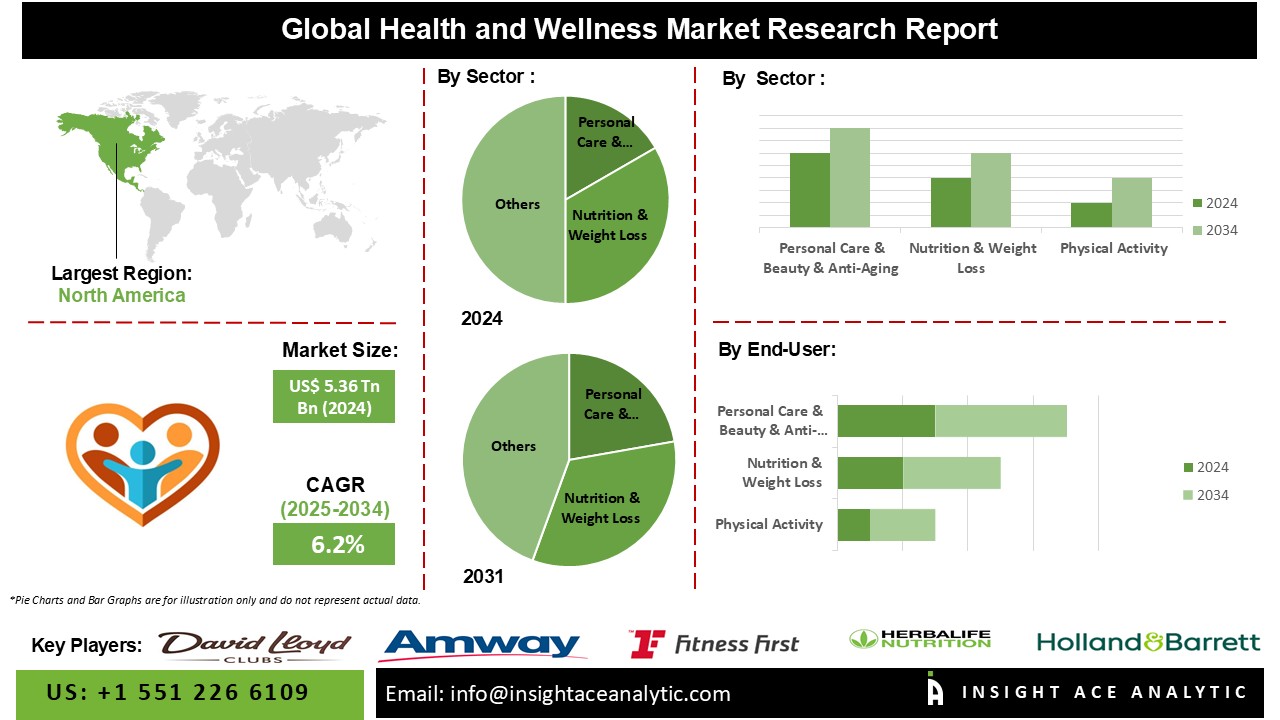

Health and Wellness Market Size was valued at USD 5.61 Bn in 2025 and is predicted to reach USD 10.20 Bn by 2035 at a 6.3% CAGR during the forecast period for 2026 to 2035.

Health and Wellness Market Size, Share & Trends Analysis Report, By Sector (Personal Care & Beauty & Anti-Aging, Nutrition & Weight Loss, Physical Activity, Wellness Tourism, Preventive & Personalized Medicine, Spa Economy, and Others), By Region, Forecasts, 2026 to 2035.

A significant catalyst for the global health and wellness market's expansion is the rising consumer expenditure on a variety of health and wellness products and services. The escalation in mental and physical health concerns, such as anxiety and depression, significantly contributes to the market's growth. Health and wellness encompass a comprehensive state of mental, physical, and spiritual well-being. This industry comprises crucial elements such as personal care and beauty items, beauty devices, weight management solutions, nutritional supplements, fitness programs, and personalized and preventive healthcare services. Moreover, offerings like wellness tourism, health resorts, wellness-oriented real estate, and natural mineral springs play essential roles in meeting consumer needs and are integral to industry operations. A pivotal factor fueling market expansion is the increasing incidence of chronic lifestyle-related ailments worldwide.

The health and wellness market is segmented on the basis of sector. Based on sector, the market is segmented as personal care & beauty & anti-aging, nutrition & weight loss, physical activity, wellness tourism, preventive & personalized medicine, spa economy, and others.

The personal care & beauty & anti-aging category is expected to hold a major share of the global health and wellness market in 2023. This prominence stems from the growing consumer interest in personal grooming and enhancing appearance, especially among younger age groups. With shifting societal standards, there's been a noticeable uptick in the desire for skincare, haircare, and anti-aging solutions, driven by the aspiration to preserve youthfulness and manage aging-related concerns. Additionally, advancements in cosmetic science and product formulations have spurred the development of inventive beauty offerings, propelling further expansion within this segment.

The North America Health and Wellness market is expected to register highest market North America exhibits higher consumer disposable income, a growing health-conscious mindset, heightened demand for healthy products, and increased awareness of health and wellness offerings among consumers. Additionally, the region benefits from the presence of numerous leading industry players and their diverse developmental strategies, which significantly contribute to the expansion of the North American health and wellness market. In addition, Asia Pacific is projected to grow at a rapid rate in the global Health and Wellness market. The progression of healthcare infrastructure and growing recognition of the significance of holistic well-being are anticipated to boost the adoption of health and wellness solutions, thereby propelling the market growth in the Asia Pacific region.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 5.61 Bn |

| Revenue Forecast In 2035 | USD 10.20 Bn |

| Growth Rate CAGR | CAGR of 6.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Application and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | David Lloyd Leisure Ltd, Amway Corporation, Bayer AG, Fitness First, Herbalife Nutrition, Holland & Barrett Retail, L’Oréal SA, Nestlé SA, Procter & Gamble, and Unilever Plc, among others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Health and Wellness Market- By Sector

Health and Wellness Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.