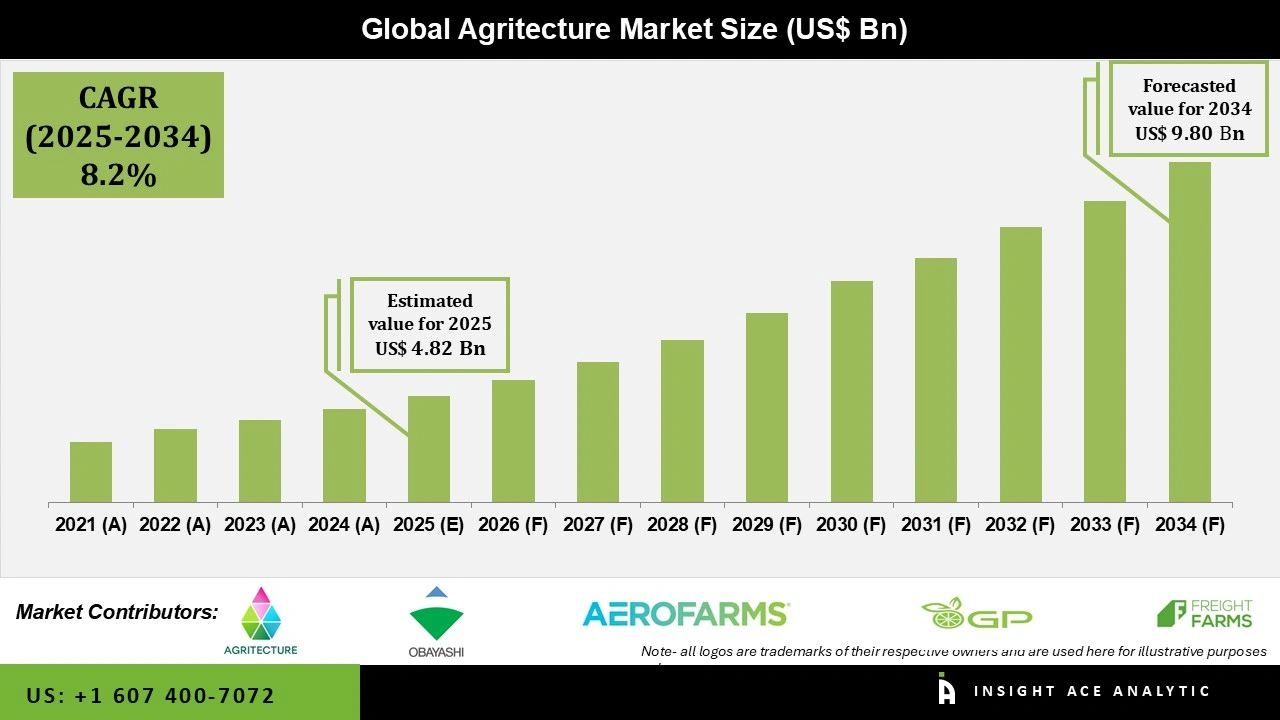

Agritecture Market Size is valued at US$ 4.8 Bn in 2025 and is predicted to reach US$ 9.8 Bn by the year 2034 at an 8.2% CAGR during the forecast period for 2025-2034.

Agritecture integrates agriculture with architecture to enable food production in urban spaces through vertical farms, rooftop greenhouses, and indoor systems. Using hydroponics, LED lighting, and climate control, it achieves 10–100x higher yields per square foot while cutting water use by 95%, eliminating pesticides, and reducing food miles by 90%. It transforms cities into sustainable food hubs, improving air quality and creating green jobs.

Rapid urbanization, shrinking farmland, and rising demand for local produce drive agritecture growth. With 68% of people living in cities by 2050 and 1.2% annual global food demand growth (OECD-FAO 2024-2033), space-efficient farming is essential. AI farm management, energy-efficient LEDs, and modular systems have improved economics, while cities like Singapore target 30% local production by 2030.

High capital costs ($100–$500/sq ft) and energy-intensive operations remain primary barriers, often requiring 20–40 kWh per kg of produce without renewable integration. Skilled labor shortages and market education also hinder widespread adoption. However, transformative opportunities are emerging: declining solar panel costs (down 89% since 2010) and battery storage make energy-neutral farms economically viable.

Digital supply chain platforms enable premium direct-to-consumer sales with 2–3x margins. Government incentives—tax credits, grants, and zoning reforms—are accelerating deployment in cities like Dubai and New York. As leading retailers (Walmart, Kroger) partner with vertical farm operators and real estate developers integrate agritecture as premium amenities, the sector is positioned for exponential growth, potentially reaching $20+ billion by 2030.

Some of the Key Players in Agritecture Market:

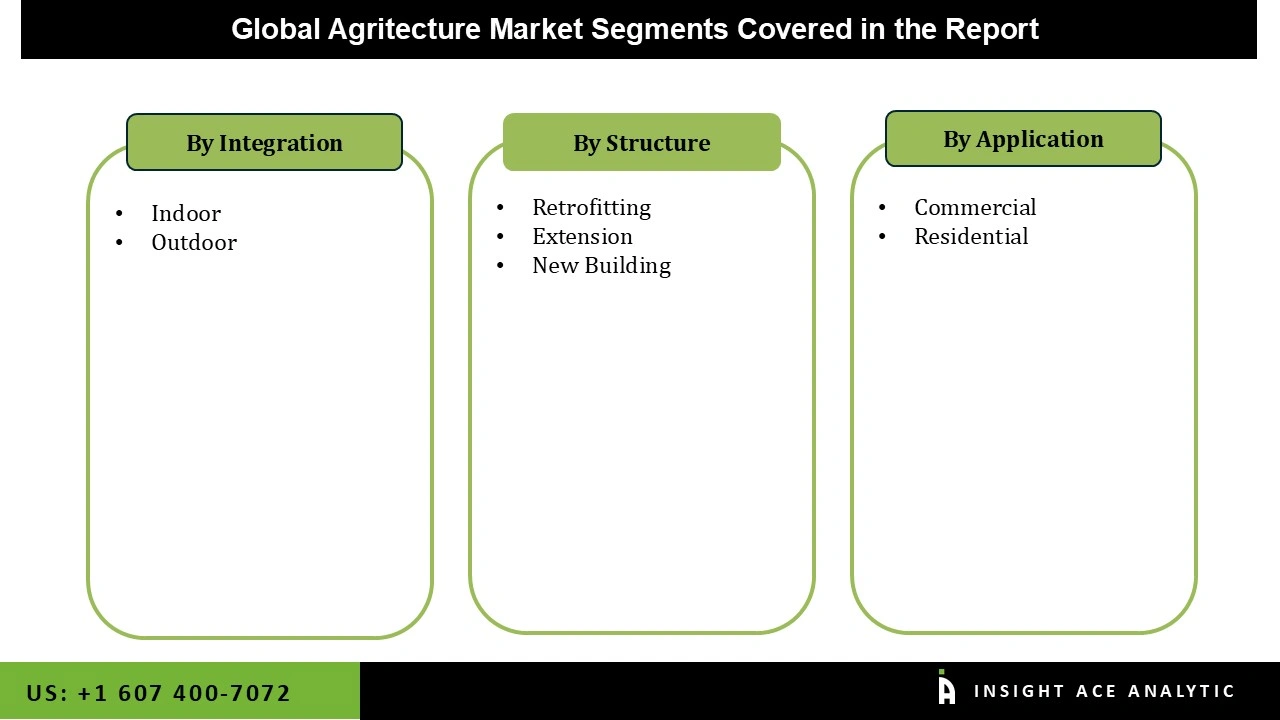

The agritecture market is segmented by integration, structure, and application. By integration, the market is segmented into indoor and outdoor. By integration, the market is segmented into retrofitting, extension, and new building. By application, the market is segmented into commercial and residential.

The Outdoor category led the Agritecture market in 2024. This convergence is fueled by due to their inherent reliance on sunshine and ventilation, outdoor systems are less expensive to install and maintain. Adoption is further accelerated by municipal regulations that support urban farming and green roofs. Because outdoor architecture increases building value, improves air quality, and offers obvious sustainability benefits that draw in both businesses and inhabitants, developers also appreciate it.

The largest and fastest-growing Application is Residential, a trend driven by growing urbanization is the main cause of this acceleration since it reduces traditional agricultural acreage and increases customer demand for fresh, locally sourced, and sustainably produced food. Residential adoption is also driven by the goal for increased environmental sustainability and food security, as integrated farming systems encourage resource efficiency and lessen the need for transportation.

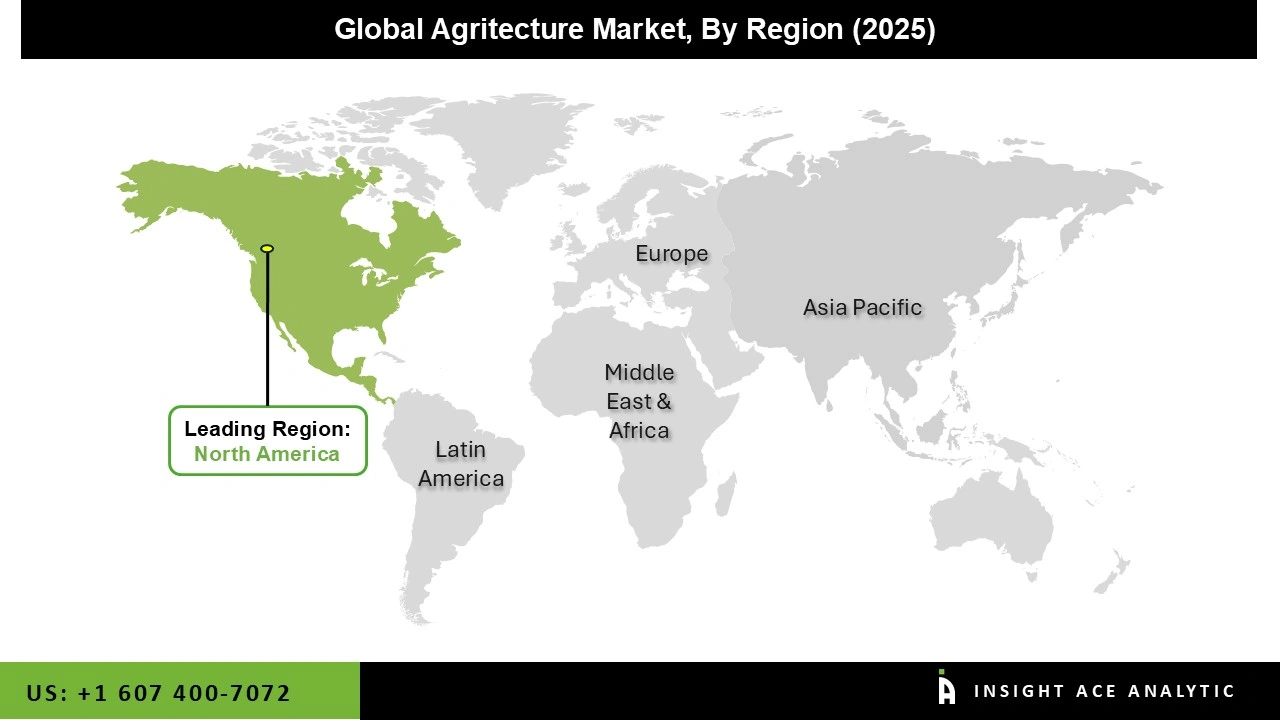

North America dominated the Agritecture market in 2024. The United States is at the forefront of this expansion. This is due to theExtensive use of cutting-edge agricultural technologies and significant investments in R&D projects. Strong government incentives and legislation that favor innovative technology and sustainable farming methods further reinforce this dominance. The demand for regional food production is also fueled by growing urbanization, which promotes the growth of modular agricultural systems and vertical farming.

With rapid population expansion becoming more and more common in the Asia-Pacific area, the Agritecture market is expanding at the strongest and fastest rate in this region. Additionally, intense pressure to produce food locally brought on by dense cities, scarce farmland, and rapid population expansion support the market growth. To increase food security, nations like South Korea, Singapore, and Japan are making significant investments in smart building-integrated growing systems and vertical farms. Adoption is encouraged in the meanwhile by growing affluence and robust government support for sustainable urban development.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 4.8 Bn |

| Revenue Forecast In 2034 | USD 9.8 Bn |

| Growth Rate CAGR | CAGR of 8.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Integration, By Structure, By Application, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Agritecture Consulting LLC, AeroFarms, LLC, Obyashi Corporation, Freight Farms, Inc., GP Solutions, Inc., LettUs Grow Ltd., FarmBox Foods, Crop One Holdings, Inc., BRIO Hydroponics, and Sky Greens |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Agritecture Market by Integration-

· Indoor

· Outdoor

Agritecture Market by Structure-

· Retrofitting

· Extension

· New Building

Agritecture Market by Application-

· Commercial

· Residential

Agritecture Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.