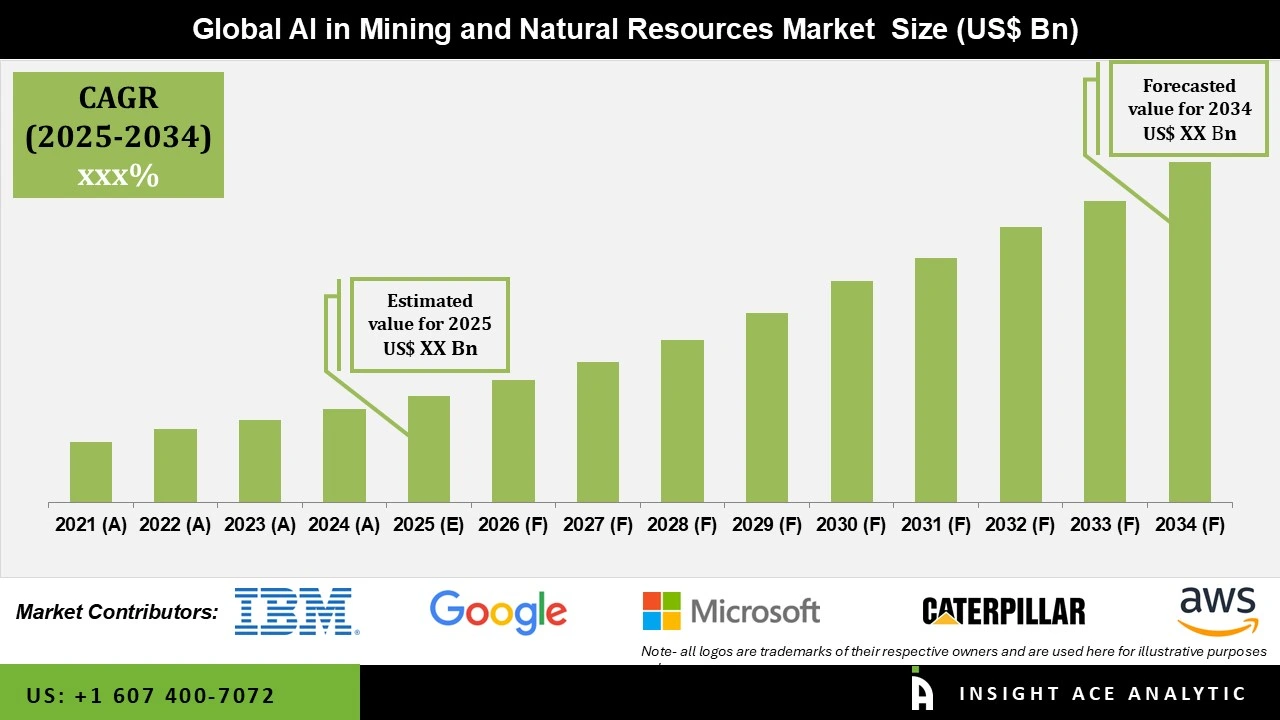

AI in Mining and Natural Resources Market Size is valued at USD 5.4 Bn in 2024 and is predicted to reach USD 35.2 Bn by the year 2034 at a 20.6% CAGR during the forecast period for 2025 to 2034.

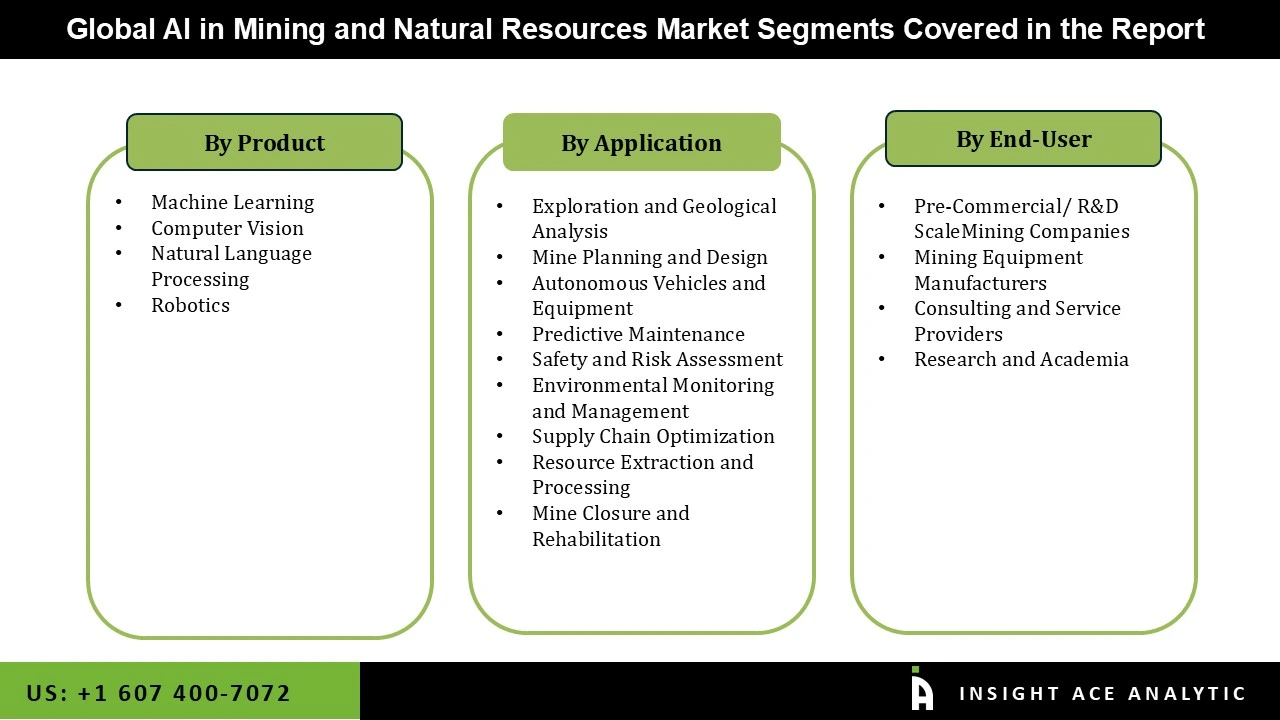

AI in Mining and Natural Resources Market Size, Share & Trends Analysis Report By Type (Machine Learning, Computer Vision, Natural Language Processing, Robotics), By Application, By End-User, By Region, And By Segment Forecasts, 2025 to 2034

Artificial intelligence has become a disruptive factor in the natural resources and mining sector. This field aims to transform resource extraction and management by utilizing AI technologies like computer vision and machine learning. AI's capacity to interpret mining businesses may improve worker safety protocols, make data-driven decisions, and maximize exploration efforts by analyzing large databases. Additionally, in dangerous mining locations, AI-powered autonomous trucks and equipment can lower operating hazards and boost production.

Artificial intelligence in mining and natural resources has a lot of potential to advance sustainable practices, boost operational effectiveness, and satisfy the growing demand for essential natural resources worldwide.The growing necessity for effective and sustainable resource management is a key impetus in the mining sector. Extensive data processing and analytical insights from AI enhance decision-making, thereby reducing environmental impact, decreasing operational expenses, and streamlining exploration and extraction processes.

AI in the mining and natural resources market is segmented by type, application, and end user. Based on type, the market is segmented into machine learning, computer vision, natural language processing, and robotics. By application, the market is segmented as exploration and geological analysis, mine planning and design, autonomous vehicles and equipment, predictive maintenance, safety and risk assessment, environmental monitoring and management, supply chain optimization, resource extraction and processing, and mine closure and rehabilitation. By end-user, the market is segmented into mining companies, mining equipment manufacturers, consulting and service providers, and research and academia.

The market is expanding due in large part to its critical role in exploration and geological analysis, where AI makes target identification, geological modelling, and efficient data processing possible. AI improves scheduling, resource allocation, and layouts in mine planning and design, resulting in more economical and sustainable mining operations. While predictive maintenance solutions reduce downtime and boost equipment reliability, autonomous vehicles and equipment that integrate artificial intelligence (AI) improve automation and safety in demanding mining conditions—AI-powered data analytics help Safety and Risk Assessment by offering real-time insights to avert potential dangers and mishaps.

Predictive maintenance is another current use of AI in mining. Mining companies have reduced downtime and increased the lifespan of both fixed and mobile assets by employing machine learning (ML) algorithms to evaluate equipment data and detect breakdowns before they happen. In addition to saving money, this strategy increases safety by reducing the likelihood of incidents involving equipment.

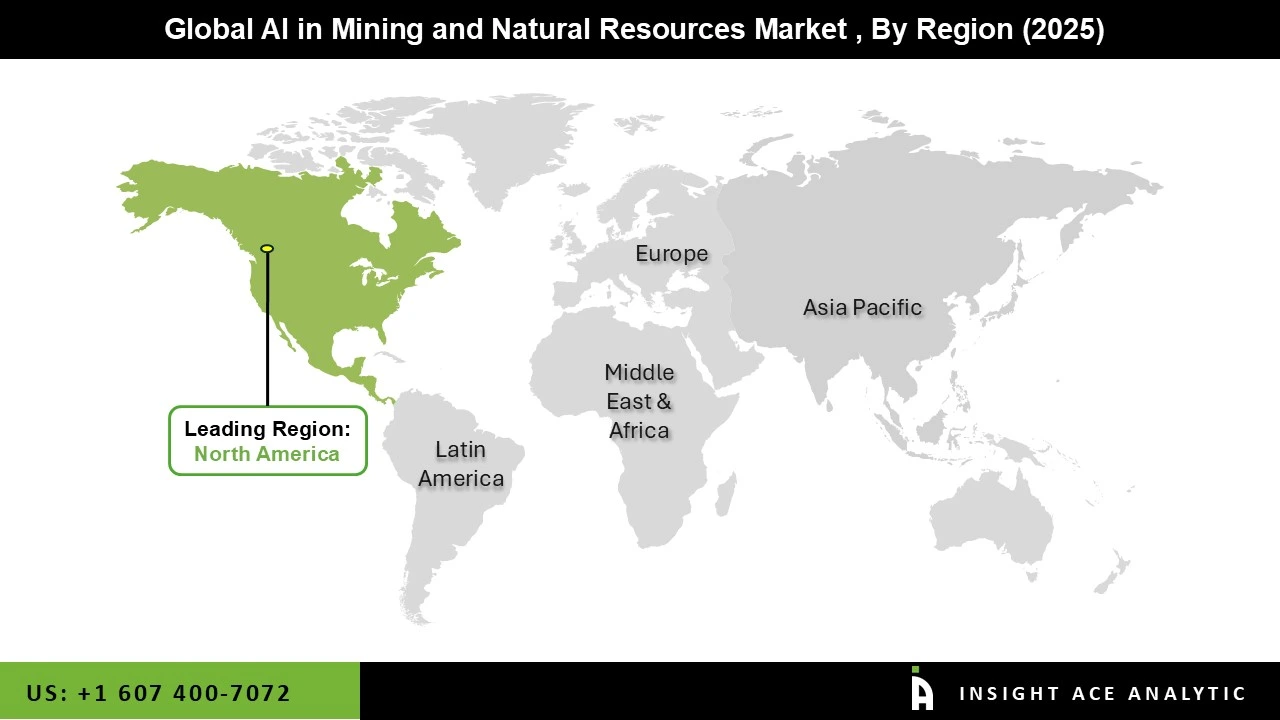

Due to significant R&D investments, technological developments, and partnerships between mining businesses and AI technology providers, North America is at the forefront of the implementation of AI in mining. The market is thriving in Europe as a result of the region's emphasis on environmentally friendly mining methods, legislative backing, and the presence of top suppliers of AI solutions.

With nations like Australia and China making significant investments in AI technology to improve safety, optimize mining operations, and satisfy resource demands, Asia Pacific offers potential for rapid growth. While the Middle East and Africa see growing AI integration for resource exploration and extraction, supporting the region's economic development, Latin America embraces AI-driven technologies to increase efficiency and productivity in the mining sector.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 5.4 Bn |

| Revenue Forecast In 2034 | USD 35.2 Bn |

| Growth Rate CAGR | CAGR of 20.6% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Application, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | IBM Corporation, Google LLC, Microsoft Corporation, Amazon Web Services, Inc., Caterpillar Inc., Komatsu Ltd., Sandvik AB, Hexagon AB, ABB Ltd., Rockwell Automation, Inc., Hitachi Construction Machinery Co., Ltd., NVIDIA Corporation, SAP SE, Cisco Systems, Inc., Wenco International Mining Systems Ltd., BHP Group, Rio Tinto Group, Vale S.A., Anglo American plc, Freeport-McMoRan Inc., Newmont Corporation, Teck Resources Limited, Glencore plc, Gold Fields Limited, Barrick Gold Corporation. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.