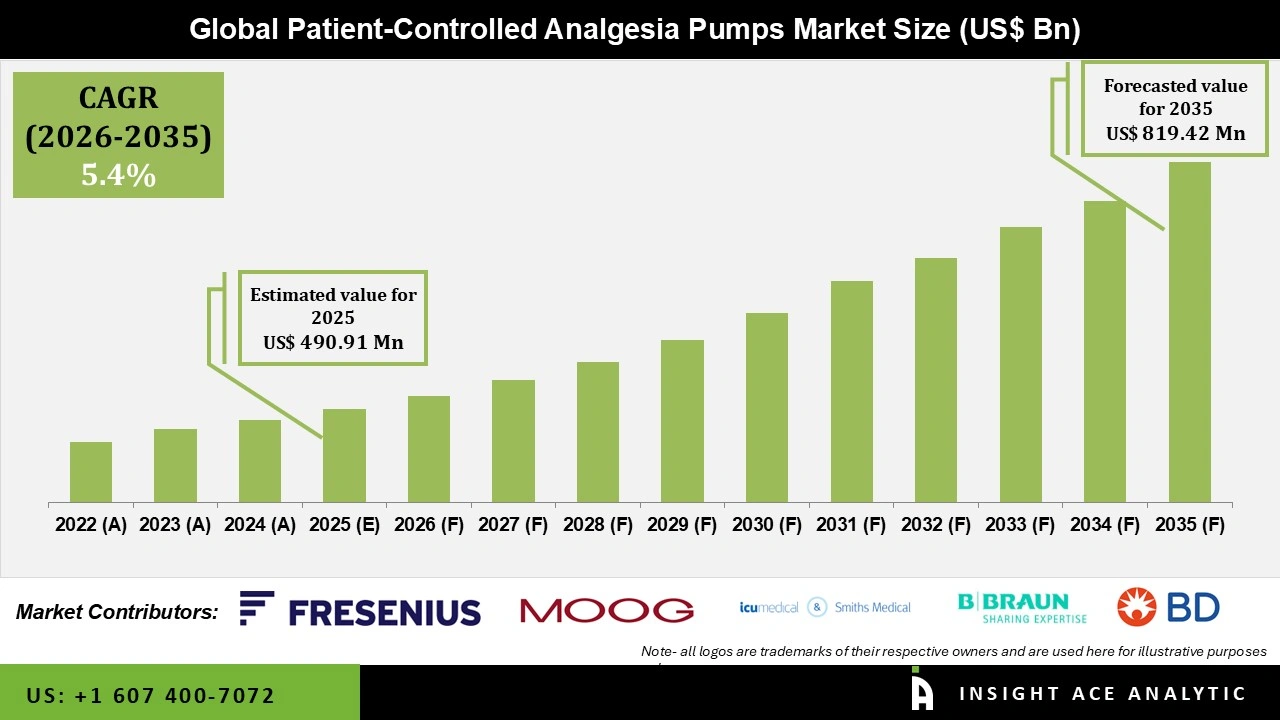

Global Patient-Controlled Analgesia Pumps Market Size is valued at USD 490.91 Mn in 2025 and is predicted to reach USD 819.42 Mn by the year 2035 at a 5.4% CAGR during the forecast period for 2026 to 2035.

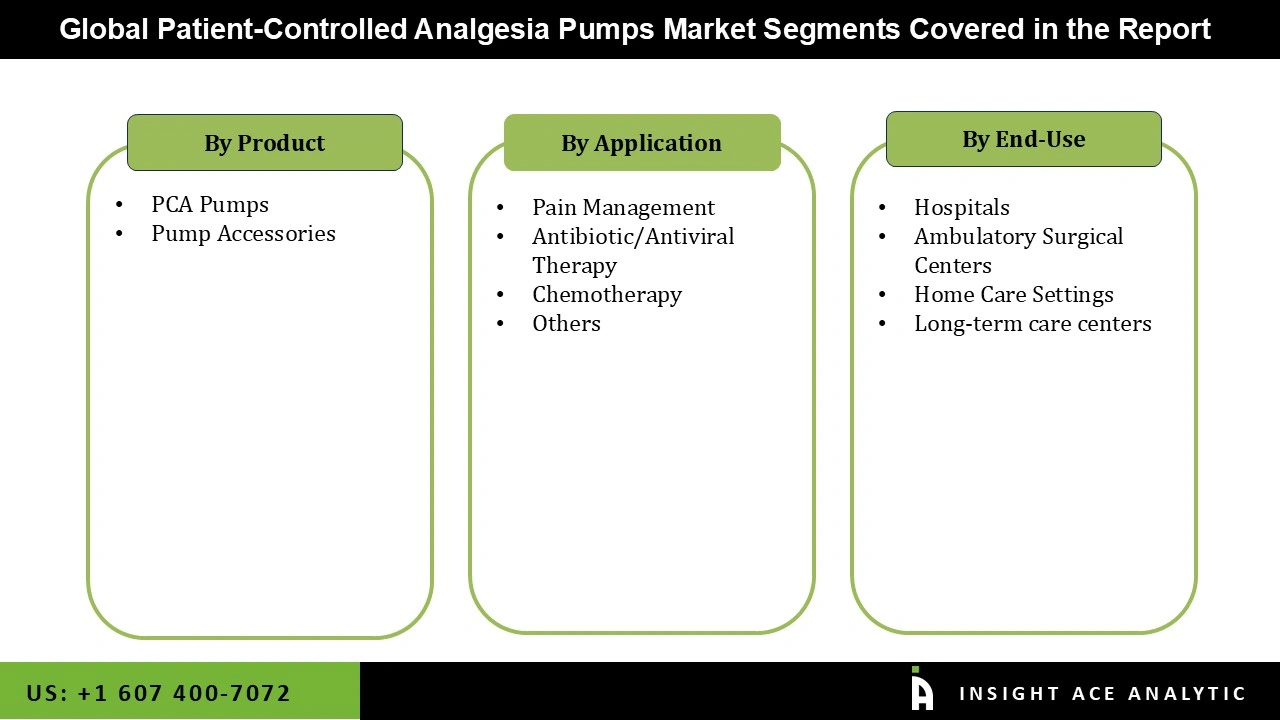

Patient-Controlled Analgesia Pumps Market Size, Share & Trends Analysis Distribution by Product Type (PCA Pumps and Pump Accessories), Application (Pain Management, Chemotherapy, Antibiotic/Antiviral Therapy, and Others), End-user (Hospitals, Ambulatory Surgical Centers, Long-term Care Centers, and Home Care Settings), By Region and Segment Forecasts, 2026 to 2035.

A patient-controlled analgesia (PCA) pump is a medical device that enables patients to use an intravenous (IV) line to self-administer pain medicine. These pumps provide a number of advantages, such as fewer postoperative problems, better recovery, less sedation, and less pharmaceutical consumption. Patients who have trouble swallowing oral drugs can also benefit from PCA pumps. In many healthcare settings, including patient, outpatient, private clinic, and at-home settings, the injected drugs are essential to therapies or medical treatments. The increasing number of surgical procedures, the rise in the prevalence of chronic pain conditions, the continuous development of pain management technologies, and the rising demand for non-invasive procedures are some of the factors contributing to the patient-controlled analgesia pumps market's strong growth.

Furthermore, there is a higher need for efficient pain management as the population ages because they are more likely to experience chronic health problems and need surgical procedures. For individualized and controlled pain management, patient-controlled analgesia pumps are frequently utilized in the older population. As a result, the growing number of elderly people is anticipated to significantly accelerate market expansion. For instance, a 2023 United Nations (UN) research report projects that throughout the next three decades, the number of persons 65 and older worldwide would triple. By 2050, there will be 1.6 billion elderly people, making up more than 16% of the global population. Additionally, patient-centered care—in which patients actively engage in treatment decisions—is becoming more and more popular. This tendency is supported by patient-controlled analgesic pumps, which give patients some control over how they manage their pain, improving their overall experience and helping the market expand.

In addition, since patients want to manage their pain in a familiar setting, the trend toward outpatient treatment and home healthcare services is driving up demand for patient-controlled analgesia pumps. Additionally, patient participation and adherence to pain management procedures are being improved by the incorporation of smart technologies into patient-controlled analgesia pumps, such as mobile applications and remote monitoring features. It is anticipated that these technologies will draw funding from major industry participants, hence accelerating growth. The development and use of next-generation PCA technologies are anticipated to be accelerated by partnerships between pharmaceutical companies, medical device manufacturers, and healthcare providers. However, the patient-controlled analgesia pumps market has a number of issues that can prevent it from expanding. Threats include issues with data privacy pertaining to linked PCA devices, sluggish adoption in some areas because of a lack of infrastructure or knowledge, and a lack of qualified staff to oversee and manage PCA treatments.

Driver

Rising Incidence of Chronic Pain Disorders

The growth in the patient-controlled analgesia pumps market is being driven by the rising incidence of chronic pain disorders like fibromyalgia, arthritis, and cancer as well as technological developments with improved safety features in PCA pumps. Patient-controlled analgesia pump sales are rising as a result of the growing number of fibromyalgia cases. Approximately 4 million Americans, or 2% of all adults, have fibromyalgia, according to data released by the Centers for Disease Control and Prevention (CDC) in May 2022. Although the exact origin of fibromyalgia is unknown, there are several ways to manage and cure it, including using a patient-controlled analgesia pump. In addition, in 2023, 22.9% of Americans said they had chronic pain. The use of these pumps is rising as a result of the rising prevalence of chronic pain conditions like fibromyalgia, which is propelling the patient-controlled analgesia pumps market expansion over the forecast period.

Restrain/Challenge

Lack of Qualified Experts and Professionals

Over the course of the forecast period, the lack of qualified experts and professionals will hinder the growth of the global patient-controlled analgesia pumps market. A shortage of qualified personnel could make it difficult to successfully use and oversee state-of-the-art technologies, which could lead to subpar patient outcomes and operational inefficiencies. Additionally, inconsistent norms and practices may result from weak regulatory frameworks, which would make it more difficult to develop and apply novel solutions. In developing nations like the Middle East, Africa, and Latin America, the absence of proper healthcare infrastructure may hinder market growth for patient-controlled analgesia pumps over the course of the projection period and impede demand for sophisticated patient-controlled analgesia pumps.

The PCA pumps category held the largest share in the Patient-Controlled Analgesia Pumps market in 2025. A system with a high-performance microprocessor and control circuits is necessary to effectively regulate the flow rate in a certain brand of patient-controlled analgesia pump. The demand for electronic pain medicine pumps is rising because they are safe and effective for providing patient-controlled epidural analgesia (PCEA) both during and after childbirth. Because they can be customized to each patient's needs, research has shown that electronic PCA pumps are appropriate for a wide range of patients. Additionally, a variety of PCA treatment mistakes may arise with PCA pumps. Errors caused by people or equipment could have an impact on dosage. This implies that during the analysis phase, growth can be impeded.

In 2025, the hospitals category dominated the Patient-Controlled Analgesia Pumps market. Hospitals use patient-controlled analgesia pumps extensively for trauma treatment, palliative care, and postoperative pain management because of the severity and complexity of the cases they treat. It is now common practice to incorporate PCA pumps into hospital pain management procedures, with the backing of established clinical guidelines and payment frameworks. Additionally, hospitals are leading the way in implementing cutting-edge electronic PCA systems, taking use of their potential to track patient usage and enhance the administration of analgesics. The hospitals are a major force behind innovation and demand in the patient-controlled analgesia pumps market due to the high amount of surgical procedures and the requirement for strict patient safety measures.

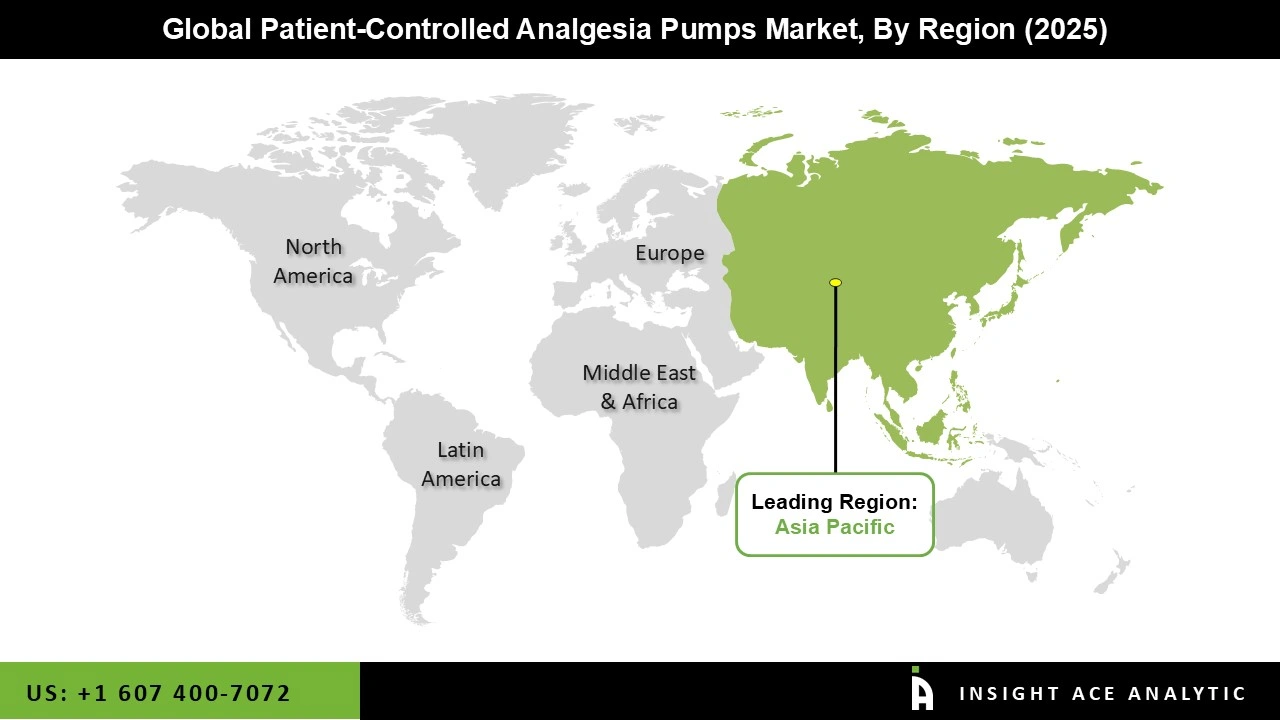

The Patient-Controlled Analgesia Pumps market was dominated by North America region in 2025. The region's strong regulatory system that promotes patient safety and device efficacy, high adoption rates of cutting-edge medical technology, and sophisticated healthcare infrastructure are all factors in its leadership. With a high rate of surgical operations, a sizable senior population, and broad awareness of pain management options, the United States in particular is a significant driver.

Additionally, North America's position at the forefront of the global patient-controlled analgesia pumps market is further cemented by the existence of major market players and continuous investments in R&D. Furthermore, the accessibility for a wide range of patients is ensured by the region's hospitals and ambulatory surgery centers' rapid adoption of new PCA technology and generally advantageous reimbursement arrangements.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 490.91 Mn |

| Revenue forecast in 2035 | USD 819.42 Mn |

| Growth Rate CAGR | CAGR of 5.4% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product Type, Application, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Moog Inc., Becton Dickinson and Company, Smiths Group/ICU Medical, B.Braun Melsungen AG, and Fresenius SE & Co. KGaA |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.