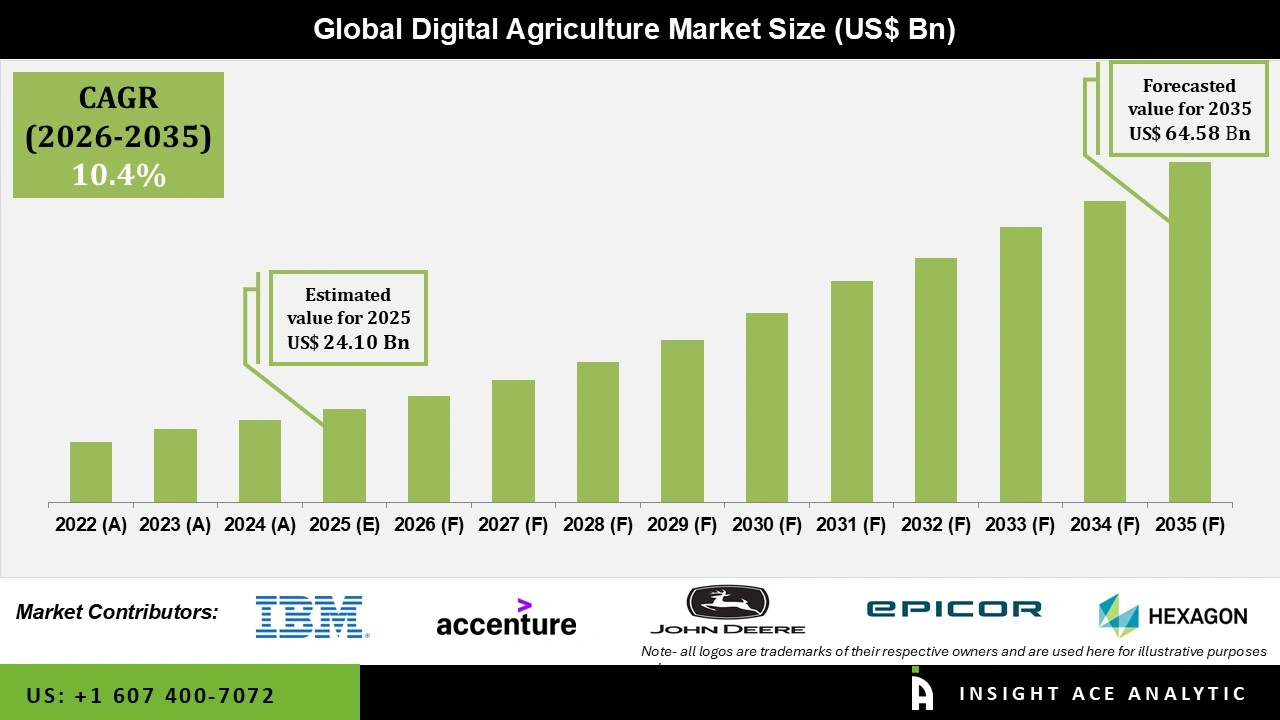

Global Digital Agriculture Market Size is valued at USD 24.10 Billion in 2025 and is predicted to reach USD 64.58 Billion by the year 2035 at a 10.4% CAGR during the forecast period for 2026 to 2035.

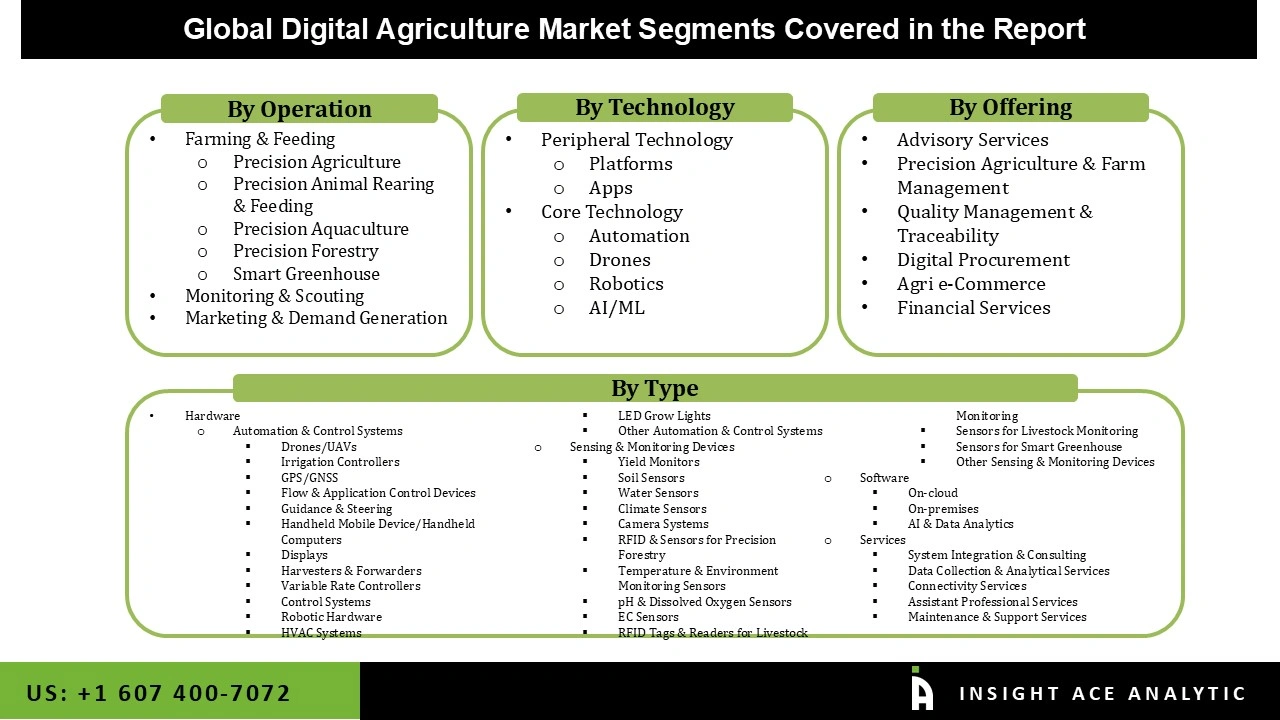

Digital Agriculture Market Size, Share & Trends Analysis Report By Offerings (Precision Agriculture & Farm Management, Agri e-Commerce), Technology (Peripheral, Core), Operation (Farming & Feeding, Monitoring & Scouting, Marketing & Demand Generation) Type (Hardware, Software, Services), Region And Segment Forecasts, 2026 to 2035.

Digital agriculture refers to plans created to enhance and control the management of agricultural operations and production tasks. Automation of record keeping, data storage, monitoring, and production processes are only a few of the many uses for this software on farms. Utilizing data-driven insights, digital farming software optimizes agricultural output and revenue, among other indicators. Individuals involved in farming and the agricultural value chain can all enhance food production through digital agriculture, which consists of utilizing new and advanced technology integrated into a unified system. As a result of the digital platform's assistance, farmers and ranchers can better link up with resources, including capital, marketing, sales, and machinery.

The agricultural sector could be entirely transformed by forming a global digital agriculture market. By using digital technology in agriculture, suppliers can increase their chances of reaching a worldwide audience, and countries can better accommodate the increasing need for food. Furthermore, the growing interest in digital agriculture and its potential to improve crop yield optimization aided in the growth of the farming industry.

However, the market growth is hampered by the high-cost criteria for the safety and health of the digital agriculture market and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high digital agriculture. Due to the high maintenance costs of modern vehicles, small farmers need to use smart digital farming solutions widely. The ongoing costs of these cars' sensors, software, hardware, and cameras threaten their market growth.

For small-scale farmers, the high cost of devices and software systems is a major obstacle to adoption in the digital agriculture market. There was a significant impact on the agricultural sector from the COVID-19 epidemic because of the travel restrictions, nationwide lockdowns, and suspension of import and export activity caused by the limited mobility of migrants and rural laborers. The global agricultural sector was hit hard by the severe scarcity of workers caused by this circumstance. The outbreak also caused a drop in agricultural equipment sales because of the unfavourable economic climate and limited shipments.

The digital agriculture market is categorized based on offering, technology, operation, and type. Offering segment includes advisory services, precision agriculture & farm management, quality management & traceability, digital procurement, Agri e-commerce, and financial services. By technology, the market is segmented into peripheral technology and core technology. The market is segmented by operation into farming & feeding, monitoring & scouting, and marketing & demand generation. The market is segmented by type into hardware, software, and services.

The precision agriculture & farm management digital agriculture market is expected to hold a major global market share in 2022. With precision agriculture and efficient farm management, farmers can decrease the quantity of inputs they utilize, effectively lowering the likelihood of environmental damage. Precision agriculture allows farmers to keep a closer eye on their crops and make better management decisions, which in turn helps keep soil healthy and decreases the likelihood of pests and diseases.

The hardware industry makes up the bulk of acrylic acid ester usage because the subcategories include access points, sensing devices, antennas, and automation and control systems. Farming is greatly enhanced by using hardware components, including sensing devices, drones, and automation and control systems, especially in countries like the US, Germany, the UK, China, and India.

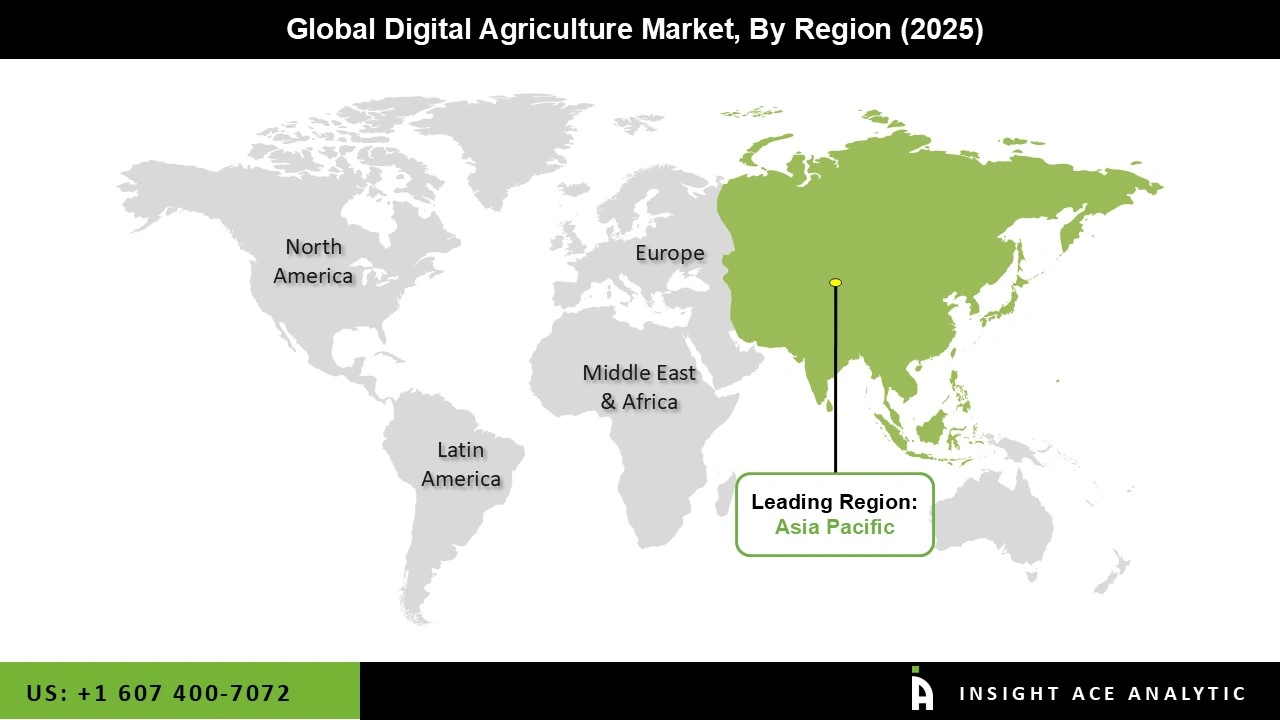

The North American digital agriculture market is expected to deliver the highest market share in revenue shortly. It can be attributed to the government's actively encouraging modern agricultural technologies and constructed infrastructure.

In addition, Asia Pacific is projected to expand in the global digital agriculture market because the governments of developing nations have taken various steps to promote the use of contemporary agricultural techniques.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 24.10 Billion |

| Revenue forecast in 2035 | USD 64.58 Billion |

| Growth Rate CAGR | CAGR of 10.4% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn,and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Offering, Technology, Operation, And Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | Cisco Systems, Inc. (US), IBM Corporation (US), Accenture (Ireland), Trimble Inc. (US), Deere & Company (US), Epicor Software Corporation (US), Hexagon AB (Sweden), Bayer AG (Germany), AGCO Corporation (US), and Vodafone Group PLC (UK). |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.