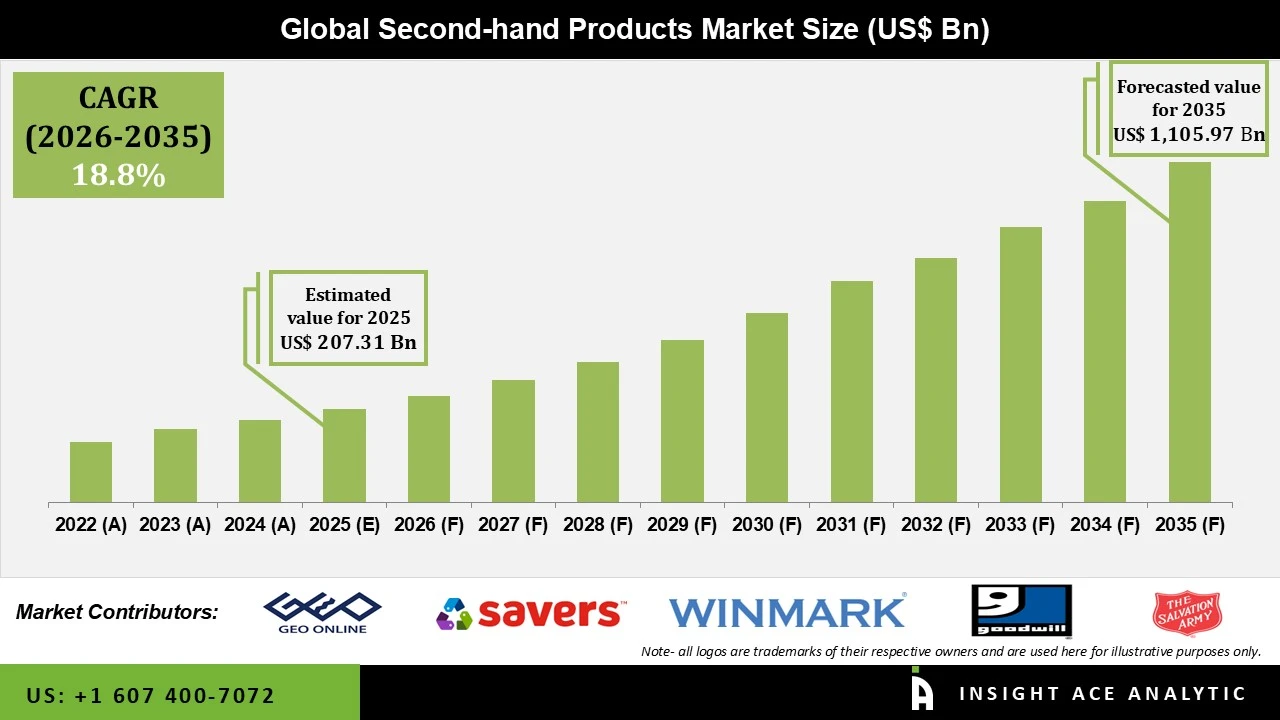

Second Hand Products Market Size is valued at USD 207.31 Bn in 2025 and is predicted to reach USD 1,105.97 Bn by the year 2035 at a 18.8% CAGR during the forecast period for 2026 to 2035.

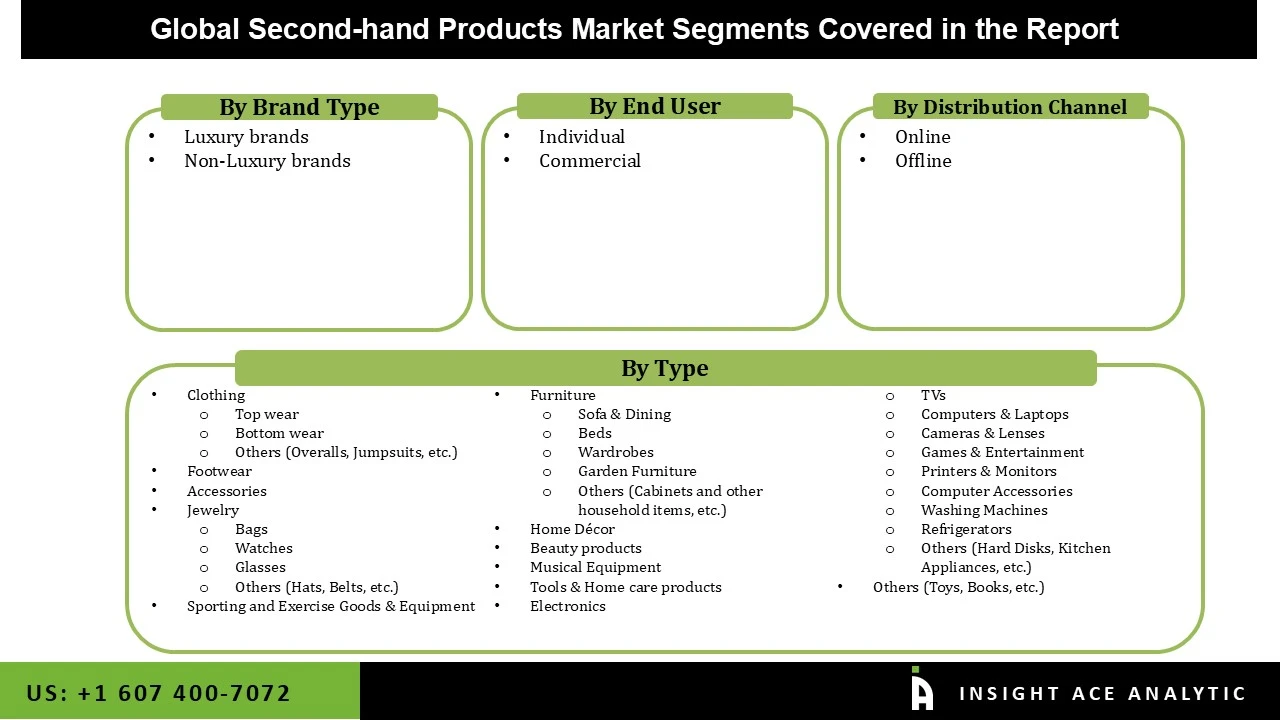

Second Hand Products Market Size, Share & Trends Analysis Distribution by Product Type (Clothing, Footwear, Accessories, Sporting and Exercise Goods & Equipment, Furniture, Home Décor, Beauty products, Musical Equipment, Tools & Home care products, Electronics, Others (Toys, Books, etc.)), By Brand Type (Luxury brands, Non-Luxury brands), By End-use (Individual, Commercial), By Distribution Channel (Online, Offline), By Region and Segment Forecasts, 2026 to 2035

The second-hand products market is related to the purchase, sale, and subsequent use of second-hand products. These products, which include electronics, cars, clothing, furniture, and home decor, among others, serve as an alternative to new products. The market has experienced tremendous growth over the years due to increased consumer knowledge about the savings and benefits associated with second-hand products. Online platforms and social media have played a critical role in the growth of the market by creating a link between the buyers and sellers. Second-hand products can be considered as products that have been used and are still functional.

Shifting customer perspectives, digital innovation, and the adoption of circular economy ideas throughout retail ecosystems are all contributing to the structural restructuring of the worldwide market for second hand goods. In order to reduce textile waste and prolong product lifecycles, customers are increasingly emphasizing ecologically responsible consumption, making sustainability a key factor in purchasing decisions. Reuse, resale, and trade-in models are examples of circular activities that are becoming more widely accepted, and purchase decisions are increasingly being influenced by sustainability.The major applications of the market are consumer electronics (smartphones, laptops, tablets, and home appliances), clothing and accessories (branded clothing, shoes, handbags, and watches), automobiles and vehicles (used cars and motorcycles), and home furniture and décor.

Moreover, brand-led resale programs are transitioning from experimental sustainability initiatives to strategically integrated revenue channels. Leading brands are embedding resale into their core business models through proprietary platforms and third-party partnerships, using trade-in credits and buy-back schemes to enhance customer retention, acquisition, and lifetime value. The rapid expansion of branded resale initiatives highlights a shift in industry perception, positioning second-hand retail not merely as an environmental solution but as a scalable commercial growth engine. But factors such as apprehensions about the quality of the product, lack of post-sales services, and government restrictions in some areas may hamper growth. Yet, the market is doing well as people are adopting eco-friendly and affordable shopping practices.

The key driver for the second-hand products market is the increasing concern for affordability and sustainability among consumers. With the rising costs of new products, especially electronics, automobiles, and luxury brands, consumers are increasingly opting for second-hand products as a viable alternative that enables them to enjoy quality products at an affordable price. In addition to the cost factor, there is also an increasing concern for environmental sustainability, including waste management and the ill effects of overproduction on the environment. This has led to a growing concern among consumers to make sustainable purchasing decisions, aligning with the principles of the circular economy by extending the life cycle of products. A growing proportion of global consumers are expected to engage in second-hand purchasing over the coming years, driven by environmental awareness as well as the experiential appeal associated with discovering unique pre-owned items. Moreover, the ease of online resale platforms has also contributed to the growing popularity of second-hand products.

The main challenge for the second-hand products market is concerns over product quality, reliability, and after-sales support. Many consumers hesitate to purchase pre-owned items due to fears about their condition, durability, or safety. Unlike new products, second-hand goods often come with limited or no warranty, minimal return options, and uncertain maintenance history, which can reduce buyer confidence. Additionally, regulatory and legal restrictions in certain regions regarding resale practices or taxes on used goods can further hinder market growth.

Among the different product types, the clothing category is expected to be the major contributor to the second-hand products market. The segment growth is pushed by high product replacement frequency, strong consumer acceptance, and rapid digital scalability. Clothing generates a continuous resale supply, as consumers refresh their wardrobes more frequently than consumers in other product categories, supporting high transaction volumes and inventory turnover. The segment has profited enormously from sustainability-driven purchasing behavior, as apparel remains one of the biggest contributors to global waste, positioning resale as a preferred circular alternative. In recent times, Consumers Have actively chosen pre-owned clothing to reduce textile waste and their carbon footprint, positioning apparel resale as the most sustainability-aligned segment. Supported by strong participation from Gen Z and Millennials and extensive platform investment, second-hand apparel continues to lead the overall market in both revenue share and growth momentum.

The non-luxury brands category is expanding at the fastest pace in the second-hand products market. This is because the non-luxury brands category is fueled by the affordability of second-hand products like electronics, clothing, and home goods. The fact that these products are replaced frequently and the ease of online shopping also contribute to their popularity. Moreover, the growing awareness of consumers about sustainable and frugal shopping practices also leads to the second-hand purchase and reuse of non-luxury products. Even though luxury brands are important, especially in the clothing and accessories market, non-luxury brands are fueling the growth of the market at a faster pace.

Asia Pacific represents the largest revenue contributor to the global second-hand products market, driven by a substantial consumer base, high transaction volumes, and a rapidly expanding digital resale ecosystem. The region undergoes robust price-sensitive demand across apparel, consumer electronics, and home products, resulting in high resale turnover despite lower average selling prices. Key countries, including China, Japan, South Korea, India, and Australia, play pivotal roles, with China and Japan accounting for a significant share of regional resale revenue due to advanced recommerce infrastructure and strong consumer engagement. Increased prevalence of mobile-first marketplaces, widespread adoption of resale culture, along with the increasing presence of organized second-hand retail chains, have accelerated further market growth. Furthermore, heightened sustainability awareness, overconsumption of fast fashion, and the growing acceptance of pre-owned goods among Generation Z and Millennial consumers are expected to drive significant market growth during the forecast period.

• January 2026: Ingka Group, the largest IKEA retailer, launched a second-hand marketplace in Sweden, with plans to expand the platform to Spain, Norway, Portugal, and Poland. The initiative enables customers to buy and sell pre-owned IKEA products locally, supporting IKEA’s sustainability goals by extending product life cycles, reducing waste, and making sustainable living more affordable.

• In Nov 2025, Goodwill launched a store modernization strategy and opened 42 net-new retail locations. The new stores were larger, brighter, and often located in higher-income neighborhoods. This expansion aimed to attract a broader customer base, including wealthier donors and Gen Z shoppers, and supported Goodwill’s efforts to strengthen its retail presence.

• In August 2025, Winmark announced that its franchise network reached a major milestone by recycling more than 2 billion items since 2010. The network included resale brands such as Plato’s Closet, Once Upon A Child, Style Encore, Play It Again Sports, and Music Go Round. Through its five resale brands, Winmark helped communities across North America buy and sell gently used clothing, sporting goods, and musical instruments. By reusing these items, Winmark reduced waste sent to landfills and supported a large-scale circular economy.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 207.31 Bn |

| Revenue forecast in 2035 | USD 1,105.97 Bn |

| Growth Rate CAGR | CAGR of 18.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product Type, Brand Type, End-use, Distribution Channel and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Geo Holdings Corporation, Savers Value Village Inc, Winmark Corp, Goodwill, Salvation Army, Plato’s Closet, Savers, Uptown Cheapskate, Buffalo Exchange, Crossroads Trading, The RealReal, Wasteland, Beacon's Closet, Pavement, Leopard Lounge, ThredUp, OfferUp, Mercari |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.