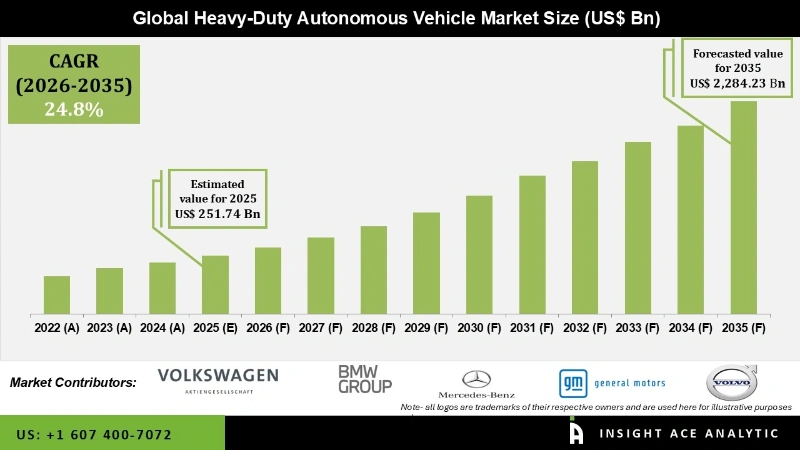

Global Heavy-Duty Autonomous Vehicle Market Size is valued at USD 251.74 Bn in 2025 and is predicted to reach USD 2,284.23 Bn by the year 2035 at a 24.8% CAGR during the forecast period for 2026 to 2035.

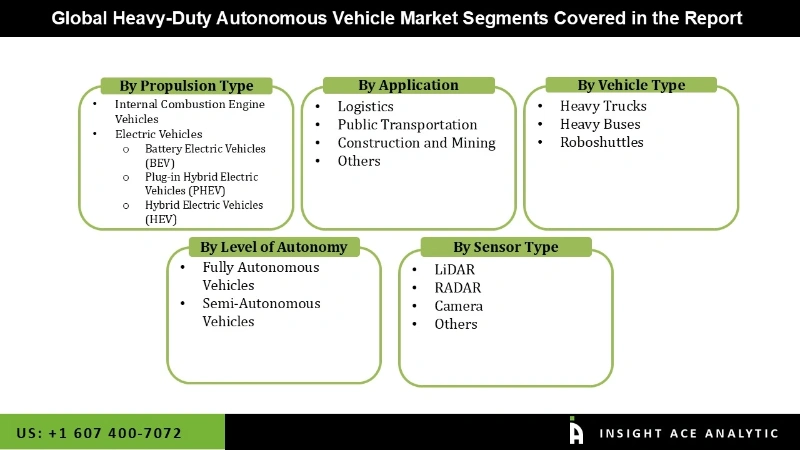

Heavy-Duty Autonomous Vehicle Market Size, Share & Trends Analysis Report By Application (Logistics, Public Transportation, Construction and Mining, Others), By Propulsion Type, By Vehicle Type, By Level of Autonomy, By Sensor Type, By Region, And By Segment Forecasts, 2026 to 2035.

Self-driving vehicles are designed for duties that require a significant load-carrying capacity and the ability to navigate challenging terrain, such as hauling materials and goods through mines and construction sites. Heavy-duty autonomous vehicles use a variety of technologies to traverse their environment and determine how to operate safely and efficiently. These include LiDAR sensors, GPS, and complex algorithms. They are frequently designed to run continuously with little help from people and can be powered by internal combustion engines or electricity.

The advantages of heavy-duty autonomous vehicles include increased productivity and efficiency as well as cheaper labour expenses. They are frequently designed to run continuously with little help from people and can be powered by internal combustion engines or electricity. The advantages of heavy-duty autonomous vehicles include increased productivity and efficiency as well as cheaper labour expenses. They are being developed and deployed by a range of companies in the transportation, logistics, construction, and mining industries, and as technology advances, it is projected that they will play an increasingly larger role in the future of these sectors.

Since human drivers are not necessary for autonomous trucks to operate, there is no longer a need to pay for wages, benefits, and overtime. Autonomous trucks also have the ability to work constantly without the need for breaks or shift changes, boosting productivity and further lowering labour expenses. Additionally, autonomous trucks can cut fuel usage. These vehicles can be designed to optimise their routes, steer clear of traffic, and spend less time idling, all of which saves fuel. Additionally, autonomous trucks may keep a constant speed, minimise abrupt acceleration and braking, and choose the route that uses the least gasoline, resulting in additional fuel savings.

The Heavy-Duty Autonomous Vehicle market is segmented on the basis of Application Propulsion Type, Vehicle Type, Level of Autonomy, and Sensor Type. Based on Application the market is divided into, Logistics, Public Transportation, Construction and Mining, and Others). The Propulsion Type segment consists of Internal Combustion Engine Vehicles and Electric Vehicles. Whereas, the Vehicle Type segment comprises Heavy Trucks, Heavy Buses, and Roboshuttles. Based on the Level of Autonomy, the market is segmented into Fully Autonomous Vehicles, Semi-Autonomous Vehicles. Lastly, By Sensor Type, the market is divided into LiDAR, RADAR, Camera, and Others.

The market was led by semi-autonomous, and this trend is estimated to continue during the projection period. For efficient driving, nearly all of the new-generation vehicles on the market include semi-autonomous technology. As a result, the segment's growth is anticipated to be fueled by the rapid adoption of semi-autonomous vehicles with technologies like ADAS, autopilot, automatic vehicle braking and parking systems, among others.

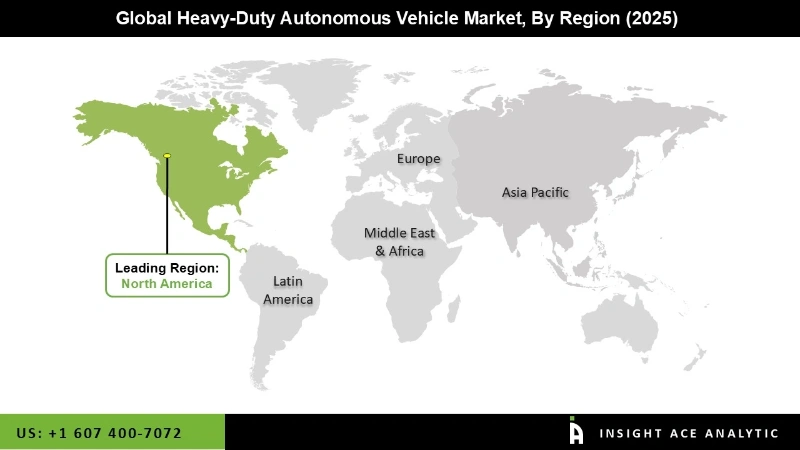

North America will dominate the market. The government's promotion of autonomous driving technologies, the region's rapidly growing economy and a well-established manufacturing sector, are all factors in this. Additionally, as heavy-duty vehicles are required in industries like mining, construction, logistics, and transportation to supply supplies and freight, it is projected that these industries would have the biggest demand for autonomous trucks. The increased electrification of vehicles is also driving the market in North America as a result of infrastructure development by businesses. Incorporating x-by-wire technology into electric vehicles is advancing autonomous driving.

Furthermore, Germany, the United Kingdom, and France are the countries that are most responsible for the market's expansion in Europe, which is a large market for autonomous trucks. The development of cutting-edge technology like AI and ADAS for autonomous driving is to blame. The high costs of adopting autonomous driving technologies, worries about the loss of truck driver jobs, and legislative barriers linked to the safety and liability of driverless trucks might all pose obstacles to the development of the market for autonomous trucks in Europe.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 251.74 Bn |

| Revenue Forecast In 2035 | USD 2,284.23 Bn |

| Growth Rate CAGR | CAGR of 24.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Application, By Propulsion Type, By Vehicle Type, By Level of Autonomy, By Sensor Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | AB Volvo, General Motors, Mercedes-Benz Group AG, BMW Group, Volkswagen AG, PACCAR Inc., Renault Trucks, Traton Group, Shanghai Newrizon Technology Co., Ltd., New Flyer (NFI Group), Karsan, Proterra, 2getthere B.V., Apollo (Baidu), Magna International Inc., ZF Friedrichshafen AG, Zoox, Inc., Cruise LLC, Schaeffler AG, P3 Mobility, HOLON GmbH, Embark Trucks Inc., Kodiak Robotics, Inc., TuSimple, Torc Robotics, Aurora Innovation Inc., PlusAI, Inc., Waymo LLC, Mobileye |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Heavy-Duty Autonomous Vehicle Market By Application-

Heavy-Duty Autonomous Vehicle Market By Propulsion Type -

Heavy-Duty Autonomous Vehicle Market By Vehicle Type -

Heavy-Duty Autonomous Vehicle Market By Level of Autonomy-

Heavy-Duty Autonomous Vehicle Market By Sensor Type-

Heavy-Duty Autonomous Vehicle Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.