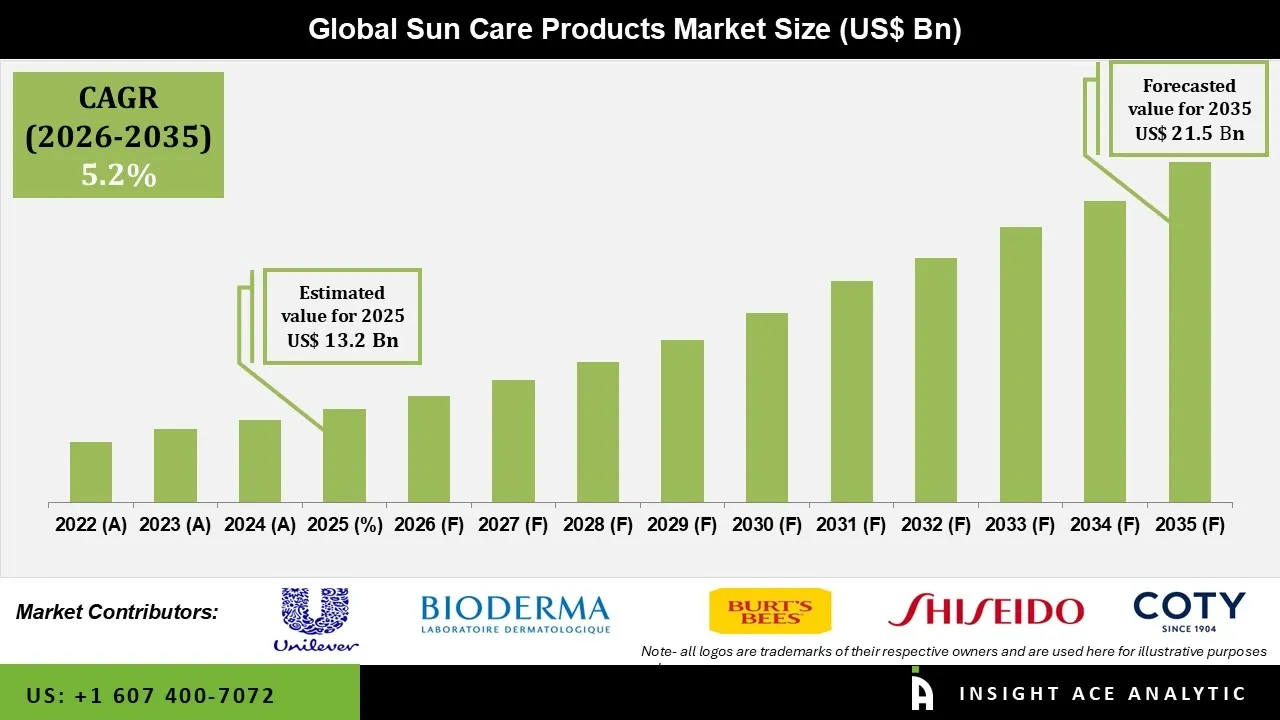

Sun Care Products Market Size is valued at USD 13.2 Bn in 2025 and is predicted to reach USD 21.5 Bn by the year 2035 at a 5.2% CAGR during the forecast period for 2026 to 2035.

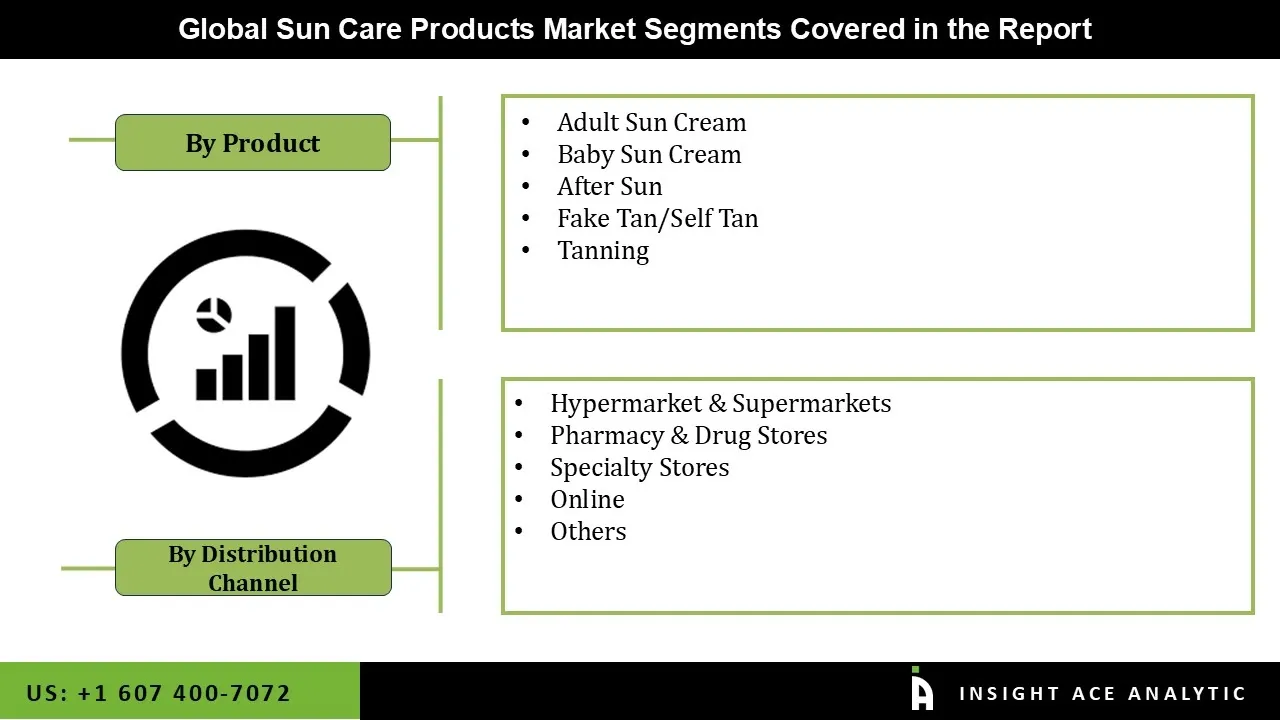

Sun Care Products Market Size, Share & Trends Analysis Distribution by Product Type (Tanning, Baby Sun Cream, Adult Sun Cream, After Sun, and Fake Tan/Self Tan), Distribution Channel (Hypermarket & Supermarkets, Pharmacy & Drug Stores, Online, Specialty Stores, and Others), and Segment Forecasts, 2026 to 2035

Sun care products are personal care formulations made to protect the skin from the ultraviolet (UV) rays. These products, which help prevent sunburn, premature skin ageing, pigmentation, and lower the risk of skin cancer, include sunscreens, sunblocks, after-sun lotions, and daily moisturisers with SPF. Sun care solutions may use chemical filters to absorb UV rays or physical (mineral) elements like zinc oxide and titanium dioxide(TiO2) to deflect and scatter UV radiation. With formulas for the face, body, lips, and sensitive skin, they are extensively used by people of all ages and skin types.

The sun care products market is mostly driven by consumers adopting sun protection habits as a result of increased awareness of the negative consequences of UV radiation, such as sunburn, early ageing, and skin cancer. The demand for sun care products is driven by this increased awareness.

Additionally, the demand for efficient sun protection has increased due to the popularity of outdoor pursuits like sports, hiking, and beach holidays. For those who participate in outdoor activities, sunscreen and other sun care items are necessary. Furthermore, the market for sun care products has grown due to the rise in worldwide travel and tourism. Sun protection products are necessary for travellers who frequently visit sunny locations in order to protect their skin from prolonged exposure to the sun.

In addition, the sun care products sector is coming up with new ideas and providing a variety of sun care products to suit different tastes. These include sunscreens with additional skincare advantages, including antioxidants and anti-ageing compounds, water-resistant formulations, mineral and organic sunscreens, and treatments for sensitive skin, all of which are driving the sun care products market expansion.

Moreover, some of the other factors propelling the expansion of the global sun care products market are product innovation and product line expansion. The need for natural, high-quality solutions that may also address other skin concerns, like anti-ageing, has significantly increased, necessitating ongoing innovation in this industry. Furthermore, the demand for high-end sun care products that can prolong skin moisture has increased due to the rise in middle-class people's discretionary income, particularly among working-class women.

The availability of these high-end goods and growing consumer purchasing power will propel the sun care products market's expansion over the course of the projected period. However, during the forecast period, the expansion of the sun care products market is anticipated to be hindered by strict regulations on ingredients and labelling in various regions. Additionally, the market for sun care products is constrained by entry hurdles due to the complexity of newly developed formulations and the demands of significant expenditure.

• The Estee Lauder Companies Inc.

• Beiersdorf AG

• Groupe Clarins

• Unilever

• Johnson & Johnson

• L'oreal

• Coty Inc.

• Shiseido Co. Ltd.

• Burt's Bees

• Bioderma Laboratories

The global sun care products market is expanding mostly due to increased awareness of UV harm. Customers' demand for sun protection solutions is rising as they become more knowledgeable about the negative effects of UV radiation, such as skin cancer, ageing, and sunburns. The market has grown as a result of people becoming more aware of the critical function these products serve in shielding their skin from the damaging effects of the sun. In response, sun care manufacturers have expanded the variety of SPF options, improved product safety and quality, and created novel and more potent sunscreen compositions. Sun care products are now considered a daily necessity for keeping skin healthy and youthful rather than seasonal necessities. As a result, the sun care products market is expanding, which reflects the rising awareness of sun damage and the growing need for skin protection.

One of the main obstacles to the expansion of the global sun care products market is the availability of fake products. Serious skin issues can be brought on by subpar fake BPC products. Because these products are less expensive than those from major suppliers, price-conscious consumers are drawn to them. Additionally, a lot of people purchase these counterfeit goods because it is challenging to distinguish between them and genuine goods due to the fact that counterfeit goods are imitations of original products, which has an impact on the market penetration and profit margins of important vendors.

Petrochemicals, parabens, and other dangerous substances included in counterfeit sun care products damage consumers' skin as well as the reputation of the brand. During the projected period, it is anticipated that these factors will have a negative effect on the sun care products market's growth.

The Adult Sun Cream category held the largest share in the Sun Care Products market in 2025. Adults are using sun lotions more frequently as they become aware of their advantages, which extend beyond preventing sunburn and early ageing. They are aware that these creams are an integral element of their skincare regimen because they provide vital protection against skin cancer, discolouration, and inflammation.

For instance, the Skin Cancer Foundation states that applying SPF 15 sunscreen every day can lower the risk of squamous cell carcinoma (SCC) and melanoma. Adults' demand for complete skin protection and general well-being is reflected in its great popularity. As customers prioritise preventive skincare routines, the creams' adaptability in providing broad-spectrum protection to a variety of skin types and preferences contributes to their popularity.

In 2025, the Hypermarket & Supermarkets category dominated the Sun Care Products market. The large-scale retail establishments like supermarkets and hypermarkets, which serve as practical gathering places for customers searching for a range of sun protection options that fit various budgets and tastes, make sun care goods broadly accessible.

These channels are essential for encouraging consumer participation and product visibility in the market because of their extensive reach and marketing initiatives. Additionally, supermarkets and hypermarkets offer a variety of skincare products and sun care products for both men and women, frequently with skilled staff in the cosmetics and beauty sections to provide knowledgeable guidance. These stores are becoming more and more well-liked by customers looking for convenience and choice when making skin care purchases because of their extensive selection, rising demand for cosmetics, and constrained shelf space.

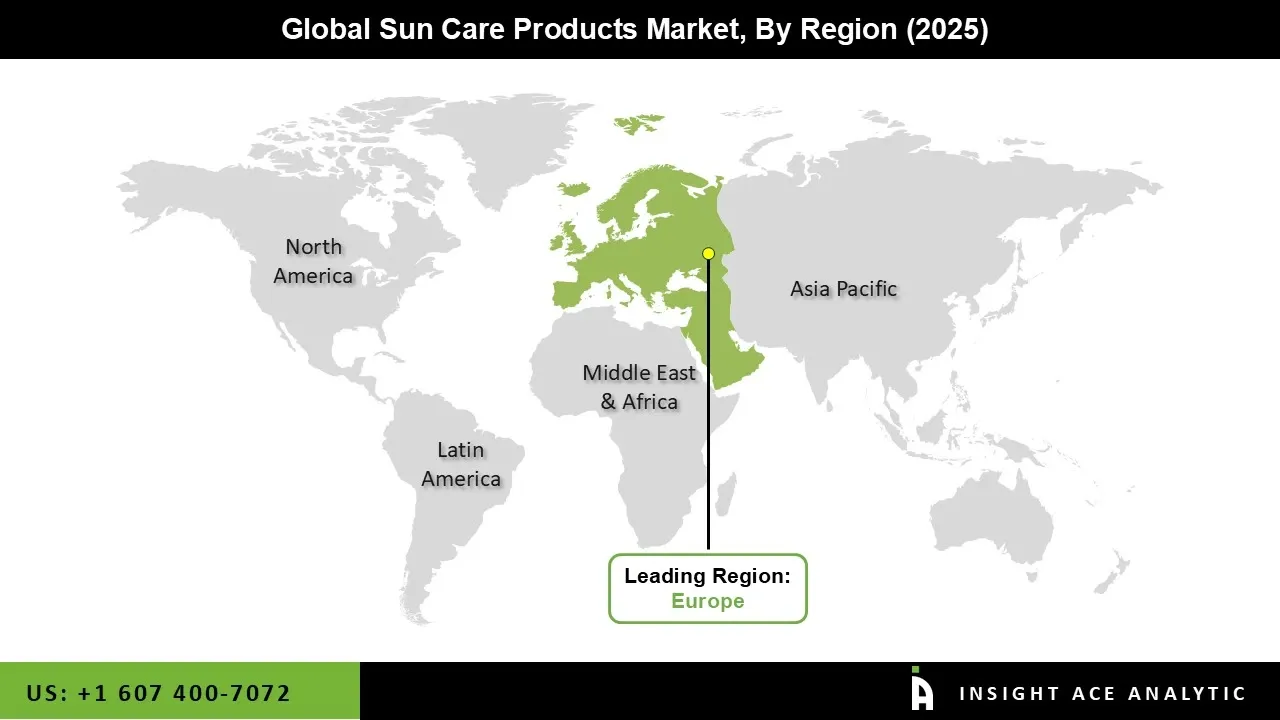

Europe dominated the sun care products market in 2025 due to its strong focus on skincare, high consumer awareness of UV risks, and widespread adoption of daily sun protection habits. The region possesses a developed market characterized by sophisticated distribution networks, cutting-edge research and development, and stringent EU regulations that guarantee product safety and efficacy, hence fostering robust customer trust.

Additionally, a culture of outdoor activities, beach tourism, and wellness trends drives demand for sunscreens and related items. European companies lead in developing eco-friendly, natural formulations and cutting-edge UV technologies to meet evolving preferences for sustainable and high-performance products.

• In March 2024, Beiersdorf AG launched the reformulated NIVEA Sun Protect & Moisture range with a new, more biodegradable filter system and 100% recycled plastic bottles across Europe. The launch is part of Beiersdorf's "Care Beyond Skin" sustainability agenda, focusing on reducing the environmental footprint of sun care while maintaining high SPF efficacy and skin compatibility.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 13.3 Bn |

| Revenue forecast in 2035 | USD 21.5 Bn |

| Growth Rate CAGR | CAGR of 5.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product Type, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | The Estee Lauder Companies Inc., Beiersdorf AG, Groupe Clarins, Unilever, Johnson & Johnson, L'oreal, Coty Inc., Shiseido Co. Ltd., Burt's Bees, and Bioderma Laboratories |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Sun Care Products Market by Product Type-

• Tanning

• Baby Sun Cream

• Adult Sun Cream

• After Sun

• Fake Tan/Self Tan

Sun Care Products Market by Distribution Channel-

• Hypermarket & Supermarkets

• Pharmacy & Drug Stores

• Online

• Specialty Stores

• Others

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.