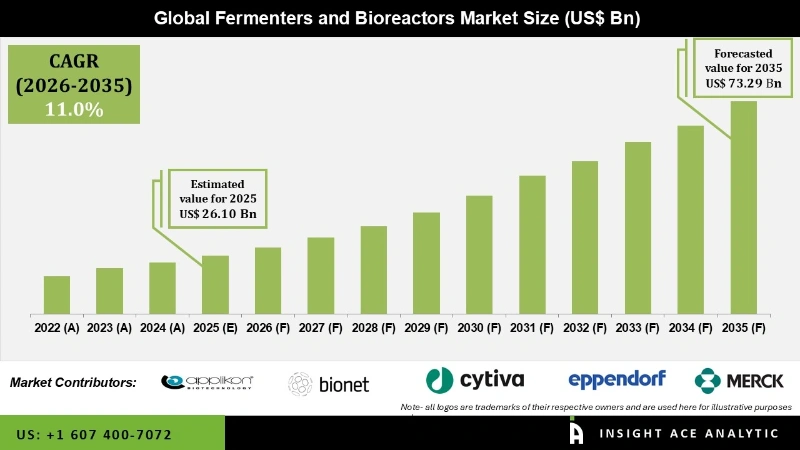

The Fermenters and Bioreactors Market Size is valued at USD 26.10 Bn in 2025 and is predicted to reach USD 73.29 Bn by the year 2035 at an 11.0% CAGR during the forecast period for 2026 to 2035.

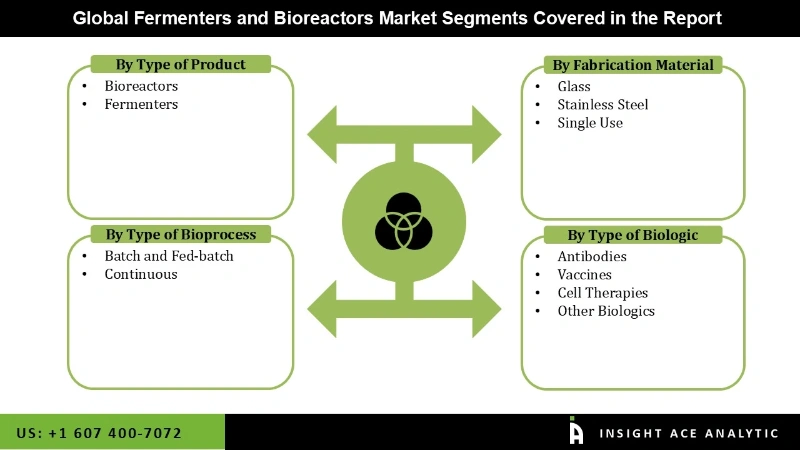

Fermenters and Bioreactors Market Size, Share & Trends Analysis Distribution by Type of Product (Bioreactors and Fermenters), Fabrication Material (Glass, Stainless Steel, Single Use), Type of Bioprocess (Batch and Fed-batch, Continuous), Type of Biologic (Antibodies, Vaccines, Cell Therapies, Other Biologics) and Segment Forecasts, 2026 to 2035.

Fermenters and bioreactors are crucial tools across various industries, including pharmaceuticals, food and beverage, and chemical production. They create optimal environments for the growth and cultivation of microorganisms, cells, and tissues, facilitating the production of a wide range of products such as antibodies, vaccines, enzymes, and biofuels. While fermenters are primarily used for bacterial and fungal cell growth in controlled conditions, bioreactors serve larger-scale applications, particularly in the biopharmaceutical sector for producing vaccines, monoclonal antibodies, and other biologics. These systems enable precise control of essential parameters like temperature, pH, dissolved oxygen, and nutrient levels, ensuring ideal growth conditions for the target organisms or cells.

The growing demand for personalized medicine, biologics, and treatments for orphan diseases significantly drives the fermenters and bioreactors market. Increasing health concerns stemming from unhealthy lifestyles have heightened the need for specialized therapies, propelling demand in the biopharmaceutical industry. As these innovative treatments become more critical, the reliance on bioreactors and fermenters is expected to expand, underscoring their vital role in advancing healthcare solutions.

The fermenters and bioreactors market type of product, fabrication material, type of bioprocess, type of biologic. By type of product the market is segmented into bioreactors and fermenters, by fabrication material market is segmented into glass, stainless steel, single use. By type of bioprocess market is segmented into batch and fed-batch, continuous. By type of biologic the market is segmented into antibodies, vaccines, cell therapies, other biologics.

The continuous bioprocess segment is significantly driving growth in the fermenters and bioreactors market due to its numerous advantages over traditional batch and fed-batch processes. Continuous bioprocessing allows for uninterrupted production, resulting in higher yields and reduced costs, as it eliminates downtime between cycles. This method facilitates real-time monitoring and control, enhancing product quality and consistency by maintaining steady-state conditions for critical parameters like pH, temperature, and nutrient levels. Additionally, continuous manufacturing reduces capital and operating expenses through increased productivity, lower water and energy consumption, and expedited processing times, while also minimizing the need for intermediate holding tanks and repeated sterilization steps.

The biopharmaceutical industry is experiencing rapid growth in antibody-based therapeutics, with innovative formats such as bi-specific antibodies, antibody-drug conjugates, and Fc fusion proteins gaining significant traction. Antibodies are versatile and effective in targeting a wide range of diseases, including cancer, autoimmune disorders, and infectious diseases, due to their specificity and ability to bind precisely to targets. This surge in approved and pipeline antibody therapeutics has created a high demand for bioreactor technologies necessary for their commercial-scale manufacturing. As a result, biopharmaceutical companies are making substantial investments in next-generation antibody engineering and production capabilities to meet this growing need.

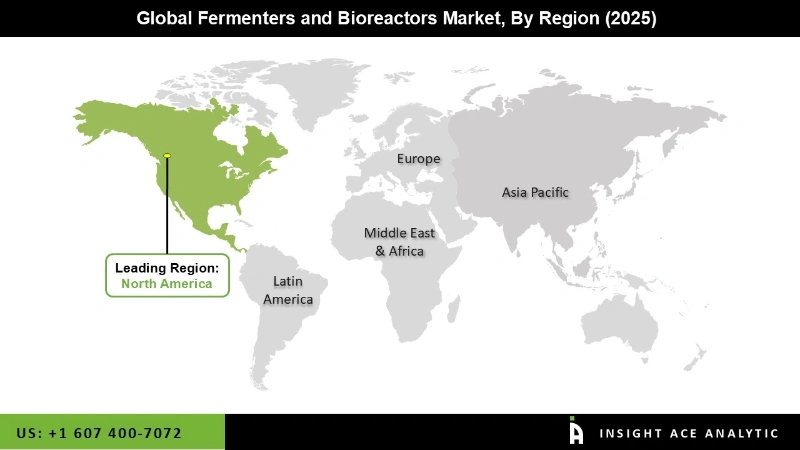

North America is witnessing significant growth in the fermenters and bioreactors market, driven by technological advancements, particularly in single-use disposable bioreactors, which have facilitated widespread adoption in the region. The strong presence of established biopharmaceutical companies and bioprocessing equipment manufacturers, such as Thermo Fisher Scientific, GE Healthcare, and Danaher Corporation, has further fueled demand for these technologies. Additionally, increasing investments in biotechnology research and development are propelling growth, as companies strive to create next-generation products with advanced features. The rising demand for biopharmaceuticals, including vaccines, monoclonal antibodies, and other biologics, is also driving the need for bioreactors and fermenters to support their manufacturing processes.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 26.10 Bn |

| Revenue Forecast In 2035 | USD 73.29 Bn |

| Growth Rate CAGR | CAGR of 11.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type of Product, Fabrication Material, Type of Bioprocess, Type of Biologic and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Getinge (Applikon), Bionet, Cytiva, Eppendorf, Merck, Ollital Technology, Parr Instrument Company, Sartorius, Shanghai Bailun Biological Technology Solaris Biotech (Donaldson), Solida Biotech, Zhengzhou Laboao Instrument Equipment (LABAO) |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Fermenters and Bioreactors Market by Type of Product -

Fermenters and Bioreactors Market by Fabrication Material -

Fermenters and Bioreactors Market by Type of Bioprocess -

Fermenters and Bioreactors Market by Type of Biologic -

Fermenters and Bioreactors Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.