Global Kratom Extract Market Size is valued at USD 227.1 Mn in 2025 and is predicted to reach USD 646.4 Mn by the year 2034 at a 12.3% CAGR during the forecast period for 2025 to 2034.

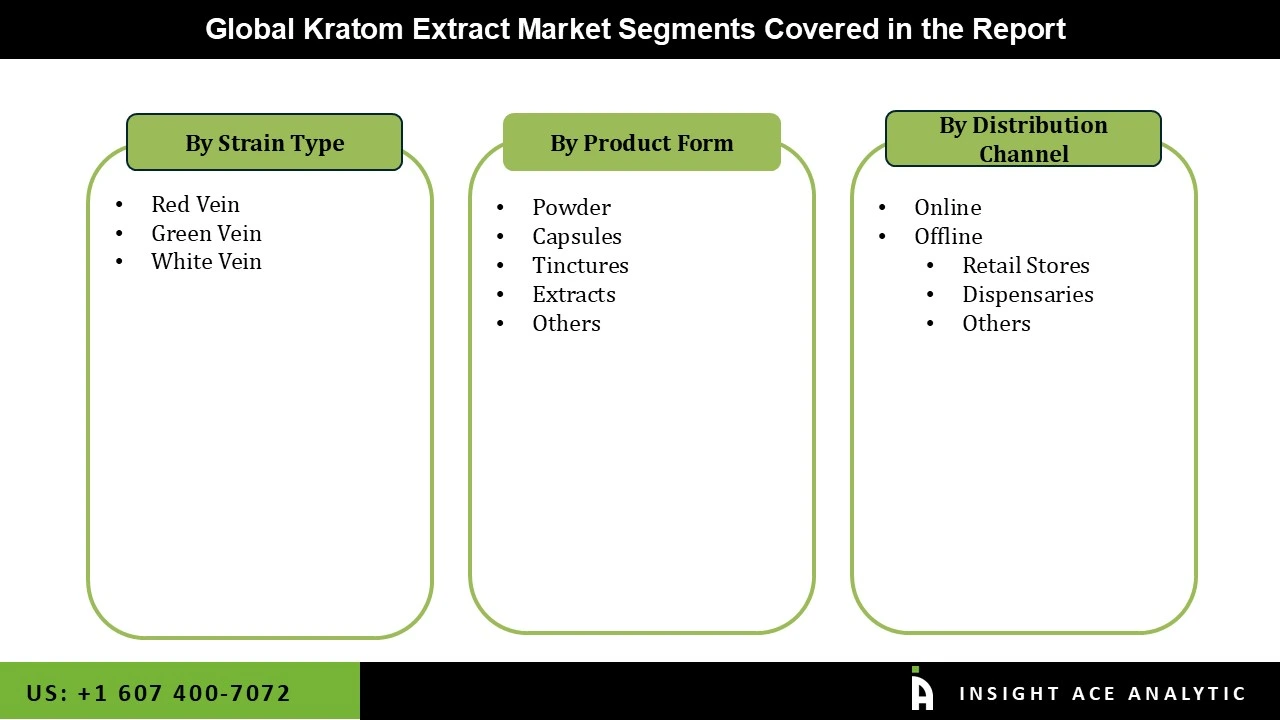

Kratom Extract Market Size, Share & Trends Analysis Distribution by Form (Extracts, Tinctures, Powder, Capsules, and Others), Strain Type (Green Vein, Red Vein, and White Vein), Distribution Channel (Online and Offline (Retail Stores, Dispensaries, Others)), and Segment Forecasts, 2025 to 2034

The chemicals found in the leaves of the Mitragyna speciosa tree, native to Southeast Asia, are concentrated into kratom extract. Kratom extract, which is rich in alkaloids like mitragynine and 7-hydroxymitragynine, is prized for its possible benefits, which can range from relaxation and pain relief at lower doses to energizing qualities at higher quantities. It comes in a variety of forms, such as liquid tinctures, powders, and capsules, and is usually made using methods like alcohol or water extraction. Although kratom extract is frequently used for its alleged benefits in relieving pain, enhancing concentration, or boosting mood, its usage is governed by safety and legal requirements because of worries about negative effects and reliance. The kratom extract market is expected to increase rapidly due to rising consumer awareness of its possible advantages and growing uses in the dietary supplement and wellness industries.

The demand for kratom extract, which is thought to have relaxing and pain-relieving qualities, is also being driven by the increased incidence of anxiety, chronic pain, and other health problems. The market for kratom extract is expanding as more individuals use it as a natural treatment for health problems. Additionally, the industry is growing since kratom extract products are easily accessible and available both online and in specialty shops. Customers have more options as more stores and online sellers provide a variety of kratom extract goods, which accelerates market expansion. Moreover, future market competition and pricing competitiveness will become increasingly severe due to the constant influx of new businesses and the high degree of product uniformity across them.

The market for kratom extract is expanding significantly due to rising consumer awareness and demand for natural substitutes for conventional medications. Additionally, the market is shifting toward more standardized, higher-quality products, reflecting consumers' increased need for dependable, consistent potency. Innovations in extraction techniques that yield more potent, purer products, as well as the development of new administration options beyond capsules and powders, such as tinctures and topical treatments, are further propelling the expansion. Furthermore, consumers are favoring kratom extracts that are ethically and sustainably sourced. However, the main obstacles in the kratom extracts market are the disparate regulatory environments in various areas, which lead to uncertainty and may impede market growth. Consumer perceptions and market expansion are also affected by concerns about potential side effects and a lack of thorough scientific research.

Driver

Growing Use of Kratom Extracts as a Substitute of Opioids

The global kratom extract market is experiencing growth, driven primarily by rising consumer interest in plant-based and alternative pain management solutions. Increasing awareness of kratom’s perceived functional benefits such as pain relief, mood improvement, and anxiety reduction- has led to its use spreading, especially in wellness and supplement markets. North America has emerged as a major growth region, reflecting shifting consumer preferences toward natural or non-pharmaceutical options and the expansion of online retail. The ongoing opioid crisis has also boosted the market, increasing demand for new ways to manage pain and support withdrawal. Some people see kratom extract as a harm-reduction option because of its alkaloid content and how it interacts with opioid receptors, which sets it apart from traditional opioids. This has made kratom extract more popular among those looking for alternatives to prescription painkillers.

Restrain/Challenge

Side Effects Associated with Kratom Extracts

Depending on the dosage, kratom has varied effects. It has been reported to have cocaine-like stimulant effects at lower dosages (1 to 5 g) and sedative opioid-like effects at higher doses (5 to 15 g). Higher dosages increase the risk of toxidrome, which manifests as nausea, dizziness, and diaphoresis before euphoria. Both chronic use and acute overdose/toxicity might have negative consequences. In addition, tremors, frequent urination, anorexia, weight loss, seizures, or psychosis are experienced by long-term users. They have withdrawal symptoms that range from hostility to sleeplessness. Hepatotoxicity, seizures, and possibly even death are the outcomes of acute toxicity. Thus, it is anticipated that all of these negative consequences of kratom use will impede the expansion of the worldwide kratom extract market.

The red vein category held the largest share in the kratom extract market in 2025, fueled by consumers' growing inclination toward natural remedies for stress reduction, relaxation, and pain relief. Red vein kratom extracts are especially well-liked by people looking for alternatives to traditional painkillers and opioids since they are generally thought to be the most sedative and analgesic of all the kratom kinds. The market for concentrated red vein extracts is being supported by growing awareness of chronic pain issues, anxiety, and sleep disturbances, particularly among working people and older populations. This is because concentrated red vein extracts have a stronger strength and a faster onset than kratom powders. Further driving market expansion is the proliferation of specialist wellness stores and online retail platforms, which have enhanced customer education and product accessibility.

In 2025, the online category dominated the Kratom Extract market due to the unparalleled ease of use and accessibility offered to clients worldwide. Due to space constraints or legal restrictions, many physical stores may not be able to offer a wide variety of products, such as strain, strength, and product forms, that are available on online platforms. Customers may investigate and buy kratom extracts that are tailored to their needs and preferences due to this large selection. Furthermore, due to social stigma or local legal issues surrounding kratom use, the covert nature of internet shopping greatly appeals to kratom users who value privacy and sensitivity.

The Kratom Extract market was dominated by the North America region in 2025, driven by growing consumer awareness of and desire for natural substitutes for prescription drugs. The kratom extract market dynamics are influenced by regulatory catalysts, such as the FDA's continuing reviews, which present suppliers with both opportunities and difficulties.

The region's emphasis on safety and quality requirements drives the kratom extract market expansion even further. The main participant in this market is the United States. Additionally, a variety of well-known brands and up-and-coming businesses are fighting for market dominance in a field that is changing quickly.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 227.1 Mn |

| Revenue forecast in 2034 | USD 646.4 Mn |

| Growth Rate CAGR | CAGR of 12.3% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2023 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Form, Strain Type, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | MIT45, VivaZen, Kratomade, Kats Botanicals, Super Speciosa, Kr8om, DBZ Enterprises (K-Chill, Kryptic), Kraken Kratom, and Happy Hippo. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.