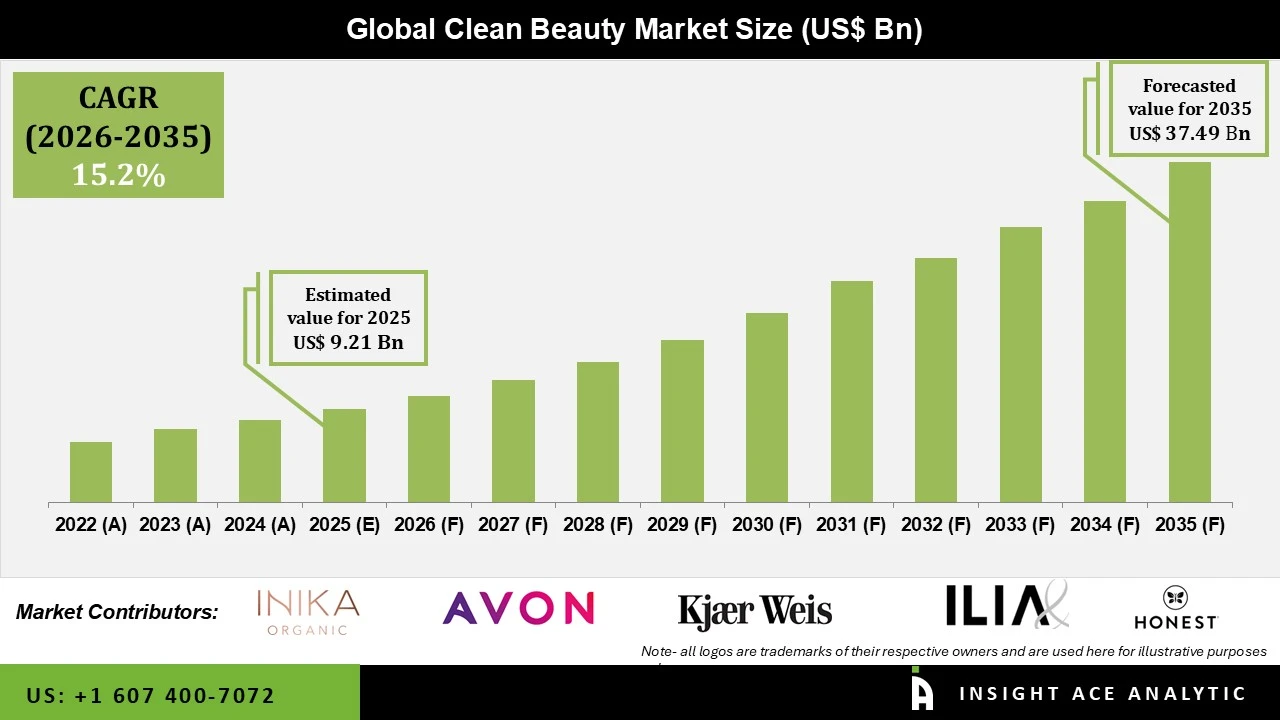

Clean Beauty Market Size is valued at USD 9.21 Billion in 2025 and is predicted to reach USD 37.49 Billion by the year 2035 at a 15.2% CAGR during the forecast period for 2026 to 2035.

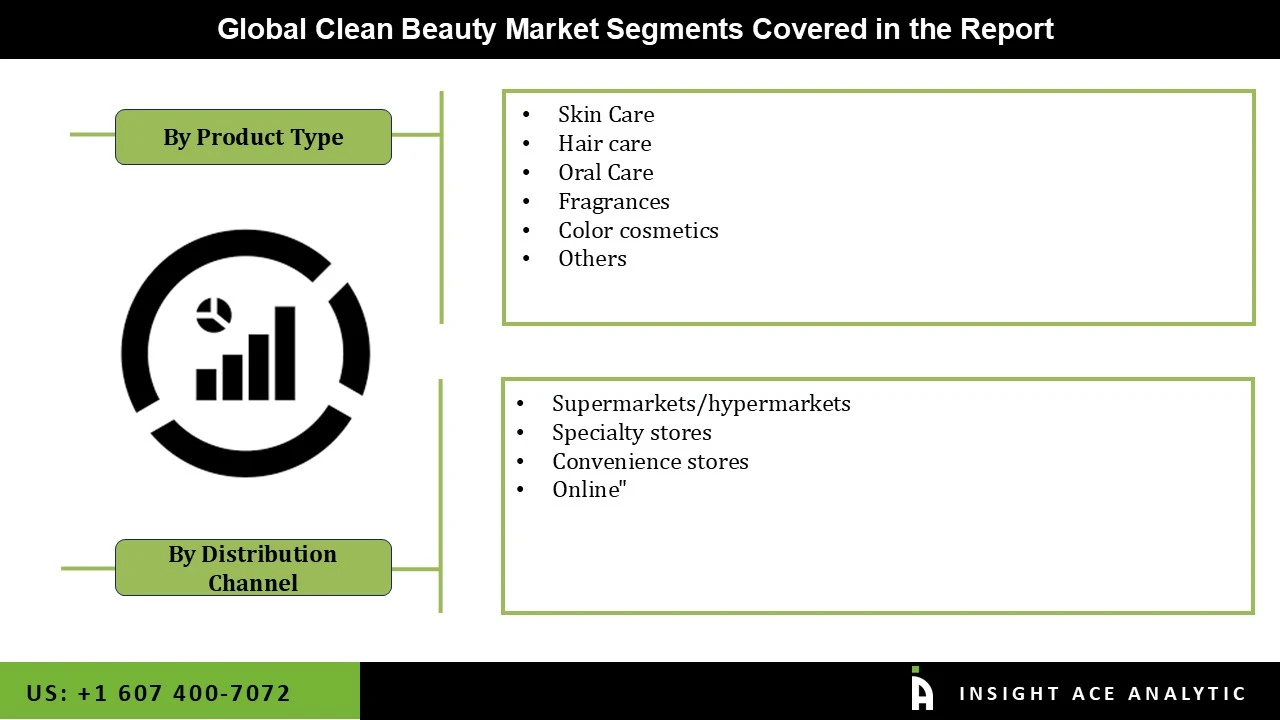

Clean Beauty Market Size, Share & Trends Analysis Report By Product Type (Skin Care, Hair care, Oral Care, Fragrances, Color Cosmetics, Others), By Distribution Channel (Supermarkets/hypermarkets, Specialty stores, Convenience stores, Online), By Region, And Segment Forecasts, 2026 to 2035.

Toxin-free and green beauty products that aren't supposed to be organic or natural are referred to as "clean beauty." These products contain clear ingredient labels and are safe to use on the face, preventing skin harm from chemicals. The clean beauty industry is primarily driven by increased demand for natural plant-based beauty products. However, high production costs are a crucial hindrance to the clean beauty business. Manufacturers have been encouraged to launch new products as research and development investments have increased due to the popularity of clean beauty products. An increasing number of women prefer anti-ageing products, which make up a significant clean beauty products market sector over the upcoming years.

Youngsters are expected to respond positively to the rising celebrity involvement in the promotion of sustainable beauty products. In addition, rising marketing for toxin-free and environmentally friendly items will propel the market forward. Furthermore, increasing R&D efforts, government initiatives to utilize sustainable components in manufacturing, and investments by major players are likely to provide lucrative revenue growth opportunities for participants in the global clean beauty market over the forecast period.

However, the high cost of clean beauty coupled with the COVID-19 outbreak may limit the growth of the target market during the forecast period. Furthermore, increasing R&D activities, government initiatives to use sustainable components for production, and investments by prominent players are factors expected to create lucrative growth opportunities in terms of revenue for players operating in the global clean beauty market over the forecast period.

The Clean beauty market is segmented based on product and distributional channel. Based on product, the market is segmented as Skin Care, Hair care, Oral Care, Fragrances, Color Cosmetics and Others. By distributional channel, the market is segmented into Supermarkets/hypermarkets, Specialty stores, Convenience stores and online.

The Online category is expected to hold a major share in the global clean beauty market in 2024 due to a rise in collaboration, mergers, and acquisitions for the development of clean beauty products. People's shopping power has been significantly affected by the internet distribution channel, which provides benefits such as doorstep delivery, simple payment options, substantial savings, and the availability of a wide range of products on a single platform. This may generate tremendous opportunities to fuel the global clean beauty market during the projection period.

The skin care segment is projected to grow at a rapid rate in the global clean beauty market. Increasing demand for face creams, sunscreens, and body lotions around the world is likely to boost market growth during the forecast period. Another factor boosting the market's growth is growing knowledge of the harmful effects of chemicals and synthetic products. Furthermore, there is an increasing demand for clean beauty products market over the upcoming years. Furthermore, the growing e-commerce sector is expected to enhance market growth even more, especially in countries such as the US, Germany, UK, China, and India.

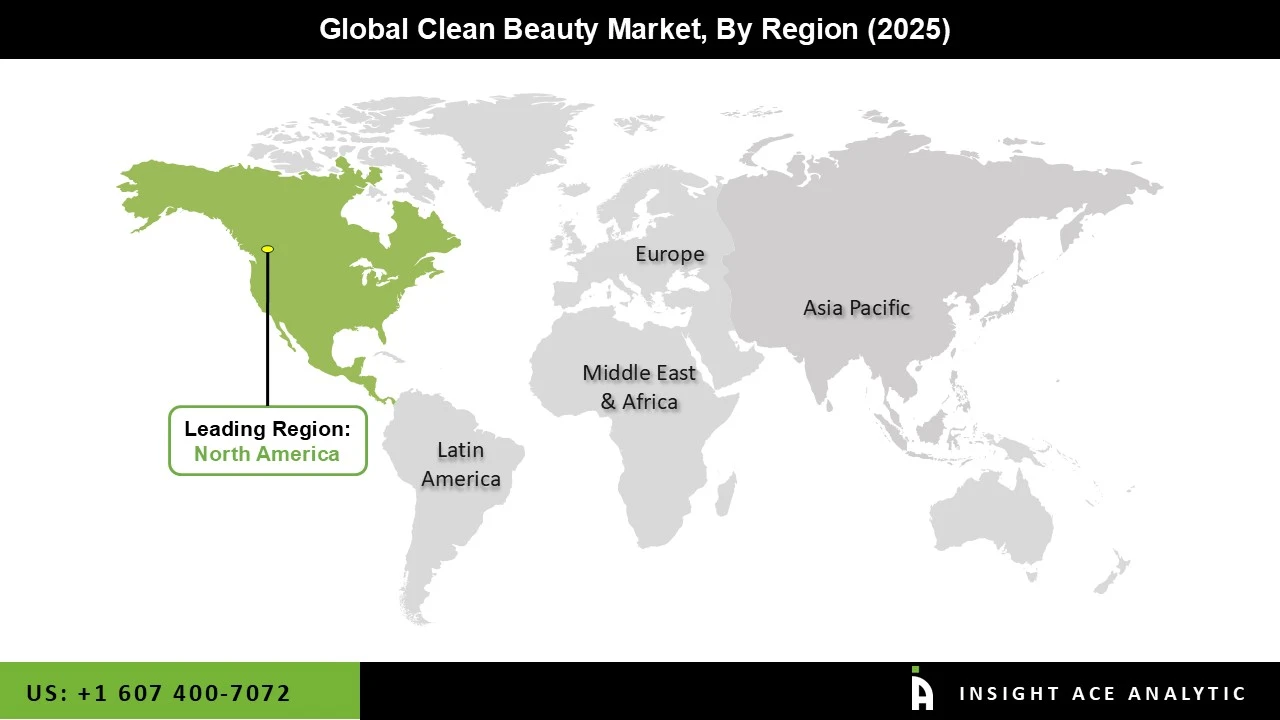

The North America Clean beauty market is expected to register the highest market share in terms of revenue soon. This can be attributed to the strong focus on the environment in the region, with the increasing adoption of clean beauty in different industries. The growth of the market in the region is attributed to aggressive marketing strategies and increasing online sales of these organic beauty products.

The region is home to one of the prominent cosmetics industries, which will contribute to the global clean beauty product market during the forecast period. Furthermore, cosmetics businesses' ongoing developments are projected to boost market growth soon. Similarly, in the coming years, the growth of the dietary supplement market is foretold to show a significant increase in the use of nutritional products, such in North America and Europe.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 9.21 Billion |

| Revenue Forecast In 2035 | USD 37.49 Billion |

| Growth Rate CAGR | CAGR of 15.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, By Distribution Channel |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | INIKA, Avon, Honest Beauty, ILIA, Zuid Organic, Kare Weis, RMS Beauty Lilah b., Juice Beauty, Ere Perez, Mineral Fusion, allure, Vapor, bare Minerals, Bite Beauty, Weleda , Credo Beauty, Burt's Bees, Inc. Estée Lauder, Lush , Naked Poppy, Inc. Beauty counter, A ether Beauty, Prima, Ritual, Youth to The People Inc., INNERSENSE ORGANIC BEAUTY INC., Pipette, Vapor Organic Beauty Inc., Hear Me Raw, Opacite, and Other Prominent Players. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Clean Beauty Market By Product Type

Clean Beauty Market By Distribution Channel

Clean Beauty Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.