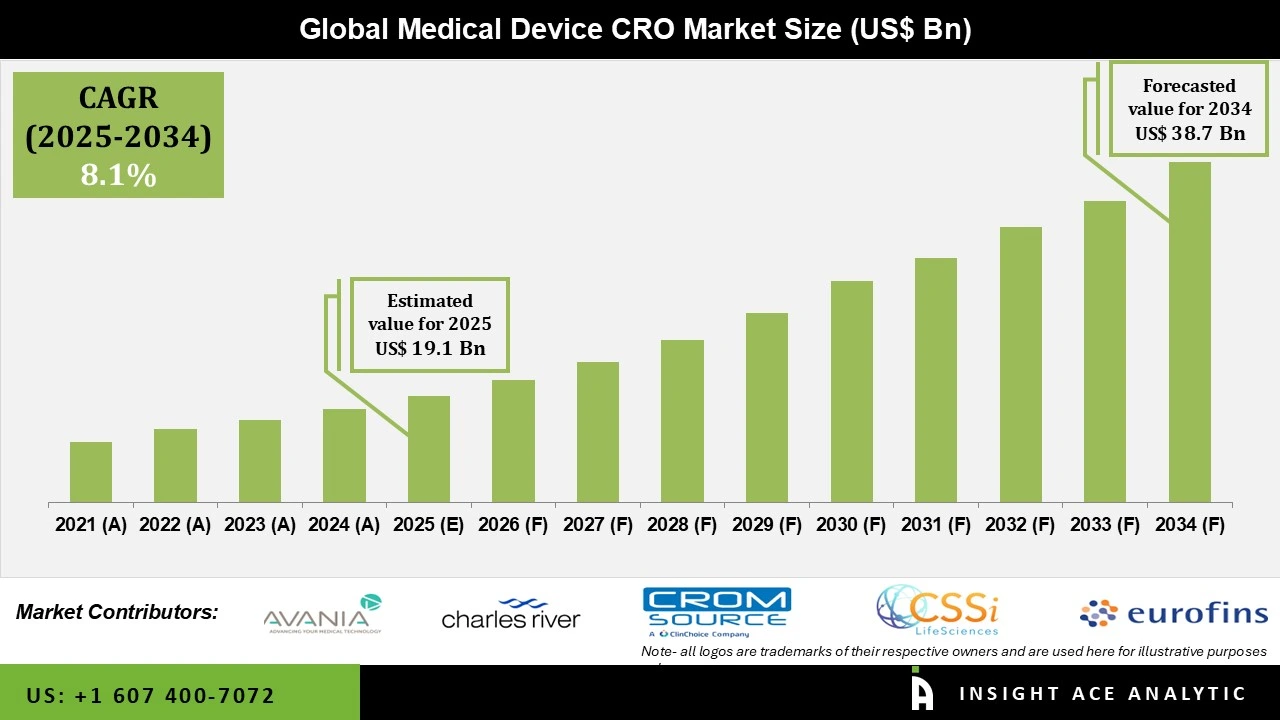

Global Medical Device CRO Market Size is valued at USD 19.1 Bn in 2025 and is predicted to reach USD 38.7 Bn by the year 2034 at a 8.1% CAGR during the forecast period for 2025-2034.

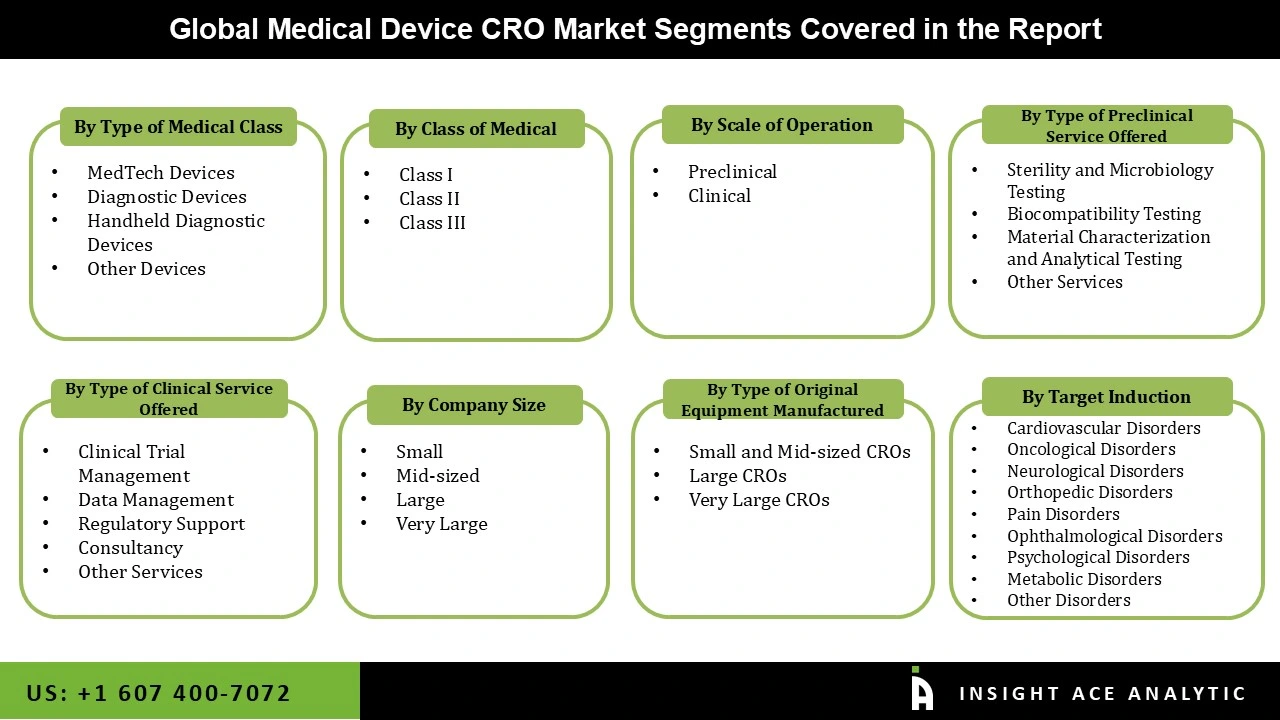

Medical Device CRO Market Size, Share & Trends Analysis Distribution by Medical Device Class (Class I, Class II, and Class III), By Medical Device Type (MedTech Devices, Handheld Diagnostic Devices, Diagnostic Devices, and Others), By Preclinical Service Offered (Biocompatibility Testing, Sterility and Microbiology Testing, Material Characterization and Analytical Testing, Others), By Type of Original Equipment Manufacturer (Small and Mid-sized CROs, Large CROs, and Very Large CROs), By Scale of Operation (Preclinical and Clinical), By Clinical Service Offered (Clinical Trial Management, Data Management, Consultancy, Regulatory Support, and Others), By Company Size (Small, Mid-sized, Large, and Very Large), By Target Indication (Cardiovascular Disorders, Orthopedic Disorders, Pain Disorders, Psychological Disorders, Oncological Disorders, Neurological Disorders, Ophthalmological Disorders, Metabolic Disorders, and Others), and Segment Forecasts, 2025-2034

A Contract Research Organization (CRO) is a business that provides clinical trial services to corporations in the pharmaceutical, biotechnology, and medical device industries. Regulatory affairs, clinical trial planning, data management, recruitment support, site selection and initiation, clinical monitoring, trial logistics, medical writing, biostatistics, and project management are among the many CRO services that are widely provided to the medical device industry. The goal of medical device CROs is to reduce costs for companies investigating novel drugs and pharmaceuticals for niche markets. Since large pharmaceutical companies no longer need to manage everything internally, they want to expedite both drug market launch and development. The medical devices CRO market's expansion may be ascribed to the rise in clinical trials focused on medical devices, the growing need for sophisticated medical equipment, and the medical device industry's increased emphasis on cutting research expenses.

The growing number of clinical trials is the primary driver of the medical device CRO market's growth. Researchers are motivated to create new, creative, and more sophisticated medical gadgets by the increasing incidence of chronic illnesses and the expansion of research and development initiatives. Before a gadget is approved for sale, medical device manufacturers must adhere to strict standards and carry out clinical trials. Additionally, the medical device CRO market is expected to rise as a result of the ongoing development of medical technology. The need for specialized contract development and production services is being driven by innovations like robotically assisted surgical instruments, minimally invasive operations, and sophisticated diagnostic gadgets. Many businesses can effectively handle these developments by outsourcing to seasoned CROs. These developments call for advanced production capabilities and strict quality standards. This guarantees adherence to regulatory standards and expedites the time-to-market for new products.

The medical device CRO market is also being driven by the healthcare industry's increased focus on quality control and regulatory compliance. Globally, regulatory bodies are enforcing strict guidelines for medical devices, mandating businesses to follow exacting testing and validation procedures. This improves the gadgets' marketability and trustworthiness while reducing the possibility of product recalls and legal problems. Additionally, the market is being driven by the integration of digital health technologies, such as telehealth and remote monitoring. By investing in cutting-edge manufacturing technology and digital capabilities, CROs are well-positioned to benefit from these trends and deliver comprehensive solutions that meet the changing needs of healthcare providers and medical device businesses. However, the high cost of medical equipment, changes in regulations, and the intricacy of payment systems for medical care are some of the main limiting factors. Over the course of the projected period, these problems are anticipated to limit market expansion.

Which are the Leading Players in the Medical Device CRO Market?

Driver

Growing Complexity of Regulatory Compliance in International Markets

The growing complexity of regulatory compliance in international markets is one of the main drivers of the medical device CRO market's growth. The medical device manufacturers are increasingly looking to CROs for their specialized regulatory consulting and clinical trial management expertise as authorities like the EMA, FDA, and other regional bodies continue to tighten their regulations and demand more stringent clinical evidence for device approval. In order to effectively traverse these constantly changing regulatory environments, CROs provide the infrastructure, expertise, and global reach required. Furthermore, small and mid-sized device manufacturers, who frequently lack the internal resources to handle complicated, multi-regional trials and compliance requirements, are more likely to rely on CRO collaborations as a result of this trend.

Restrain/Challenge

Complicated and Dynamic Regulatory Compliance Environment

The complicated and dynamic regulatory compliance environment that governs medical devices in many areas is a significant barrier to the medical device CRO market. Regulatory bodies like the FDA, EMA, and other national agencies impose strict post-market surveillance requirements, arduous approval procedures, and significant clinical evidence requirements on medical devices. The time, expense, and operational load for CROs and their clients are increased by frequent regulatory revisions, such as more stringent clinical assessment requirements, improved safety and performance standards, and region-specific documentation formats. Additionally, it is difficult to develop standardized clinical procedures due to regional variations in regulatory frameworks, which frequently necessitate numerous submissions and protocol adjustments.

The clinical category held the largest share in the Medical Device CRO market in 2025. Because of the growing complexity and volume of clinical studies, this segment was dominant. The clinical trials require strict standards and require competence to be completed because they involve human subjects. Clinical trials must be observed from several sites, particularly Phases 2 and 3. Furthermore, the medical device CROs help medical device manufacturers gather and analyse data for larger research. Additionally, they support clinical monitoring, patient recruitment and retention, site launch and management, and site selection and feasibility.

In 2025, the Cardiovascular Disorders category dominated the Medical Device CRO market, fueled by the global increase in cardiovascular disease prevalence. The diagnostic imaging equipment, pacemakers, and stents are among the devices used in cardiology. Due to factors like sedentary lifestyles, ageing populations and rising heart health awareness, there is an increased need for these devices. Furthermore, to take advantage of their specialized knowledge and guarantee adherence to strict regulatory requirements, medical device companies are increasingly contracting with CROs to design and manufacture cardiology equipment.

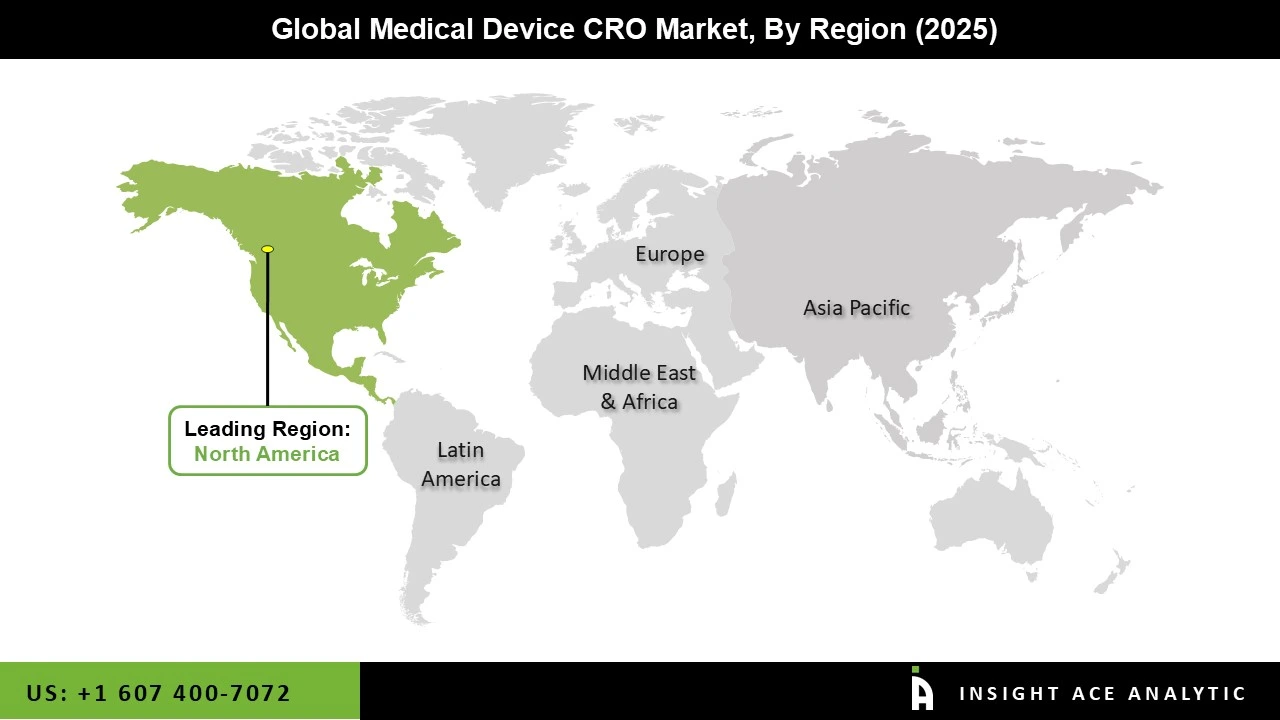

The Medical Device CRO market was dominated by the North America region in 2025. One of the main causes driving the market growth in North America is anticipated to be the rapid expansion of medical device development to suit the growing need for effective healthcare in the region. Additionally, during the course of the forecast period, the market is predicted to increase due to the growing demand for medical device cost reductions.

With access to a sizable patient population and a suitable regulatory framework, the United States, in particular, is a global centre for clinical research and medical device innovation. The U.S. medical device CRO business is expanding as a result of large medical device companies outsourcing portions of their operations, including report writing and publishing, clinical trial application services, product design, and regulatory services. Moreover, because of the continuous expenditures in precision medicine and digital health, the region is anticipated to continue growing steadily.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 19.1 Bn |

| Revenue forecast in 2034 | USD 38.7 Bn |

| Growth Rate CAGR | CAGR of 8.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Medical Device Class, Medical Device Type, Preclinical Service Offered, Type of Original Equipment Manufacturer, Scale of Operation, Clinical Service Offered, Company Size, Target Indications, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | IQVIA, Avania, Charles River Laboratories, WuXi AppTec, CSSi LifeSciences, Eurofins Medical Testing, CROMSOURCE, NAMSA, Qserve, and Medpace |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.