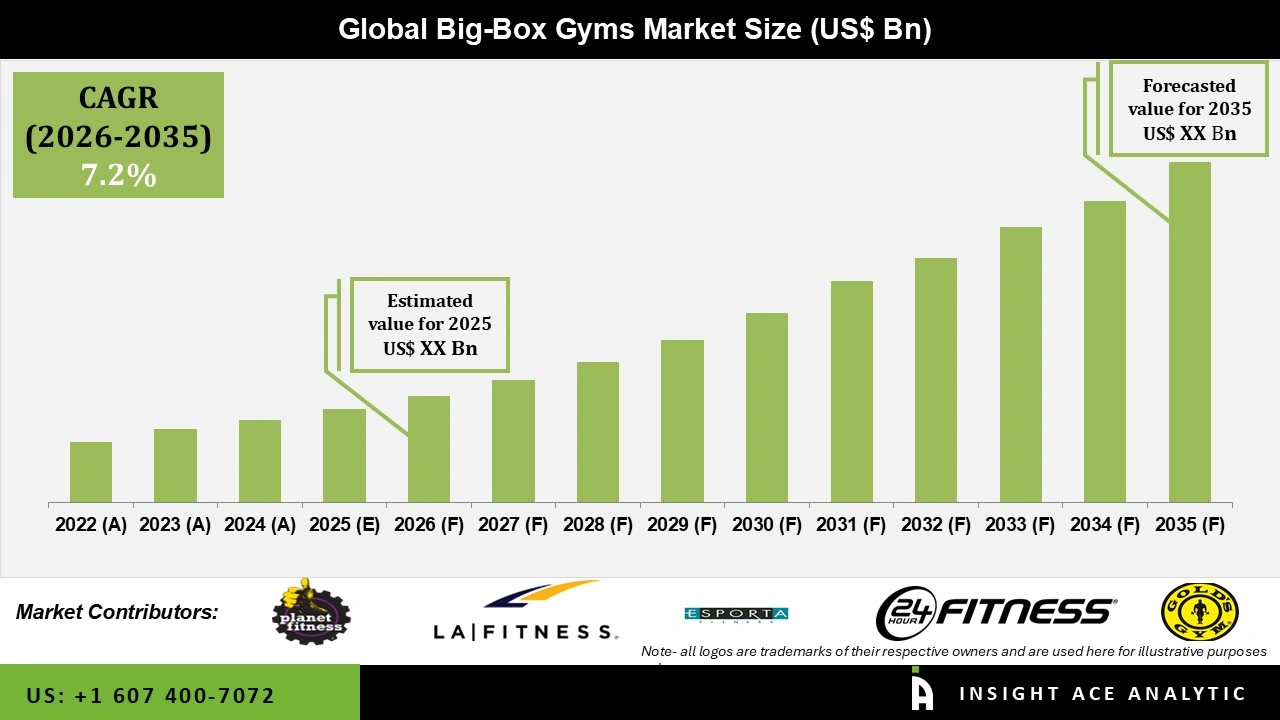

Global Big-Box Gyms Market Size is predicted to develop at an 7.2% CAGR during the forecast period for 2026 to 2035.

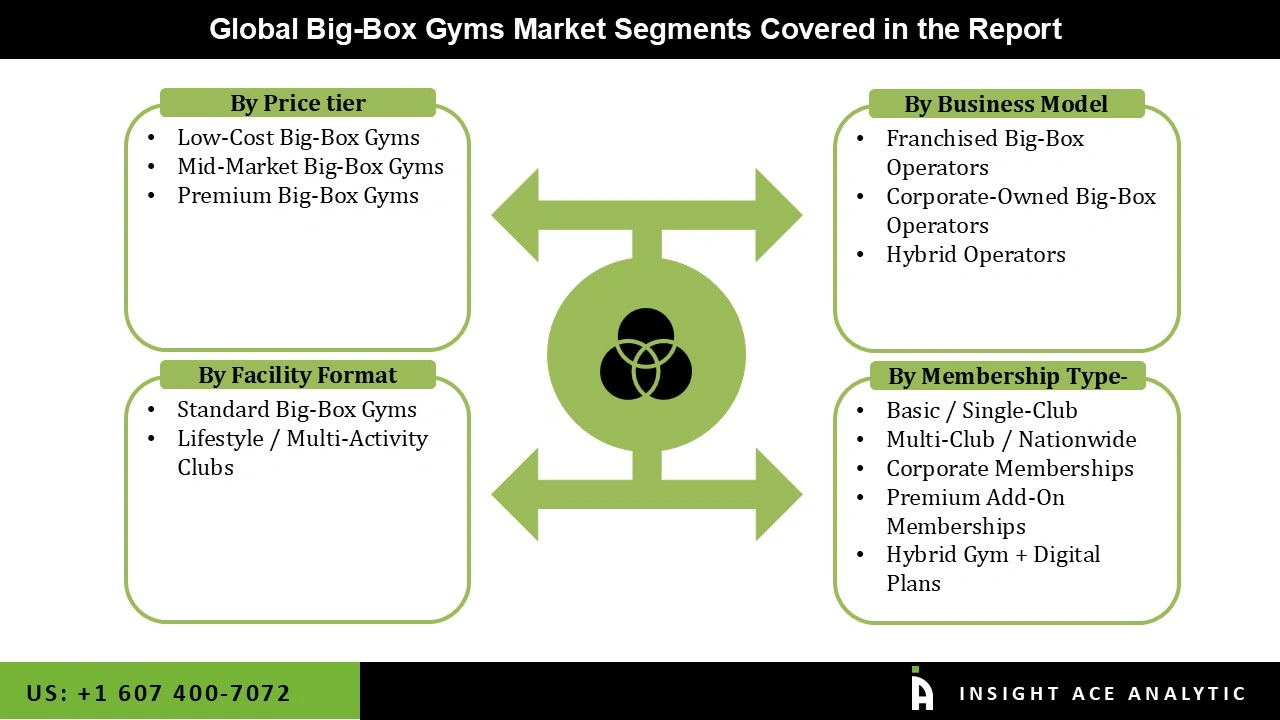

Big-Box Gyms Market Size, Share & Trends Analysis Distribution by Price Tier (Low-Cost Big-Box Gyms, Mid-Market Big-Box Gyms, Premium Big-Box Gyms), By Business Model (Franchised Big-Box Operators, Corporate-Owned Big-Box Operators, Hybrid Operators), By Facility Format (Standard Big-Box Gyms, Lifestyle / Multi-Activity Clubs),By Membership Type (Basic / Single-Club, Multi-Club / Nationwide, Corporate Memberships, Premium Add-On Memberships, Hybrid Gym + Digital Plans) and Segment Forecasts, 2026 to 2035

Big-box gyms are large fitness centers, usually run by big companies, offering affordable memberships to attract many members. They are the most common type of gym, known for their extensive range of equipment and standardized services across multiple cities and countries. These full-service facilities span thousands of square feet and include wide workout areas with cardio machines, strength equipment, and free weights. Their consistency across locations makes them convenient for people who travel. The business model relies on low-cost, high-volume memberships, with added revenue from personal training and premium plans. Many also feature group fitness studios, locker rooms, and sometimes pools, saunas, or spas, appealing to a broad range of fitness needs. They attract a broad audience by offering flexibility, space, and independent workout options, making them highly popular globally.

The global big-box gyms market is growing due to rising health awareness, lifestyle changes, and urbanization. People seek structured fitness solutions to prevent lifestyle-related diseases, while aging populations prioritize programs for longevity and wellness. Affordable, high-volume memberships combined with comprehensive facilities, cardio and strength equipment, group classes, and recovery zones offer significant value. Technological integration, including wearables, mobile apps, and AI-driven personalization, enhances engagement and retention. Trends like hybrid fitness models, nutrition counseling, mindfulness programs, and eco-friendly practices reflect holistic health. Community-driven experiences and partnerships with employers and healthcare providers further boost membership, making big-box gyms essential for convenient, comprehensive fitness globally.

The big-box gyms market faces a few challenges despite its strong growth. Running large fitness centres requires high operating costs, including equipment, maintenance, and staffing, which can impact profitability. In many cities, finding spacious and affordable locations is difficult, limiting expansion. Membership fees can also be a concern for some customers, especially during economic uncertainty, leading to slower sign-ups or cancellations. At the same time, digital and home-fitness options create competition, making it harder for gyms to retain members. However, there is a major opportunity in AI technology. By using AI-driven tools like personalized workout recommendations, smart scheduling, predictive maintenance for equipment, and automated member engagement gyms can improve efficiency, cut costs, and offer a more customized experience. This helps attract new members, keep existing ones engaged, and strengthen overall growth in a competitive fitness market.

Driver

Rising Health Awareness along with a Significant Generational Shift Drives Big-Box Gym Growth.

Rising health awareness continues to be a major driver of big-box gym growth, but current market growth is largely influenced by shifting lifestyle and generational fitness trends. Customers are being encouraged to embrace structured exercise regimens and preventive health practices due to the increasing frequency of lifestyle-related diseases like obesity, diabetes, cardiovascular disorders, and stress-related conditions. Demand is being further accelerated by a significant generational shift: millennials and Gen Z make up roughly 80% of new health club members, and they seek flexible and technology-enabled workout involvement. These younger consumers are driving the adoption of tech-integrated workouts, bite-sized fitness content, live-streaming classes, wearable tracking integration, and hybrid gym experiences. Additionally, the rising popularity of strength and functional training, driven by an increased focus on metabolic health and longevity benefits, is further prompting big-box gyms to redesign facilities and expand training zones. Together, these combining trends are transforming large fitness centers into comprehensive health and lifestyle hubs, strengthening their long-term growth potential.

Restrain/Challenge

High Operating Costs: The Biggest Barrier for Big-Box Fitness Centers

A major restraint for big-box gyms is their high operating costs. Running a large fitness center requires heavy investment in equipment, regular maintenance, utilities, and a skilled team of trainers and staff. These expenses continue throughout the year, even when member activity fluctuates. Because the costs are so high, gyms must carefully manage their budgets and pricing to stay profitable. This can limit their ability to expand, upgrade facilities, or offer lower membership fees. As a result, high operating costs remain one of the biggest challenges for the big-box gym industry.

The global big-box gyms market is primarily driven by low-cost memberships, which make fitness accessible to a wide audience. Affordable pricing attracts many members, including first-time gym-goers and cost-conscious individuals, encouraging regular workout habits. These gyms provide well-equipped facilities, including cardio and strength equipment, group classes, and recovery zones, offering excellent value for money. By combining convenience, variety, and affordability, low-cost big-box gyms have become the preferred choice for fitness enthusiasts worldwide, fuelling market growth and broadening access to structured and comprehensive fitness solutions for diverse populations.

Franchised operators are a major driver of growth in the global big-box gyms market. This business model allows gyms to expand rapidly by opening multiple locations while maintaining consistent services, equipment, and facilities across all outlets. Franchisees benefit from an established brand and can adapt offerings to meet the needs of local communities, attracting more members and building loyalty. The model also generates revenue through franchise fees and royalties, enabling expansion without heavy investment by the parent company. By combining brand consistency with local flexibility, franchised big-box gyms are helping make fitness accessible to more people worldwide.

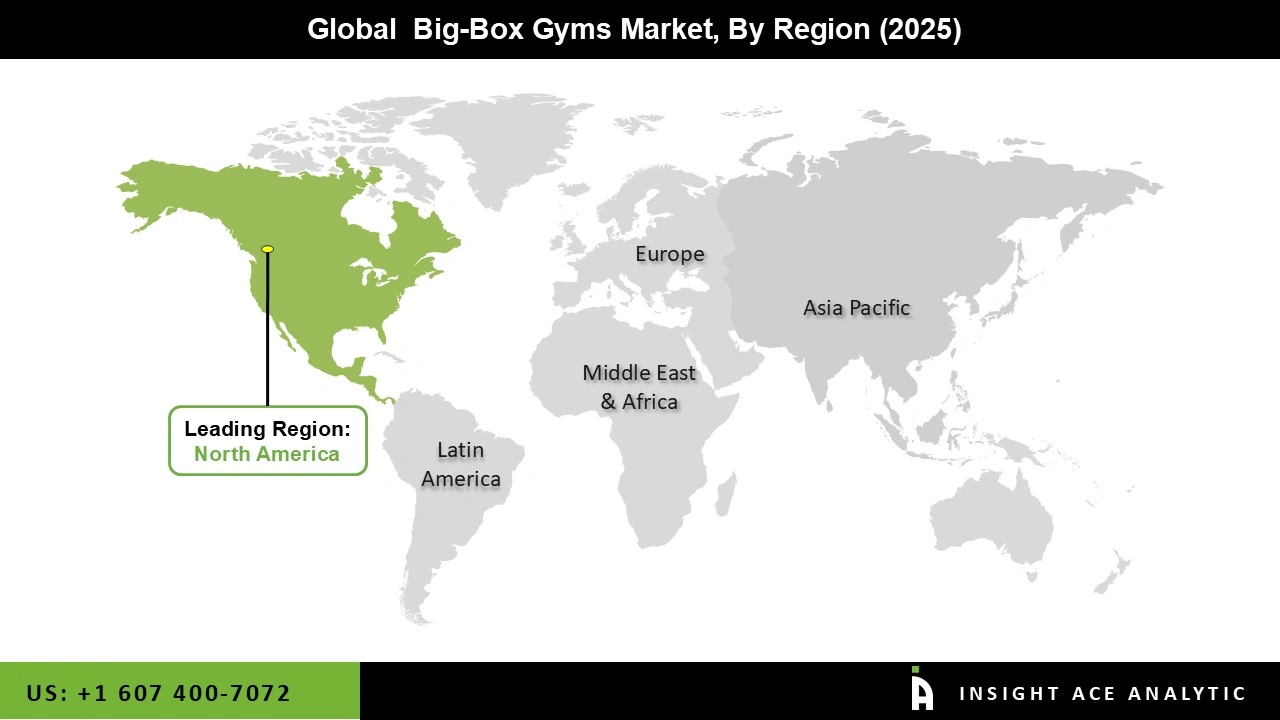

North America leads the global big-box gyms market because the region has a strong fitness culture and high awareness about health and wellness. People in the U.S. and Canada invest heavily in gym memberships to prevent lifestyle-related diseases and maintain active lifestyles. The region also has a well-established network of large gym chains, advanced equipment, and digital fitness tools that attract and retain members. Strong purchasing power, urban lifestyles, and quick adoption of technologies like wearables, mobile apps, and AI-based training further strengthen the market.

At the same time, the Asia-Pacific region is the fastest-growing market. Rapid urbanization, rising incomes, increasing health awareness, and expanding gym chains are driving strong demand across countries like China, India, and Australia. This makes Asia-Pacific the most dynamic and rapidly expanding region in the global big-box gym industry.

In Apr 2025, 24 Hour Fitness (USA) introduced several innovations to enhance member experience, including Recovery24 with advanced recovery tools, Premium Fit24 with intelligent training machines, and Reformer24 Pilates for affordable boutique-quality classes. They also launched the FitPerks Loyalty Program to reward consistent gym engagement. These initiatives focus on wellness, personalization, and member retention.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 7.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type of Product, Company Size, Scale of Operation, Type of Molecule, Type of Highly Potent Finished Dosage |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S., Canada, Germany, France, U.K., Italy, Spain, China, India, Japan, Australia, South Korea, Hong Kong, Southeast Asia, Brazil, Mexico, GCC Countries, Israel, South Africa |

| Competitive Landscape | Planet Fitness, LA Fitness, Esporta Fitness, 24 Hour Fitness, Gold’s Gym, Crunch Fitness, Anytime Fitness, Life Time Fitness, Equinox, VASA Fitness, YMCA / YWCA Fitness Centers, Snap Fitness, Retro Fitness, YouFit Gyms, EOS Fitness, GoodLife Fitness (Canada), Fitness First, Virgin Active, PureGym, The Gym Group, Basic-Fit, McFIT / RSG Group, VivaGym Group, Jetts Fitness (Australia, Asia), Fernwood Fitness (Australia), SATS Fitness (Nordic Region), Smart Fit (Latin America), Konami Sports Clubs (Japan), Central Sports (Japan), Viva Leisure (Australia), Others. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.