NSAID and acetaminophen have become popular as more people look for quick fixes for common pains like headaches, menstrual cramps, dental discomfort, and mild musculoskeletal pain. Additionally, the growth of this category has been aided by public awareness campaigns, improved access in pharmacies, supermarkets, and online retail channels, and an increasing focus on pain self-management.

In 2025, the Acute Pain & Headache category dominated the NSAID-Acetaminophen Combination Analgesic market. There is a persistent need for efficient short-term pain treatment due to the high prevalence of acute pain problems such as dental pain, postoperative discomfort, musculoskeletal injuries, and tension-type or migraine headaches. In this market, NSAID–acetaminophen combinations are particularly prized because they have synergistic analgesic effects that increase patient satisfaction and therapeutic results by offering quicker and more thorough relief than either agent alone. Furthermore, the segment's growth has been aided by rising public knowledge of pain management choices and increased attention from medical professionals to multimodal analgesia techniques, particularly in surgical and emergency care settings.

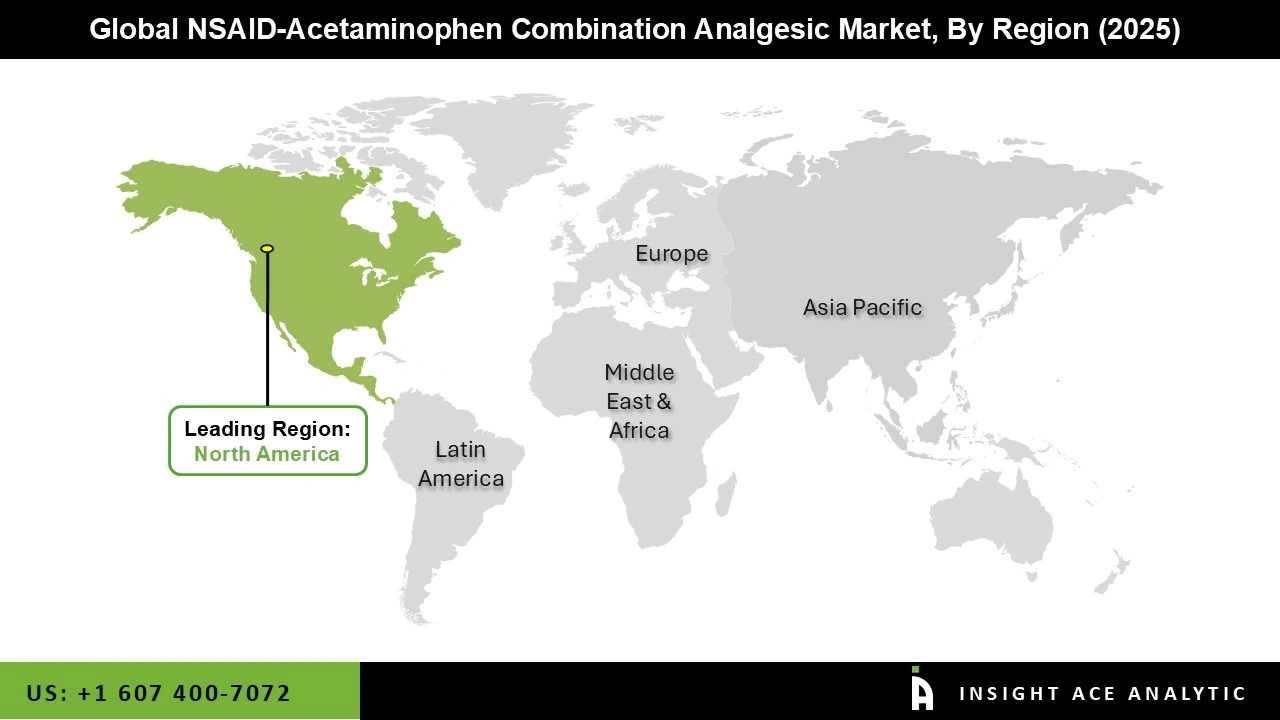

The NSAID-Acetaminophen Combination Analgesic market was dominated by the North America region in 2025, driven by the widespread availability of affordable drugs and the growing expense of healthcare. Additionally, the region's tendency to self-medicate for headaches and colds, as well as the high prevalence of chronic illnesses like arthritis and back pain, have contributed to the NSAID–acetaminophen combination analgesic market's expansion.

Furthermore, the region's advantageous reimbursement regulations and robust healthcare infrastructure facilitate market expansion. In addition, the use of NSAID–acetaminophen combination analgesics as a safer alternative has been emphasized in government health initiatives aimed at treating pain without the use of opioids, which has improved NSAID–acetaminophen combination analgesic acceptance in this region.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 3,073.30 Mn |

| Revenue forecast in 2035 | USD 4,137.82 Mn |

| Growth Rate CAGR | CAGR of 3.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Application, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Pfizer, Johnson & Johnson / TYLENOL Combos, Bayer / Excedrin Combos, Generic Manufacturers, Reckitt (OTC), and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.