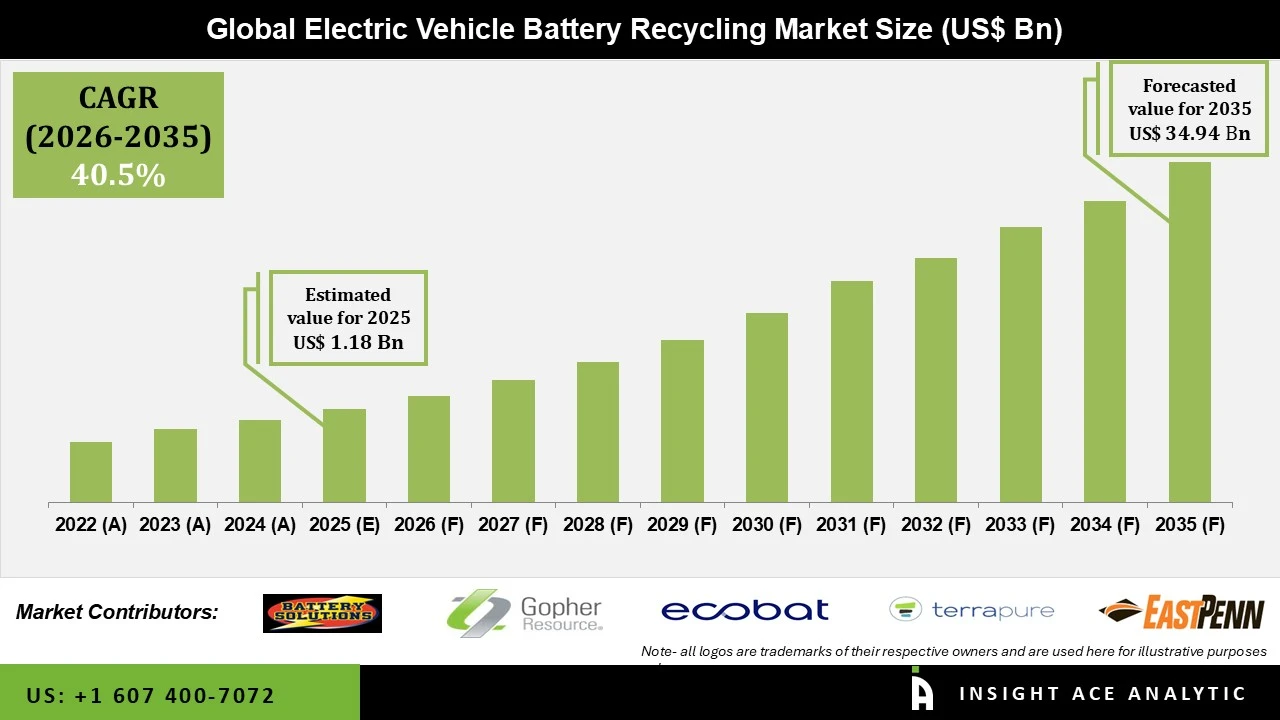

Electric Vehicle Battery Recycling Market Size is valued at 1.18 Billion in 2025 and is predicted to reach 34.94 Billion by the year 2035 at a 40.5% CAGR during the forecast period for 2026 to 2035.

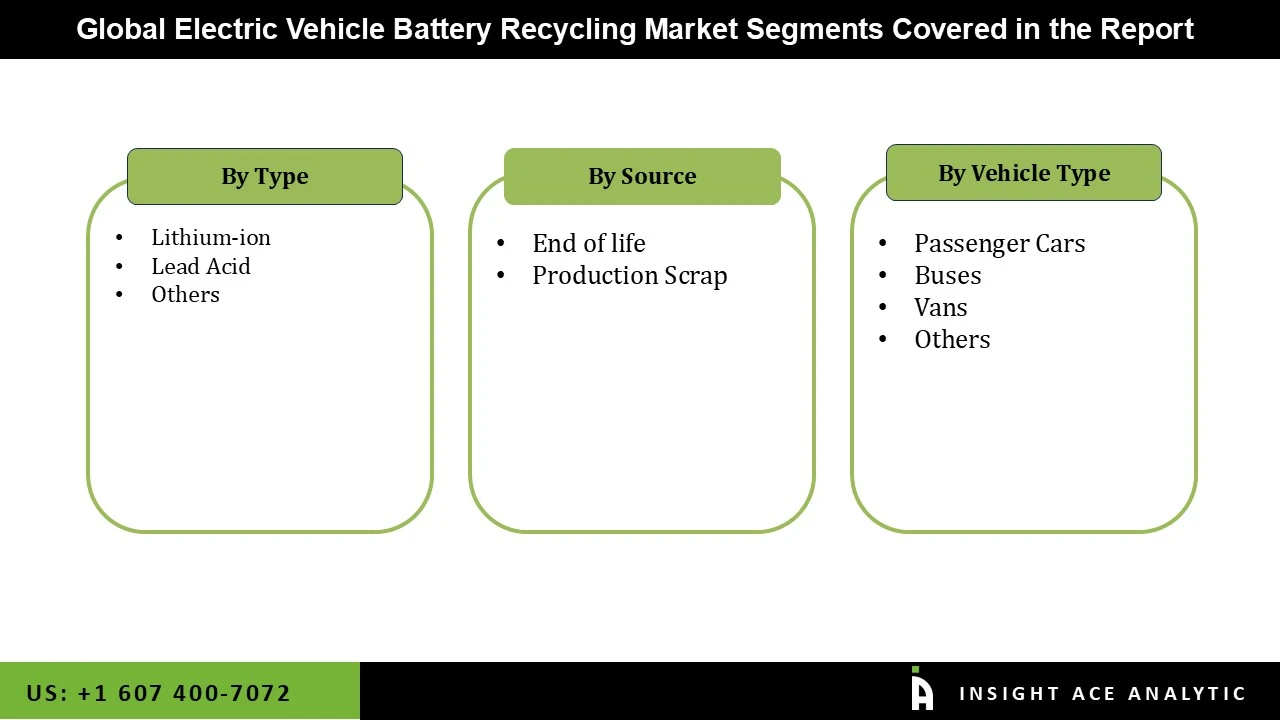

Electric Vehicle Battery Recycling Market Size, Share & Trends Analysis Report by Type (Lithium-ion, Lead Acid), By Source (End of life, Production Scrap), By Vehicle Type (passenger cars, buses, vans), Region And Segment Forecasts, 2026 to 2035

Electric vehicle (EV) battery recycling is the process of collecting, dismantling, and reprocessing batteries from electric vehicles in order to recover valuable materials while minimizing environmental impact. EV batteries are typically composed of metals such as lithium, cobalt, nickel, and manganese, as well as electrolytes and polymers. The growing global usage of electric vehicles is a significant driving force in the electric vehicle battery recycling market. As the number of electric vehicles on the road grows, so does the number of end-of-life batteries that need to be recycled, generating demand for efficient recycling solutions. Moreover, continuous technical breakthroughs in battery recycling procedures are propelling the market's efficiency and cost-effectiveness.

However, many countries enacted lockdowns and restrictions during the early stages of the pandemic, resulting in a temporary slowdown in electric vehicle sales. As the number of electric vehicles on the road fell, so did the volume of end-of-life batteries available for recycling, reducing demand for recycling services.

The Electric Vehicle Battery Recycling Market is segmented on the basis of type, source, and vehicle type. Based on type, the market is segmented as Lithium-ion, Lead Acid, and Others. The source segment includes end-of-life and production scrap. By vehicle type, the market is segmented into passenger cars, buses, vans, and others.

The Lithium-ion category is expected to hold a major share of the global Electric Vehicle Battery Recycling Market in 2022. Global demand for battery electric cars (BEV) and hybrid electric vehicles (HEV) is predicted to drive the segment's growth. Lithium-ion batteries are the most often used type of battery in electric cars (EVs) and thus play an important part in the electric vehicle battery recycling market. Because of its high energy density, long cycle life, and relatively lightweight compared to other battery chemistries, lithium-ion batteries are the leading battery chemistry used in EVs.

The bus segment is anticipated to grow at a rapid rate in the global Electric Vehicle Battery Recycling Market. Increased demand for electric buses and vehicles, for example, is predicted to enhance the use of battery recycling services. The desire for clean and sustainable public transit is driving the global adoption of electric buses. When compared to regular diesel buses, electric buses emit less pollutants, produce less noise, and consume less energy. As the number of electric buses on the road increases, so does the volume of end-of-life bus batteries accessible for recycling.

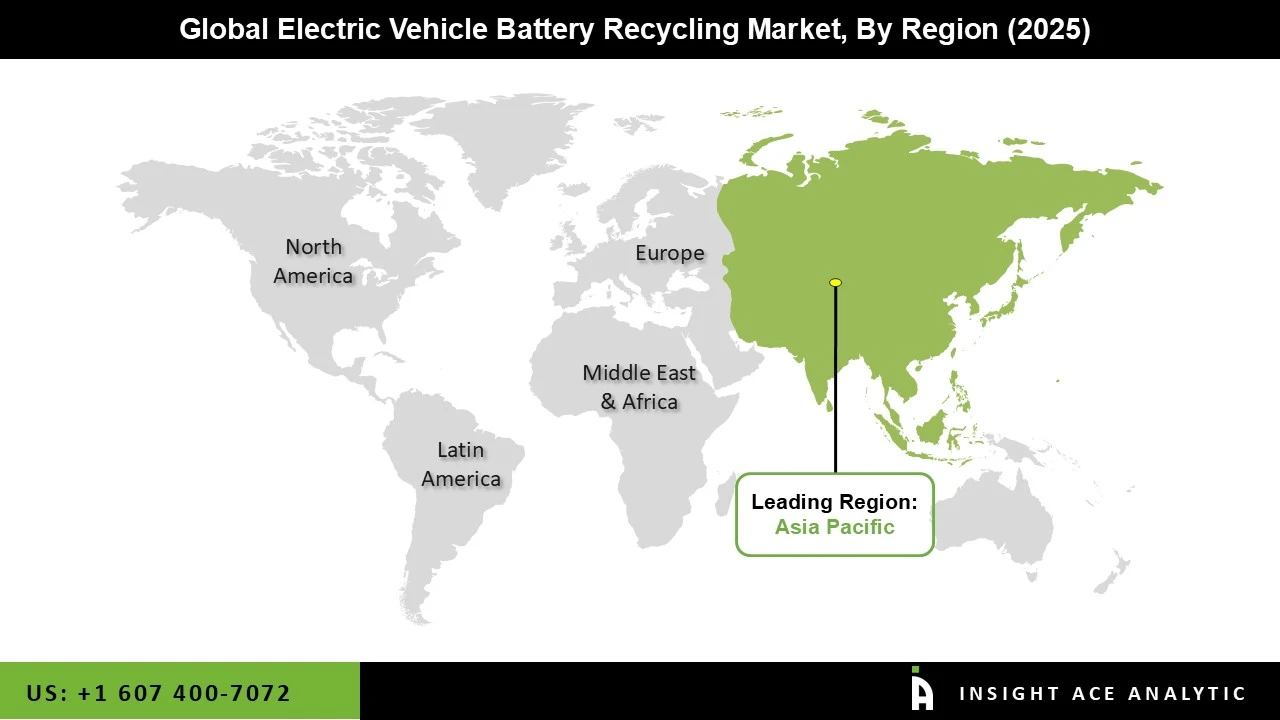

Asia Pacific Electric Vehicle Battery Recycling Market is expected to register the highest market share in terms of revenue in the near future. An increasing number of electric vehicles in the region (particularly in China) and greater investment in electric car battery cooling systems by private and state entities are projected to fuel market expansion. During the projection period, Europe is expected to increase steadily.

The severe EU carbon-emissions regulations have boosted electric vehicle sales in the region, increasing demand for batteries. During the projected period, North America is expected to account for a sizable share of the market. The presence of market players in the region, the introduction of electric vehicles in public transportation, and more consumer disposable income are projected to fuel market expansion in this region.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.18 Bn |

| Revenue Forecast In 2035 | USD 34.94 Bn |

| Growth Rate CAGR | CAGR of 40.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Source, And Vehicle Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia |

| Competitive Landscape | Battery Solutions LLC; Gopher Resource LLC; Ecobat Logistics; Terrapure BR Ltd.; East Penn Manufacturing Company; Retriev Technologies; COM2 Recycling Solutions; Call2Recycle; Exide Technologies; Gravita India Ltd. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Electric Vehicle Battery Recycling Market By Type-

Electric Vehicle Battery Recycling Market By Source-

Electric Vehicle Battery Recycling Market By Vehicle Type-

Electric Vehicle Battery Recycling Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.