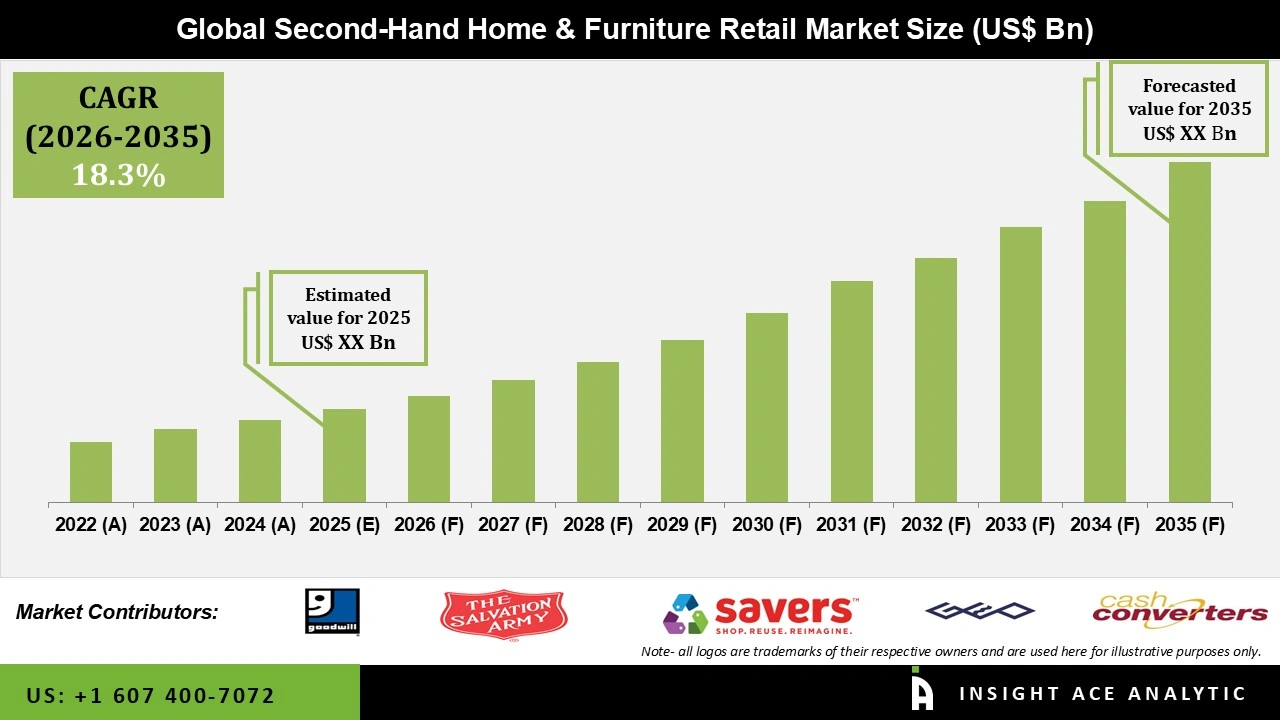

Global Second-Hand Home and Furniture Retail Market Size is developed at a 18.3% CAGR during the forecast period for 2026 to 2035.

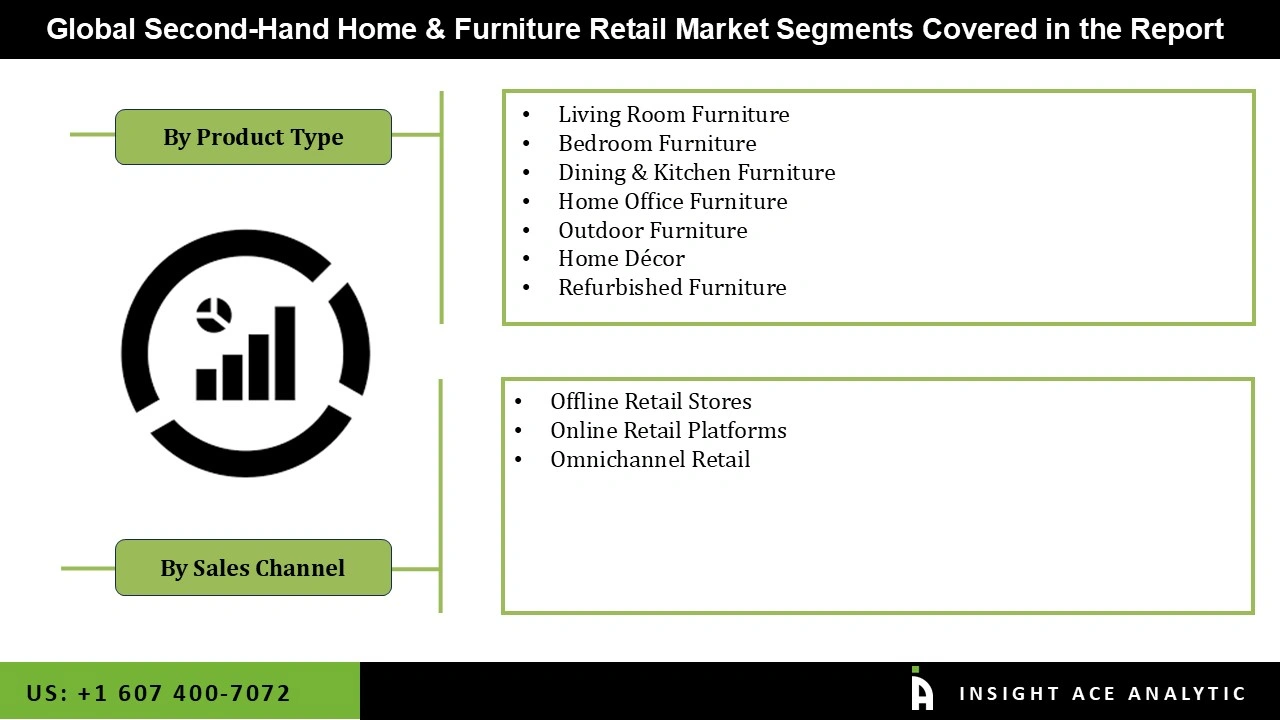

Second-Hand Home and Furniture Retail Market Size, Share & Trends Analysis Distribution by Product Type (Living Room Furniture, Bedroom Furniture, Dining & Kitchen Furniture, Home Office Furniture, Outdoor Furniture, Home Décor, Refurbished Furniture), by Sales Channel (Offline Retail Stores, Online Retail Platforms, Omnichannel Retail) and Segment Forecasts, 2026 to 2035.

The second-hand home and furniture retail market refers to the buying and selling of pre-owned household furniture and home décor items through physical stores, online platforms, and omnichannel retail models. This market includes a wide range of products such as living room, bedroom, dining, home office, outdoor furniture, décor accessories, and refurbished or restored pieces that are resold in usable or like-new condition. These offerings appeal to value-conscious consumers seeking affordable, stylish, and sustainable home solutions while extending the lifecycle of furniture and reducing waste. Second-hand home and furniture retail plays an important role in promoting sustainability, cost savings, and circular economy practices. Consumers increasingly choose pre-owned furniture to furnish homes at lower prices, access unique or vintage designs, and reduce the environmental impact associated with new furniture production. Retailers in this space often add value through refurbishment, quality checks, delivery services, and flexible buying options, improving customer trust and overall shopping experience.

The second-hand home and furniture retail market growth is further being driven by rising awareness of sustainability, increasing urbanization, growth in rental housing, and the rapid expansion of online resale platforms and marketplaces. Younger consumers, in particular, are embracing second-hand furniture as a smart and eco-friendly alternative. However, the market faces challenges such as inconsistent product quality, limited standardization, logistics and storage costs for bulky items, and lower consumer confidence in unorganized resale channels. Despite these constraints, continuous digital innovation, better refurbishment practices, and organized retail participation are expected to strengthen the market’s long-term growth potential during the forecast period.

Driver

Rising Sustainability Awareness and Shifting Consumer Preference Toward Second-Hand Furniture

Rising awareness of sustainability is the primary driver shaping the second-hand home and furniture retail market. Consumers are becoming more environmentally responsible and are actively looking for ways to reduce waste and lower their carbon footprint. Purchasing pre-owned furniture is increasingly viewed as a practical and meaningful step toward sustainable living, as it extends product lifecycles and reduces the demand for new manufacturing. In addition to environmental benefits, second-hand furniture offers strong value for money, making it attractive to budget-conscious households and younger consumers. Urban buyers, in particular, appreciate the combination of affordability, functionality, and eco-conscious choice. This growing shift in consumer mindset continues to fuel market demand and long-term growth.

Restrain/Challenge

Inconsistent Product Quality and Lack of Standardization

Inconsistent product quality and the lack of standardization remain major challenges for the second-hand home and furniture retail market. Unlike new furniture, pre-owned items vary widely in condition, usage history, and remaining lifespan, making it difficult for buyers to judge quality with confidence. Differences in grading, refurbishment practices, and pricing across sellers further add to confusion and hesitation among consumers. This challenge is especially prominent in unorganized and peer-to-peer resale channels, where limited quality checks and unclear return policies reduce trust. For retailers, the absence of standardized evaluation and certification processes increases operational complexity and can lead to higher return rates and customer dissatisfaction. As a result, inconsistent quality directly impacts consumer confidence, slowing market adoption despite growing demand for sustainable and affordable furniture options.

The Living room furniture represents the most influential and revenue-generating segment in the second-hand home and furniture retail market. This category includes sofas, couches, coffee tables, TV units, cabinets, and seating solutions that are central to everyday home use and interior aesthetics. Because the living room is the most visible and frequently used space in a home, consumers are more willing to invest in upgrading or replacing these items, even when choosing second-hand options.

Demand for pre-owned living room furniture is especially strong among urban households, renters, students, and young professionals who seek affordable yet stylish furnishing solutions. These items are often well-maintained, durable, and easier to refurbish, making them attractive for resale. In addition, online platforms and organized retailers have improved quality checks, refurbishment, and delivery services for bulky living room items, increasing buyer confidence. As a result, this segment continues to drive market growth by combining high demand, strong resale value, and wide consumer appeal.

Online retail platforms have become the most influential sales channel in the second-hand home and furniture retail market, largely because they make buying and selling used furniture simple, fast, and convenient. Customers can browse a wide variety of products from the comfort of their homes, compare prices easily, and access detailed photos, condition descriptions, and seller ratings before making a decision. This transparency helps build trust, which is especially important in the second-hand space. For sellers and organized retailers, online platforms reduce the need for large physical store networks while expanding reach across cities and regions. Value-added services such as refurbishment, quality checks, doorstep pickup, and delivery have further improved the customer experience. As digital adoption continues to rise, online channels are playing a central role in driving sales and shaping the market’s future growth.

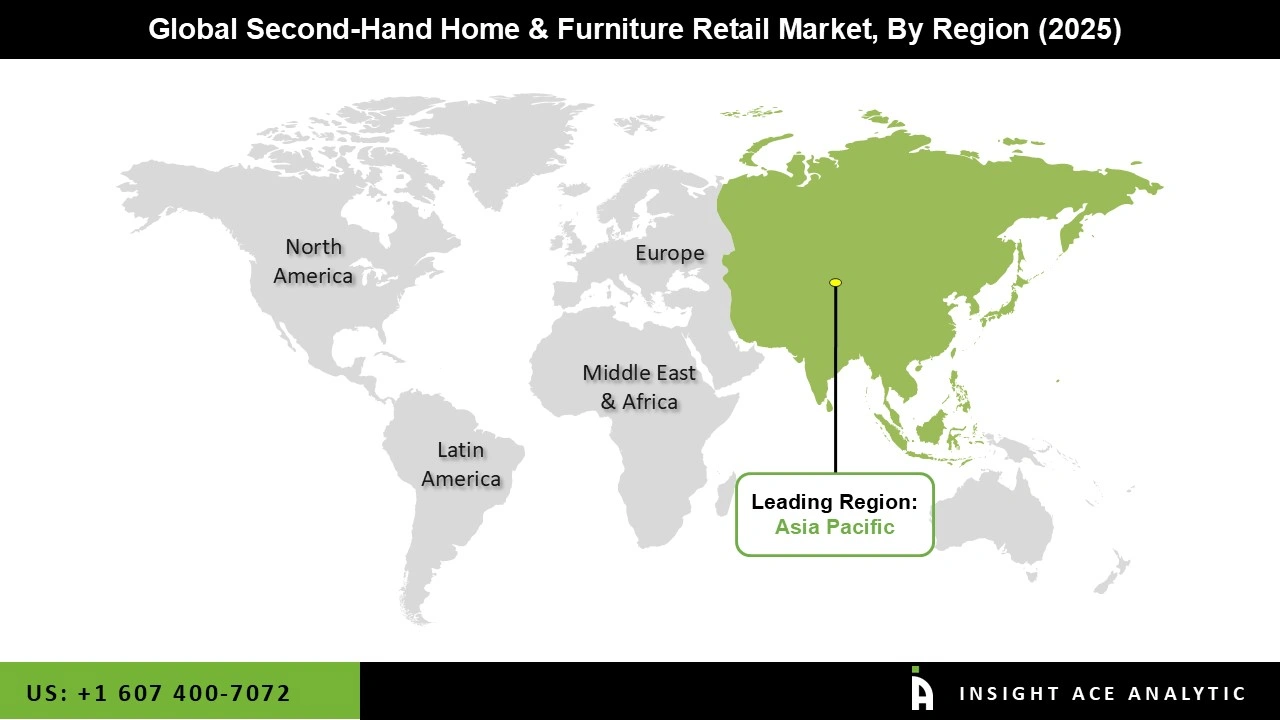

Asia-Pacific dominated the second-hand home and furniture retail market due to a combination of economic practicality, demographic scale, and strong digital adoption. The region’s large population base, coupled with rising urbanization and a growing middle-class segment, has increased demand for affordable home furnishing solutions. Many consumers prefer second-hand furniture as a cost-effective option, especially in fast-growing cities where relocation for jobs or education is common. Smaller living spaces in densely populated urban areas further encourage the purchase of functional, budget-friendly, and easily replaceable furniture rather than expensive new items. In addition, long-standing cultural practices around reuse, repair, and resale of household goods have made consumers more comfortable with buying pre-owned furniture.

The rapid growth of e-commerce, mobile apps, and social commerce platforms has significantly improved accessibility, price transparency, and trust in second-hand furniture transactions. Organized players offering refurbishment, quality assurance, logistics, and doorstep delivery have enhanced customer confidence and professionalized the market. Rising awareness of sustainability, waste reduction, and circular economy principles has also supported demand, positioning Asia-Pacific as the leading and fastest-growing region in the global second-hand home and furniture retail market.

• In March 2025, Salvation Army thrift operations benefited from the broader second-hand retail boom, supported by increased consumer interest in value-driven and sustainable shopping. The organization experienced higher donation volumes and improved in-store foot traffic as economic caution and circular consumption trends influenced purchasing behavior.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 18.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, Sales Channel and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East and Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Goodwill, Salvation Army, Savers, Geo Holdings, Cash Converters, BHF Furniture, Emmaüs, ThredUp (limited furniture), The RealReal (luxury furniture), Kaiyo, AptDeco, Chairish, 1stDibs, IKEA Buy Back and Resell, Savers (online + stores), Goodwill (online + stores) |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.