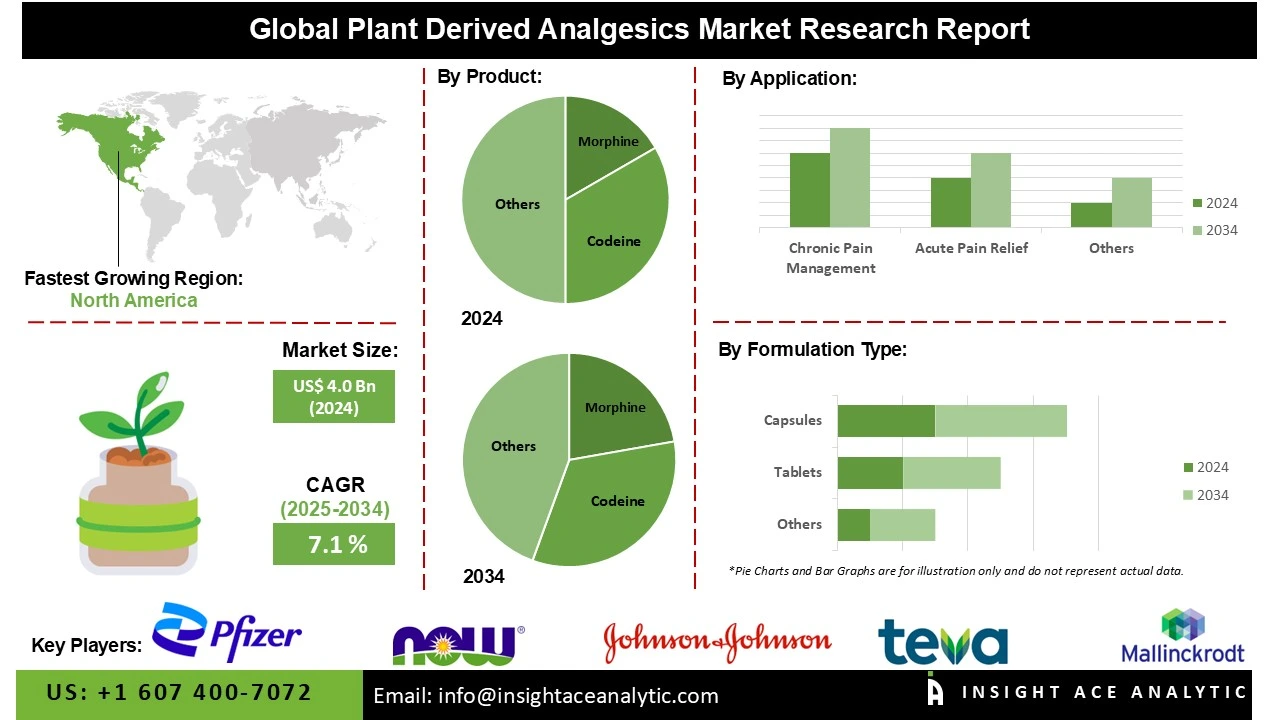

Plant Derived Analgesics Market Size is valued at US$ 4.0 Bn in 2024 and is predicted to reach US$ 7.87 Bn by the year 2034 at an 7.1% CAGR during the forecast period for 2025-2034.

Analgesics made from plants are used to treat headaches, inflammation, muscular injuries, and arthritis. The usage for pain treatment is supported by mechanisms such as suppression of peripheral mediators, modification of opioid and cholinergic pathways, and anti-inflammatory properties; nevertheless, some adverse effects and the necessity of clinical evaluation are noted.

Relevant examples range from morphine derived from Papaver somniferum to botanicals like turmeric, ginger, lavender, peppermint, and cinnamon employed for inflammatory and central analgesic effects. They are administered orally or topically as decoctions, macerations, poultices, or standardized extracts, including powders, tinctures, and pills used in formulations. The global market for Plant Derived Analgesics is expanding due to the rising awareness of herbal medicine, fewer side effects, and increasing acceptance of plant-based treatments.

The rising awareness of herbal medicine is another element propelling the plant derived analgesics market. The plant derived analgesics market is expanding because rising awareness of herbal medicine is driving the plant derived analgesics market as people seek natural, safer, and chemical-free pain relief options with fewer side effects and proven therapeutic benefits.

About 14.1% of female university students utilized herbal remedies (such as ginger, chamomile, and cinnamon) for menstruation discomfort (primary dysmenorrhea), compared to >50% who used traditional NSAIDs or acetaminophen. However, regulatory complexity and inconsistent global standards are some of the obstacles impeding the growth of the plant derived analgesics sector. Over the course of the forecast period, opportunities for the plant derived analgesics market will be created by gradual policy evolution regarding cannabis-based medicines.

Some of the Key Players in Plant Derived Analgesics Market:

· Pfizer Inc.

· Mallinckrodt Pharmaceuticals

· Teva Pharmaceutical Industries Ltd.

· Johnson & Johnson

· NOW Foods

· Purdue Pharma L.P.

· Sun Pharmaceutical Industries Ltd.

· Endo Pharmaceuticals Inc.

· GW Pharmaceuticals (Jazz Pharmaceuticals)

· Canopy Growth Corporation

· Charlotte's Web Holdings, Inc.

· Tilray Brands, Inc.

· Curaleaf Holdings, Inc.

· Hikma Pharmaceuticals PLC

· Amneal Pharmaceuticals, Inc.

· Others

The plant derived analgesics market is segmented product type, formulation type, application, and sales channel. By product type, the market is segmented into morphine, codeine, salicin, cannabinoids (CBD), and curcumin. By formulation type, the market is segmented into tablets, capsules, creams, injectable forms, and oils. By application, the market is segmented into chronic pain management, acute pain relief, post-surgical pain, and neuropathic pain. By sales channel, the market is segmented into hospitals, clinics, retail sales, online sales, and hypermarkets & supermarkets.

The morphine segment led the plant derived analgesics market in 2024. This convergence is fueled by its superior analgesic capabilities, including potent discomfort relief, well-established clinical protocols, and thorough healthcare integration which enables healthcare organizations to achieve optimal pain control in a variety of acute and chronic pain environments. Morphine products stand out due to their extensive safety documentation, demonstrated clinical efficacy, and integration with multimodal pain management techniques that improve patient outcomes while upholding the highest standards of comfort appropriate for a variety of surgical, cancer, and chronic pain applications.

The tablets segment represents the largest and fastest-growing formulation type in the plant-derived analgesics market. This growth is driven by the broad acceptance of oral solid dosage forms, which offer superior patient convenience, dose precision, and treatment adherence, ensuring consistent therapeutic outcomes. Tablets also align with manufacturing efficiency and scalability standards favored by pharmaceutical producers. Moreover, increasing investment in controlled-release technologies and advanced formulation engineering aimed at optimizing pain management therapies further strengthens the dominance of this segment across both prescription and over-the-counter analgesic markets.

North America dominated the plant derived analgesics market in 2024. The United States is at the forefront of this expansion. This is due to significant demand for herbal-based pain relief products and high consumer awareness of natural healthcare options. Market dominance is supported by the region's sophisticated pharmaceutical sector, continuing research on chemicals derived from plants, and growing demand for non-opioid substitutes. The robust market presence in North America is also a result of favorable laws, the general accessibility of herbal supplements, and the rising demand for environmentally friendly, plant-based goods.

The Asia-Pacific region is witnessing the strongest and fastest growth in the plant-derived analgesics market, primarily driven by the widespread acceptance of long-established traditional medical systems such as Traditional Chinese Medicine (TCM), Ayurveda, and Kampo. These practices are increasingly integrated with modern healthcare, fueling demand for plant-based pain management solutions. Government initiatives including funding programs, simplified regulatory frameworks, and support from organizations like the WHO Traditional Medicine Center and India’s AYUSH guidelines further accelerate market development. Additionally, rapid urbanization and a rising preference for natural pain relief alternatives sustain the region’s leading CAGR and long-term growth outlook.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 4.0 Bn |

| Revenue Forecast In 2034 | USD 7.87 Bn |

| Growth Rate CAGR | CAGR of 7.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, By Formulation Type, By Application, By Sales Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Pfizer Inc., Mallinckrodt Pharmaceuticals, Teva Pharmaceutical Industries Ltd., Johnson & Johnson, NOW Foods, Purdue Pharma L.P., Sun Pharmaceutical Industries Ltd., Endo Pharmaceuticals Inc., GW Pharmaceuticals (Jazz Pharmaceuticals), Canopy Growth Corporation, Charlotte's Web Holdings, Inc., Tilray Brands, Inc., Curaleaf Holdings, Inc., Hikma Pharmaceuticals PLC, and Amneal Pharmaceuticals, Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Plant Derived Analgesics Market by Product Type

· Morphine

· Codeine

· Salicin

· Cannabinoids (CBD)

· Curcumin

Plant Derived Analgesics Market by Formulation Type

· Tablets

· Capsules

· Creams

· Injectable Forms

· Oils

Plant Derived Analgesics Market by Application

· Chronic Pain Management

· Acute Pain Relief

· Post-Surgical Pain

· Neuropathic Pain

Plant Derived Analgesics Market by Sales Channel

· Hospitals

· Clinics

· Retail Sales

· Online Sales

· Hypermarkets & Supermarkets

Plant Derived Analgesics Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.