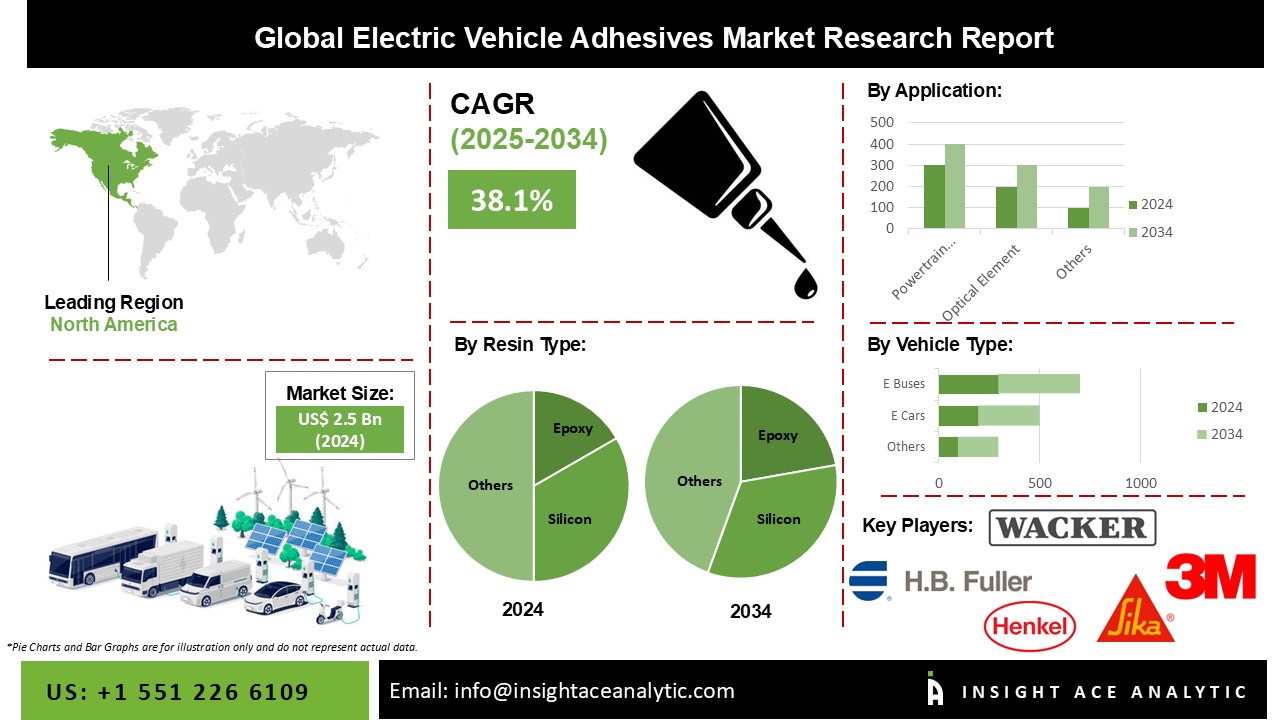

Electric Vehicle Adhesives Market Size is valued at USD 2.5 Bn in 2024 and is predicted to reach USD 63.1 Bn by the year 2034 at a 38.1% CAGR during the forecast period for 2025-2034.

Electric vehicle (EV) adhesives are specialized adhesive materials used in EV manufacturing. They serve various purposes, including bonding and sealing battery components, managing heat, insulating electrical parts, reducing noise, and enhancing structural integrity. These adhesives need to be strong, thermally conductive, electrically insulating, durable, and environmentally friendly to support the unique requirements of electric vehicles. Electric vehicles have become more popular. The demand for specialized adhesives that can withstand high temperatures, vibration, and other harsh conditions also increases developed countries' strict regulations regarding greenhouse gas emissions, which will propel market expansion during this time. These standards have boosted the use of electric vehicles in these regions.

The main automakers are raising their investment levels to produce electric vehicles. A bigger interest in the good is anticipated throughout the forecast. Thus, major electric car manufacturers are concentrating on diversifying their product range by offering a variety of models. Greater adoption of electric-powered vehicles will additionally fuel market expansion. Electric vehicles have become very popular in recent years. Almost 10 Bn electric vehicles are on the road in different parts of the world. And it will develop throughout the ensuing years. Electric automobiles and coaches have also been in high demand to help the transportation sector. Throughout the projection period, the market expansion will be fueled by various legislative frameworks encouraging electric vehicles.

The electric vehicle adhesives market is segmented based on application, resin type, form and substrate. As per the applications, the market is segmented as powertrain, optical element, sensors, communication, and body frame. The market is divided into epoxy, acrylic, silicone, polyurethane, and others based on resin type. The market is segmented into film & type, liquid, and others based on the form type. Based on substrate, the electric vehicle adhesives market is segmented as plastic, composite and metals.

The liquid category will hold a major global market share in 2021. A solid substance is produced that merges the substrates through a chemical or chemical reaction by sandwiching two substrates with a liquid adhesive. Liquid adhesives are used in electric cars for some things, including the exterior, interior, and electric batteries. Outside applications have the highest demand for liquid adhesives after interior applications. In an electric car, significant quantities of the vehicle's structural body.

The polyurethane segment is projected to grow rapidly in the global electric vehicle adhesives market. Due to the numerous types of resins used in its production, it has different qualities. These sealants are employed in many industries according to their qualities. The demand for polyurethane adhesives will increase throughout the forecast due to their remarkable quality, which gives an elasticity of around 600%. This glue has a very high degree of flexibility.

Asia Pacific regional market holds the largest market share due to the region's increasing demand for electric vehicles, combined with government initiatives to promote sustainable transportation adoption. The Asia Pacific region's significant growth in the electric vehicle adhesive market is expected to be driven by the occurrence of major electric vehicle manufacturers and suppliers. This is projected to result in increased demand for specialized adhesives for use in the production of electric vehicles, thereby creating growth opportunities for players in the market. Moreover, the European region is estimated to hold the second-largest market share since the rising demand for electric vehicles, major electric vehicle manufacturers and suppliers, and government initiatives promoting sustainable transportation.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 2.5 Bn |

| Revenue Forecast In 2034 | USD 63.1 Bn |

| Growth Rate CAGR | CAGR of 38.06 % from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume (Ton) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Application, Resin Type, Vehicle Type, Substrate, Form |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Henkel AG & Co. KGaA (Germany), H.B. Fuller (US), Sika AG (Switzerland), 3M (US), Wacker Chemie AG (Germany), Arkema S.A. (France), Ashland Inc. (US), PPG Industries (US), Parker Hannifin Corporation (US), Illinois Tool Works Inc. (US), Jowat SE, Permabond LLC, DELO Industrie Klebstoffe GmbH & Co. KGaA, Uniseal, Inc., Riëd B.V., L&L Products, Dymax Corporation, WEICON Gmbh & Co. KG, ThreeBond Co., Ltd., Evonik Industries AG, KLEIBERIT SE & Co. KG, Metlok Private Limited, Hexcel Corporation, Lohmann Technologies, US Adhesives |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Electric Vehicle Adhesives Market By Application

Electric Vehicle Adhesives Market By Resin Type

Electric Vehicle Adhesives Market By Vehicle Type

Electric Vehicle Adhesives Market By Substrate

Electric Vehicle Adhesives Market By Form

Electric Vehicle Adhesives Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.