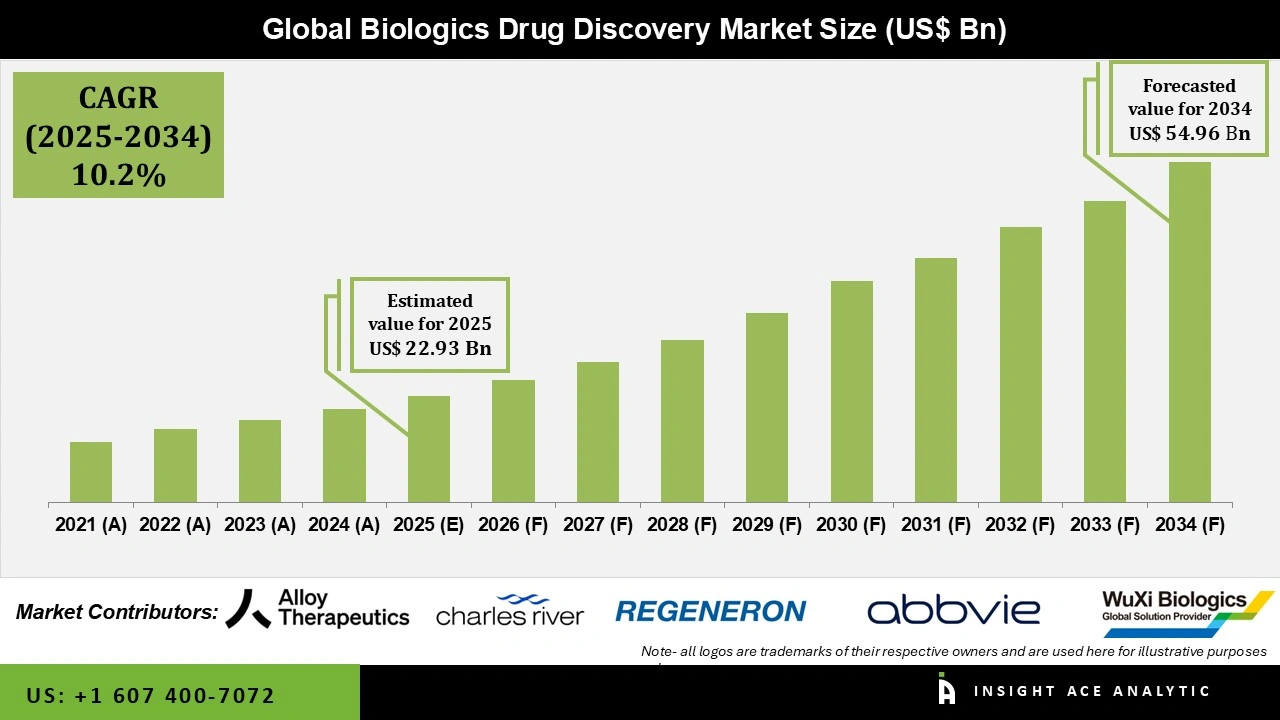

Global Biologics Drug Discovery Market Size is valued at US$ 22.9 Bn in 2025 and is predicted to reach US$ 54.9 Bn by the year 2034 at an 10.2% CAGR during the forecast period for 2025 to 2034.

Biologics Drug Discovery Market Size, Share & Trends Analysis Distribution By Method (Target Identification/Validation, Hit Generation/Validation, Lead Identification, and Lead Optimization), By Manufacturing Type (In-House Manufacturing and Outsourced Manufacturing), By Type (Monoclonal Antibodies, Recombinant Proteins, and Other Biologics), and Segment Forecasts, 2025 to 2034

Biologics drug discovery enables the development of highly precise therapies that work in harmony with the body’s natural biological processes. It supports scientists in designing monoclonal antibodies, protein-based drugs, and cell-derived therapies for conditions that often resist traditional small-molecule treatments. Because biologics offer targeted action with reduced side effects, they are widely used in oncology, autoimmune disorders, and rare diseases. By tailoring treatments to specific biomarkers, biologics significantly improve therapeutic effectiveness. Overall, this field expands the options available for complex diseases and drives innovation in next-generation therapeutics. As healthcare systems shift toward more accurate and durable treatments, the global biologics drug discovery market continues to grow.

The rise in cancer, autoimmune diseases, and chronic illnesses is another element propelling the Biologics Drug Discovery market. The market is expanding because of growing need for targeted medicines that are more effective than conventional medications at treating complicated and chronic disorders. The WHO estimates that there were around 9.7 million deaths resulted from cancer globally. About 1 in 5 people will develop cancer during their lifetime; about 1 in 9 men and 1 in 12 women will die from it.

However, biologics development is an expensive and time-consuming process that frequently calls for intricate production procedures and stringent quality standards are some of the obstacles impeding the growth of the Biologics Drug Discovery sector. Over the course of the forecast period, opportunities for the Biologics Drug Discovery market will be created by integration of artificial intelligence (AI) into biologics drug discovery.

Which are the Leading Players in Biologics Drug Discovery Market?

· Alloy Therapeutics, Inc.

· Charles River Laboratories International, Inc.

· Regeneron Pharmaceuticals, Inc.

· WuXi Biologics (Cayman) Inc.

· AbbVie Inc.

· Amgen, Inc.

· Astellas Pharma Inc.

· AstraZeneca Plc

· Bristol-Myers Squibb

· Novo Nordisk A/S

· Novartis AG

· Evotec SE

· Eli Lilly and Company

· GenScript Biotech Corporation

· Gilead Sciences, Inc.

· Merck KGaA

· Others

The biologics drug discovery market is segmented by method, by manufacturing type, and type. By method, the market is segmented into target identification/validation, hit generation/validation, lead identification, and lead optimization. By manufacturing type, the market is segmented into in-house manufacturing and outsourced manufacturing. By type, the market is segmented into monoclonal antibodies, recombinant proteins, and other biologics.

The target identification/validation segment led the biologics drug discovery market in 2024. In the early phases of biologics development, this section is crucial since the success of therapeutic initiatives depends on the identification of possible drug candidates, such as antibody therapies. Phage display screening and hybridoma screening are two of the most used techniques in hit creation and validation; both are essential for producing and verifying high-affinity antibodies. While hybridoma screening remains a key component of the manufacturing of monoclonal antibodies, phage display enables the quick screening of huge antibody libraries to select specific candidates.

Outsourced Manufacturing segment represents the largest and fastest-growing manufacturing type in biologics drug discovery, driven by its ability to reduce operating costs, enhance scalability, and provide access to specialized expertise. By partnering with contract manufacturing organizations (CMOs), companies can leverage advanced capabilities such as high-throughput screening, large-scale biologics production, and state-of-the-art bioprocessing without heavy capital investment. This model is especially vital for small and mid-size biotechs, which rely on external partners to support the discovery, development, and manufacturing of monoclonal antibodies, recombinant proteins, and cell and gene therapies. As biologics pipelines expand, outsourcing continues to accelerate innovation and operational efficiency across the industry.

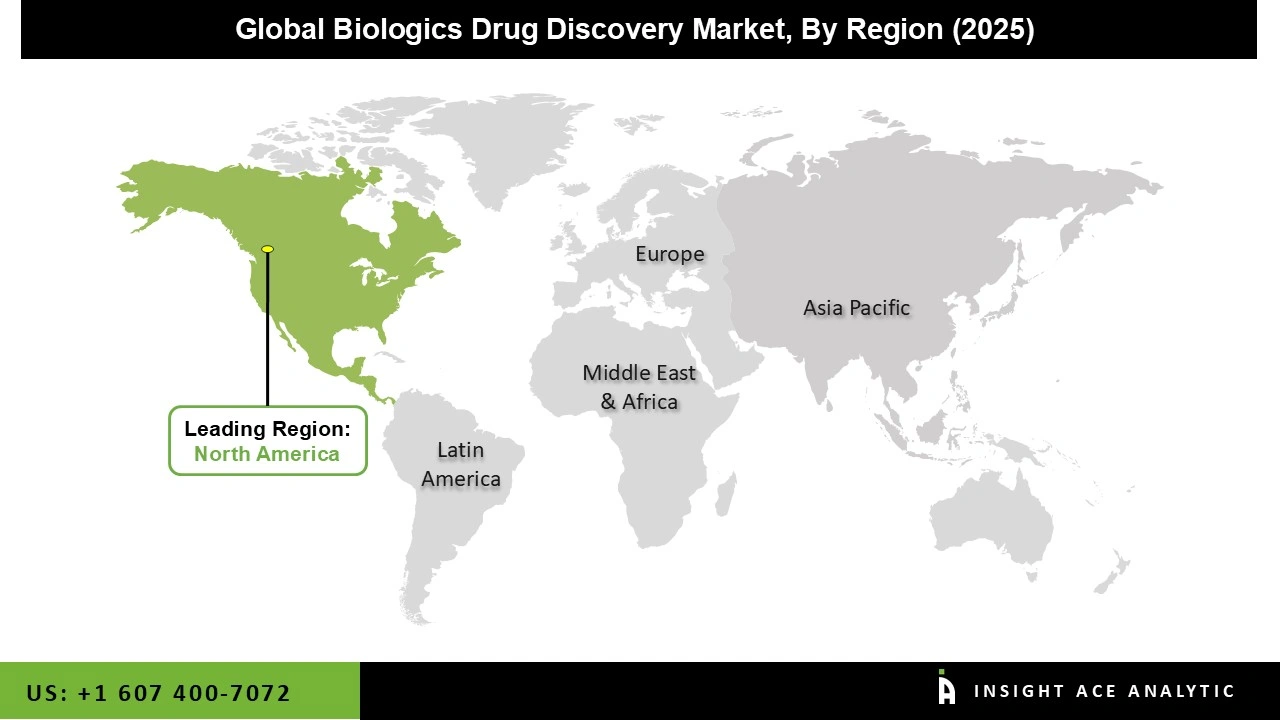

North America dominated the biologics drug discovery market in 2024. The United States is at the forefront of this expansion. This is due to the region's strong combination of cutting-edge research facilities, well-funded biotechnology businesses, and consistent government backing for novel therapeutics, are attributed to this. Demand is maintained by a high prevalence of complicated and chronic illnesses, and development is facilitated by well-established regulatory frameworks. Major pharmaceutical companies, a wealth of venture funding, and access to highly qualified scientific staff further solidify North America's position as the industry's premier hub.

Rapidly growing biotech capabilities becoming more and more common in the Asia-Pacific area, the biologics drug discovery market is expanding at the strongest and fastest rate in this region. Additionally, the need for biologic medicines is increasing due to rising rates of autoimmune diseases, cancer, and chronic illnesses. To encourage collaborations, governments are constructing research parks, enhancing regulatory processes, and providing incentives. The region is expanding rapidly and gaining international momentum thanks to lower development costs, a sizable patient pool, and expanding industry-academia partnerships.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 22.9 Bn |

| Revenue Forecast In 2034 | USD 54.9 Bn |

| Growth Rate CAGR | CAGR of 10.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Method, By Manufacturing Type, By Type, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Alloy Therapeutics, Inc., Charles River Laboratories International, Inc., Regeneron Pharmaceuticals, Inc., WuXi Biologics (Cayman) Inc., AbbVie Inc., Amgen, Inc., Astellas Pharma Inc., AstraZeneca Plc, Bristol-Myers Squibb, Novo Nordisk A/S, Novartis AG, Evotec SE, Eli Lilly and Company, GenScript Biotech Corporation, Gilead Sciences, Inc., and Merck KGaA |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Biologics Drug Discovery Market by Method

· Target Identification/Validation

· Hit Generation/Validation

· Lead Identification

· Lead Optimization

Biologics Drug Discovery Market by Manufacturing Type

· In-House Manufacturing

· Outsourced Manufacturing

Biologics Drug Discovery Market by Type

· Monoclonal Antibodies

· Recombinant Proteins

· Other Biologics

Biologics Drug Discovery Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.