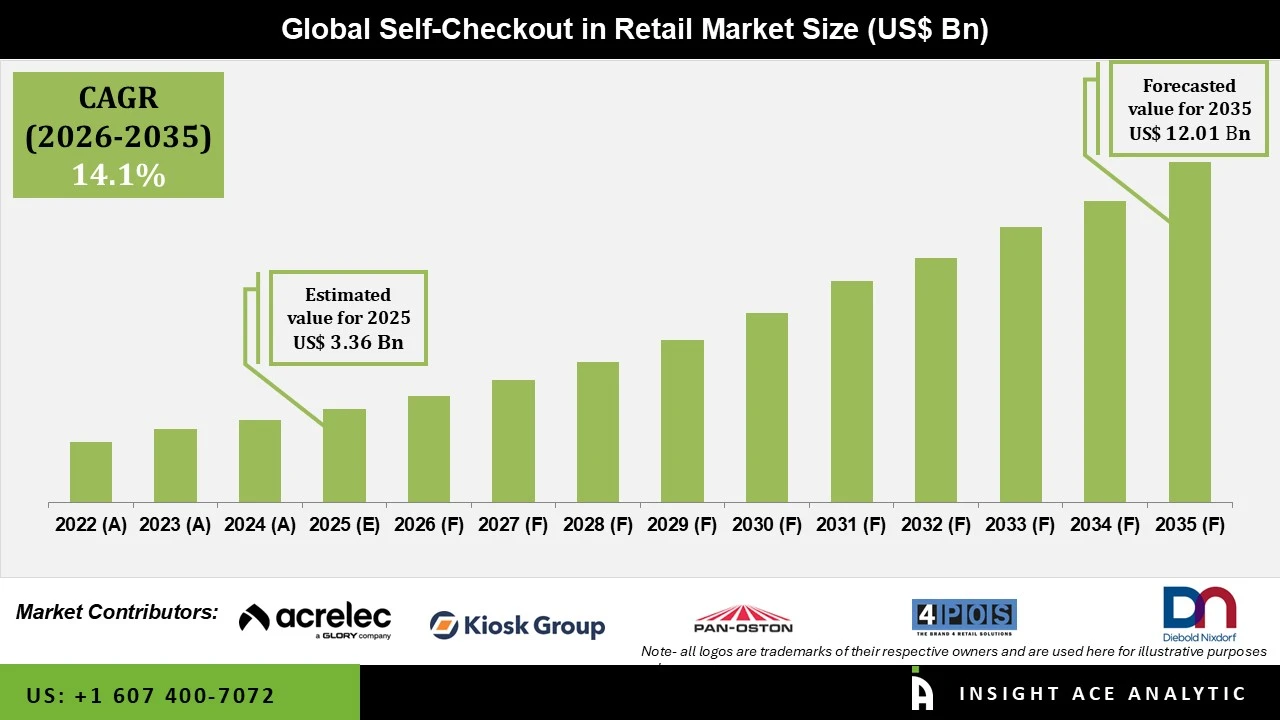

Self Checkout in Retail Market Size is valued at USD 3.36 Bn in 2025 and is predicted to reach USD 12.01 Bn by the year 2035 at a 14.1% CAGR during the forecast period for 2026 to 2035.

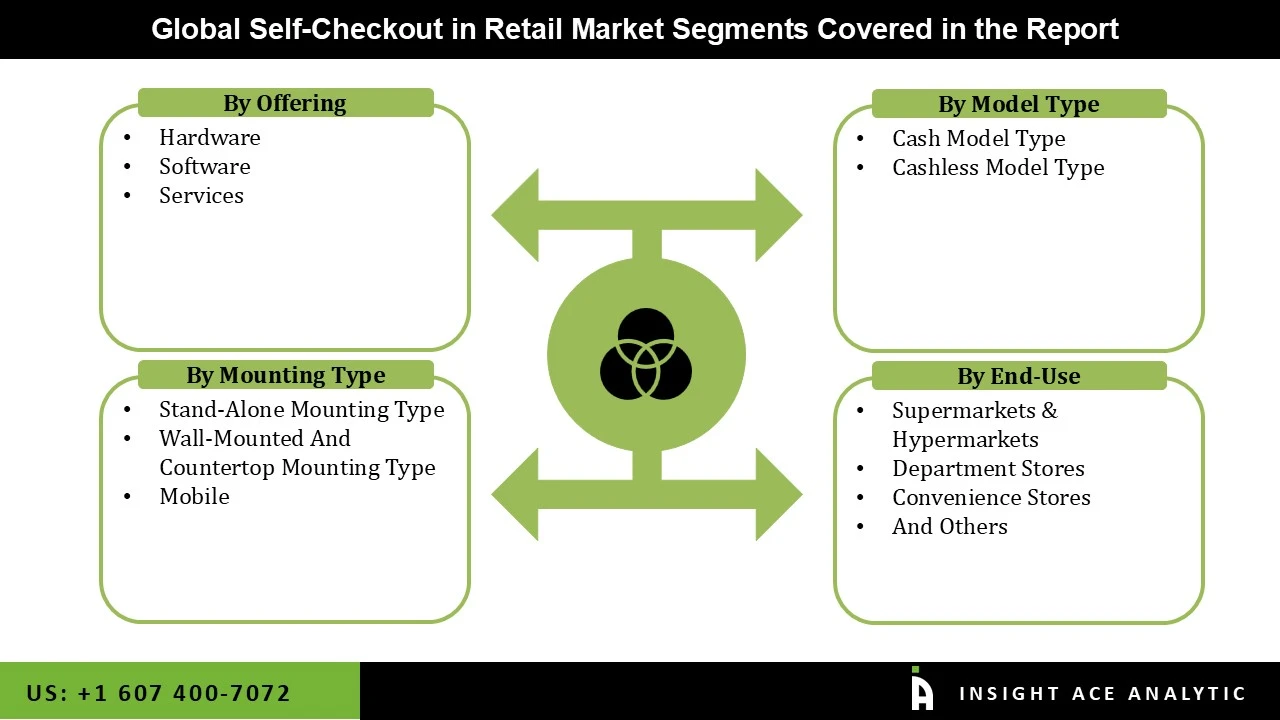

Self Checkout in Retail Market Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), by Model Type (Cash Model, Cashless Model), By Mounting Type, By Region, And by Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Self-checkout (SCO) scanners, often referred to as aided-checkout (ACO) or self-service checkouts (SSC) are devices that allow customers to complete their purchases from a business without requiring a conventional staffed checkout. Customers can now scan item barcodes and complete their entire purchase without needing one-on-one worker assistance, thanks to the use of SCOs. Self-checkout lanes can be found in convenience and department stores, but they are most frequently used in supermarkets. The market is still expanding at a steady rate thanks to technological advancements and rising IoT penetration in the retail sector. To alleviate in-store problems with inventory mapping, product information identification, payment, and customer experience, store owners are spending more and more on technology.

The market's top companies are working together to install self-checkout in retail at retail establishments. Self-checkout devices are increasingly being used at convenience stores, malls, supermarkets, and retail businesses to save time and money. Other factors driving the market's expansion include the lack of experienced personnel in emerging countries, growing labor prices, and a preference for individualized shopping experiences.

The industry is being driven in large part by rising automation demand as well as technological developments aimed at lowering theft rates. Additionally, the well-established and widespread use of retail networks like supermarkets and hypermarkets and the growing digitalization are opening up the potential for self-checkout in retail. The rising use of smartphones supports the trend toward cashless payment transactions on mobile devices because it is highly convenient and economical. Participants in the banking industry have been encouraged by this to meet the growing demand for cashless payment services through mobile apps.

The self-checkout in the retail market is segmented on the offering, model type, mounting type and end-user. Based on offering, the market is segmented into hardware, software and services. Based on the model type, self-checkout in the retail market is segmented into cash and cashless models. Based on the mounting type, the self-checkout in the retail market is segmented into stand-alone mounting type, wall-mounted and countertop mounting type, and mobile. Based on end-user, self-checkout in the retail market is segmented into supermarkets & hypermarkets, department stores, convenience stores, and others.

The market's leading segment is hypermarkets & supermarkets. The increase is attributable to the rising popularity of self-checkout machines in supermarkets and hypermarkets. Self-checkout in retail has become increasingly popular due to the substantial increase in shoppers at supermarkets and the necessity to increase personnel productivity in the stores while improving customer happiness. They can also embrace self-checkout due to rising personnel costs and the need to use available floor space effectively.

Services grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the expected time. Retailers are being influenced to use consultancy, maintenance, and motivational services by considerations such as the need for efficient systems that provide flexibility in the store's front end, quicker processing, and simple method and service integration in traditional checkout systems and self-checkout. The increase in consulting and managed services are also attributed to the demand for customized solutions that consider store layouts and the ongoing retail in-store transformation. A further factor driving the segment's growth is the demand for expert consulting services to integrate customized or modified software in the systems.

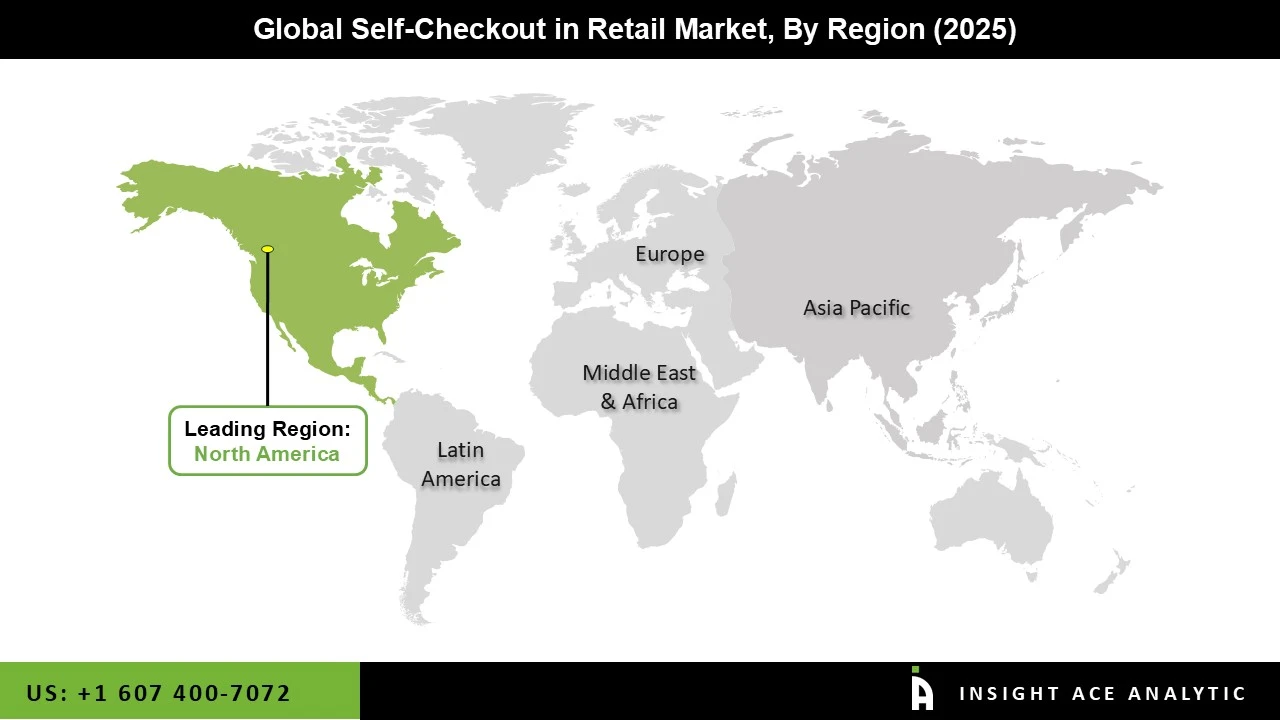

The North American self-checkout in the retail market is expected to register the highest market share in revenue shortly. The increase in retail outlets, department shops, and convenience stores is a significant component boosting the market growth rate. The market growth rate for self-checkout in retail is also increasing due to the growing digitization of developing economies. One of the key reasons for promoting market expansion in this region is the rising popularity of smart technology for streamlining the in-store shopping experience. In addition, Asia Pacific is projected to grow rapidly in the global self-checkout in the retail market. The buy-as-you-need trend, which is gaining consumer favor and encouraging numerous large-size retail grocery store chains to open convenience stores in the area, is responsible for this increase.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 3.36 Billion |

| Revenue Forecast In 2035 | USD 12.01 Billion |

| Growth Rate CAGR | CAGR of 14.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn,and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Offering, Model Type, Mounting Type, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Acrelec, Kiosk Group, Flooid, Gilbarco Inc, Pan Ostan, Strongpoint, 4POS AG, Diebold Nixdorf, Incorporated, Fujitsu LTD, ECR Software Corporation, ITAB Group, NCR Corporation, Zebra Technologies, and Pyramid Computer GMBH |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Offering

By Model Type

By Mounting Type

By End-User

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.