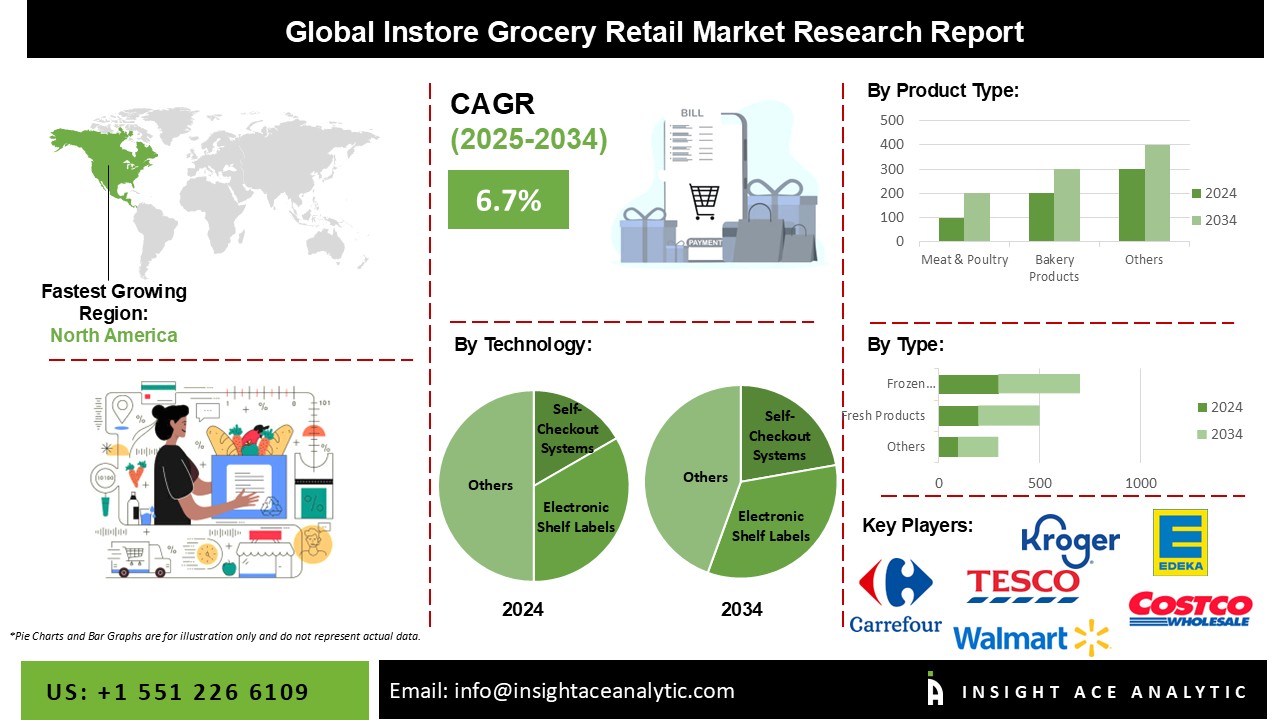

Instore Grocery Retail Market Size is predicted witness at a 6.7% CAGR during the forecast period for 2025-2034.

Instore Grocery Retail Market Size, Share & Trends Analysis Report by Technology (Self-Checkout Systems, Electronic Shelf Labels, Autonomous Store Inventory Management, Digital Signage, Customer Analytics, Automated Replenishment, Others), By Product Type (Dairy Produce, Meat & Poultry, Canned & Packaged Foods, Bakery Products, Snacks & Sweets, Others), By Store Type, Type, Region And Segment Forecasts, 2025-2034.

Retailers continuously compete for market share in the very competitive in-store food retail business. Price, product quality, convenience, and customer service are all important factors in attracting and retaining customers. Multiple reasons have led to opportunities in the industry of in-store food purchasing.

These include the rising customer desire for wholesome and fresh food options, technical developments like self-checkout lanes and digital billboards, and the development of omnichannel shopping. Moreover, grocery stores that diversify their product selection to include specialist items like organic and locally sourced goods can exploit these opportunities. To increase operational effectiveness, it is also vital to optimize their supply chains and logistics. Convenience stores and other smaller-format establishments are becoming increasingly popular, allowing retailers to draw in customers and offer convenient, customized shopping experiences.

Additionally, customer behavior and preferences modifications encourage the creation and acceptance of innovative food delivery methods. The supermarket industry's landscape is shifting as consumers' shopping preferences change, placing an ever-increasing value on speed and convenience. Due to this trend, convenience stores, smaller-format stores, and online delivery services have increased, offering significant difficulties for established in-store grocery businesses.

The Instore Grocery Retail market is segmented based on technology and application. The market is segmented based on technology such as self-checkout systems, electronic shelf labels, autonomous store inventory management, digital signage, customer analytics, automated replenishment, etc. The Instore Grocery Retail market is segmented by product type into dairy produce, meat & poultry, canned & packaged foods, bakery products, snacks & sweets, and others. By Store Type, the market is segmented as supermarkets & hypermarkets, convenience stores, and specialty stores. By type, the market is bifurcated into fresh products, frozen products.

The bakery products category will hold a major share in the global instore grocery retail market 2024. Customers particularly value the bread, pastries, cakes, and sandwiches that bakeries offer and the other fresh goods they offer. Many customers find in-store grocery stores appealing because they can conveniently purchase these goods and groceries in one location. In addition, many supermarkets and hypermarkets have in-house bakeries, enhancing the selection of fresh bread goods available to customers.

The self-checkout segment is projected to grow rapidly in the global instore grocery retail market. Peoples no longer have to wait in the queue at traditional checkout counters because self-checkout devices offer a quick and simple way to complete their purchases. This ultimately results in greater consumer satisfaction. Furthermore, by adding cutting-edge technology like machine learning, artificial intelligence, and computer vision, self-checkout systems have advanced tremendously. Thanks to these developments, the checkout procedure is much faster and more accurate.

The most recent developments in self-checkout technology incorporate complex technologies like computer vision and machine learning. These technologies make scanning and payment processes more accurate and effective. Mobile self-checkout systems have also grown, enabling customers to scan and pay for things using their cell phones, eliminating the need for actual scanning equipment.

The North America Instore Grocery Retail market is expected to register the highest share in revenue soon. Developing e-commerce platforms and online grocery shopping have substantially impacted the traditional in-store retail business. Many retailers have used digital tactics to provide options for online purchasing and improve the overall customer experience. In addition, Asia Pacific is projected to grow rapidly in the global Instore Grocery Retail market.

The need for a larger variety of fresh, organic, and healthful food options is growing among consumers in the Asia Pacific region. Convenience stores and smaller grocery retail outlets that are simple for customers to access are in higher demand due to rapid urbanization and busy lives.

| Report Attribute | Specifications |

| Growth rate CAGR | CAGR of 6.7% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Technology, Product Type, Store Type, and Type |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Walmart, Costco Wholesale Corp, Edema Group, Tesco, Kroger, Carrefour, Ahold Delhaize, Aldi, Lidl, Inc., and Amazon, among others |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Instore Grocery Retail Market By Technology

Instore Grocery Retail Market By Product Type

Instore Grocery Retail Market By Store Type

Instore Grocery Retail Market By Type

Instore Grocery Retail Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.