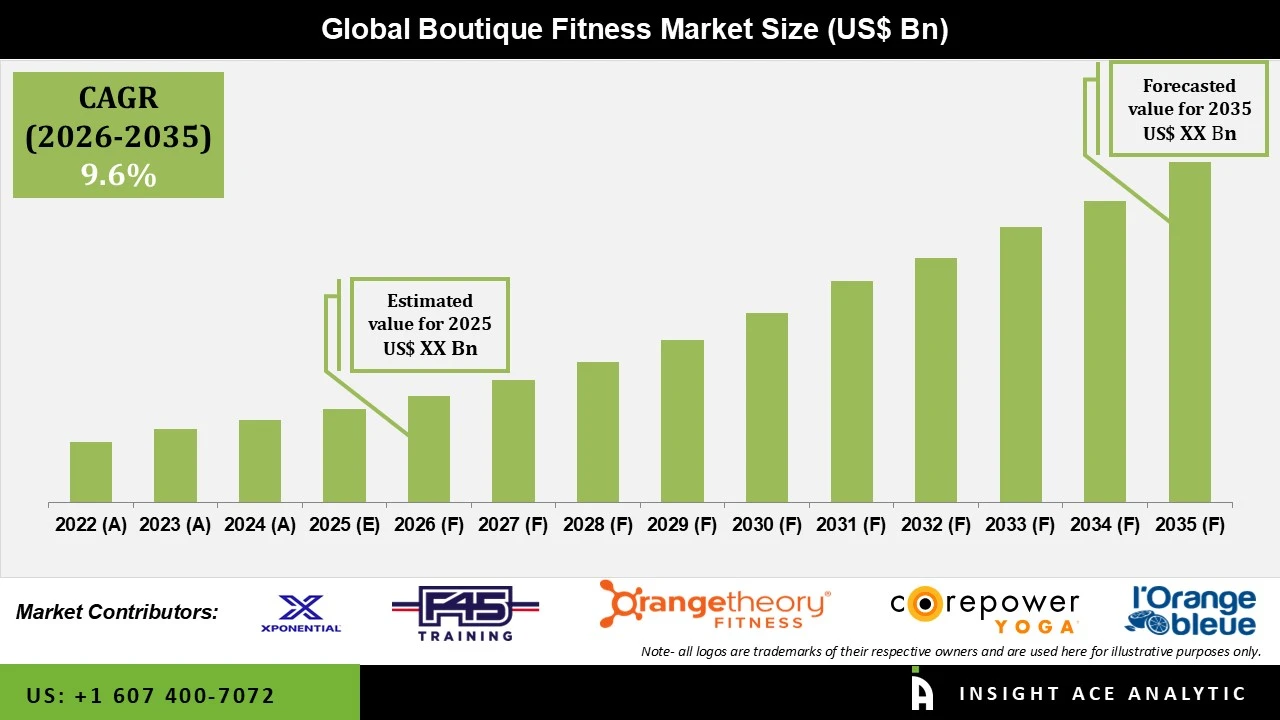

Boutique Fitness Market Size is predicted to grow at a 9.6% CAGR during the forecast period for 2026 to 2035.

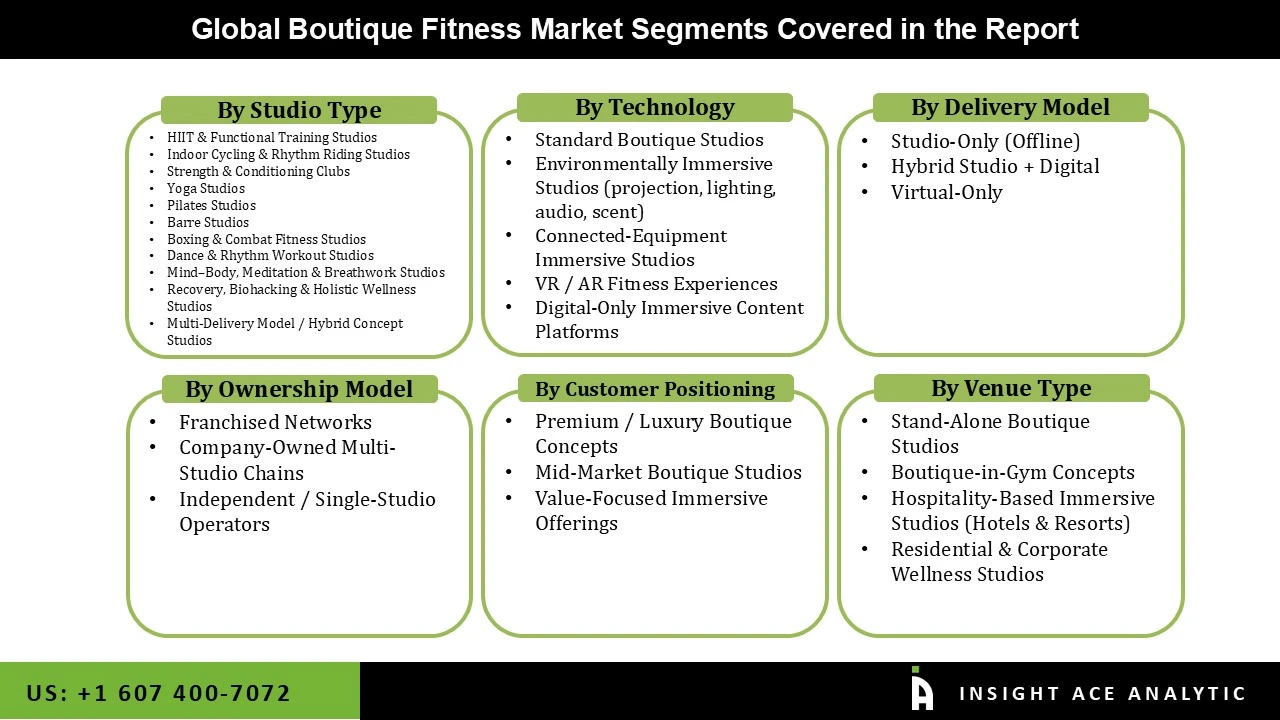

Boutique Fitness Market Size, Share & Trends Analysis Distribution by Studio Type(HIIT & Functional Training Studios, Indoor Cycling & Rhythm Riding Studios, Strength & Conditioning Clubs, Yoga Studios, Pilates Studios, Barre Studios, Boxing & Combat Fitness Studios) ,By Technology(Standard Boutique Studios, Environmentally Immersive Studios, Connected-Equipment Immersive Studios, VR / AR Fitness Experiences, Digital-Only Immersive Content Platforms), By Delivery Model(Studio-Only (Offline), Hybrid Studio + Digital, Virtual-Only),By Ownership Model( Franchised Networks, Company-Owned Multi-Studio Chains, Independent / Single-Studio Operators), By Customer Positioning(Premium / Luxury Boutique Concepts, Mid-Market Boutique Studios, Value-Focused Immersive Offerings),By Venue Type(Stand-Alone Boutique Studios, Boutique-in-Gym Concepts, Hospitality-Based Immersive Studios (Hotels & Resorts), Residential & Corporate Wellness Studios)and Segment Forecasts, 2026 to 2035

The global boutique fitness market is the sector of the fitness industry that delivers premium, focused, and member-centric workout experiences in small studios. Boutique studios focus on specialized programs such as HIIT, functional training, yoga, pilates, cycling, and strength training, offering a more intimate and motivating environment compared to traditional gyms. These studios emphasize community, expert guidance, and immersive experiences, helping members stay committed and achieve measurable fitness results. The rise of technology-enabled workouts, hybrid fitness models, and flexible scheduling is further expanding the market. With increasing health awareness, urbanization, and disposable incomes, boutique fitness is becoming a preferred choice for individuals looking for efficient, enjoyable, and effective fitness solutions worldwide.

The global boutique fitness industry is being accelerated by the growing demand for personalized and specialized workout experiences. Consumers are increasingly seeking programs that are tailored to their individual goals and fitness levels. Boutique studios focus on creating immersive, motivating, and community-driven environments that encourage long-term participation. The integration of technology, connected equipment, wearable devices, and hybrid fitness models further enhances convenience and engagement. Rising awareness of overall health and wellness, coupled with urban lifestyles and the desire for premium, high-quality, and socially interactive experiences, is driving the sustained growth of the global boutique fitness market.

The expansion of the global boutique fitness market is being fueled by the growing demand for personalized, results-driven, and engaging workout experiences. Boutique studios offering HIIT, yoga, Pilates, cycling, and functional training are increasingly popular, while technology-enabled and hybrid fitness models are further broadening their reach. However, the market also faces certain challenges, including the high cost of memberships, the need to maintain consistent quality and trainer expertise, and competition from traditional gyms or digital fitness platforms. For upcoming years, innovation, immersive experiences, and community-focused programs are expected to overcome these challenges and support the sustained growth of the global boutique fitness market.

• Xponential Fitness

• F45 Training

• Orangetheory Fitness

• Barry’s

• SoulCycle

• Equinox Group

• CorePower Yoga

• CrossFit

• Solidcore

• Club Pilates

• Pure Barre

• YogaSix

• StretchLab

• BFT (Body Fit Training)

• Rumble Boxing

• CycleBar

• Row House

• SLT

• The Bar Method

• Burn Boot Camp

• 9Round

• Cult.fit / Cure.fit

• L’Orange Bleue

• TRIB3

• Viva Leisure

• BoxUnion

• Title Boxing Club

• Physique 57

• Les Mills (Immersive Fitness, The Trip)

• Black Box VR

• Studio Society

• Aviron

• Others

The global boutique fitness market is primarily driven by the growing demand for personalized and specialized workout experiences. Modern fitness enthusiasts are seeking programs tailored to their individual goals, abilities, and schedules, rather than one-size-fits-all routines. Boutique studios accommodate this need by offering customized sessions in formats, ensuring that every member gets the right level of intensity and guidance. By focusing on personal attention, measurable results, and goal-oriented programs, these studios create a motivating and engaging environment that keeps members committed and encourages long-term participation, making personalization the key driver of market growth.

One of the main challenges facing the global boutique fitness market is the high cost of memberships. Boutique studios offer specialized programs, personalized coaching, and premium facilities, which make memberships more expensive than traditional gyms or digital fitness alternatives. This premium pricing can limit accessibility for many potential customers, particularly in price-sensitive regions or among younger demographics with lower disposable incomes. As a result, while boutique studios deliver high-quality and engaging fitness experiences, the high membership cost can slow adoption, restrict market reach, and confine the market to a niche audience, posing a significant restraint on overall growth.

The global boutique fitness market is segmented across six key dimensions: studio type, technology, delivery model, ownership model, customer positioning, and venue type. By studio type, it includes HIIT and functional training studios, indoor cycling and rhythm riding studios, strength and conditioning clubs, yoga studios, Pilates studios, barre studios, and boxing and combat fitness studios, catering to diverse workout needs. Based on technology, the market ranges from standard boutique studios to environmentally immersive studios, connected-equipment immersive studios, VR and AR fitness experiences, and digital-only immersive content platforms. By delivery model, offerings are classified into studio-only (offline), hybrid studio plus digital, and virtual-only formats. The market is further defined by ownership structures such as franchised networks, company-owned multi-studio chains, and independent or single-studio operators.

Customer positioning segments the market into premium or luxury boutique concepts, mid-market boutique studios, and value-focused immersive offerings. Finally, by venue type, boutique fitness services operate through stand-alone studios, boutique-in-gym concepts, hospitality-based immersive studios in hotels and resorts, as well as residential and corporate wellness studios, highlighting the wide range of operating environments.

The connected-equipment immersive studios category is emerging as a key driver in the boutique fitness market, fueled by the growing demand for personalized and engaging workout experiences. These studios are favored for their ability to deliver real-time performance tracking, interactive displays, and gamified challenges, making workouts both motivating and effective. The need for connected-equipment studios is further increased by the rise of hybrid fitness models, where members seek the flexibility to continue workouts both in-studio and at home. Their focus on functional movements, holistic fitness, and member engagement ensures long-term participation and high customer satisfaction.

HIIT and functional training studios are gaining momentum in the boutique fitness market due to the rising demand for fast, results-driven workouts. These studios stand out for offering high-intensity sessions that combine strength, endurance, and functional movements, allowing members to achieve maximum results in minimal time. The segment is further boosted by the growing popularity of community-driven classes, personalized coaching, and performance tracking, which keep participants engaged and motivated. Morever, emphasis on motivation, community, and measurable results ensures high member satisfaction and long-term participation.

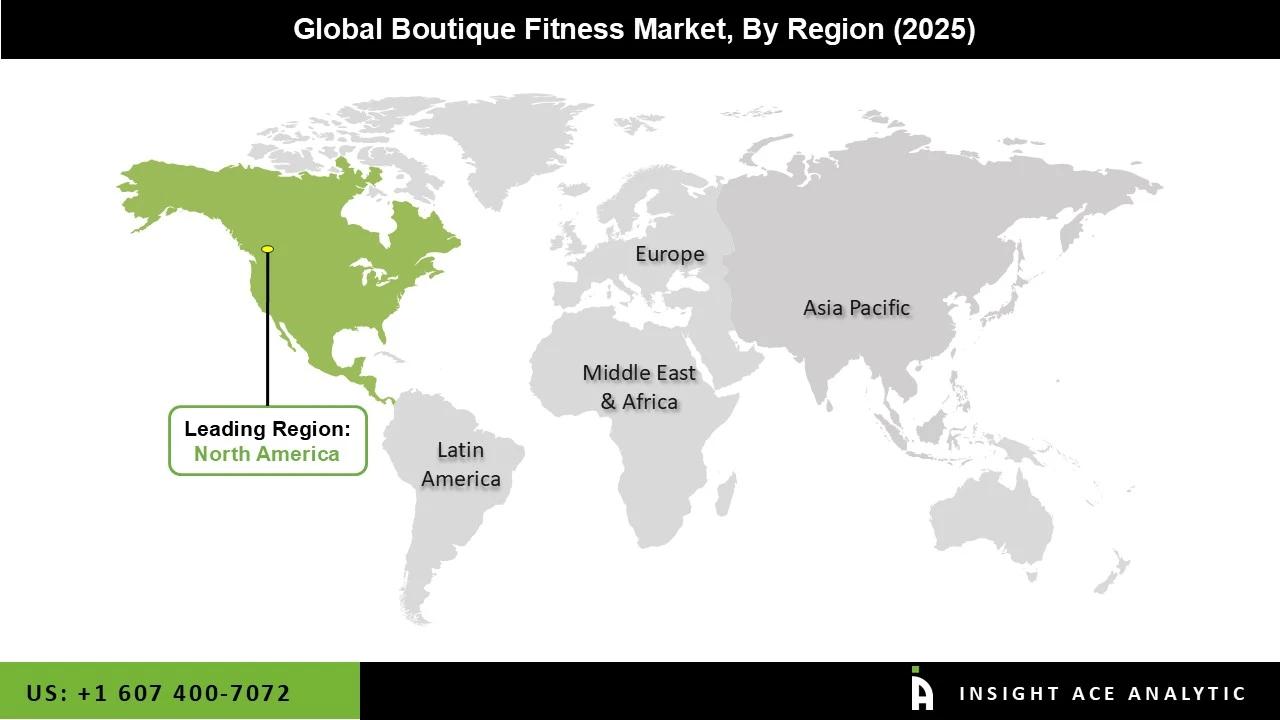

The global boutique fitness market is dominated by the North America because fitness and wellness are deeply rooted in everyday life in the U.S. and Canada. People are highly aware of the importance of staying active and are encouraged through public health messaging to focus on preventive care and healthy living. With higher spending power, consumers are willing to pay for premium, experience-driven workouts rather than only using low-cost gyms. Busy urban lifestyles in major cities increase demand for short, structured, and time-efficient classes that easily fit into daily schedules. The region is also quick to adopt new fitness trends and technologies, supported by widespread use of smartphones, fitness apps, digital payments, and online bookings. A strong entrepreneurship and franchising culture has helped boutique studios expand rapidly, while growing focus on mental health, stress management, and overall lifestyle wellness continues to drive demand for personalized and community-based fitness experiences.

• In May 2025, F45 Training launched a global brand campaign titled “This is F45 Training”, designed to reposition the company beyond high-intensity interval training (HIIT) toward a broader wellness, recovery, and performance optimization ecosystem. The campaign emphasized holistic fitness solutions, integrating training, recovery partnerships, and lifestyle wellness engagement to strengthen brand identity globally.

• In Oct 2024, CrossFit announced partnerships aimed at supporting metabolic health monitoring and ecosystem integration for performance tracking. The initiative focused on aligning CrossFit training methodology with data-driven health and performance analytics, including collaboration with digital health and wearable technology platforms.

• In Jan 2024, Orangetheory Fitness had merged with Self Esteem Brands (Anytime Fitness) to form Purpose Brands. The company launched a brand refresh with the campaign "Every Reason is the Right Reason", featuring updated colors, typography, and a focus on longer, healthier lives. During the year, the company opened over 31 new studios worldwide, including in India, Saudi Arabia, and the US, and tested Hyrox training while expanding Orangetheory Outdoors for outdoor workouts.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 9.6% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Studio Type, Technology, Delivery Model, Ownership Model, Customer Positioning, Venue type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Xponential Fitness, F45 Training, Orangetheory Fitness, Barry’s, SoulCycle, Equinox Group, CorePower Yoga, CrossFit, Solidcore, Club Pilates, Pure Barre, YogaSix, StretchLab, BFT (Body Fit Training), Rumble Boxing, CycleBar, Row House, SLT, The Bar Method, Burn Boot Camp, 9Round, Cult.fit / Cure.fit, L’Orange Bleue, TRIB3, Viva Leisure, BoxUnion, Title Boxing Club, Physique 57, Les Mills (Immersive Fitness, The Trip), Black Box VR, Studio Society, Aviron, Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• HIIT & Functional Training Studios

• Indoor Cycling & Rhythm Riding Studios

• Strength & Conditioning Clubs

• Yoga Studios

• Pilates Studios

• Barre Studios

• Boxing & Combat Fitness Studios

• Standard Boutique Studios

• Environmentally Immersive Studios

• Connected-Equipment Immersive Studios

• VR / AR Fitness Experiences

• Digital-Only Immersive Content Platforms

• Studio-Only (Offline)

• Hybrid Studio + Digital

• Virtual-Only

• Franchised Networks

• Company-Owned Multi-Studio Chains

• Independent / Single-Studio Operators

• Premium / Luxury Boutique Concepts

• Mid-Market Boutique Studios

• Value-Focused Immersive Offerings

• Stand-Alone Boutique Studios

• Boutique-in-Gym Concepts

• Hospitality-Based Immersive Studios (Hotels & Resorts)

• Residential & Corporate Wellness Studios

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.