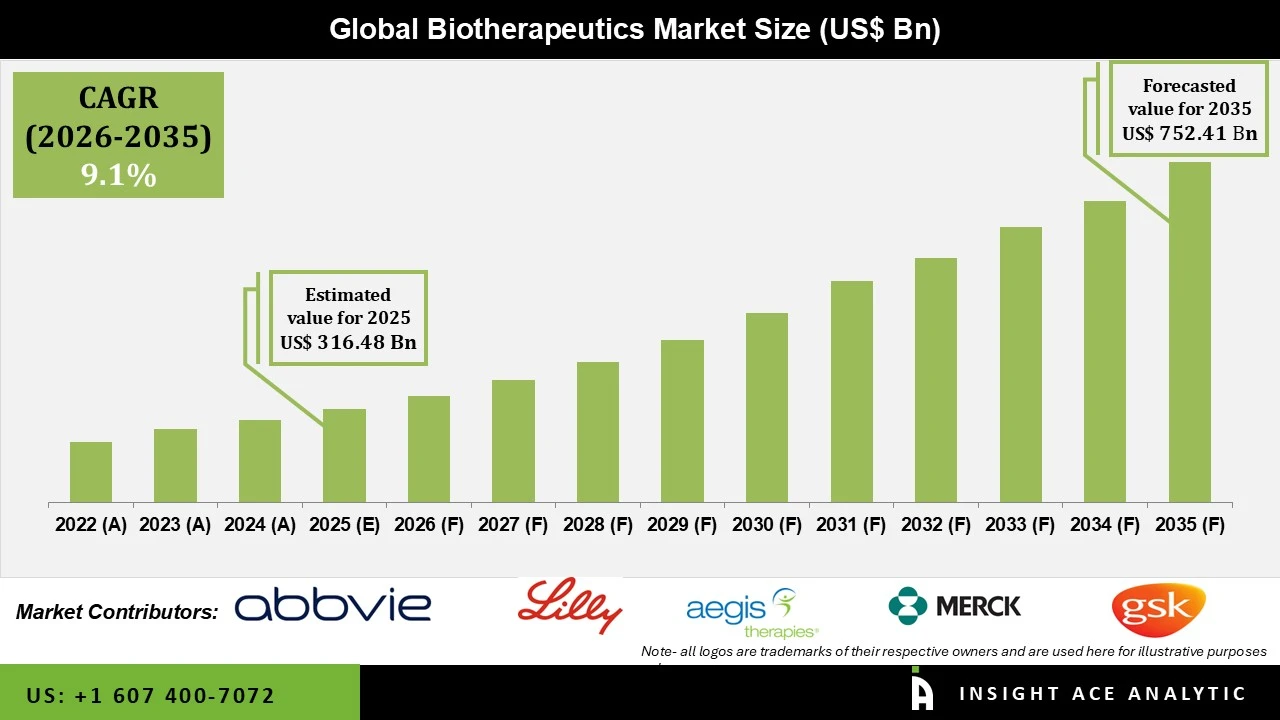

Biotherapeutics Market Size is valued at USD 316.48 Bn in 2025 and is predicted to reach USD 752.41 Bn by the year 2035 at a 9.1% CAGR during the forecast period for 2026 to 2035.

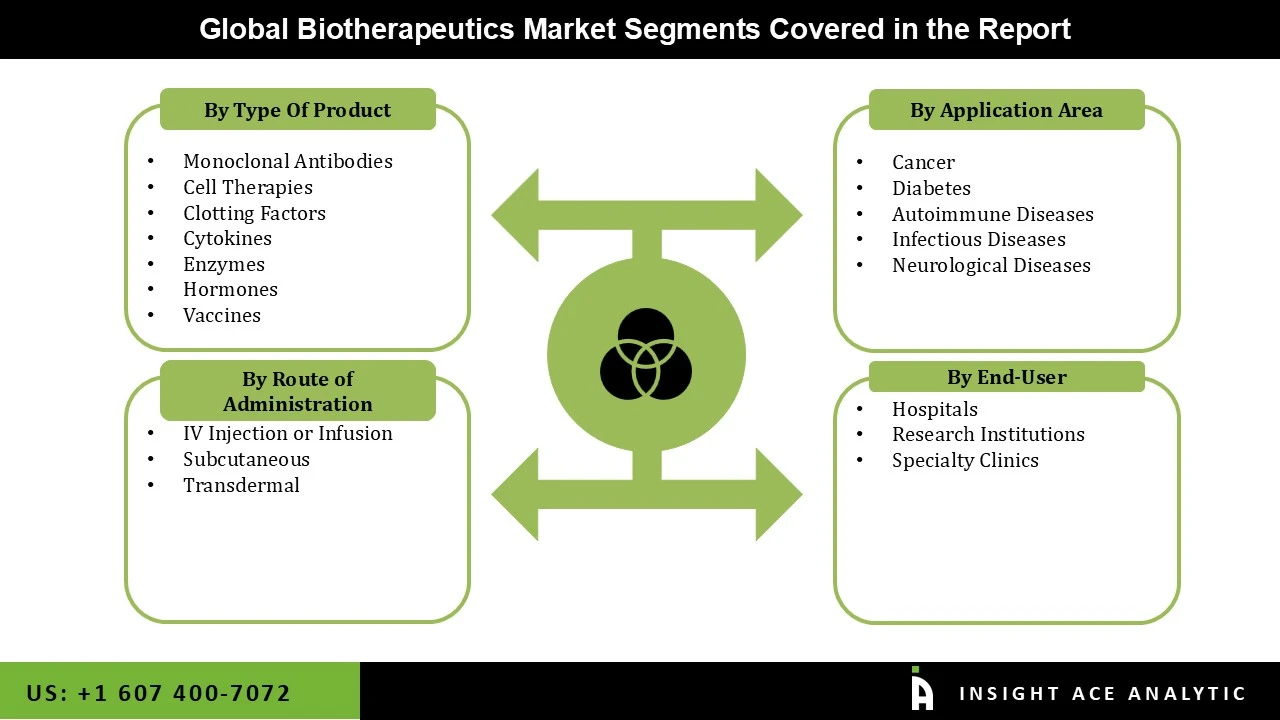

Biotherapeutics Market Size, Share & Trends Analysis Distribution by Type (Monoclonal Antibodies, Vaccines, Clotting Factors, Enzymes, Cytokines, Hormones, and Cell Therapies), Route of Administration (Subcutaneous, IV Injection or Infusion, and Transdermal), Application (Diabetes, Cancer, Infectious Diseases, Autoimmune Diseases, and Neurological Diseases), End-user (Hospitals, Specialty Clinics, and Research Institutions), and Segment Forecasts, 2026 to 2035

Biotherapeutics are pharmaceuticals that come from biological sources and work by interacting with particular parts of the human body to prevent, treat, or manage illnesses. It includes products such as monoclonal antibodies, vaccines, recombinant proteins, cell and gene treatments, and therapeutic enzymes, which are made utilizing living cells, microorganisms, or biological processes as opposed to conventional chemical medications. These treatments are extremely targeted and frequently more successful for complicated problems like cancer, autoimmune disorders, hereditary diseases, and chronic inflammatory conditions since they are made to target disease pathways at the molecular or cellular level. The increasing use of antibody-based biotherapeutics to target malignant cells and their growing application in other therapeutic areas have caused a significant growth in the biotherapeutics market.

The rising incidence of chronic and fatal illnesses like cancer, autoimmune diseases, diabetes, and uncommon genetic disorders is a prominent factor propelling the growth of the biotherapeutics market. The patients and medical professionals are becoming more aware of the drawbacks of traditional small-molecule medications, especially with regard to their unfavourable side effects and long-term effectiveness. Additionally, monoclonal antibodies, recombinant proteins, cell and gene treatments, and other biotherapeutics provide tailored treatment techniques that work on certain disease pathways, improving clinical results. The global adoption of biotherapeutic products is being greatly accelerated by this increased desire for individualized and precise therapies.

Furthermore, the biotherapeutics market is expanding significantly due to ongoing developments in biotechnology and biopharmaceutical research. The advances in drug development platforms, cell culture technology, and genetic engineering have increased the medicinal uses of biologics and improved production efficiency. The market is expanding because of increased R&D spending by biotechnology and pharmaceutical firms, as well as robust regulatory backing for innovative biologics. Moreover, the biotherapeutics market's long-term growth forecast is being reinforced by the growing biologics pipeline and the increasing approval rates of advanced medicines. Additionally, the biotherapeutics market is expanding due in large part to favourable regulatory frameworks and growing healthcare costs.

• AbbVie

• AstraZeneca

• Cubist Pharmaceuticals

• Bayer

• Eli Lilly

• Endo International

• FluGen

• Aegis Therapeutics

• Allergen

• GenBiotech

• GlaxoSmithKline

• Roche

• Sanofi

• Galena Biopharma

• Johnson & Johnson

• Medicure

• Novartis

• Takeda Pharmaceuticals

• Novo Nordisk

• Pfizer

• Merck

• Thermo Fisher Scientific

The growing occurrence of complicated and chronic diseases including cancer, autoimmune disorders, and genetic abnormalities is one of the major factors propelling the biotherapeutics market's expansion. The desire for targeted and disease-modifying medicines that are more effective and have fewer side effects than traditional small-molecule medications is rising as the global disease burden transitions from acute to chronic illnesses. Additionally, for certain disorders, biotherapeutics—such as recombinant proteins, cell and gene treatments, and monoclonal antibodies—are especially useful since they are made to act on particular biological pathways. Furthermore, growing clinical success rates, better knowledge of illness mechanisms, and ongoing biotechnology advancements are all speeding up adoption and greatly propelling the biotherapeutics market expansion.

One of the key obstacles facing the global biotherapeutics market is growing regulatory ambiguity. Regulators have difficulty creating precise criteria since biotherapeutic items involve innovative and diverse microbial strains. As these regulations are dynamic, producers may face major challenges as compliance requirements may alter or remain ambiguous, delaying the certification of new products. Additionally, the regulatory agencies like the FDA, EMA, and other international authorities are still creating frameworks to handle the special qualities of live biotherapeutics, which frequently do not fall under the purview of conventional pharmaceutical laws. Thus, the biotherapeutics market will be restricted by constantly monitoring legislative developments and modifying its tactics accordingly.

The Monoclonal Antibodies category held the largest share in the Biotherapeutics market in 2025. Their ability to treat various ailments, particularly those that have historically been challenging to treat—like some types of cancer and autoimmune diseases—is the primary factor behind their widespread use. More significant investments are made when mAbs are approved for new applications. The relevance of monoclonal antibodies (mAbs) is expanding in both clinical practice and research due to the increasing prominence of innovative therapy choices and the great accuracy that mAbs provide in targeting extremely specific disease pathways. Their benefits in improving treatment results are complemented by ongoing improvements in production methods that may lead to their increased accessibility.

In 2025, the hospitals category dominated the Biotherapeutics market, driven by the increasing number of complex and chronic illnesses that need sophisticated biologic treatments, including autoimmune diseases, cancer, and uncommon genetic abnormalities. Since biotherapeutics, such as monoclonal antibodies, vaccinations, and cell and gene therapies, require specialized infrastructure and qualified medical personnel, hospitals are the main locations for their diagnosis, administration, and monitoring. Additionally, the increase of tertiary care hospitals, the rise in inpatient admissions, and the expanding use of precision and personalized medicine all contribute to this expansion.

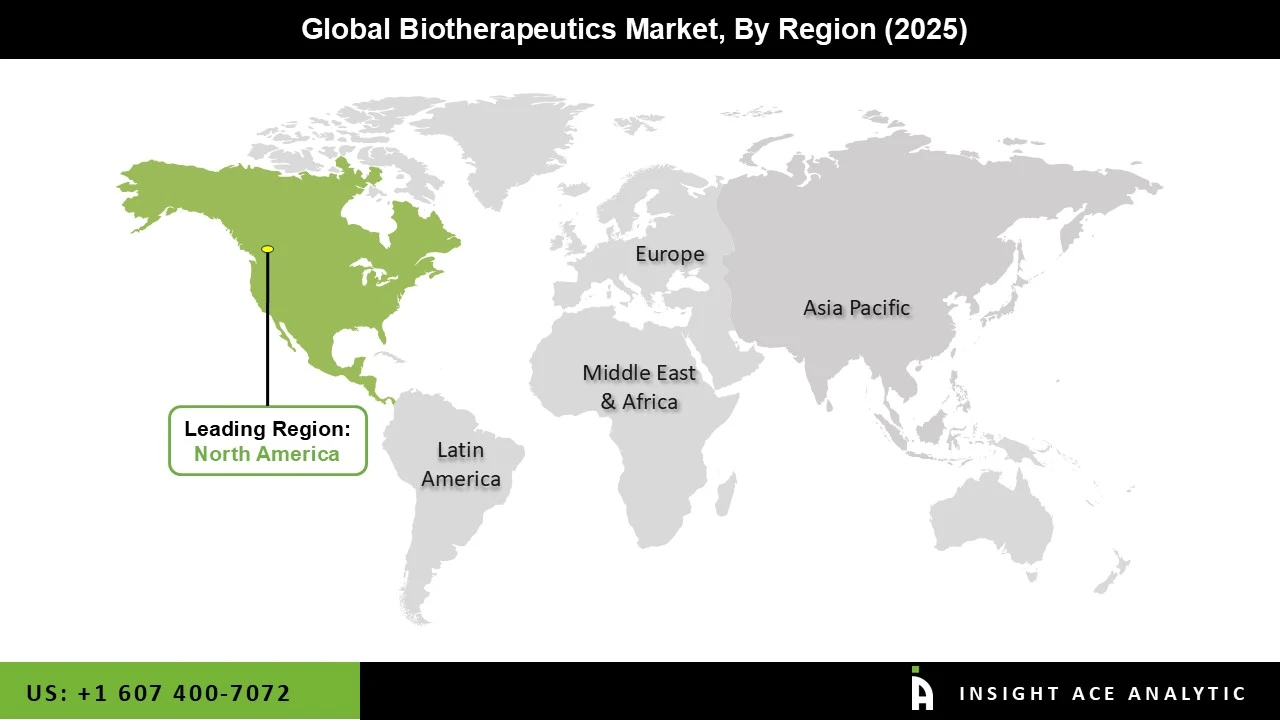

The Biotherapeutics market was dominated by the North America region in 2025, driven by a well-established healthcare system, widespread use of cutting-edge biologic treatments, and significant funding for biotechnology R&D. Strong clinical trial activity, a large number of top biopharmaceutical businesses, and advantageous regulatory frameworks that encourage innovation and expedite the commercialization of biologics are all advantages for the region. The need for monoclonal antibodies, recombinant proteins, and cell and gene therapies is being driven by the rising incidence of chronic diseases like diabetes, cancer, and autoimmune disorders. Furthermore, expanding biosimilar approvals, broad insurance coverage for biologics, and high healthcare spending are all facilitating market expansion and enhancing patient access.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 316.48 Bn |

| Revenue forecast in 2035 | USD 752.41 Bn |

| Growth Rate CAGR | CAGR of 9.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Route of Administration, Application, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | AbbVie, AstraZeneca, Cubist Pharmaceuticals, Bayer, Eli Lilly, Endo International, FluGen, Aegis Therapeutics, Dr. Reddy’s, Allergen, GenBiotech, GlaxoSmithKline, Roche, Sanofi, Galena Biopharma, Johnson & Johnson, Medicure, Novartis, Takeda Pharmaceuticals, Novo Nordisk, Pfizer, Merck, and Thermo Fisher Scientific |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Monoclonal Antibodies

• Vaccines

• Clotting Factors

• Enzymes

• Cytokines

• Hormones

• Cell Therapies

• Subcutaneous

• IV Injection or Infusion

• Transdermal

• Diabetes

• Cancer

• Infectious Diseases

• Autoimmune Diseases

• Neurological Diseases

• Hospitals

• Specialty Clinics

• Research Institutions

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.