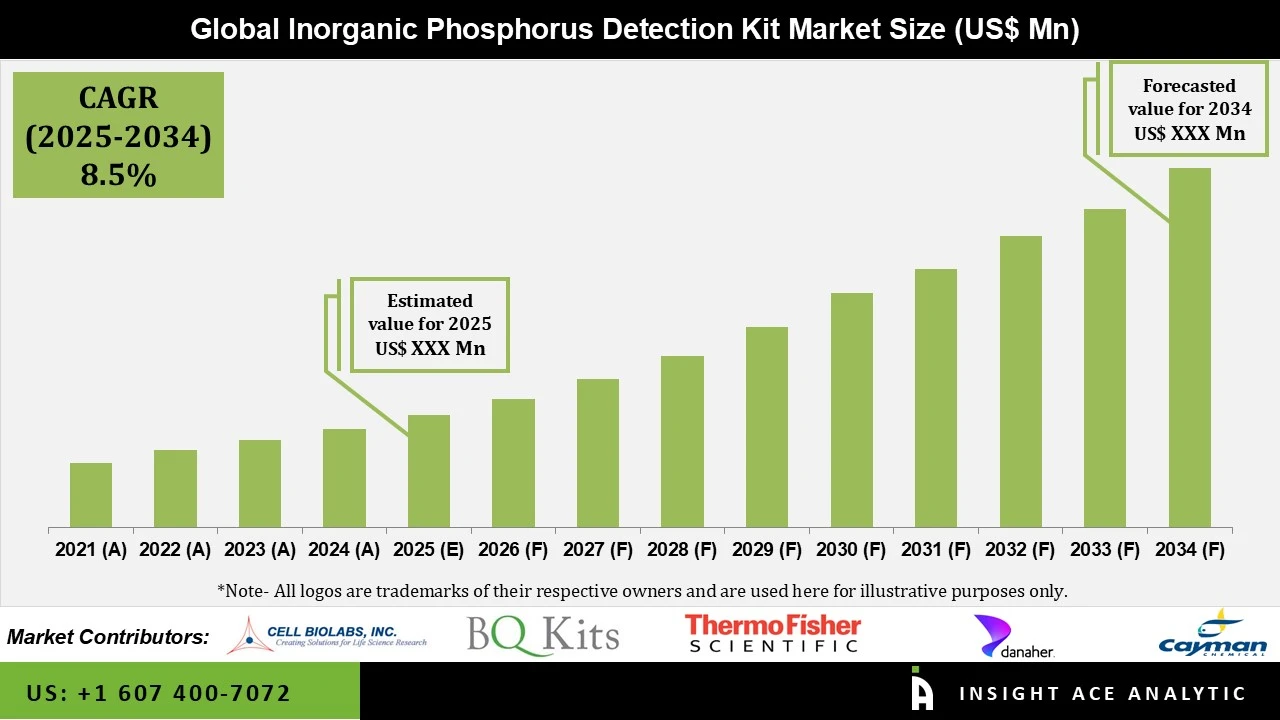

Global Inorganic Phosphorus Detection Kit Market is predicted to reach at a 8.5% CAGR during the forecast period for 2025-2034.

The content of inorganic phosphate (PO₄³⁻) in biological samples such as blood serum, plasma, and urine, as well as in water, soil extracts, and industrial samples, can be quantitatively measured using an inorganic phosphorus detection kit. The kit usually operates on a colorimetric concept, in which inorganic phosphorus combines with particular reagents to generate a phosphomolybdate complex, which develops a blue color whose intensity is exactly proportionate to the concentration of phosphate.

These kits are commonly used in environmental monitoring, agriculture, food testing, biochemical research, and clinical diagnostics to evaluate kidney function, bone metabolism, and parathyroid abnormalities. The inorganic phosphorus detection kit market is expanding due to the growing need for phosphorus testing in medical diagnostics, especially in hospitals and research facilities. The availability of cutting-edge testing technology and government measures to upgrade healthcare infrastructure are also driving the inorganic phosphorus detection kit market growth.

The rising incidence of chronic illnesses like diabetes, bone disorders, and chronic renal disease, which frequently entail imbalances in inorganic phosphorus levels, is another major factor propelling the inorganic phosphorus detection kit market's expansion. This directly drives the need for dependable and effective detection kits in clinical diagnostics by requiring regular and accurate monitoring of phosphorus in biological samples. Furthermore, the other main factor for the market growth is the rising worldwide concern over water pollution, especially eutrophication brought on by too much phosphorus in water bodies. The need for inorganic phosphorus detection kits for efficient environmental monitoring and compliance is rising as governments and environmental organizations impose stricter rules on phosphorus discharge from industrial, agricultural, and urban sources.

The inorganic phosphorus detection kit market is currently seeing rapid growth due to the urgent requirement for precise and effective phosphorus measurement in a variety of industries. These developments are essential for boosting study results, guaranteeing environmental quality, and expanding healthcare diagnostic skills. Additionally, due to the urgent requirement for precise and fast phosphorus quantification in a variety of industries, the inorganic phosphorus detection kit market provides substantial strategic growth possibilities across numerous important applications. The inorganic phosphorus detection kit market is being significantly impacted by the strategic growth prospects, which are focusing expenditures on its most important and rapidly expanding applications.

Which are the Leading Players in the Inorganic Phosphorus Detection Kit Market?

Driver

Growing Attention to Nutritional Monitoring

The need for inorganic phosphorus detection kits has been driven by a growing understanding of nutrition and how it directly affects health. Monitoring is crucial for people, especially those on special diets or receiving particular medical treatments, as adequate phosphorus levels are necessary for bone health and energy metabolism. The market potential is increased as more nutritionists and dieticians incorporate phosphorus evaluation into their evaluations. Further driving the inorganic phosphorus detection kit market expansion will be the emergence of customized diet regimens and functional foods designed to sustain ideal phosphorus levels.

Restrain/Challenge

High Cost of these Kits

The price and production costs of inorganic phosphorus detection kits can be major market barriers. Manufacturers may find it difficult to set competitive prices for their goods due to the high expenses of raw materials, R&D, and regulatory compliance. This is especially troublesome in industries that are cost-conscious, such as smaller labs and educational institutions, where a lack of funds may limit their ability to make purchases. Additionally, price concerns brought on by economic swings may push consumers toward less expensive options. The manufacturers find it difficult to strike a balance between cost and quality, which could hinder the expansion of the inorganic phosphorus detection kits market.

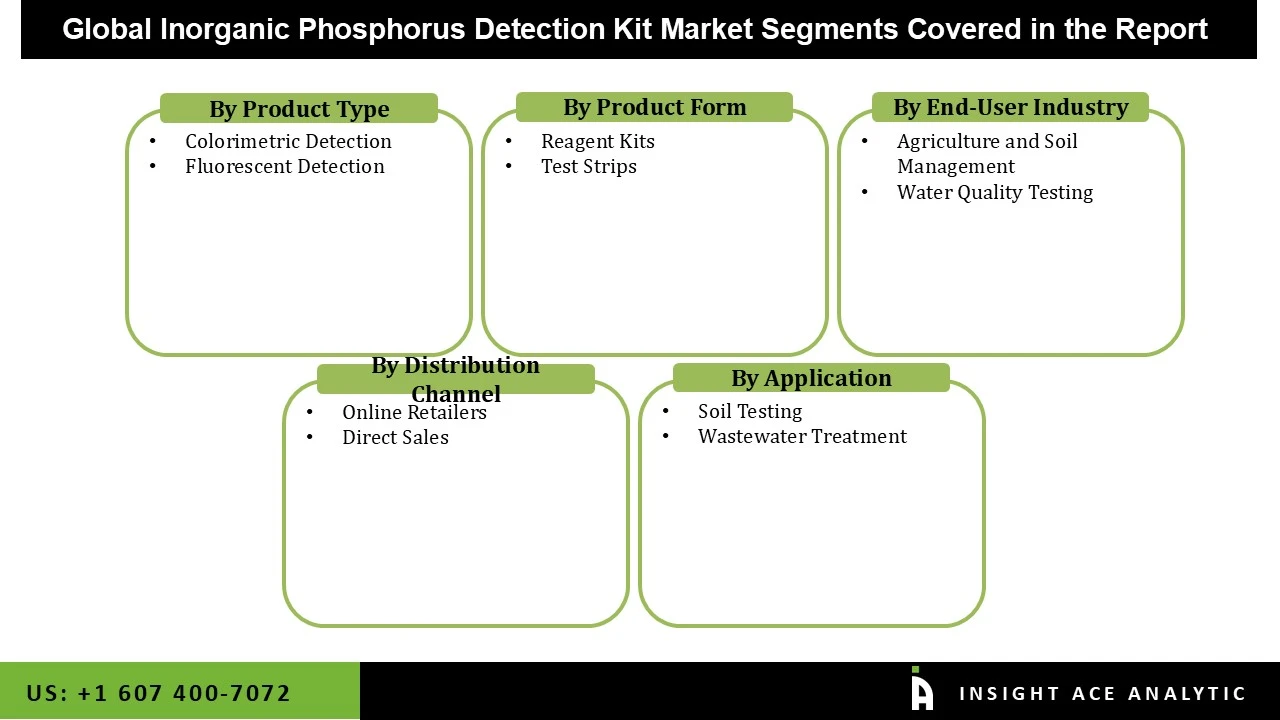

The market is comprehensively segmented across five key dimensions to reflect its diverse technological, product, and commercial structure. The core technology is categorized by Type, including Colorimetric, Electrochemical, Fluorescent, and Spectrophotometric Detection methods. Available Product Forms span Reagent Kits, Multi-Parameter Analyzers, and Test Strips. Key Applications drive demand in areas such as Soil Testing, Hydroponics, Wastewater Treatment, and Public Health Monitoring. The primary End-users comprise sectors like Agriculture and Soil Management, the Food and Beverage Industry, Environmental Monitoring agencies, Water Quality Testing facilities, and Clinical Research and Diagnostics. Finally, products reach these users through various Distribution Channels, including Direct Sales, Pharmaceutical and Laboratory Suppliers, Online Retailers, and a network of Distributors and Resellers.

The colorimetric detection category held the largest share in the Inorganic Phosphorus Detection Kit market in 2024. Colorimetric kits, which use a color shift proportionate to the amount of inorganic phosphorus in a sample, are widely used due to their ease of use and affordability. In order to assess intensity using spectrophotometric methods, these kits usually use chemicals that react with phosphorus to form a colorful product. Because it is simple to use and can evaluate numerous samples at once, this approach is frequently used in laboratories for both field and research purposes.

In 2024, the soil testing category dominated the Inorganic Phosphorus Detection Kit market due to the growing emphasis on sustainable agriculture and efficient fertilizer use worldwide. The significance of precision fertilizer management to increase crop output while avoiding soil degradation and phosphorus runoff is becoming more recognized by farmers and agronomists. The need for trustworthy inorganic phosphorus testing kits is further supported by government programs that support balanced fertilizer application, precision farming, and soil health cards. Additionally, the market expansion is also being accelerated by the growing usage of soil testing services in developing economies, the expansion of commercial agriculture, and the growing acceptance of modern farming practices.

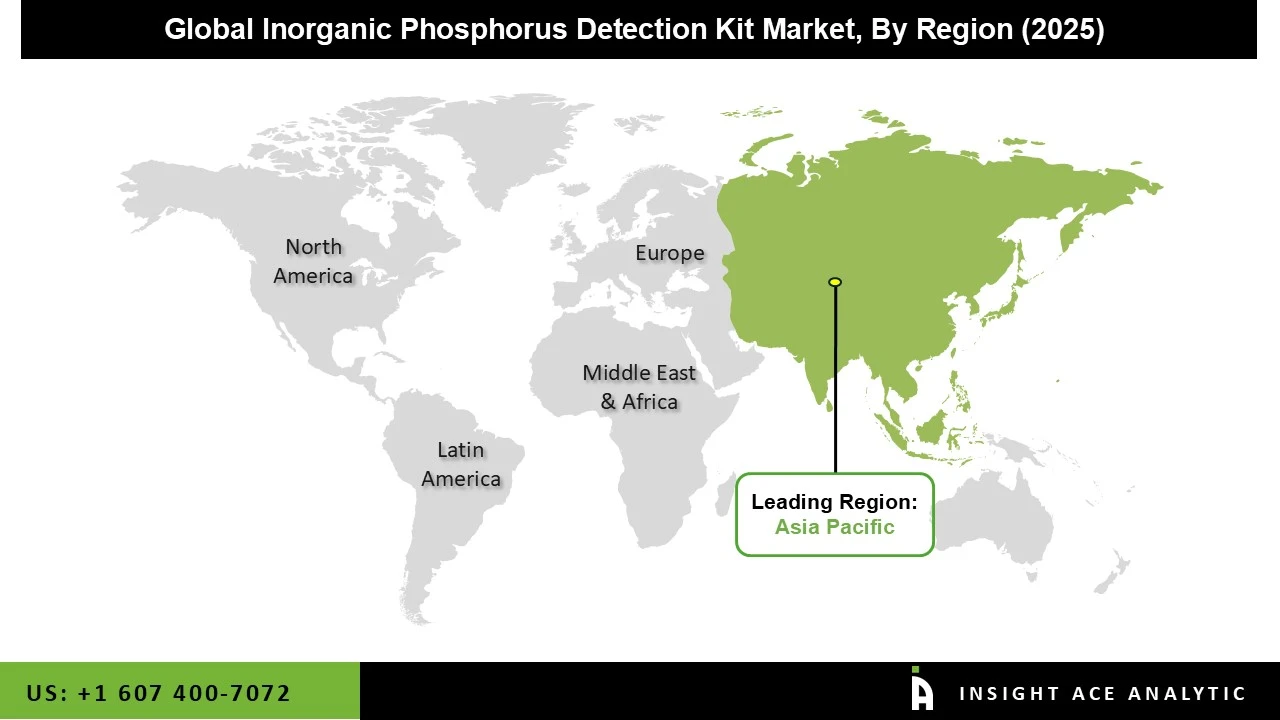

The Inorganic Phosphorus Detection Kits market was dominated by North America region in 2024 driven mostly by strict environmental rules implemented by organizations like the EPA on wastewater discharge, drinking water quality requirements, and nutrient monitoring for lakes and rivers. In order to adhere to these regulations and stay out of trouble, utilities, environmental testing facilities, and businesses involved in industries including chemicals, fertilizers, food and beverage production, and power generation are investing more in phosphorus monitoring.

Strong R&D and academic funding for oceanography, ecological studies, and water quality also sustain demand from research institutes and universities. Additionally, because phosphorus testing is utilized in some biochemical and clinical assays, the region's sophisticated healthcare and clinical diagnostics infrastructure also plays a role.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 8.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2024 to 2034 |

| Historic Year | 2021 to 2023 |

| Forecast Year | 2024-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Product Form, Application, End-user, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Danaher, Thermo Fisher Scientific, Formosa Biomedical Technology Corporation, Cell Biolabs Inc, BQ Kits Inc, Junzheng Group, and Cayman Chemical Company. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.