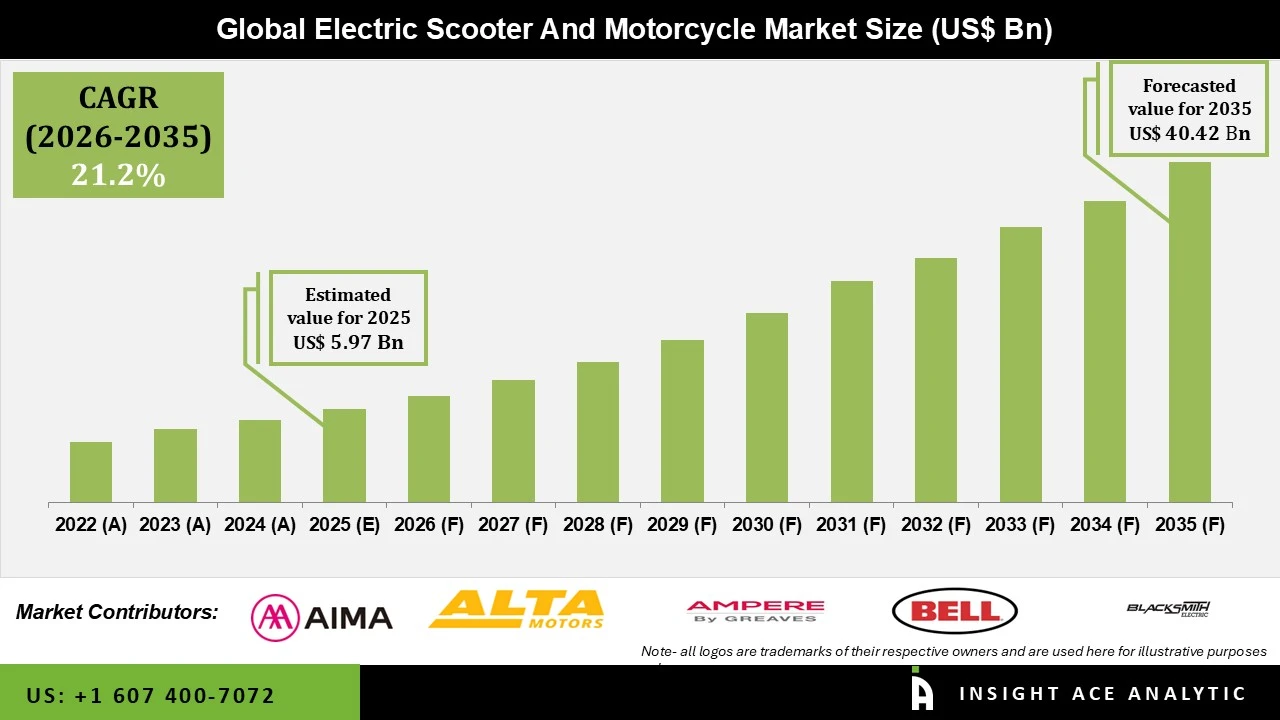

Electric Scooter and Motorcycle Market Size is valued at USD 5.97 Billion in 2025 and is predicted to reach USD 40.42 Billion by the year 2035 at a 21.2% CAGR during the forecast period for 2026 to 2035.

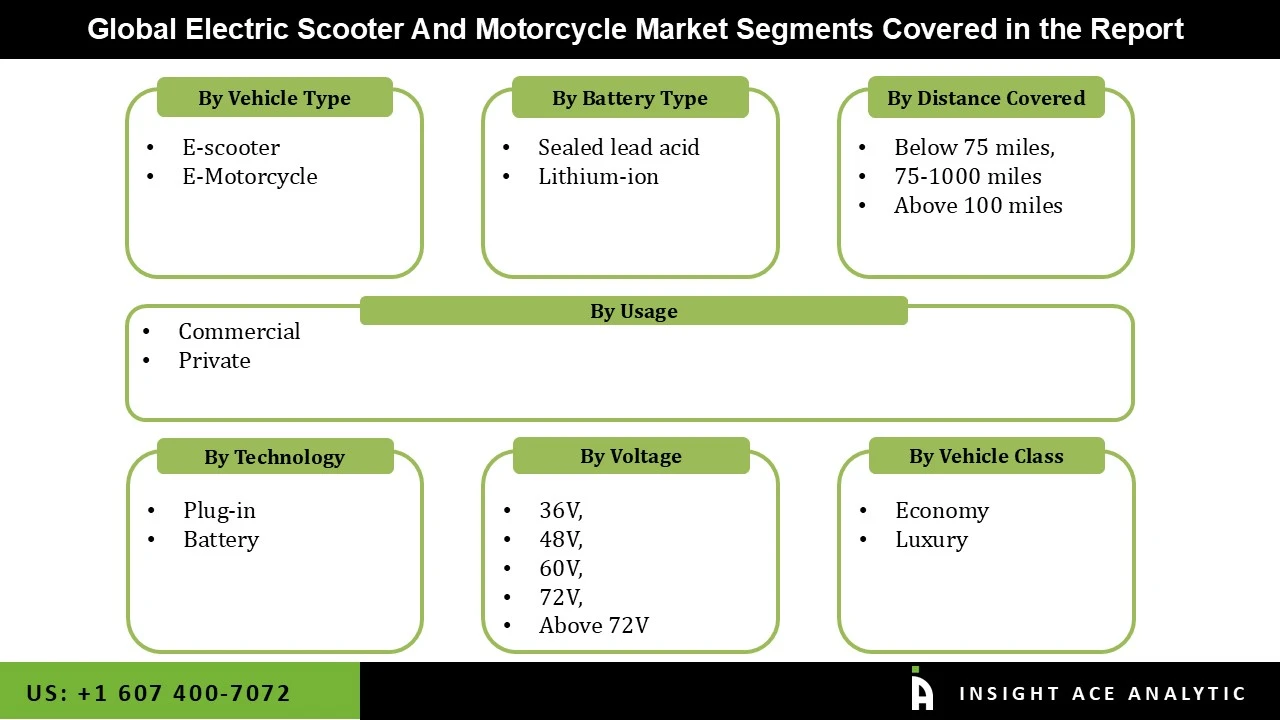

Electric Scooter and Motorcycle Market Size, Share & Trends Analysis Report By Vehicle (E-Scooters/Mopeds & E-Motorcycles), Battery (Lead Acid & Lithium-ion), Distance (below 75 miles, 75-1000 miles, and above 100 miles), Voltage (36V, 48V, 60V, 72V, Above 72V), Technology (Plug-Ins And Batteries), Usage, Vehicle Class, By Region, And Segment Forecasts, 2026 to 2035

The market for electric motorcycles and scooters was adversely affected by the COVID-19 outbreak. The global shutdown restrictions halted the manufacturing and sales of new vehicles, including electric motorcycles and scooters. Moreover, due to supply chain interruptions, production delays were brought on by the need for more raw materials to make various scooter and motorbike parts. Yet, the market anticipates a recovery in the economy following the COVID-19 pandemic due to the global trend toward cleaner mobility.

Furthermore, the market was heavily hit by the decline in car output and labor shortage. The market is anticipated to reverse during the forecast period as car manufacturers have resumed operations due to progressively increasing automobile sales in nations with low COVID-19 instances. Furthermore, the manufacturers are putting backup plans in place to reduce potential business risks and maintain customer relationships in crucial areas of the vehicle industry.

The long-term need for sustainable transportation is the main driver of market expansion. Rising government initiatives and environmental concerns are a few of the key drivers propelling the market's growth. The market's expansion is also anticipated to be fueled by rising energy prices and competition among newly developed energy-efficient technologies.

The Electric Scooter and Motorcycle market is segmented by vehicle type, battery type, distance covered, technology, voltage, vehicle class, and usage. The market is segmented as E-scooter and E-Motorcycle based on vehicle type. By the battery type, the market is segmented into sealed lead acid and lithium-ion. By distance covered, the market is segmented as below 75 miles, 75-1000 miles, and above 100 miles. By technology, the market is segmented into plug-ins and batteries. The market is divided into 36V, 48V, 60V, 72V, and above 72V by voltage. The market is segmented as economy and luxury based on vehicle class. Based on usage, the market is divided into commercial and private.

Due to reduced upfront costs and the availability of more models on the market, which give purchasers a variety of alternatives, e-scooters sell more frequently than e-motorcycles. The popularity of the e-scooter is being fueled by its attraction as a toy and a potential mode of transportation for commuting. As a result, numerous firms are starting to inundate large cities with thousands of scooters that can be rented by the minute.

The industry was dominated by the personal use segment, which brought in a major part of the total revenue. Due to their environmental friendliness, low cost, light weight, low maintenance requirements, and ease of maneuverability, e-scooters are revolutionizing the personal vehicle market. They are generally favored above their electric competitors. E-scooters are also well-liked by millennials as well as low- and middle-income groups. To create a proactive driving experience, many manufacturers are incorporating linked car technology in these scooters.

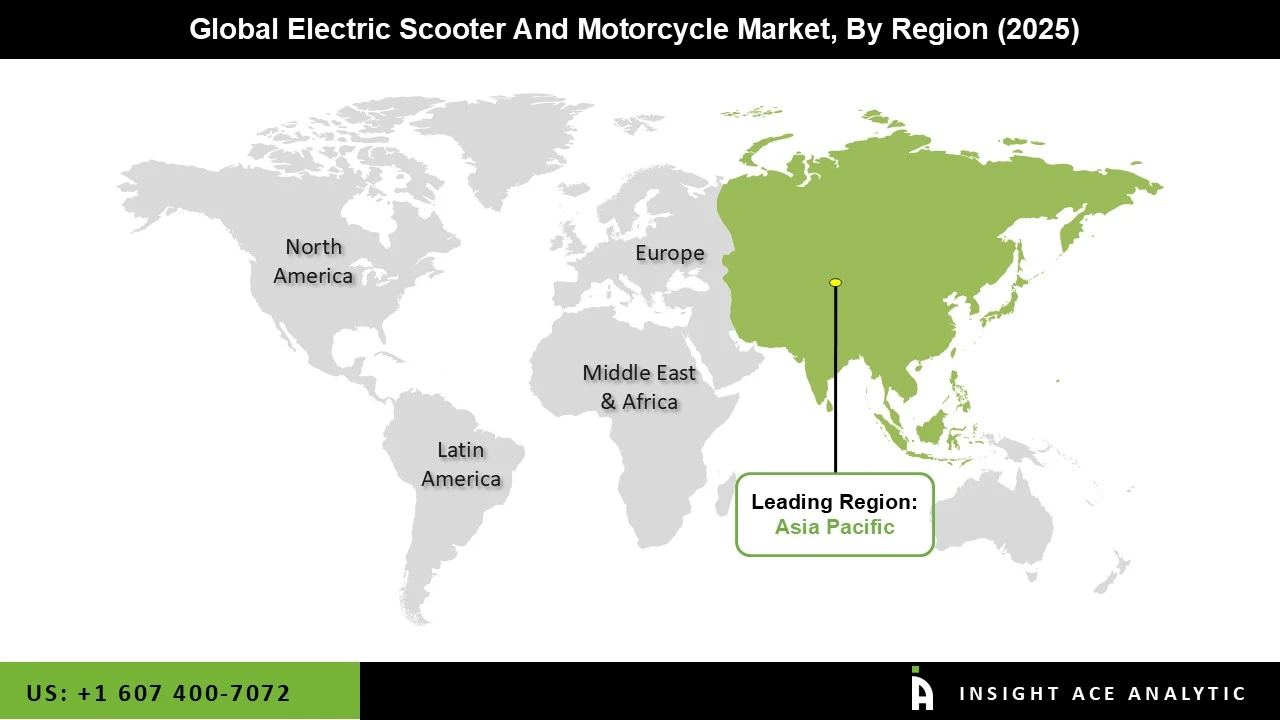

The majority of worldwide industry revenue came from Asia Pacific, which also led the sector globally. China, Taiwan, and Japan have produced the majority of e-scooter manufacturers globally, accounting for the most considerable proportion. China has become a significant producer and exporter of e-scooters in addition to being one of the largest consumers. Jiangsu Xinri Electric Vehicle Co., Ltd., Yadea, AIMA Group, Zhejiang Luyuan, and Niu International are among the suppliers participating in the Chinese market.

Rapid urbanization, the rising affordability of e-scooters, and rising consumer awareness of clean energy mobility to reduce vehicle emissions are further factors driving the regional industry. Also, research and development activities will continue to improve this market over the following ten years significantly.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 5.97 Billion |

| Revenue forecast in 2035 | USD 40.42 Billion |

| Growth rate CAGR | CAGR of 21.2% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Vehicle Type, Battery Type, Distance Covered, Technology, Voltage, Vehicle Class, And Usage |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Yadea Technology Group Ltd., Jiangsu Xinri E Vehicle Co. Ltd., NIU International, Hero Electric, and Okinawa Autotech Private Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Electric Scooter and Motorcycle Market By Vehicle Type-

Electric Scooter and Motorcycle Market By Battery Type-

Electric Scooter and Motorcycle Market By Distance Covered-

Electric Scooter and Motorcycle Market By Technology-

Electric Scooter and Motorcycle Market By Voltage-

Electric Scooter and Motorcycle Market By Vehicle Class-

Electric Scooter and Motorcycle Market By Usage-

Electric Scooter and Motorcycle Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.