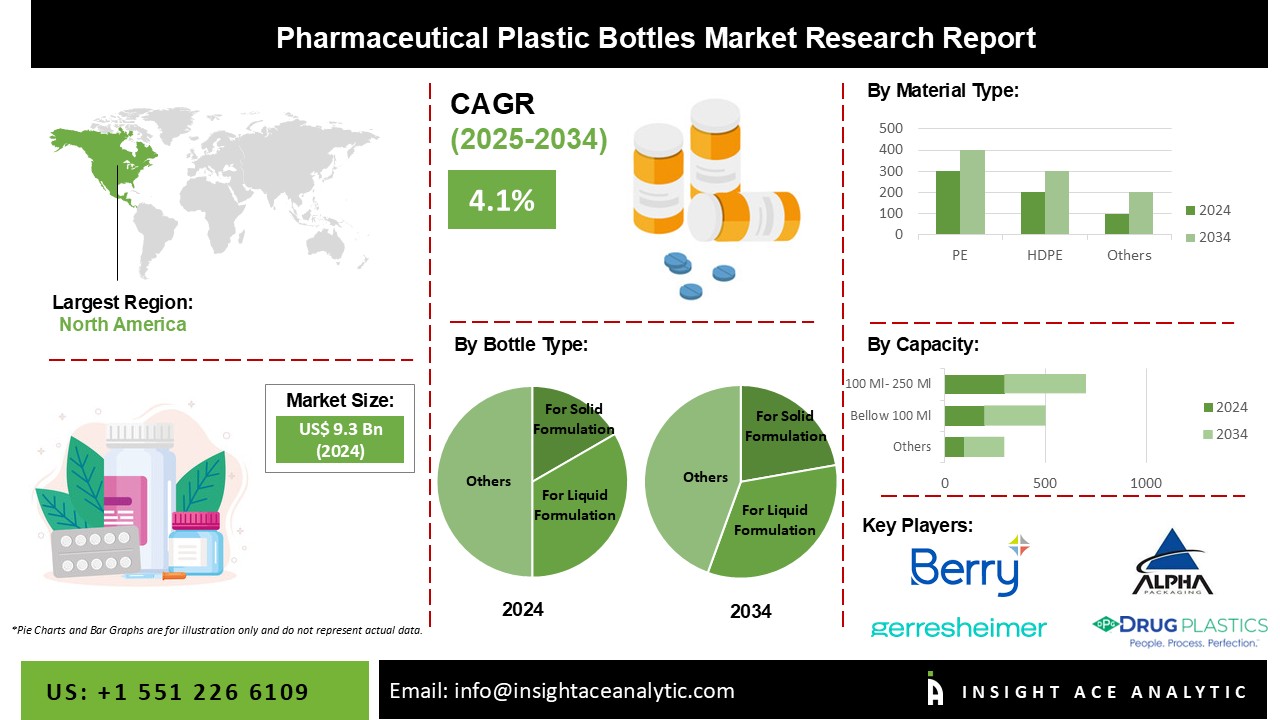

Pharmaceutical Plastic Bottles Market Size is valued at USD 9.3 Billion in 2024 and is predicted to reach USD 13.7 Billion by the year 2034 at a 4.1% CAGR during the forecast period for 2025 to 2034.

Pharmaceutical Plastic Bottles Market Size, Share & Trends Analysis Report By Bottle Types (Plastic Bottles for Solid Formulation, Plastic Bottles for Liquid, Plastic Bottles for Ophthalmic/Nasal Formulation), By Material Types, By Capacity, By Region, And By Segment Forecasts, 2025 to 2034

.

.

Key Industry Insights & Findings from the Report:

The demand for plastic packaging has witnessed a large increase in the pharmaceutical industry due to its unrivaled ability. Barrier against moisture, high dimensional stability, high impact strength, resistance to strain, low water absorption, transparency, heat and flame resistance, and extension of expiry dates are other features that have led to increased adoption in pharma. The market for pharmaceutical plastic bottles is expanding due to rising sustainability concerns, which are being addressed by increasing recycling rates and reducing the pharmaceutical industry's environmental impact. Technological advancements and the increasing use of plastic bottles in solid and even liquid oral medicines have contributed to the growth of the pharmaceutical plastic bottle market. Increased use of dietary supplements and other healthcare products is also driving demand for pharmaceutical plastic bottles, which is expected to drive the target market's growth.

However, growing concerns about the use of plastics due to their negative impact on the environment are driving consumers to reduce their use, which may limit the target market's growth to some extent. Furthermore, one of the factors impeding the development of the global pharmaceutical plastic bottle market is stringent government plastic regulations.

The global pharmaceutical plastic bottle market is segmented based on bottle types, material types, and capacity. Based on bottle types, the market is segmented as plastic bottles for the solid formulation, plastic bottles for liquid, and plastic bottles for ophthalmic/nasal formulation. The other material types segment includes polyethylene (PE), high-density polyethylene (HDPE), low-density polyethylene (LDPE), polyethylene terephthalate

| polyvinyl chloride |

(PET), polypropylene (PP), and polyvinyl chloride (PVC). By capacity, the market is segmented into below 100 ml, 100 ml – 250 ml, and above 250 ml.

The high-density polyethylene (HDPE) category is expected to hold a major share in the global pharmaceutical plastic bottle market in 2021. This is attributed to the growing usage of high-density polyethylene (HDPE) in manufacturing pharmaceutical plastic bottles. HDPE is operated to make a variety of bottles, including un-pigmented bottles, which are translucent and have excellent stiffness and barrier properties. According to Plastics Europe, a report published by an association of European plastic manufacturers in December 2020, the consumption of HDPE in Europe in 2019 was around 6.5 million tons. HDPE is also commonly used in the commercial sector for larger containers due to its high strength-to-weight ratio and lower brittleness than PP. It keeps its lightweight nature when molded, making it suitable for larger containers such as plastic canisters. The new barrier resin technology uses less resin to mold and craft high-density polyethylene (HDPE) bottles while maintaining barrier protection properties.

Plastic bottles for the ophthalmic/nasal formulations have emerged as the leading contributors to the growth of the global pharmaceutical plastic bottles market, based on bottle types of segment. The increased use of corticosteroid drugs in nasal formulations for a variety of treatments is increasing consumption. Moreover, the growing problem of pollution-related eye allergies is a significant factor driving up demand.

The North American pharmaceutical plastic bottles market is expected to register the highest market share in terms of revenue during the forecast period. The market for plastic bottles in the United States is expected to increase substantially due to rising consumption and industrial applications of plastic-made containers and bottles. Plastic projects are expected to increase across various products and industries, including beverage, food and water, pharmaceutical, and household. According to Pharmaceutical Commerce, the pharmaceutical market in the United States is expanding. Americans are expected to spend USD 635 to USD 655 billion on pharmaceuticals by 2023. In comparison to 2019, this represents a solid 29.6–33.7% increase in spending in 2020. As a result, it is almost certain that it will be the country with the highest pharmaceutical expenditure. In addition, Asia Pacific is projected to grow at a rapid rate in the global pharmaceutical plastic bottles market owing to the strong presence of manufacturing industries. Besides that, lower labour costs and easy access to raw materials are also expected to drive the region's target market growth. China is one of Asia's largest pharmaceutical markets, making it profitable for manufacturers of pharmaceutical plastic bottles.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 9.3 Billion |

| Revenue Forecast In 2034 | USD 13.7 Billion |

| Growth Rate CAGR | CAGR of 4.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Bottle Types, By Material Types, By Capacity |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Berry Global Inc., Amcor Plc, Gerresheimer AG, AptarGroup, Inc., O. Berk Company, LLC, Alpha Packaging Holdings, Inc., Comar, LLC, Alpack Inc., ALPLA Werke Alwin Lehner GmbH & Co KG, Drug Plastics Group, Bormioli Pharma S.p.a., C.L.Smith Company, United States of America Plastic Corporation, Weener Plastics Group BV, Origin Pharma Packaging, Pretium Packaging Corporation, Pro-Pac Packaging Group Pty Ltd, Gil Plastic Products Ltd, Drug Plastics Group, Frapak Packaging, Other Prominent Players |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Bottle Types -

By Material Types -

By Capacity -

By Region -

North America -

Europe -

Asia-Pacific -

Latin America -

Middle East & Africa -

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.