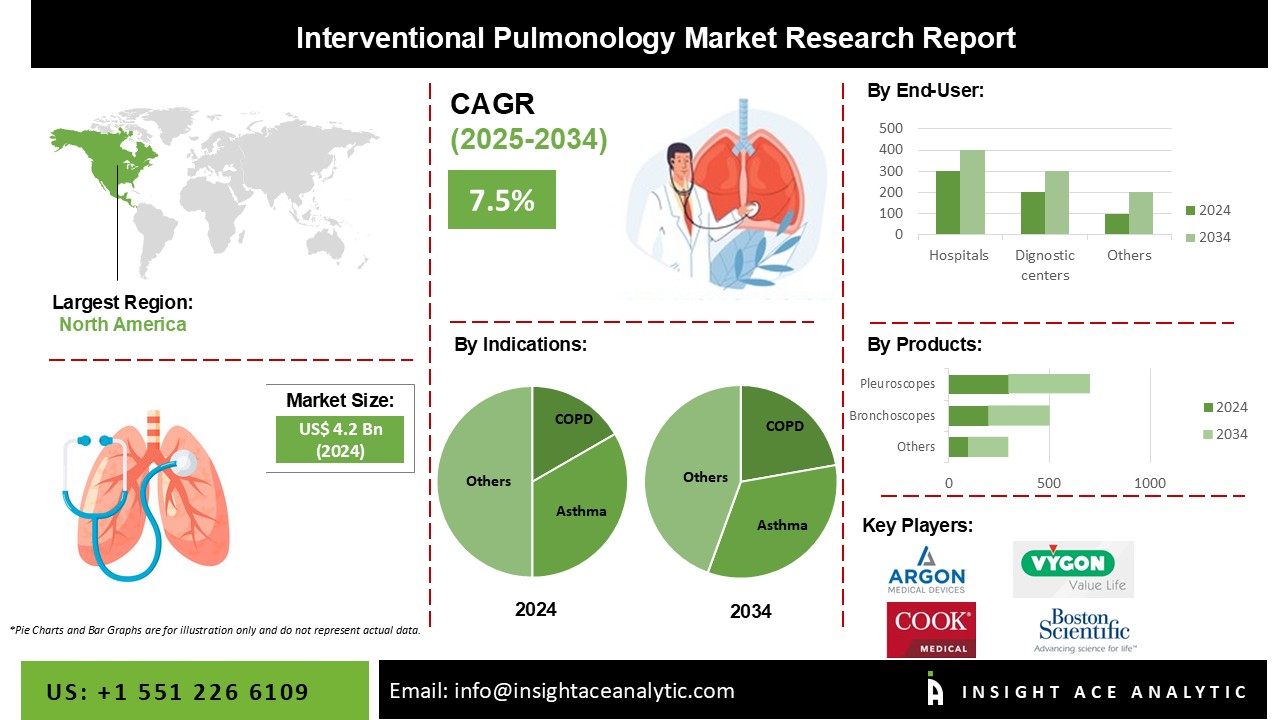

Interventional Pulmonology Market Size is valued at 4.2 Billion in 2024 and is predicted to reach 8.6 Billion by the year 2034 at a 7.5% CAGR during the forecast period for 2025-2034.

Interventional pulmonology uses non-surgical, minimally invasive procedures to diagnose and treat lung cancer, thoracic cancer, tracheal cancer, and other respiratory system problems. Endoscopic procedures are employed, which entail inserting an instrument into the human body to investigate and treat internal organs and tissues. Shortness of breath, coughing, and chest pain are just a few symptoms that interventional pulmonary medicine can help with. Interventional pulmonology is a relatively new field that has surged in popularity in the last decade. It employs sophisticated devices to detect and treat a wide range of lung disorders.

In addition to pulmonologists, cardiothoracic surgeons do interventional pulmonology therapies on a frequent basis. During the forecast period, factors such as rising lung cancer awareness and rising healthcare expenditure for research and development activities are expected to fuel market growth. However, the market's growth would be restricted by the associated patient risk, high maintenance costs, and barriers to entry for new enterprises. Increased use of e-cigarettes, rising healthcare expenses, and improved training programs for interventional pulmonologists are all possibilities.

The Interventional Pulmonology Market is segmented on the basis of indications, end-users and products. Based on indications, the market is segmented as COPD, Asthma, Lung Cancer, Tracheal & Bronchial Stenosis, and Other Indications. By end-users, the market is segmented into Hospitals and Ambulatory Surgical Centers, Diagnostic Centers and Specialty Clinics, and Other End-Users. By-products, the market is segmented into Bronchoscopes, Electromagnetic Navigation Bronchoscopy Systems, Pleuroscopes, Respiratory Endotherapy Devices, Airway Stents, Pleural Catheters, Endobronchial Valves, and Bronchial Thermoplasty Systems.

In 2021, the worldwide interventional pulmonology market was led by respiratory endotherapy devices and is projected to continue over the forecast period. Bronchoscopic and endoscopic diagnostics and surgery are performed using respiratory endotherapy equipment. Bias forceps, cytology brushes, aspiration needles, electrosurgery snares, foreign body removal tools, guide sheaths, and other similar devices used in endotherapy procedures include biopsy forceps, cytology brushes, aspiration needles, electrosurgery snares, and foreign body removal tools, guide sheaths, and other similar devices used in respiratory endotherapy procedures.

In 2021, the asthma category accounted for the majority of the global interventional pulmonology market. Asthma affects people of any age, but children are the most affected. Recurrent bouts of dyspnea and wheezing characterize the condition, which varies in severity and frequency from person to person. It can happen to an individual at any time of day or night.

North America, Europe, Latin America, Asia Pacific, the Middle East and Africa make up the worldwide interventional pulmonology market. North America is estimated to hold the highest share of the global interventional pulmonology market during the forecast period. However, due to an ageing population, changing sickness trends, and increased demands from healthcare facilities, the interventional pulmonology market in the Asia Pacific region is projected to expand substantially over the forecast period, making it a prominent region in the worldwide market.

| Report Attribute | Specifications |

| Market size value in 2023 | USD 4.2 Billion |

| Revenue forecast in 2031 | USD 8.6 Billion |

| Growth rate CAGR | CAGR of 7.5% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | By Indications, Products, End-User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Argon Medical, Body Vision Medical Ltd., Boston Scientific Corporation, C. R. Bard, Inc. (Becton, Dickinson and Company), CONMED Corporation, Cook Medical, ENDO-FLEX GmbH, Fujifilm Corporation, KARL STORZ SE & Co. KG, Medtronic, Olympus Corporation, Pennine Healthcare, PENTAX Medical, Pulmonx Corporation, Richard Wolf GmbH, Rocket Medical plc., TAEWOONG, and Vygon |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Indications -

By End-Users-

By Products-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.