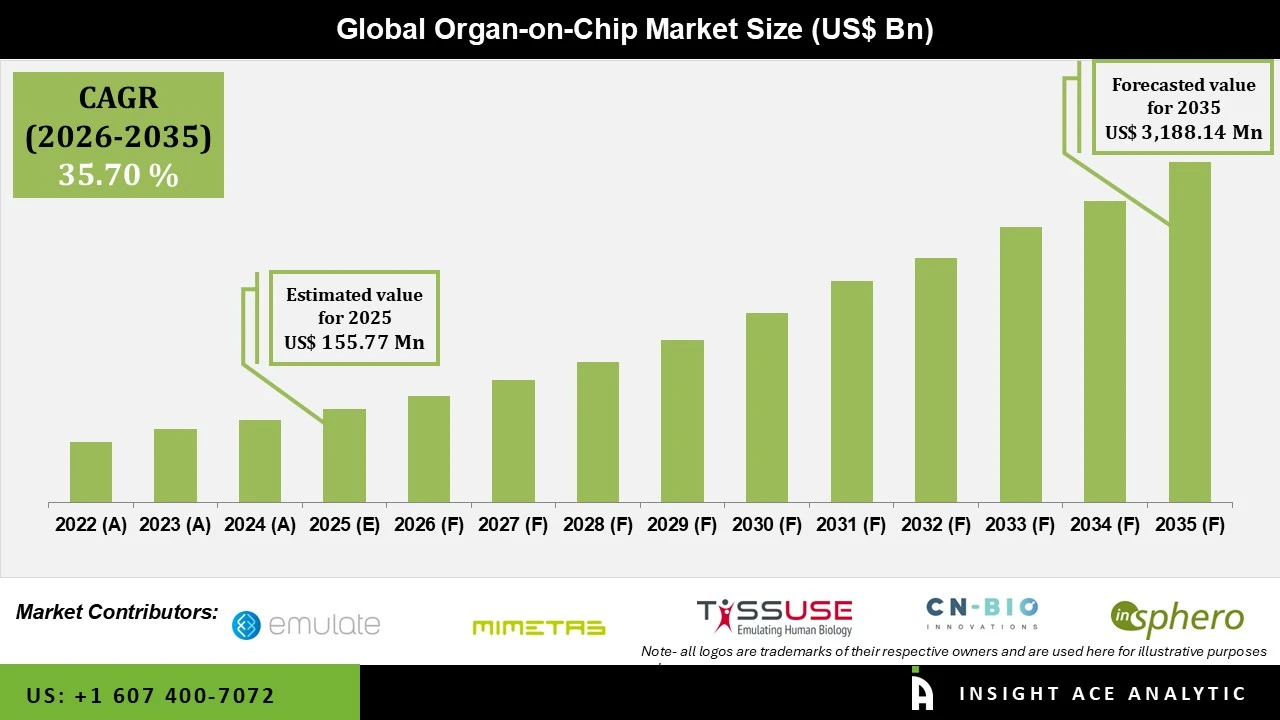

Organ on Chip Market Size is valued at USD 155.77 Mn in 2025 and is predicted to reach USD 3188.14 Mn by the year 2035 at a 35.70% CAGR during the forecast period for 2026 to 2035.

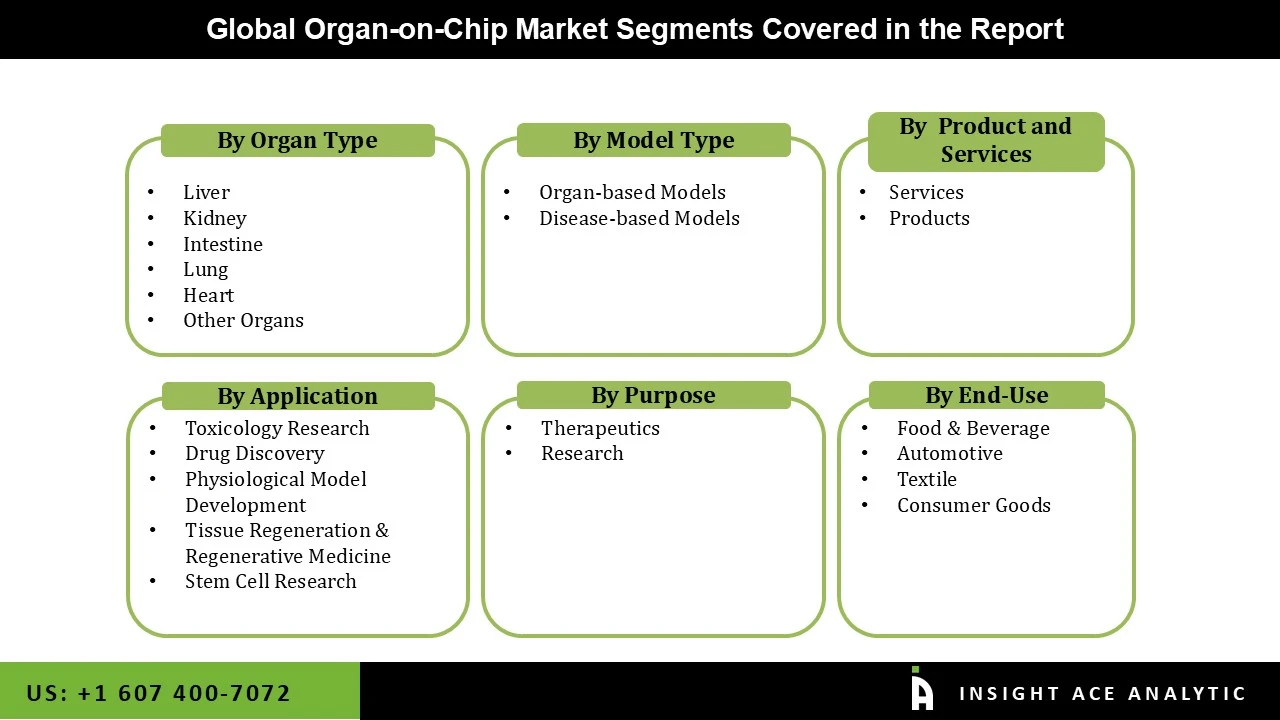

Organ on Chip Market Size, Share & Trends Analysis By Organ Type (Liver, Kidney, Intestine, Lung, Heart, Other Organs), By Model Type (Organ-based Models, Disease-based Models), By Product & Service (Services (Custom Services, Standard Services), Products (Instruments, Consumables & Accessories, Software)), By Application, By Purpose, By End User, by Region, And by Segment Forecasts, 2026 to 2035.

Organ-on-a-chip (OoC) technology, which involves micro-engineered biomimetic systems reflecting the structural and functional characteristics of human tissue, integrates biomaterial technology, cell biology, and engineering into a miniaturized platform. Various models have been successfully developed, including lung-on-a-chip, liver-on-a-chip, kidney-on-a-chip, heart-on-a-chip, intestine-on-a-chip, and skin-on-a-chip.

The FDA has expressed confidence in this innovative technology and has formed partnerships with industries and institutes engaged in its advancement. OoC models have broad applications across scientific domains, such as disease model development, drug screening, toxicology, pathogenesis studies, efficacy testing, and virology. The integration of multiple organ-on-chip modules into a unified body-on-chip device holds significant potential for diagnosis and treatment, particularly in addressing complications from the ongoing COVID-19 pandemic. Consequently, the market demand for developing organ-on-chip devices is expected to skyrocket in the near future.

Organ-on-chip (OoC) technology has thrived due to converging advances in tissue engineering and microfabrication. Progress in cell and tissue engineering has evolved from simple 2D monocultures to sophisticated 3D co-culture systems. Another pivotal factor behind the success of OoCs is microsystems technology, a fabrication approach borrowed from the integrated circuit industry. This technology employs lithographic pattern transfer to create nanometer- and micrometer-scale structures. Milestones in OoC development are closely linked with key technological advancements in microsystems technology, which was initially used in analytical chemistry to create laboratory-on-a-chip devices. This technology has propelled the development of microfluidic systems as well as miniaturized actuators and sensors, enhancing the capabilities of OoCs significantly.

The organ-on-a-chip market is segmented by organ type (liver, kidney, intestine, lung, heart, and other organs), model type (organ-based and disease-based models), and product & service offerings, which include instruments, consumables & accessories, software, and both custom and standard services. Applications span toxicology research, drug discovery, physiological model development, tissue regeneration and regenerative medicine, and stem cell research.

Based on purpose, these systems are used for both therapeutic and research needs. Key end users include pharmaceutical and biotechnology companies, the cosmetics industry, academic and research institutes, and other specialized users.

Based on the by application, the market is divided into drug discovery, toxicity testing, and other applications. Among these, the drug discovery segment is expected to be the highest-growing. Pharmaceutical companies are increasingly adopting Organ-on-Chip (OoC) technology for drug discovery to enhance the efficiency and accuracy of preclinical testing. OoCs provide a more reliable prediction of human responses compared to traditional animal models and 2D cell cultures. Additionally, OoC technology supports the development of personalized medicine by enabling the testing of drug responses on chips populated with cells derived from individual patients. This capability is particularly appealing in the context of precision medicine initiatives, as it allows for tailored therapeutic strategies based on individual patient profiles.

Based on the organ type, the market is categorized into liver-on-a-chip, kidney-on-a-chip, lung-on-a-chip, heart-on-a-chip, brain-on-a-chip, and other organ-on-chip. Among these, the liver-on-a-chip segment dominates the market. The liver plays a central role in drug metabolism and detoxification, making liver-on-a-chip devices indispensable for studying drug-induced liver injury (DILI), a major concern in drug development and a leading cause of drug withdrawal from the market. Regulatory agencies, like the FDA, emphasize liver models in their guidance and approvals, further driving the adoption of liver-on-a-chip systems in preclinical testing. Significant research interest and funding are directed towards liver-on-a-chip technology, underscoring its critical role in drug development and disease modeling. This focus on liver models enhances the accuracy of preclinical testing and contributes to safer and more effective drug development.

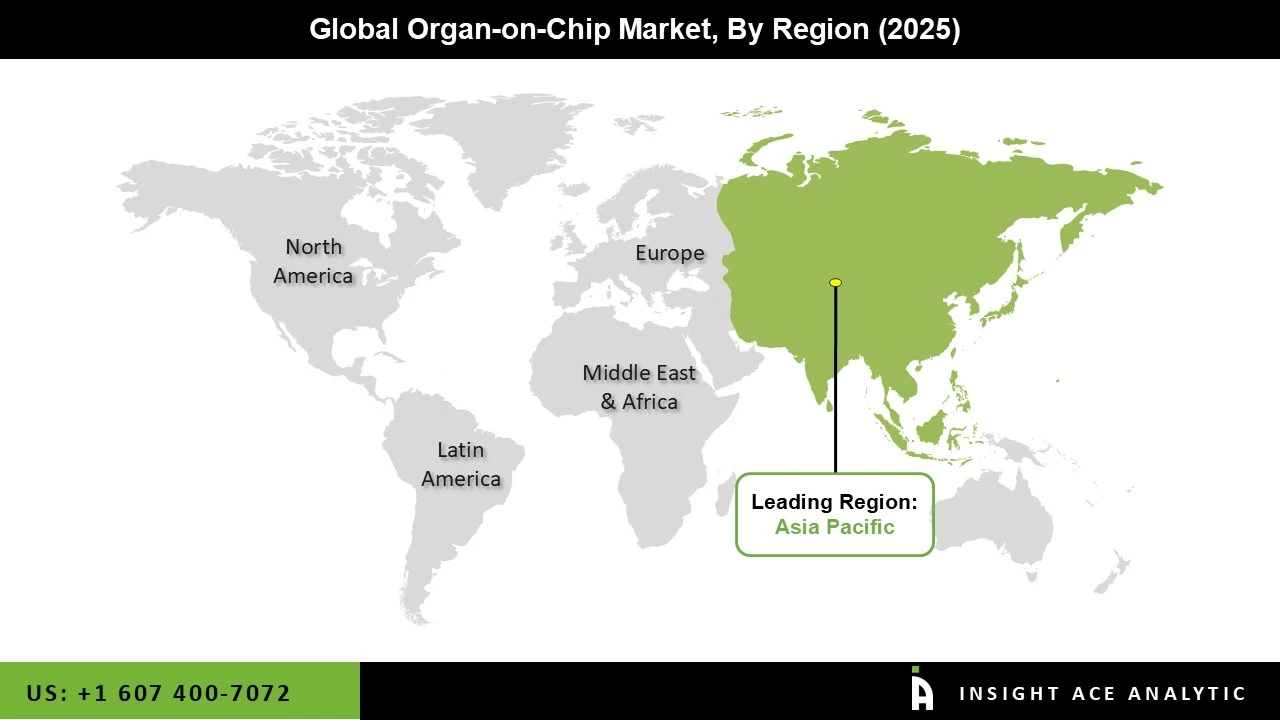

The Asia Pacific region has witnessed significant expansion in its pharmaceutical and biotechnology sectors, with many global pharmaceutical companies establishing R&D centers to leverage cost advantages and skilled labor. This growth is further fueled by increasing healthcare demands driven by a growing population, the rising prevalence of chronic diseases, and an aging demographic. These factors collectively heighten the need for advanced medical technologies, including organ-on-chip systems, to enhance drug development and healthcare solutions in the region.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 155.77 Mn |

| Revenue Forecast In 2035 | USD 3188.14 Mn |

| Growth Rate CAGR | CAGR of 35.70% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Model Type, By Organ Type, By Product And Services, By Purpose, By Application, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Emulate, Inc., MIMETAS B.V., TissUse GmbH, CN Bio Innovations Ltd., InSphero, Alveolix AG, Fluigent, Nortis, Inc., Hesperos, Inc., AxoSim, BEOnChip, Altis Biosystems, SynVivo, Inc., Obatala Sciences, Dynamic42 GmbH, Lena Biosciences, AIM Biotech Pte. Ltd., React4life, Initio Cell, NETRI SAS, Revivocell, BI/OND, BiomimX S.r.l., Cherry Biotech, Elvesys, Javelin Biotech, and Kirkstall Ltd. are leading companies operating in the organ-on-a-chip market. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Organ-on-Chip Market, By Organ Type

Global Organ-on-Chip Market – By Model Type

Global Organ-on-Chip Market – By Product and Services

Global Organ-on-Chip Market – By Application

Global Organ-on-Chip Market – By Purpose

Global Organ-on-Chip Market – By End User

Global Organ-on-Chip Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.