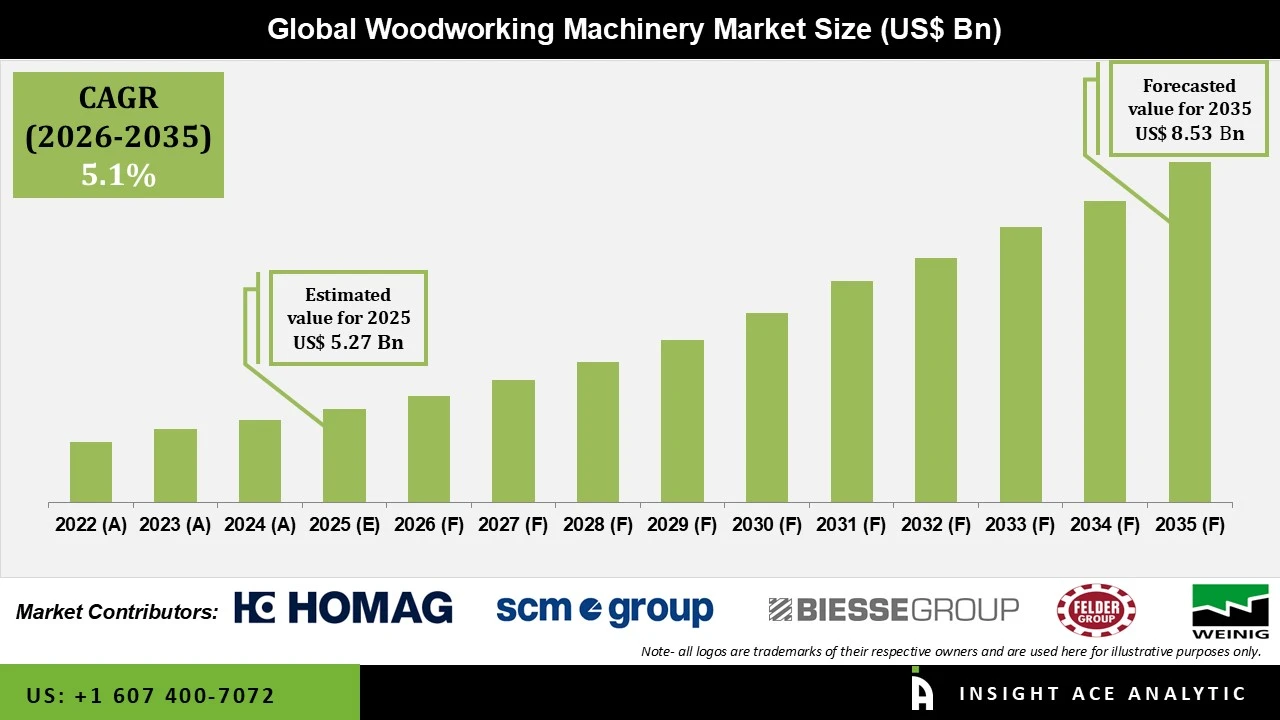

Woodworking Machinery Market Size is valued at USD 5.27 Bn in 2025 and is predicted to reach USD 8.53 Bn by the year 2035 at a 5.1% CAGR during the forecast period for 2026 to 2035.

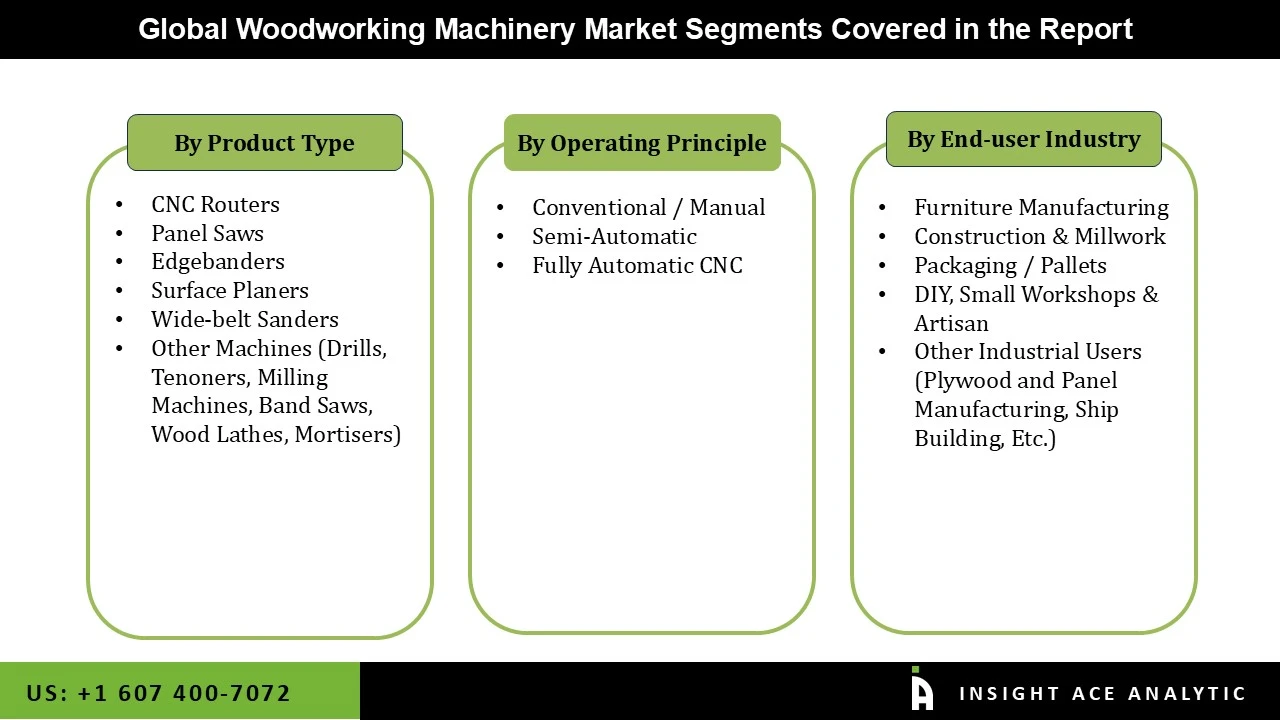

Woodworking Machinery Market Size, Share & Trends Analysis Distribution by Operating Principle (Conventional / Manual, Semi-Automatic, and Fully Automatic CNC), Product Type (Surface Planers, CNC Routers, Edgebanders, Panel Saws, Wide-belt Sanders, and Others (Drills, Wood Lathes, Milling Machines, Tenoners, Band Saws, Mortisers)), End-user (Packaging / Pallets, Furniture Manufacturing, DIY, Construction & Millwork, Small Workshops & Artisan, and Others (Plywood and Panel Manufacturing, Ship Building)), and Segment Forecasts, 2026 to 2035

The equipment used to process wood, perform various operations on raw wood, and transform it into desired final products is known as woodworking machinery. Small-scale commercial production facilities that specialize in timber products use these machines. The machines fall into two categories: stationary machines, which move the material in the desired shape while the machine remains stationary, and non-stationary machines, which move the material while it remains fixed to produce the desired result. The primary factor propelling the woodworking machinery market is the growing need for furniture and cabinetry brought on by an increase in home remodeling and building projects.

The rising use of engineered wood products, which are widely used in construction and furniture manufacture, is another factor driving the expansion of the woodworking machinery market. This is explained by the growing popularity of using eco-friendly building materials and the demand for high-quality, long-lasting wood goods. Furthermore, the expansion of the woodworking machinery market is primarily driven by increased building and construction activity worldwide. Additionally, the woodworking machinery market is growing as more people use wooden items and bespoke furniture these days. To meet consumer demand and boost overall output, manufacturers are investing in innovative machinery to ensure precision and efficiency.

In addition, a noteworthy trend is the introduction of woodworking machinery, which speeds up manufacturing processes and improves production efficiency. This change is the result of rising labor costs and demands for accuracy and precision, which attracted most producers to do away with manual labor on machines. Moreover, the cutting-edge technology used in the woodworking sector boosts the woodworking machinery market expansion. In wealthy countries and in the majority of developing countries where industries are emerging, this trend is highly noticeable. Additionally, makers of woodworking machinery are benefiting from the growth of e-commerce and online retailing. The market for both ready-made and bespoke timber products is expanding online. Therefore, to produce high-quality goods faster, producers can invest in efficient equipment.

• HOMAG Group

• SCM Group

• Felder Group

• Holz-Her

• Paolino Bacci

• IMA Schelling Group

• Timesavers

• Leadermac (Cantek)

• Biesse Group

• Michael Weinig AG

• Nanxing Machinery

• Anderson Group

• Grizzly Industrial

• JET (JPW)

• Makita Corp.

• Laguna Tools

• SawStop

• Festool

• Powermatic (JPW)

• Shandong Baide

• Other Prominent Players

The woodworking machinery market is anticipated to grow in the future due to the construction industry's continued expansion. In order to produce doors, windows, furniture, and other architectural components that are essential to building structures, woodworking technology is utilized in construction for the precise shape, cutting, and assembly of wood components. For instance, the Australian Bureau of Statistics, a government agency with headquarters in Australia, stated in July 2023 that the number of homes under construction rose from 240,065 in 2022 to 240,813 in the March quarter of 2023.

New homes accounted for 103,778 of these, up from 101,240 the year before. Additionally, advanced woodworking machinery that can create intricate cuts and finishes is expected to become increasingly necessary as a result of the growing trend of consumers purchasing personalized furniture, which enables them to express their own distinct taste in home décor. The customization has emerged as a key purchasing factor in today's market, as buyers need furniture that not only satisfies their fundamental functional needs but also reflects their unique aesthetic preferences. Thus, the growth of the woodworking machinery market is being driven by the construction sector's increasing expansion.

The production costs and profitability of woodworking machinery are greatly impacted by price volatility for raw materials, particularly wood. These businesses struggle to keep consistent pricing strategies and efficiently manage budgets due to fluctuating expenses brought on by erratic supply chain interruptions. The ability of woodworking enterprises to invest in new equipment and technology is hampered by this unpredictability, which frequently results in increased operating costs and decreased profit margins. Companies may thus find it difficult to innovate, increase productivity, and maintain market competitiveness. Furthermore, erratic production schedules might result from the unpredictability of raw material cost and availability, which will further impact long-term company growth and customer satisfaction. In order to address these problems, businesses might need to investigate alternate materials and implement more adaptable procurement practices, but these approaches also present a number of difficulties.

The fully automatic CNC category held the largest share in the Woodworking Machinery market in 2025 because it provides accurate and effective woodworking procedures to satisfy the demands of the building, furniture, and cabinetry industries. The automated machines increase manufacturing speed, reduce errors, and reduce human labor, making them more efficient for producing large-scale and customized wood goods. As automated control systems, robots, and CNC technology become more common in industrial applications, the market grows. Additionally, because manufacturers utilize automated solutions to accomplish safe operations and energy efficiency while overcoming rising labor expenditures, the woodworking machinery market demonstrates the fully automatic CNC segment's dominant position.

In 2025, the furniture manufacturing category dominated the Woodworking Machinery market. This increase results from the increased demand for wooden products around the world, which are prized for their strength, beauty, and environmental friendliness. The demand for sophisticated tools that can efficiently create a variety of styles is rising as more people choose wood's organic appearance for their houses. Additionally, a major driver of this industry's expansion is the quick rise in residential and commercial real estate projects, which increases demand for new house furnishings and commercial settings. Households and businesses spend more on functional yet aesthetically pleasing wood-based interiors as cities expand and people's incomes increase. This results in a constant need for contemporary machinery that can produce accurate results with smooth finishes, regardless of production volume.

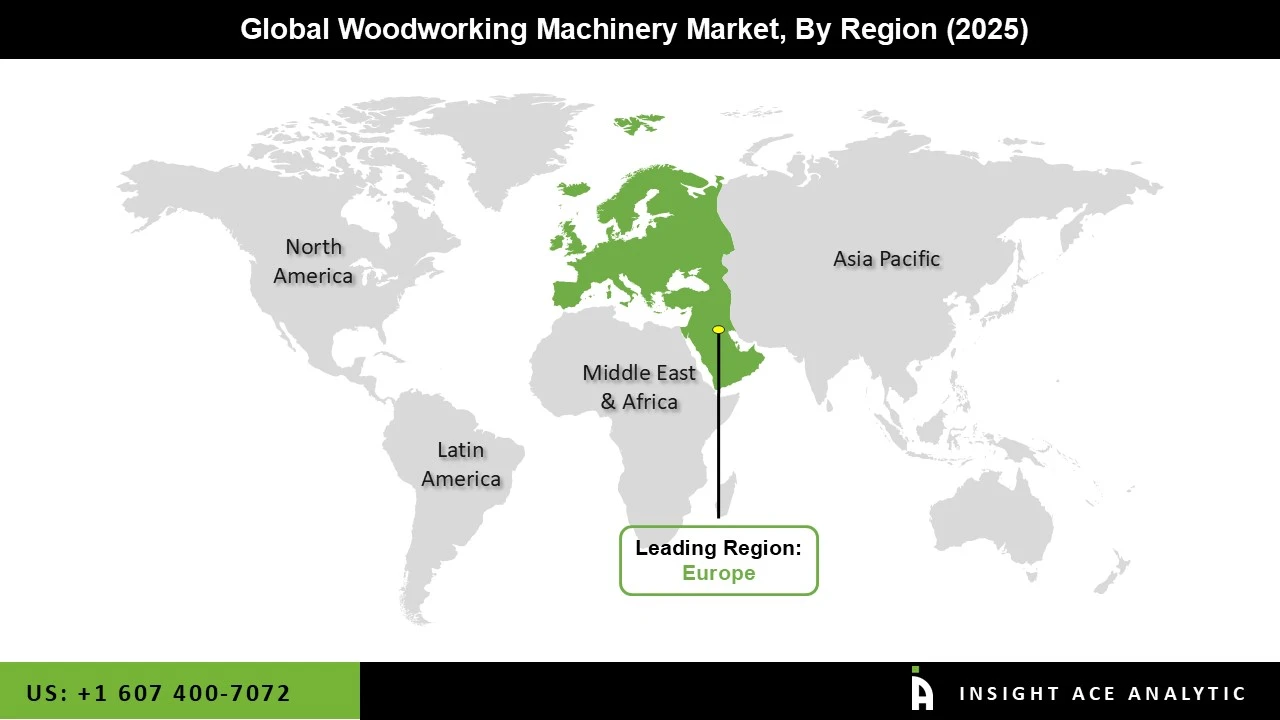

The Woodworking Machinery market was dominated by European region in 2025. The region's robust woodworking and furniture manufacturing industries, which flourish in Germany, Italy, and France due to their production of precise, high-quality wood items, allow it to dominate the market. Additionally, modern woodworking machinery is becoming more and more popular due to the demand for custom furniture, cabinets, and interior design solutions. By implementing automated systems, digital technologies, and energy-saving equipment, European manufacturing facilities have increased their operating efficiency and output quality. This covers intelligent monitoring systems, robotic systems, and CNC machines. Furthermore, due to stringent safety and environmental requirements that demand manufacturers utilize contemporary, sustainable equipment, the European woodworking machinery industry continues to hold its dominant position in the global market.

• March 2025: Comeva's FRAME BR-605E CNC line was introduced with the goal of improving accuracy while machining aluminum and wood rebates and door frames. Production is streamlined and efficiency is increased by the system's autonomous loading and unloading capabilities. When combined with Comeva's clever COMEVA DOORS software, it enables simple modifications and maximizes performance. Productivity and quality are guaranteed by the FRAME BR-605E, which is designed for high-volume manufacturing. With this cutting-edge solution, Comeva is positioned as a major pioneer in contemporary frame production technology.

• August 2024: Inside Biesse 2024, Biesse S.p.A.'s premier event, was held in the Biesse Bengaluru Showroom.Inside Biesse 2024 highlighted Biesse's dedication to machine manufacturing innovation and perfection, serving not only the woodworking industry but also a range of other industries with its multi-material solutions.

• March 2024: The acquisition of Stähle-Hess's grinding machine portfolio was finalized by Michael Weinig AG. The purchase includes technical know-how and design documentation for machines made by Rotofinish, Gloria, and Saturn that will be marketed and produced under the Weinig name starting in 2025.

• June 2023: In partnership with Visionet, Rockler Woodworking plans to modernize its outdated ERP and point-of-sale systems in order to improve its e-commerce infrastructure. By modernizing business procedures, this calculated action seeks to give clients a flawless purchasing experience. The improvements are intended to improve customer satisfaction, encourage loyalty, and expedite commerce operations—all of which will lead to better commercial results.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 5.27 Bn |

| Revenue forecast in 2035 | USD 8.53 Bn |

| Growth Rate CAGR | CAGR of 5.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Operating Principle, Product Type, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | HOMAG Group, SCM Group, Felder Group, Holz-Her, Paolino Bacci, IMA Schelling Group, Timesavers, Leadermac (Cantek), Biesse Group, Michael Weinig AG, Nanxing Machinery, Anderson Group, Grizzly Industrial, JET (JPW), Makita Corp., Laguna Tools, SawStop, Festool, Powermatic (JPW), and Shandong Baide |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Conventional / Manual

• Semi-Automatic

• Fully Automatic CNC

• Surface Planers

• CNC Routers

• Edgebanders

• Panel Saws

• Wide-belt Sanders

• Others

o Drills

o Wood Lathes

o Milling Machines

o Tenoners

o Band Saws

o Mortisers

• Packaging / Pallets

• Furniture Manufacturing

• DIY

• Construction & Millwork

• Small Workshops & Artisan

• Others

o Plywood and Panel Manufacturing

o Ship Building

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Mexico

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.