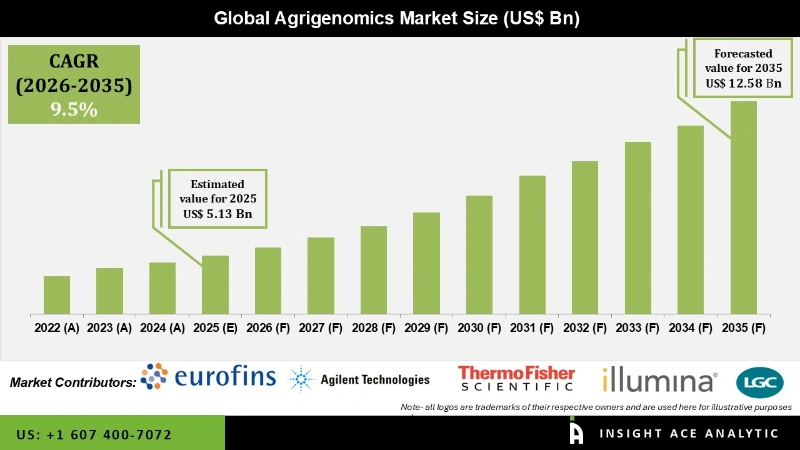

Global Agrigenomics Market Size is valued at USD 5.13 Billion in 2025 and is predicted to reach USD 12.58 Billion by the year 2035 at a 9.5% CAGR during the forecast period for 2026 to 2035.

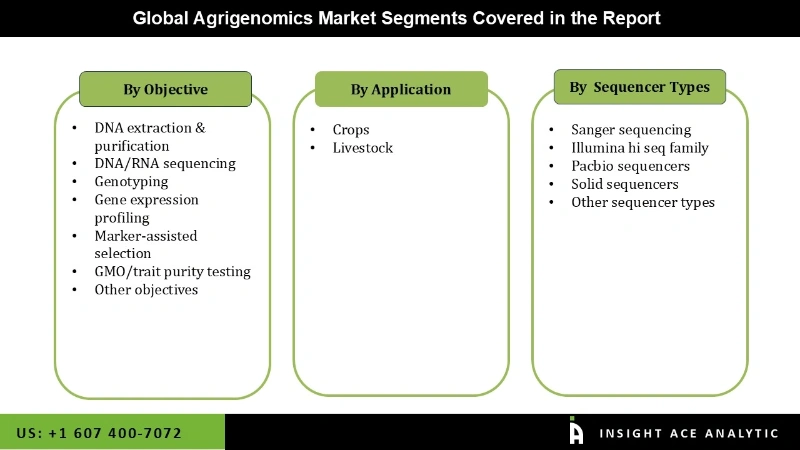

Agrigenomics Market Size, Share & Trends Analysis Report By Sequencer Types (Sanger sequencing, Illumina hi seq family, Pacbio sequencers, Solid sequencers, Other sequencer types), By Application (Crops, Livestock), By Objective, By Region, And By Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Agrigenomics refers to the use of genomics in agriculture, this is majorly used to improve crop health and yield a good harvest. The population of the world has experienced a major boom in the past few years and hence global food consumption has also increased substantially in order to meet this high demand, farmers are deploying various farming techniques and strategies to boost their production and maximize profits.

Agrigenomics minimizes the risk of harvest damage and improves the efficiency on an overall standard. Agrigenomics is also applicable for livestock and this can lead to better animal health subsequently resulting in a lower risk of genetic disease in animals. This helps in enhancing the overall output of animal livestock and gives their owners a better revenue generation potential.

However, different research approaches towards research and a lack of infrastructure to support agrigenomic practices are anticipated to hamper the global agrigenomics market growth over the forecast period. The COVID-19 pandemic resulted in a major drop in agrigenomic research activity and hampered growth but as the world is returned back to normal we are expected to see good growth in the overall agrigenomics market across the world.

The Agrigenomics market is categorized on the basis of sequencer types, objectives, and applications. Based on sequencer types, the market is segmented as Sanger sequencing, Illumina hi seq family, Pacbio sequencers, Solid sequencers, and Other sequencer types. By objectives, the market is segmented into DNA extraction & purification, DNA/RNA sequencing, Genotyping, Gene expression profiling, Marker-assisted selection, GMO/trait purity testing, and Other objectives. By application, the market is segmented into crops and livestock.

The crops segment accounts for a dominant market share and is projected to maintain this stance across the forecast period. Increasing use of genotyping and sequencing technologies to improve the quality of crops and influence genetic variations to get desired results and outcomes. Increasing the use of gene editing to grow plants irrespective of the season will also influence agrigenomics market potential in this segment.

The Illumina hi seq family-based tests account for a major market share of the global agrigenomics market. The ability and flexibility of this series of tests to perform various applications is the major factor that is predicted to boost agrigenomics market growth via this segment through 2028. Whereas Sanger sequencing is expected to be the second most popular sequencing technique due to its increasing popularity and limited costs.

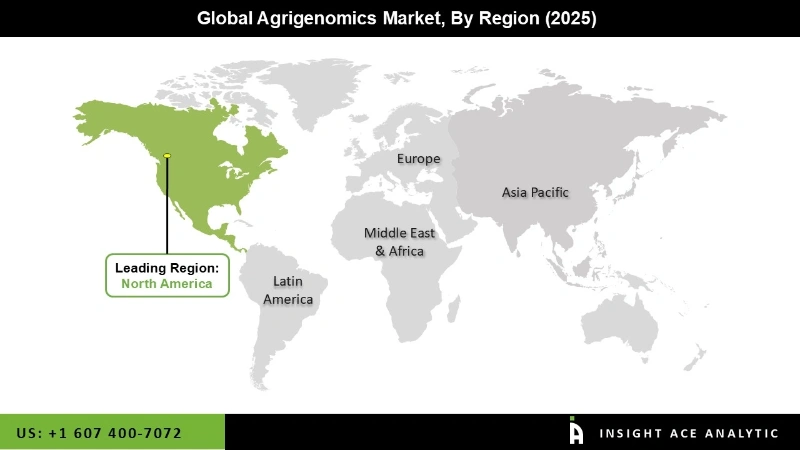

Demand for agrigenomics is expected to be high in the North American region over the forecast period owing to the rapid adoption of novel technologies in this region and increasing focus on agricultural production improvement. Increasing investments in research and rising support from government initiatives are other factors that will favour the agrigenomics market potential across the forecast period. Increasing demand for foods is also predicted to positively influence agrigenomics market growth. By 2030, the United States and Canada are expected to be key markets in this area. Advancements in sequencing technologies in the food and beverage industry will also help market potential in the North American region.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 5.13 Billion |

| Revenue forecast in 2035 | USD 12.58 Billion |

| Growth rate CAGR | CAGR of 9.5% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | By Sequencer Type, Application, Objective |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Eurofins Scientific (Luxembourg), Agilent Technologies, Inc. (US), Thermo Fisher Scientific Inc. (US), LGC Limited (UK), Illumina, Inc. (US), Zoetis Inc. (US)., Other Prominent Players. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Sequencer Types -

By Application

By Objective

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.