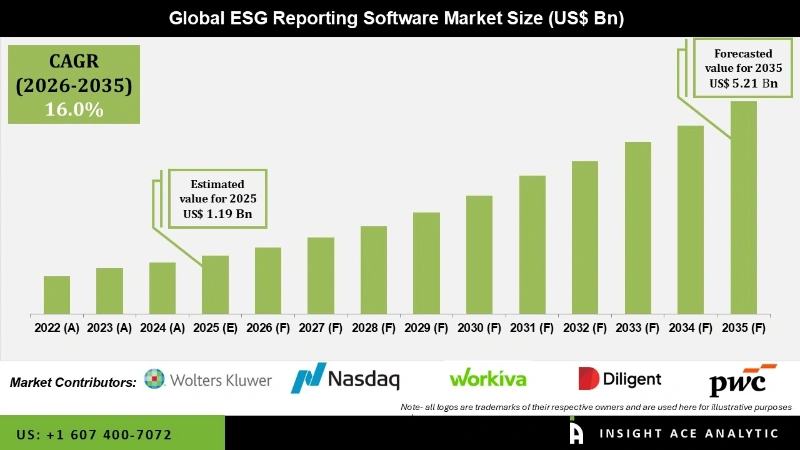

Global ESG Reporting Software Market Size is valued at USD 1.19 Billion in 2025 and is predicted to reach USD 5.21 Billion by the year 2035 at a 16.0% CAGR during the forecast period for 2026 to 2035.

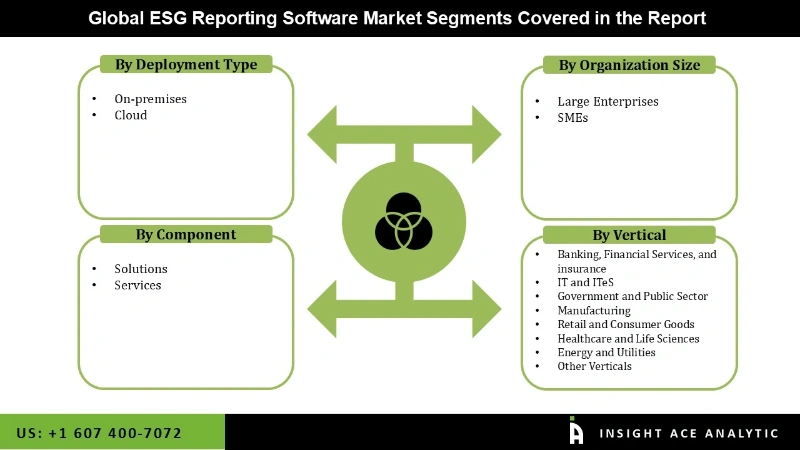

ESG Reporting Software Market Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment Type (On-premises, Cloud), By Organization Size (Large Enterprises, SMEs), By Vertical (BFSI, Government, Public Sector & Non-Profit, Retail), By Region, And By Segment Forecasts, 2026 to 2035

Eco-friendly, social, and governance (ESG) reporting, a type of corporate disclosure, outlines a firm's environmental, social, and governance dedications, efforts, and developments. Because of the need for inexpensive storage due to the increase in data, cloud-based information management infrastructures are frequently adopted. It is favoured because it requires less support from IT infrastructure, can be implemented quickly and predictably, upgrades automatically and seamlessly, and can be used more easily with cloud-based data.

As a result, businesses are implementing new methods and technology more frequently in order to lower energy expenses and adhere to energy-efficiency laws. Governments everywhere are setting higher goals for pollution restrictions and energy standards. Through the application of real-time data-driven predictive modelling methodologies, big data and analytics technologies are assisting enterprises in the energy sector in lowering their overall operating expenses. Analytics investment has surged across a number of industries, including banking, finance and insurance, healthcare, and E&U, as a result of these advantages.

However, businesses will spend a lot of money integrating EHS infrastructure with their current software. Adoption by SMEs can be extremely difficult due to associated costs, such as the high initial cost, which limits the adoption's potential. Because of this, integrating environmental, sustainability, and governance (ESG) reporting tools with enterprise resource planning (ERP) systems is becoming increasingly difficult./ The COVID-19 pandemic has had an adverse effect on the regional market for ESG reporting software. This is because it has caused several end-use businesses to cease operations, including electricity, oil and gas, chemicals, and others.

The ESG Reporting Software market is segmented based on component, deployment type, organization size, and vertical. As per the component, the market is divided into Solutions and services. The deployment type segment comprises on-premises and cloud. As per the organization size, the market is divided into large Enterprises and SMEs. According to vertical, the market is divided into BFSI, government, public sector & non-profit, and retail.

The cloud ESG reporting software is expected to hold a significant global market share in 2022 because of the growing popularity of cloud-based solutions and the advantages of cloud-based deployment, like easy accessibility and lower capital costs.

The SME segment is projected to grow rapidly in the global digital substation market because it has also been demonstrated that ESG activities increase staff productivity, cut costs, and improve efficiencies for SMEs. While the adoption of statutory ESG regulations is still sluggish, SMEs can gain an advantage by locating pertinent voluntary frameworks and aligning their ESG priorities with industry best practices. By doing this, they are able to take advantage of their advantage over slower-moving rivals, especially in countries like the US, Germany, the UK, China, and India.

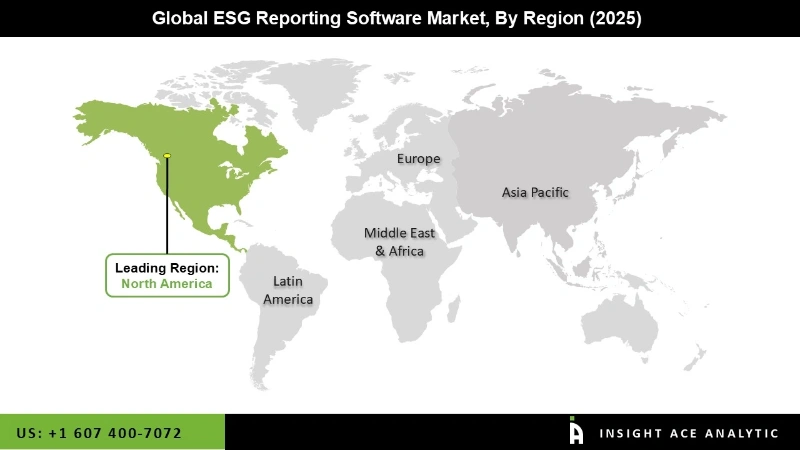

The North American ESG reporting software market is expected to register the greatest market share in revenue in the near future. It can be attributed that environmental risks have been reduced by the widespread use of environmental, sustainability, and governance (ESG) reporting software. In addition, It is projected that improving reimbursement guidelines and building out the healthcare infrastructure will spur market expansion. In addition, Asia Pacific is estimated to expand rapidly in the global digital substation market, boosted by increased demand for power in the ESG software market during the coming years, owing to breast cancer rates and the use of advanced diagnostic techniques.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.19 Billion |

| Revenue Forecast In 2035 | USD 5.21 Billion |

| Growth Rate CAGR | CAGR of 16.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Component, By Deployment Type, By Organization Size, By Vertical |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Wolters Kluwer (Netherlands), Nasdaq (US), PwC (UK), Workiva (US), Refinitiv (UK), Diligent (US), Sphera (US), Cority (Canada), Intelex (Canada), Greenstone (UK), Novisto (Canada), Emex (Ireland), Enhelix (US), Anthesis (UK), Diginex (Hong Kong), Bain & Co. (US), Keramida (US), Isometrix (US), Accuvio (acquired by Diligent) (US). |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.