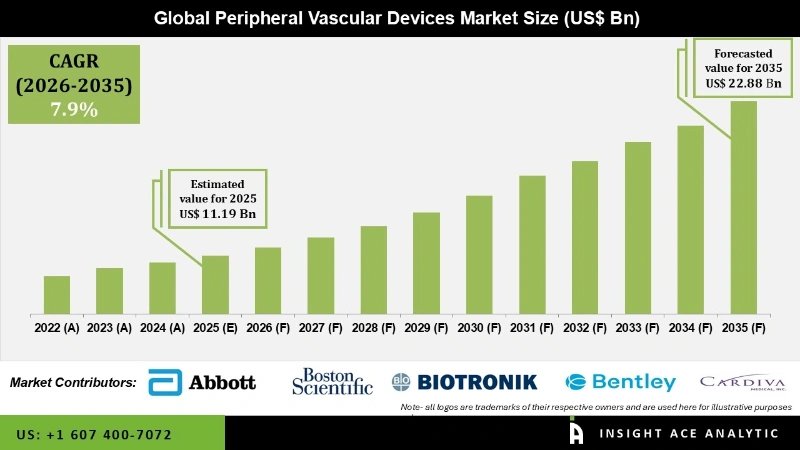

Global Peripheral Vascular Devices Market Size is valued at USD 11.19 Bn in 2025 and is predicted to reach USD 22.88 Bn by the year 2035 at a 7.9% CAGR during the forecast period for 2026 to 2035.

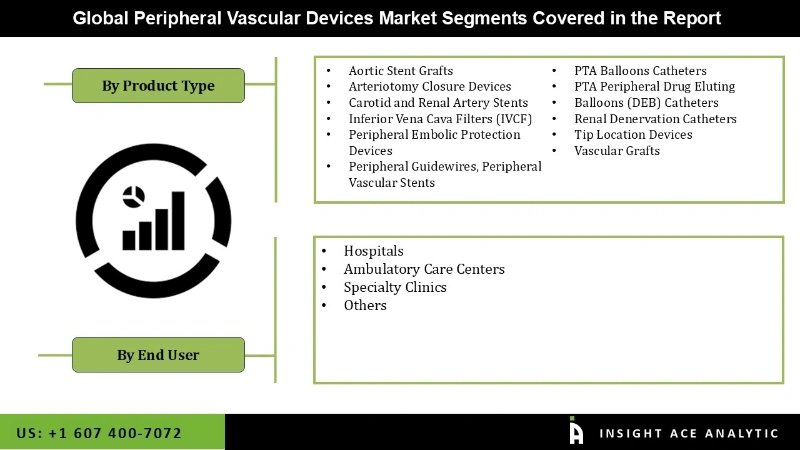

Peripheral Vascular Devices Market Size, Share & Trends Analysis Report By Product Type (Aortic Stent Grafts, Arteriotomy Closure Devices, Carotid and Renal Artery Stents, Inferior Vena Cava Filters (IVCF)), By End-User, By Region, And By Segment Forecasts, 2026 to 2035

Peripheral vascular disease (PVD) is caused due to accumulation of plaque within the inside lining of arteries. With the increasing age, the incidence of PVD also increases. It is more common among the diabetic and smoking population. More than 5% of the population above age 50 years suffers from PVD. Insufficient blood flow and narrowing of arteries are the most common peripheral diseases caused due to plaque build-up. These diseases can be treated through minimally invasive surgeries. Peripheral vascular devices are used for the treatment of these blocked arteries and to remove the build-up plaque.

Peripheral vascular stents, peripheral transluminal angioplasty balloon catheters, and aortic stents are the most used devices for the treatment of PVD. The growth of this market is driven by factors such as rising incidences of PVD, increasing demand for minimally invasive procedures, changing lifestyles, and the global aging population. Asia is expected to be the largest market with high growth opportunities owing to rising disposable income and the high unmet medical needs of the patient population.

The peripheral vascular devices market is a segment based on product type, end-user, and geography. In terms of product type, the global market is segregated aortic stent-grafts, arteriotomy closure devices, carotid and renal artery stents, inferior vena cava filters (IVCF), peripheral embolic protection devices, peripheral guidewires, peripheral vascular stents, PTA balloons catheters, PTA peripheral drug-eluting, balloons (DEB) catheters, renal denervation catheters, tip location devices, and vascular grafts. The peripheral vascular stents market holds a major share in the total peripheral vascular devices market.

The growth of this market is justified by the increasing incidence rate of lifestyle diseases such as obesity and diabetes. The embolic protection devices market is expected to grow at the highest growth rate during the forecasted period. Technological advancements in the devices such as tracking the position during the procedure and drug-coated stents would boost the demand for these devices as it overcomes the issues faced by surgeons.

Based on end-user, the global peripheral vascular devices market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and others. PVD is a vastly under-diagnosed disease, less than 30% of the total patient population are diagnosed with PVD. Lack of awareness among patients is the main reason for the under-diagnosis of PVD. It is estimated that 20% of the total patient population have PVD, and are prone to high-risk factors such as diabetes and obesity contributors for the development of PVD. Hence, with the increasing aging population, the incidence rate of PVD would also grow to impact the growth of the market. The rising incidence rate would have a high impact on the growth of the peripheral vascular devices market throughout the forecast period.

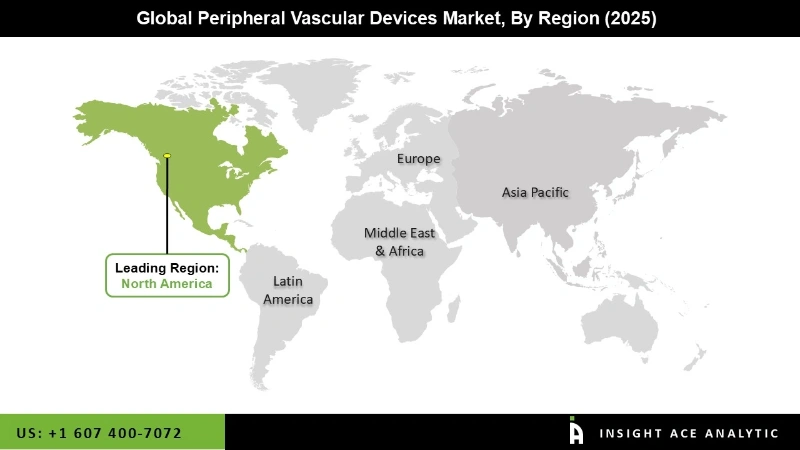

Based on geography, the global Peripheral Vascular Devices market has been segmented into North America, Asia Pacific, Latin America, Europe, and Middle East & Africa. In terms of revenue, North America is estimated to account for the largest share in the global market in 2019. There is a general increase in the peripheral and lower limb procedures which would boost the market for these devices during the forecast period; more than 15% of the total aged population suffers from PAD in this region. The aging population in North America is expected to increase by around 5% every year.

However, the infections caused due to peripheral vascular implantations and surgeries would prove to be a challenge for the growth of these devices. In order to overcome these issues and meet patient's demands, manufacturers are coming up with newer and technologically advanced products which would increase the base of the treatable population. Market players such as Cordis Corporation, Boston Scientific Corporation, and Abbott Laboratories have a significant presence in the North American market.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 11.19 Billion |

| Revenue Forecast In 2035 | USD 22.88 Billion |

| Growth Rate CAGR | CAGR of 7.9 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, By End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Abbott Laboratories, Boston Scientific Corp, Biotronik, Bentley InnoMed GmbH, Cardiva Medical Inc., Medtronic plc, W. L. Gore & Associates Inc, Avascular S.L.U, Cook Medical Inc, Terumo Corp, B. Braun Melsungen AG, Getinge AB, C. R. Bard Inc (BD), Cardinal Health Inc., Cordis Corp, Endologix Inc, and Terumo Medical Corporation among others. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Peripheral Vascular Devices Market By Product Type

Global Peripheral Vascular Devices Market By End-Users

Global Peripheral Vascular Devices Market By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.