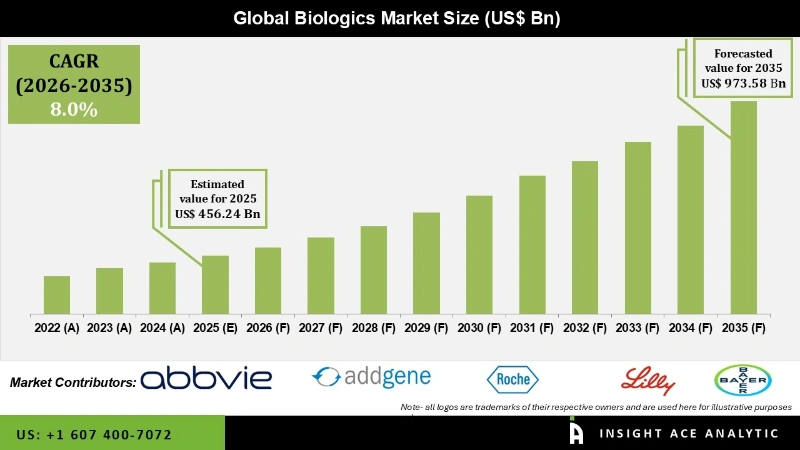

Global Biologics Market Size is valued at USD 456.24 Bn in 2025 and is predicted to reach USD 973.58 Bn by the year 2035 at a 8.0% CAGR during the forecast period for 2026 to 2035.

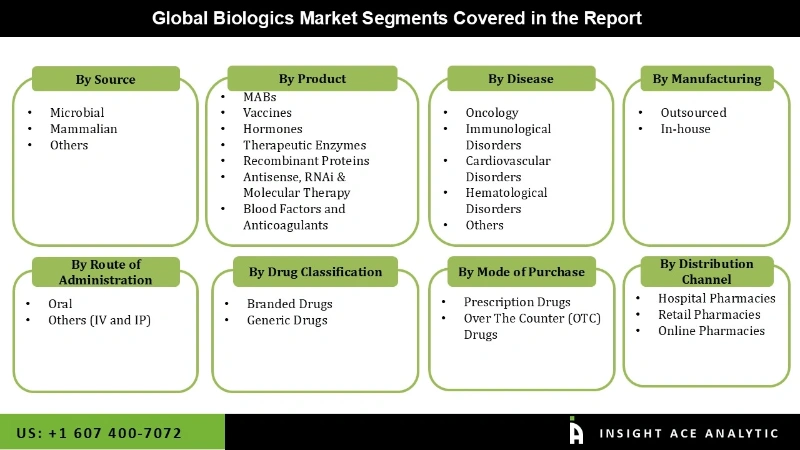

Biologics Market Size, Share & Trends Analysis Report By Source (Microbial, Mammalian, Others), By Product (MABs, Vaccines, Antisense, RNAi & Molecular Therapy, Recombinant Proteins, Others), By Disease (Oncology, Immunological Disorders, Cardiovascular Disorders, Hematological Disorders, Others), By Manufacturing (Outsourced, In-house), By Route of Administration, By Drug Classification, By Mode of Purchase, By Distribution Channel, By Region, And Segment Forecasts, 2026 to 2035.

Biologics are drugs manufactured from organic materials that can treat various disorders, including immune-related illnesses such as Crohn's disease, psoriasis, ankylosing spondylitis, and rheumatoid arthritis. The intriguing feature is that biologics are isolated from various natural sources, whether carbohydrates, proteins, nucleic acids, or a complex mixture of these materials.

The improved understanding of disease's genetic and molecular foundation has paved the way for creating various tailored treatments. Recmbinant proteins, for example, help the immune system identify and bind foreign molecules. Advances in manufacturing capability development are expected to increase biopharmaceutical production capacity. The use of single-use systems in the synthesis and processing of biopharmaceuticals is also among these breakthroughs.

However, the COVID-19 pandemic had a large market impact. During the pandemic, there was a huge demand for biologics, which contributed significantly to the market's rise. For example, the National Research Council of Canada and China-based CanSino Biologics collaborated on the development of a COVID-19 vaccine in Canada in May 2020. During the pandemic, the considerable research and development operations for the treatment of COVID-19 contributed considerably to the expansion of the biologics market.

The biologics market is segmented based on source, product, disease, manufacturing, route of administration, drug classification, mode of purchase, distribution channel. Based on source, the market is segmented as microbial, mammalian, and others. The products segment includes MABs, Vaccines, Antisense, RNAi & Molecular Therapy, Recombinant Proteins, Others. By disease category, the market is segmented into Oncology, Immunological Disorders, Cardiovascular Disorders, Hematological Disorders, Others. Manufacturing segment includes Outsourced, In-house, Route of Administration segment includes Oral and Others (IV and IP), Drug Classification segment includes Branded & Generic Drugs, Mode of Purchase segment includes Prescription & Over-The-Counter (OTC) Drugs, and Distribution Channel segment includes Hospital, Retail and online.

The microbial category is expected to hold a major share of the global Biologics Market in 2022. This is attributed to the high number of medications developed by employing these products. Microbial expression systems commonly include E. Coli and yeast. Recombinant insulin, granulocyte-macrophage colony-stimulating factor, platelet-derived growth factor, and recombinant interferon are all products of these expression systems. Companies utilizing microbial systems include Johnson & Johnson, Novartis, and Genentech.

The oncology segment is projected to grow at a rapid rate in the global Biologics Market owing to the rising incidence of cancer coupled with the presence of different R&D programs. These efforts include cancer-eradication gene treatments and antisense therapeutics. Additionally, oncology is expected to retain its supremacy during the predicted period. The increased use of goods to lessen the number of adverse effects connected with the use of cancer chemotherapy is one of the drivers for the expected growth.

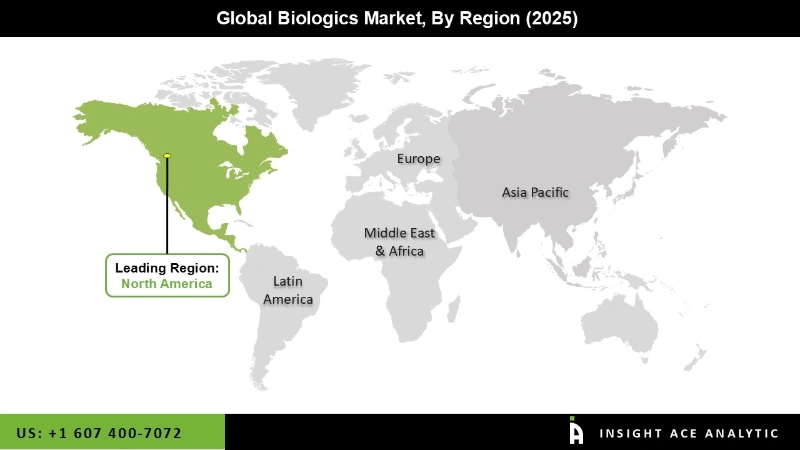

The North America Biologics Market is expected to register the highest market share in terms of revenue in the near future. This can be attributed to significant corporations, engaging reimbursement policies, and considerable R&D investment. In the United States, biologics account for around 38% of overall medication spending. Approval of new biologic drugs will likely boost market expansion throughout the projection period; for example, the US FDA approved 21 BLAs in 2021. Because of increased R&D spending for biologic development, as well as the availability of a high number of FDA-approved biologics in the country, the United States market for biologics will account for a considerable proportion in 2021. In addition, Germany holds the largest proportion of the European biologics market.

The presence of a sophisticated manufacturing sector, favorable reimbursement, the availability of several approved medications, and the target patient group all contribute to this market's supremacy in Europe.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 456.24 Bn |

| Revenue Forecast in 2035 | USD 973.58 Bn |

| Growth rate CAGR | CAGR of 8.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Source, Product, Disease, Manufacturing, Route of Administration, Drug Classification, Mode of Purchase, Distribution Channel |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Samsung BioLogics; Amgen; Novo Nordisk A/S; AbbVie Inc.; Sanofi; Pfizer Inc.; Inc.; GSK group of companies; Merck & Co., Celltrion; Precision Biologics, Inc.; Johnson & Johnson Services, Inc; Eli Lilly and Company; Novartis AG; Merck KGaA; Bayer AG; F. Hoffmann-La Roche Ltd; and AstraZeneca |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Biologics Market By Source

Biologics Market By Product

Biologics Market By Disease

Biologics Market By Manufacturing

Biologics Market By Route of Administration

Biologics Market By Drug Classification

Biologics Market By Mode of Purchase

Biologics Market By Distribution Channel

Biologics Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.