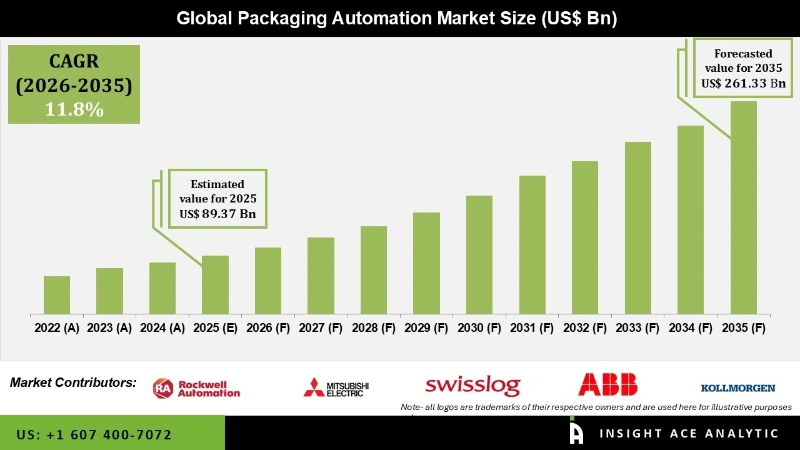

Packaging Automation Market Size is valued at USD 89.37 billion in 2025 and is predicted to reach USD 261.33 billion by the year 2035 at a 11.8% CAGR during the forecast period for 2026 to 2035.

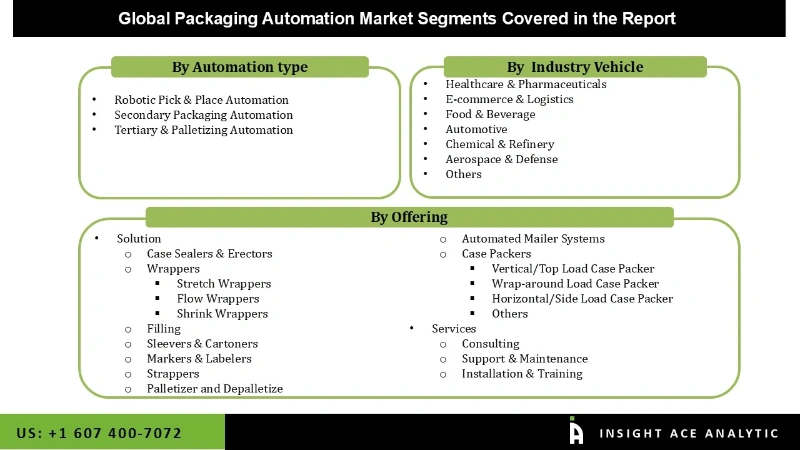

Packaging Automation Market Size, Share & Trends Analysis Report By offering (Solution, Services), automation type (robotic pick & place automation, secondary packaging automation, tertiary & palletizing automation), and industry vehicle (Healthcare, E-commerce & Logistics, food & beverage, automotive), By Region, And Segment Forecasts, 2026 to 2035.

Packaging automation is the process of packaging without any human assistance. A brilliant tactic that enables manufacturing or packaging organizations to accomplish more work with fewer resources is to eliminate superfluous employment. Production operations are more productive and efficient thanks to automated devices. Because automated machines are efficient and can cut labor costs and time, manufacturers are increasingly using them to package commodities and products. Automation is being used in the manufacturing sector because of its many advantages, including more flexibility, safer working conditions, rigorous quality, less waste, and inexpensive costs.

Furthermore, based on the demands of product labeling and presentation needs, the introduction of the programming feature in these machines allows diversity and non-repetitiveness of the duties and activities. The expansion of the packaging automation industry is being constrained by the high development and maintenance costs associated with these devices. The overall price of these machines will rise as a result of the incorporation of cutting-edge technologies and the demand for trained labour.

Additionally, adequate and routine maintenance of the machinery is necessary for their ongoing and regular operation, which adds to the cost. Further, the industry's expansion is being hampered by the government's strict restrictions regarding worker safety when automated packing processes are used. All these factors are anticipated to drive market expansion.

Some of the major key players in the packaging automation market are

The packaging automation market is segmented on the basis of offering, automation type, and industry vehicle. Based on the offering, the market is segmented into solution, wrappers, filling, case sealers & erectors, sleevers & cartoners, markers & labelers, strappers, palletizer and depalletizer, automated mailer systems, case packers, services, consulting, support & maintenance, installation & training. Based on automation type robotic pick & place automation, secondary packaging automation, tertiary & palletizing automation. Based on industry vehicle healthcare & pharmaceuticals, healthcare & pharmaceutical manufacturing companies, contract manufacturing organizations, e-commerce & logistics, e-commerce, contract packaging, logistics companies, food & beverage, automotive, chemical & refinery, aerospace & defense and others.

The subcategory of solutions is anticipated to have the biggest market share. Due to the growing significance of minimizing unscheduled downtime through optimized maintenance scheduling and failure prevention, increasing throughput by identifying performance bottlenecks, reducing production and manufacturing defects, and improving overall product quality, this sector of the packaging automation market is expanding. The solution category is anticipated to have the greatest CAGR over the forecast period.

The market for packaging automation is anticipated to be dominated by the robotic pick & place automation segment. This market's expansion is attributable to elements like better product handling, variety, and adaptability as compared to traditional automation. It also minimizes the need for manual product loading into a packaging machine. This lowers labor expenses and boosts an industry's production, which justifies the accompanying expense.

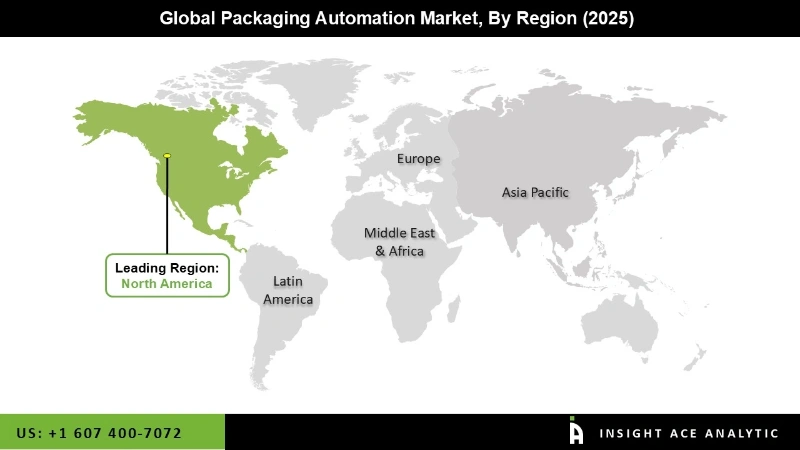

The European region is anticipated to dominate the market over the forecast period. The rapid adoption of new technology by the general public, the presence of numerous manufacturing industries, and the availability of packaging automation providers in the region are all contributing factors to the market's rapid growth in Europe. These businesses provide a variety of automated packaging systems. Besides, due to the region's expanding use of products and services in the manufacturing, e-commerce, and healthcare sectors, Asia-Pacific is predicted to see a significant CAGR over the projection period. The growing need for packaged goods and beverages in the country, which is projected to be one of the factors driving the adoption of packaging automation in the Asia-Pacific market, makes corrugated packaging even more essential.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 89.37 billion |

| Revenue forecast in 2035 | USD 261.33 billion |

| Growth rate CAGR | CAGR of 11.8% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Offering, Automation Type, And Industry Vehicle |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Rockwell Automation, Inc., Mitsubishi Electric Corporation, Swisslog Holding AG, ABB Ltd., Kollmorgen Corporation, ULMA Packaging, Multivac Group, Coesia SpA. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of the Packaging Automation market-

Packaging Automation market By Offering-

Packaging Automation market By Automation type-

Packaging Automation market By Industry Vehicle-

Packaging Automation market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.