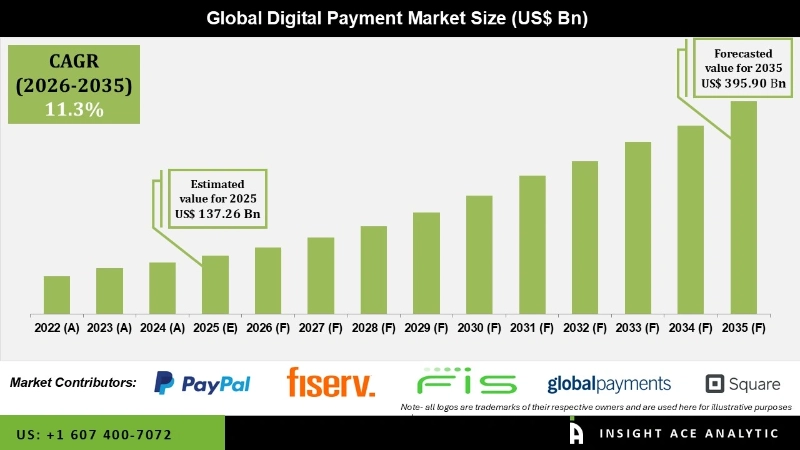

Global Digital Payment Market Size is valued at USD 137.26 Billion in 2025 and is predicted to reach USD 395.90 Billion by the year 2035 at a 11.3% CAGR during the forecast period for 2026 to 2035.

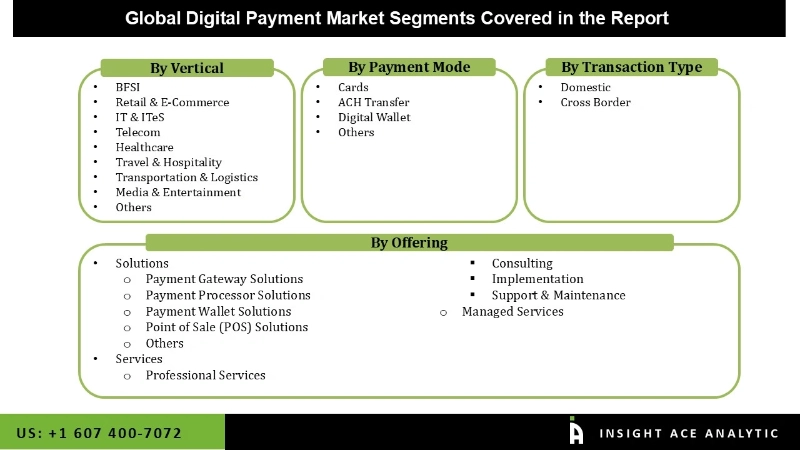

Digital Payment Market Size, Share & Trends Analysis Report By Offering (Solutions (Payment Gateway, Payment Processors, Payment Wallet, Point of Sale, and Other Solutions), Services (professional services (Consulting, Implementation, Support & Maintenance), Managed Services), By Transaction Type, Payment Mode, By Vertical, By Region, And By Segment Forecasts, 2026 to 2035.

Digital payment refers to transferring payments via electronic devices such as mobile phones, computers, etc. This technology has been consistently advancing over the past few years. Many additional payment options have been integrated into the digital payment system, encompassing online transactions, card swapping, NFC card tapping, and code scanning. Digital payments continue to evolve with ongoing technological advancements, offering consumers and businesses more secure and efficient ways to manage financial transactions. This constant improvement and variety of payment methods are increasing the popularity of digital payments. Furthermore, expanding internet access to every available location increases the demand for digital payment. Smartphone adoption is also prompting people to pursue digital marketing.

Moreover, the COVID-19 pandemic has had a favourable impact on the industry, resulting in a significant increase in online sales as well as the increased use of online payment methods. During the pandemic, customers worldwide have migrated from offline to internet buying. Customer fear about being in crowded areas during the pandemic is fuelling demand for online retailing.

The Digital Payment Market comprises significant segments like offering, transaction type, payment mode, and vertical. As per the offerings, the market is divided into solutions and services.

The solutions segment includes payment gateway solutions, payment processor solutions, payment wallet solutions, point of sale (POS) solutions, and others. According to services, the market comprises professional services and managed services. The professional services segment includes consulting, implementation, and support & maintenance. By transaction type, the market is segmented into domestic and cross-border. The payment mode segment includes cards, ACH transfers, digital wallets, and others. The vertical segment is divided into BFSI, retail & e-commerce, IT & ITES, Telecom, Healthcare, travel & hospitality, transportation & logistics, media & entertainment, and others.

The media & entertainment category is expected to hold a major share of the global Digital Payment Market in 2024. The rise of the smartphone market and the availability of high-speed and low-cost data services are driving the growth of this industry. This vertical is witnessing a significant transition in how media content is available to customers. While print and electronic media remain the dominant traditional techniques in the media and entertainment sectors, the availability of digital media material via mobile devices facilitated by the internet is fast rising.

The payment wallet solutions segment is projected to grow rapidly in the global Digital Payment Market. Payment wallets, which are often accessed through mobile apps, let users digitally store, manage, and conduct various financial activities. They can connect to different payment methods and support a wide range of transactions. Payment wallets are frequently used to make in-store and online purchases, as well as bill payments and peer-to-peer transfers. They promote financial inclusion, encourage competition, and adhere to financial regulations. While global competitors such as Apple Pay and Google Pay dominate, localized providers serve specific regions as well. Payment wallets are essential in modern digital finance.

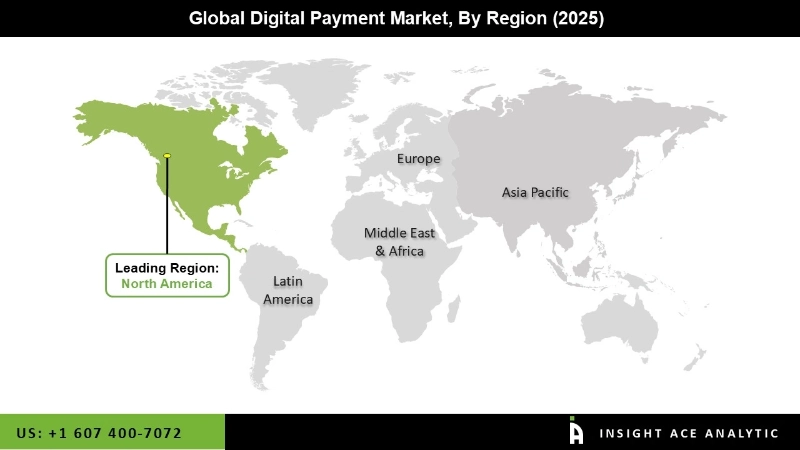

The Digital Payment Market of Asia Pacific is expected to record the maximum market share in revenue in the near future. The Asia Pacific Digital Payment market includes China, Japan, India, and other countries. Due to a variety of circumstances, the Asia-Pacific (APAC) region is seeing an increase in demand for digital payment solutions. Rapid economic growth, broad smartphone usage, a tech-savvy population, the e-commerce boom, government initiatives, international trade, urbanization, fintech innovation, and an emphasis on financial inclusion all contribute to this demand. The dynamic economies of APAC, as well as the growing need for convenient and secure financial transactions, are driving the adoption of digital payment systems, making the area a hotspot for digital payment innovation and expansion.

Additionally, North America is expected to grow at a significant rate. Factors such as increased deployment and technological advancements in smart parking meters boost the regional market. Furthermore, the growing number of unmanned establishments in the United States is increasing the demand for digital payment solutions.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 137.26 Billion |

| Revenue Forecast In 2035 | USD 395.90 Billion |

| Growth Rate CAGR | CAGR of 11.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Offering, Services, Transaction Type, Payment Mode, Vertical |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia |

| Competitive Landscape | PayPal (US), Fiserv (US), FIS (US), Global Payments (US), Square (US), Stripe (US), VISA (US), Mastercard (US), Worldline (France), Adyen (Netherlands), ACI Worldwide (US), Temenos (Switzerland), PayU (Netherlands), Apple (US), JPMorgan Chase (US), WEX (US), FLEETCOR (US), Aurus (US), PayTrace (US), Stax by FattMerchant (US), Verifone(US), Spreedly (US), Dwolla (US), BharatPe (India), Payset (UK), PaySend (UK), MatchMove (Singapore), Ripple (US), and EBANX (Brazil) |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Digital Payment Market By Offering-

Digital Payment Market By Transaction Type-

Digital Payment Market By Payment Mode-

Digital Payment Market By Vertical-

Digital Payment Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.