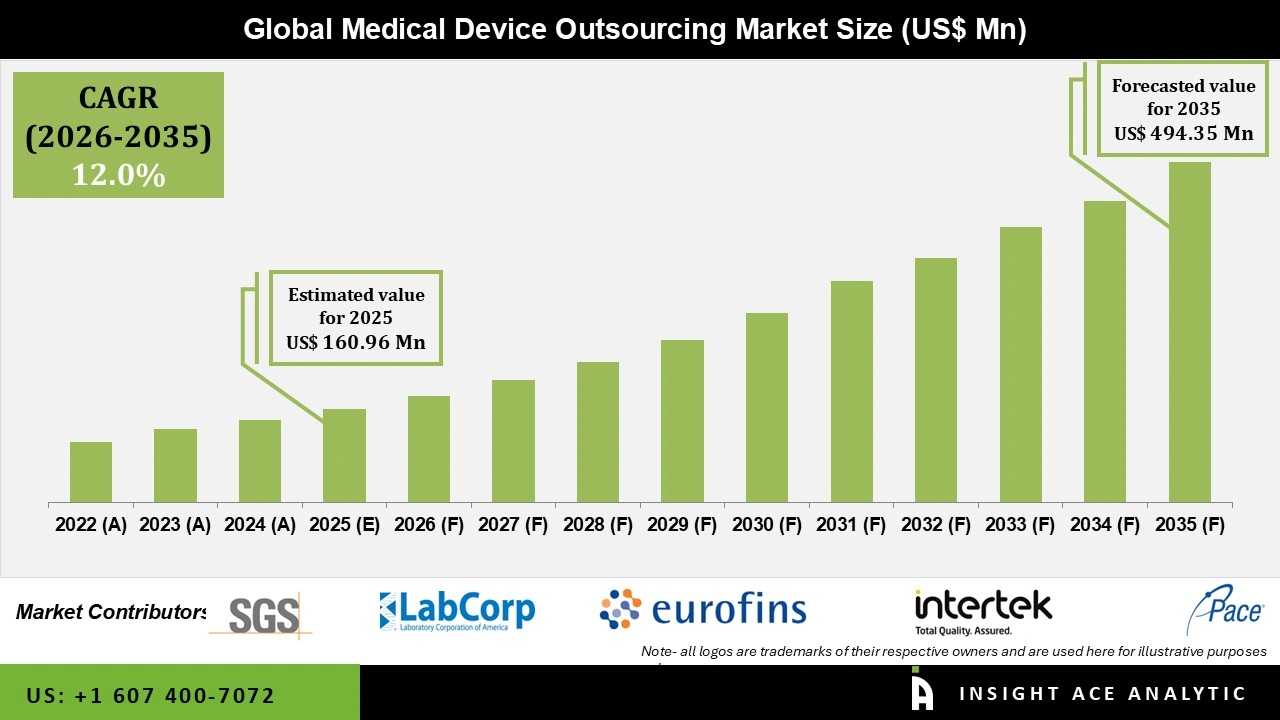

Global Medical Device Outsourcing Market Size is valued at USD 160.96 billion in 2025 and is predicted to reach USD 494.35 billion by the year 2035 at a 12.0% CAGR during the forecast period for 2026 to 2035.

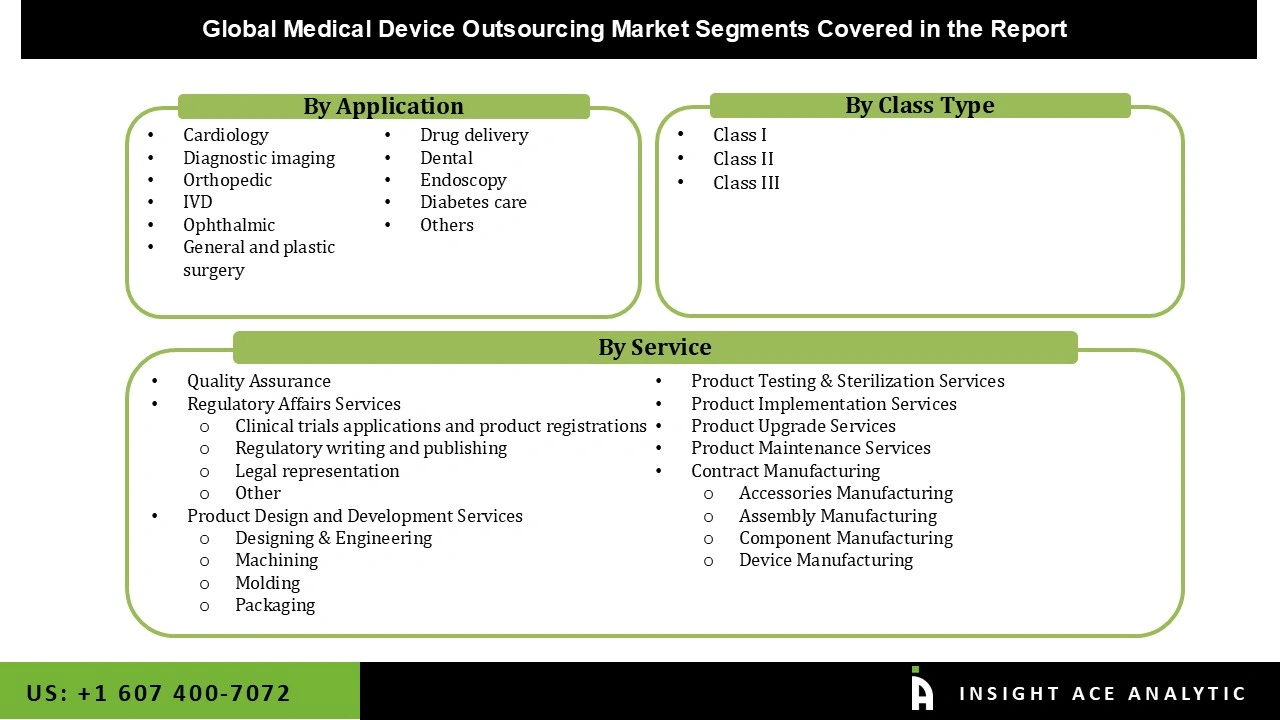

Medical Device Outsourcing Market Size, Share & Trends Analysis Report By Services (Quality Assurance, Contract Manufacturing), By Therapeutic Area (Cardiology, Diagnostic Imaging, Orthopedic, IVD, Ophthalmic, General And Plastic Surgery, Drug Delivery), By Class (Class I, Class II, And Class III), By Region, And Segment Forecasts, 2026 to 2035.

Medical device outsourcing is a supply chain management phenomenon that focuses on contracting with a third party for product design, production, packaging, testing, prototyping, and verification of medical equipment in a sterile and regulated environment. Typically, outsourcing entails a contract between the client company and the supplier or external outsourced service provider. Over the forecast period, the increased frequency of chronic diseases such as cancer is expected to drive the expansion of the worldwide medical devices outsourcing market. Cancer has become much more common in the last few decades.

However, the global outbreak of COVID-19 has interrupted healthcare workflows. The sickness has compelled a number of sectors, including various sub-domains of healthcare, to temporarily close their doors. The COVID-19 epidemic had an overall detrimental impact on key participants in the medical device outsourcing business. In the framework of the medical device outsourcing sector, the COVID-19 pandemic has caused supply chain interruptions and a delay in production.

The medical device outsourcing market is segmented on the basis of service outlook, type, and application. Based on service outlook, the market is segmented as quality assurance, regulatory affairs services (clinical trials applications and product registrations, regulatory writing and publishing, legal representation, other), product design and development services (designing & engineering, machining, molding, packaging), product testing & sterilization services, product implementation services, product upgrade services, product maintenance services, and contract manufacturing (accessories manufacturing, assembly manufacturing, component manufacturing, and device manufacturing). The class type segment includes Class I, Class II, and Class III. By application, the market is segmented into cardiology, diagnostic imaging, Orthopedic, IVD, ophthalmic, general and plastic surgery, drug delivery, dental, endoscopy, diabetes care, and others.

The contrast manufacturing category is expected to hold a significant share of the global medical device outsourcing market in 2022. The focus on lowering production costs is intensifying, which is accelerating this market's expansion. The complexity of manufacturing is also a factor in the market's expansion. The production of safe and high-quality medical equipment is a top priority for medical device makers. There are several layers of rules and regulations as a result of the rigorous examination process used in the development of medical devices. Thus, there is a demand for manufacturing services as a result.

The cardiology segment is projected to grow at a rapid rate in the global medical device outsourcing market. This is brought on by the high prevalence of diseases such as congenital heart disease, hypertension, rheumatic heart disease, atrial fibrillation, angina pectoris, and myocardial infarction. The need for cardiovascular devices is rising due to the growing prevalence of CVDs worldwide. Additionally, due to the high complexity of cardiovascular devices, the need for technical know-how, and the high cost of producing these devices, OEMs are more likely to outsource the production of these devices.

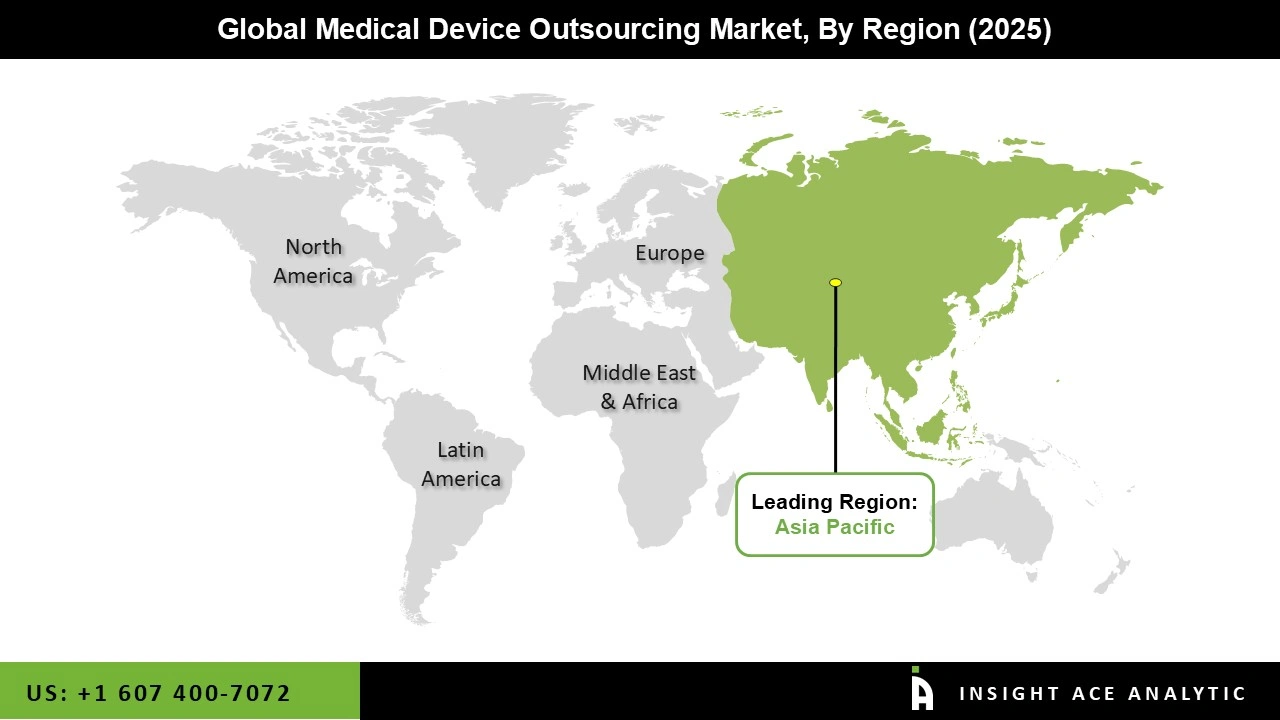

Asia Pacific medical device outsourcing market is expected to register the highest market share in terms of revenue in the near future. The supporting aspects expected to drive this regional market include the presence of market players and competitive pricing. In addition, the growing patient population suffering from chronic and infectious diseases is propelling market expansion in this region. Moreover, North America is also expected to grow significantly during the predicted period.

Due to the well-established production hubs for high-end, consistent, and complex medical equipment, this is the case. Furthermore, North America's highly advanced electronic industry gives it an advantage over other regions. This region is also home to a large number of medical device businesses, which outsource a portion of their regulatory and consulting functions to regulatory service providers, contributing to the regional market's growth.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 160.96 Bn |

| Revenue forecast in 2035 | USD 494.35 Bn |

| Growth rate CAGR | CAGR of 12.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Service Outlook, Type, And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | SGS SA; Laboratory Corporation of America Holdings; Euro fins Scientific; Pace Analytical Services, Inc.; Intertek Group plc; WuXiAppTec; North American Science Associates, LLC; TÜV SÜD; Sterigenics U.S., LLC (GTCR, LLC); Charles River Laboratories; Medical Device Testing Services; RJR Consulting, Inc.; Mandala International.; Freyr; Global Regulatory Partners; PAREXEL International Corporation (EQT Private Equity and Goldman Sachs Asset Management); Emergo (UL LLC); Bioteknica; Accell Clinical Research, LLC; Genpact.; Criterium, Inc.; ; Promedica International; Med pace; ICON plc.; IQVIA Inc.; Integer Holdings Corporation; Tecomet Inc. (Charlesbank Capital Partners, LLC); Jabil Inc.; FLEX LTD.; Celestica Inc.; Sanmina Corporation.; Plexus Corp.; Phillips Medisize (Molex, LLC); Cantel Medical Corp. (STERIS plc) and West Pharmaceutical Services, Inc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Medical Device Outsourcing Market By Service-

Medical Device Outsourcing Market By Class Type-

Medical Device Outsourcing Market By Application

Medical Device Outsourcing Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.