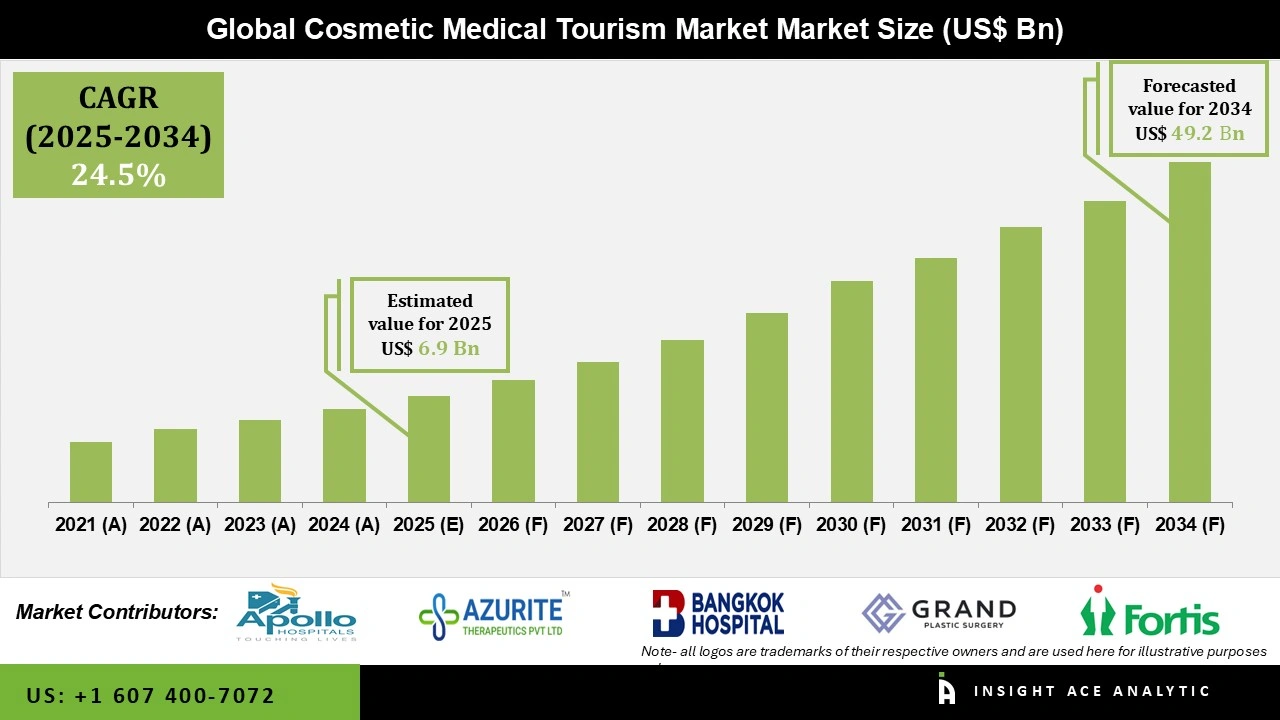

Cosmetic Medical Tourism Market Size is valued at US$ 6.9 Bn in 2025 and is predicted to reach US$ 49.2 Bn by the year 2034 at an 24.5% CAGR during the forecast period for 2025-2034.

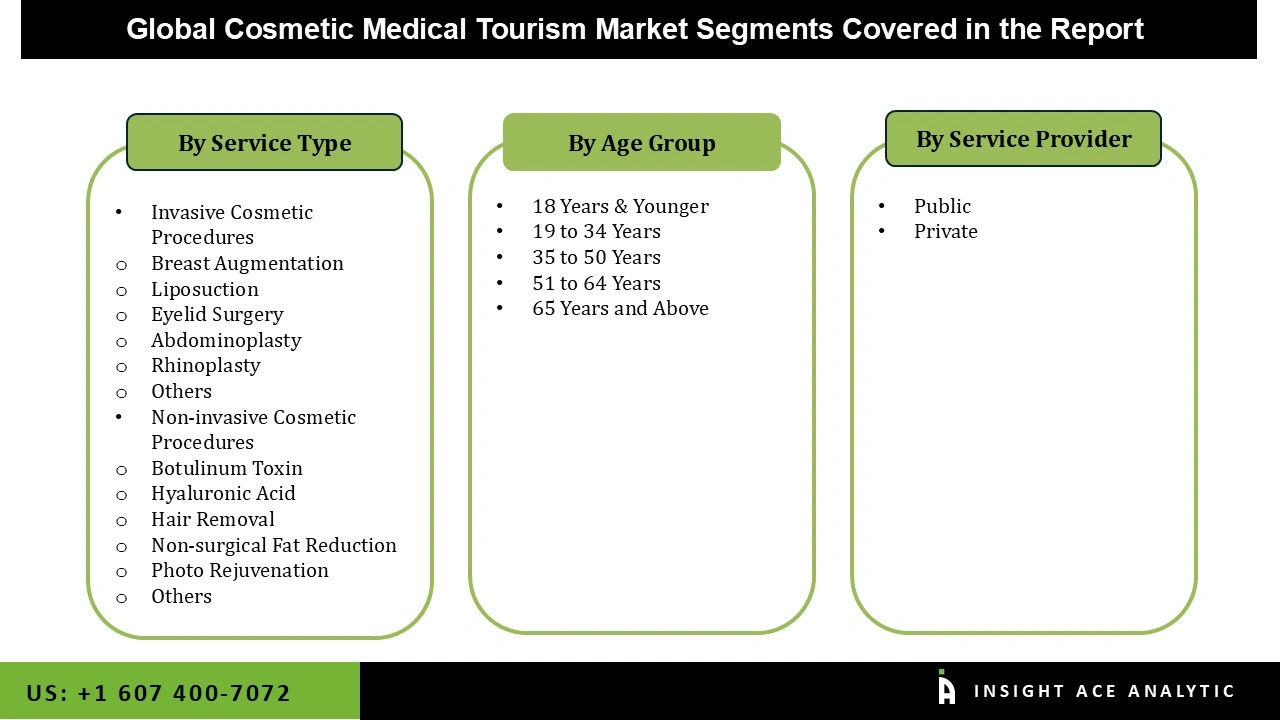

Cosmetic Medical Tourism Market Size, Share & Trends Analysis Distribution by Age Group (18 Years & Younger, 19 to 34 Years, 35 to 50 Years, 51 to 64 Years, 65 Years and Above), Service Type (Invasive Cosmetic Procedures (Breast Augmentation, Abdominoplasty, Liposuction, Rhinoplasty, Eyelid Surgery, Others) and Non-invasive Cosmetic Procedures (Botulinum Toxin, Hair Removal, Hyaluronic Acid, Photo Rejuvenation, Non-surgical Fat Reduction, Others)), Service Provider (Public and Private), and Segment Forecasts, 2025-2034.

Cosmetic medical tourism refers to the rapidly expanding practice of travelling abroad for elective aesthetic procedures such as facelifts, rhinoplasty, breast augmentation, liposuction, abdominoplasty, hair transplantation, and non-surgical treatments. Patients are primarily motivated by cost savings of 50–80 % compared to prices in high-income countries, even after travel and accommodation expenses. Equally important drivers include shorter or nonexistent waiting times, access to surgeons with exceptionally high procedural volumes and specialized expertise, and the opportunity to combine surgery with discreet recovery in an attractive vacation setting.

Rising global disposable income, intensified beauty consciousness fueled by social media and celebrity culture, and the destigmatization of aesthetic enhancement have dramatically increased demand for cosmetic procedures worldwide. However, prohibitive costs and long public-sector wait times in North America, Western Europe, and Australia push patients toward international options.

Governments in leading destination countries actively support this trend through targeted medical tourism strategies: streamlined medical visas, official promotion of accredited facilities, infrastructure investment, and public–private partnerships that ensure consistent quality standards. Enhanced global air connectivity, the rise of specialized medical tourism agencies, and transparent online reviews have further lowered barriers, making cross-border surgery feel safe and routine for an expanding middle-class and affluent patient base.

The sector is rapidly adopting AI-driven outcome simulations, blockchain for secure records, and universal accreditations (JCI, ISAPS) to build trust. As of 2025, the clear leaders are South Korea (facial surgery), Turkey (hair transplants and full-body packages), Thailand (hospitality and volume), Brazil/Colombia (body contouring), Mexico (North American proximity), and India (emerging premium hub). These destinations attract millions annually with world-class results, luxury recovery options, and 50–80% cost savings.

Some of the Key Players in Cosmetic Medical Tourism Market:

The cosmetic medical tourism market is segmented by age group, service type, and service provider. By age group, the market is segmented into 18 years & younger age, 19 to 34 years, 35 to 50 years, as well as 51 to 64 years, 65 years and above. By service type, the market is segmented into invasive cosmetic procedures (breast augmentation, abdominoplasty, liposuction, rhinoplasty, eyelid surgery, others) and non-invasive cosmetic procedures (botulinum toxin, hair removal, hyaluronic acid, photo rejuvenation, non-surgical fat reduction, others). By service provider, the market is segmented into public and private.

The cosmetic medical tourism market was dominated by the 35–50 year age group in 2024, and it is projected to expand at the highest CAGR over the duration of the forecast. Compared to other age groups, those between the ages of 35 & 50 are more likely to undergo cutting-edge cosmetic procedures, which is the primary factor contributing to this segment's growth. People in this age bracket are also more self-conscious about their appearance, which leads them to undergo multiple cosmetic procedures to improve it. The International Society of Aesthetic Plastic Surgery, for instance, reported in June 2024 that 700,328 women between the ages of 35 and 50 had breast augmentation surgery globally.

In 2024, the private sector held the largest global market share for cosmetic medical tourism, indicating its dominance in the industry. Several private clinics and hospitals offering a variety of medical services, including cosmetic procedures, are among the key elements propelling the market's expansion. In June 2024, for example, the International Travel and Health Insurance Journal reported that there were around 38,512 medical facilities in Thailand as of 2023, with 25,148 of those being private hospitals and clinics.

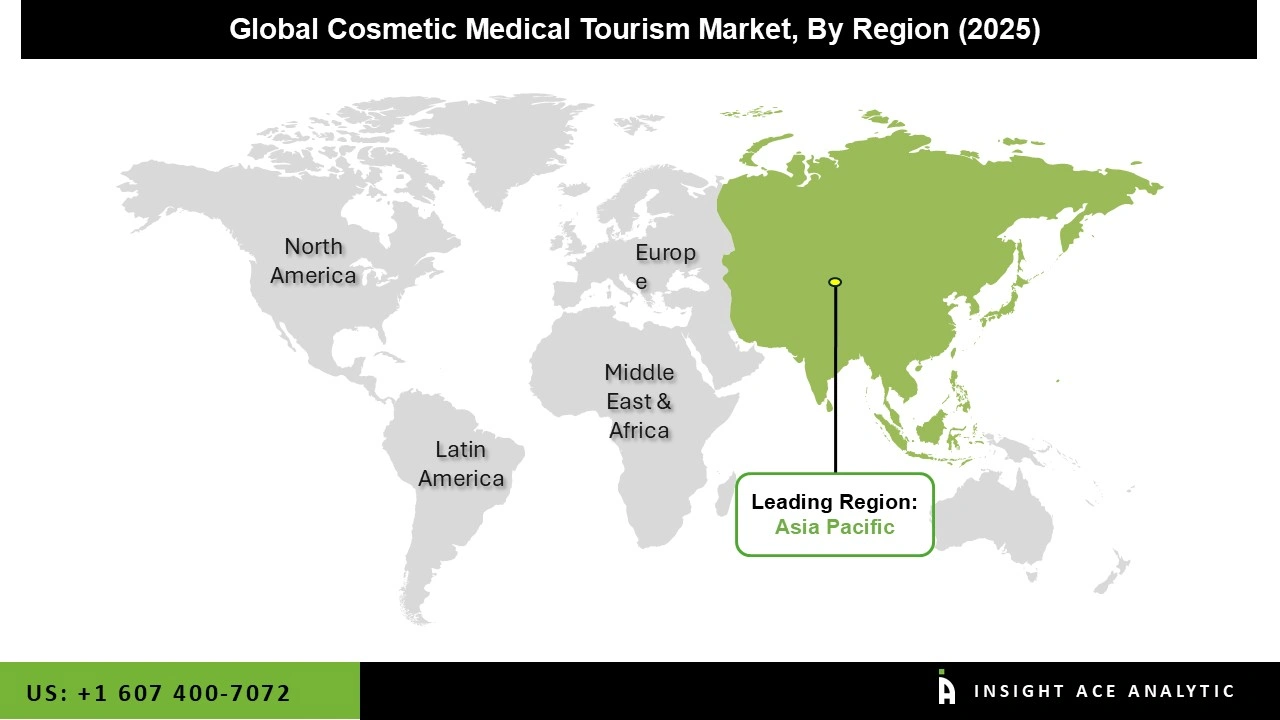

The Asia-Pacific region has solidified its position as the world’s leading medical tourism hub, combining high-quality clinical care with costs often 60–80 % lower than in Western countries. Thailand, India, Malaysia, and Singapore dominate the landscape, attracting millions of international patients annually for procedures ranging from cosmetic surgery and dental work to complex interventions such as cardiac surgery, organ transplantation, and oncology treatment. Notably, India welcomed over 7.3 million medical tourists in 2024, a significant increase from 6.1 million in 2023, underscoring the region’s growing appeal and infrastructure maturity.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 6.9 Bn |

| Revenue Forecast In 2034 | USD 49.2 Bn |

| Growth Rate CAGR | CAGR of 24.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Age Group, By Service Type, By Service Provider, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Fortis Healthcare, KPJ Healthcare Berhad, Apollo Hospitals Enterprise Ltd., Bangkok Hospital, Azurite Medical & Wellness, Grand Plastic Surgery, Livonta Global, Asthetica, The Esthetic Clinics, Medical Care Hungary Kft, Gleneagles Healthcare India Private Limited, Dhanwantari's Chrysalis, and Nera Clinic |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Cosmetic Medical Tourism Market by Age Group-

· 18 Years & Younger

· 19 to 34 Years

· 35 to 50 Years

· 51 to 64 Years

· 65 Years and Above

Cosmetic Medical Tourism Market by Service Type -

· Invasive Cosmetic Procedures

o Breast Augmentation

o Abdominoplasty

o Liposuction

o Rhinoplasty

o Eyelid Surgery

o Others

· Non-invasive Cosmetic Procedures

o Botulinum Toxin

o Hair Removal

o Hyaluronic Acid

o Photo Rejuvenation

o Non-surgical Fat Reduction

o Others

Cosmetic Medical Tourism Market by Service Provider-

· Public

· Private

Cosmetic Medical Tourism Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.