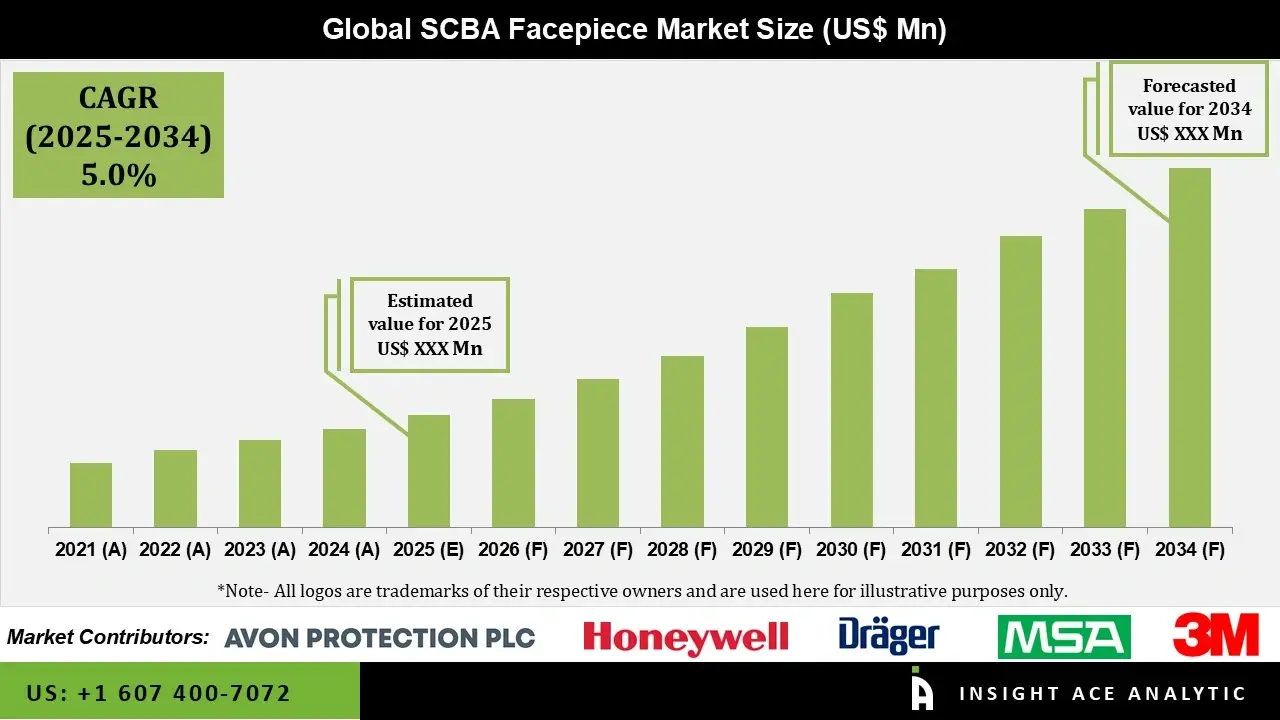

SCBA Facepiece Market expected to grow at a 5.0% CAGR during the forecast period for 2025-2034.

The SCBA (Self-Contained Breathing Apparatus) facepiece is an essential part of respiratory protective gear intended for usage in dangerous situations, including emergency response situations, industrial settings, or firefighting. It serves as the interface between the user and the breathing apparatus, guaranteeing a tight seal that filters out dangerous impurities and delivers clean, breathable air.

The facepiece usually has a clear visor for visibility, adjustable straps for a snug fit, and is constructed from sturdy, heat-resistant materials like rubber or silicone. Comfort, dependability, and compatibility with other PPE (Personal Protective Equipment), including helmets or communication equipment, are prioritized in its design.

The SCBA facepieces market is expanding significantly due to the rising need for respiratory protection in a number of industries. The growing awareness of occupational health and safety standards worldwide and an increase in safety laws boost the market growth. Additionally, the use of upgraded SCBA facepieces is being driven by technological breakthroughs such as improved comfort, durability, and fit designs. Furthermore, growing applications in the mining, industrial, chemical processing, and defense sectors support the SCBA facepiece market growth.

Moreover, the increased investments in safety equipment by governments and commercial organizations around the world also contribute to the industry's growth, and improving economic conditions in developing nations further encourage the SCBA facepiece market expansion.

In addition, the SCBA facepiece market is influenced by shifting labor demographics and growing acceptance of personal safety equipment in non-traditional sectors like electronics and pharmaceuticals. Furthermore, there is an urgent need for workers to have adequate respiratory protection due to growing industrialization, especially in the building, manufacturing, and chemical processing industries. This trend is further accelerated by investments in infrastructure development in emerging economies.

However, SCBA facepieces are costly to manufacture and acquire, particularly full-face variants with sophisticated features. Costs are increased by high-quality materials like silicone and polycarbonate, as well as safety certificates. This may restrict adoption among smaller emergency services or in cost-sensitive markets. Therefore, it is expected that this will restrict the SCBA facepiece market growth.

• 3M Company

• MSA Safety Incorporated

• Avon Protection plc

• Sundström Safety AB

• Honeywell International, Inc.

• Interspiro AB

• Shigematsu Works Co., Ltd.

• Drägerwerk AG & Co. KGaA

• Scott Safety

• Duram Mask

The SCBA facepiece market is expanding rapidly as a result of increasing occupational safety and regulatory requirements. More strict respiratory protection laws are being implemented by government agencies and authorities for workplace safety in a variety of industries, comprising construction, mining, chemicals, and firefighting. SCBA facepieces are essential for adhering to regulations like OSHA requirements and NFPA 1981, which promote worker safety in environments with dangerous gases or low oxygen levels.

The need for certified facepieces is growing quickly in both developed and developing markets as adherence becomes crucial. Additionally, industries like heavy manufacturing, oil and gas extraction, and firefighting that often expose workers to smoke, dangerous vapors, or cramped spaces are investing more in high-quality respiratory gear. This is anticipated to boost the adoption of SCBA facepieces.

Over the course of the projected period, the SCBA facepiece market expansion is expected to be constrained by high initial investment and continuing maintenance costs. Superior SCBA systems, especially those with advanced features, require a high upfront cost. The total cost is influenced by the purchase price as well as ongoing expenses for maintenance, fit evaluations, hygiene, and eventual replacement of obsolete parts.

These financial commitments may impede procurement or limit thorough implementation for smaller organizations, volunteer firefighting teams, or companies in undeveloped areas. Moreover, the SCBA facepiece market's growth is being constrained by the intricacy of usage and training requirements. SCBA facepieces require proper fit assessments, regular inspections, and user experience; they are not simple to use straight out of the box. Safety is at risk due to improper fitting or adjustment.

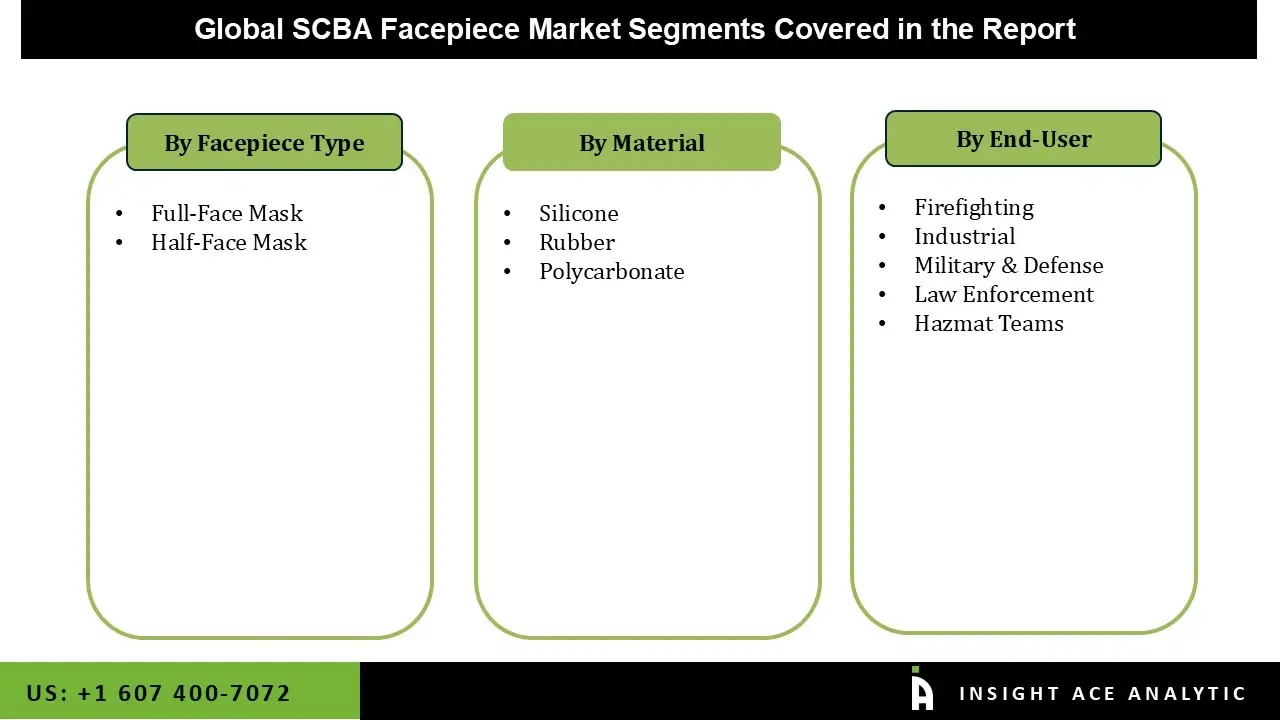

The full-face mask category held the largest share in the SCBA Facepiece market in 2024 because of its extensive use in industrial activities and firefighting, as well as its exceptional protection. Agencies and employers are being encouraged to switch from half-mask solutions to full-face units that integrate respiratory and eye protection into a single authorized device due to growing regulatory pressure and proposed emergency-response regulations. Additionally, full-face masks are the preferred option for firefighting, HAZMAT, and many industrial applications because they provide measurably better face seals and integrated eye protection, lowering contamination risk in chemical, confined-space, and hazardous materials scenarios.

In 2024, the firefighting category dominated the SCBA Facepiece market because of the growing focus on workplace and firefighter safety, which is driven by more stringent government laws and occupational health standards that require the use of improved respiratory protection in dangerous situations, particularly fire events. The development of fire service infrastructure and the increasing number of firemen worldwide, especially as regional urbanization and industrial growth pick up speed, are other important factors.

The need for better-equipped firefighting units—supported by contemporary SCBA facepieces that provide improved comfort, clear vision, and dependable performance in smoke-filled environments—increases in tandem with the growth of cities and the diversification of industrial operations.

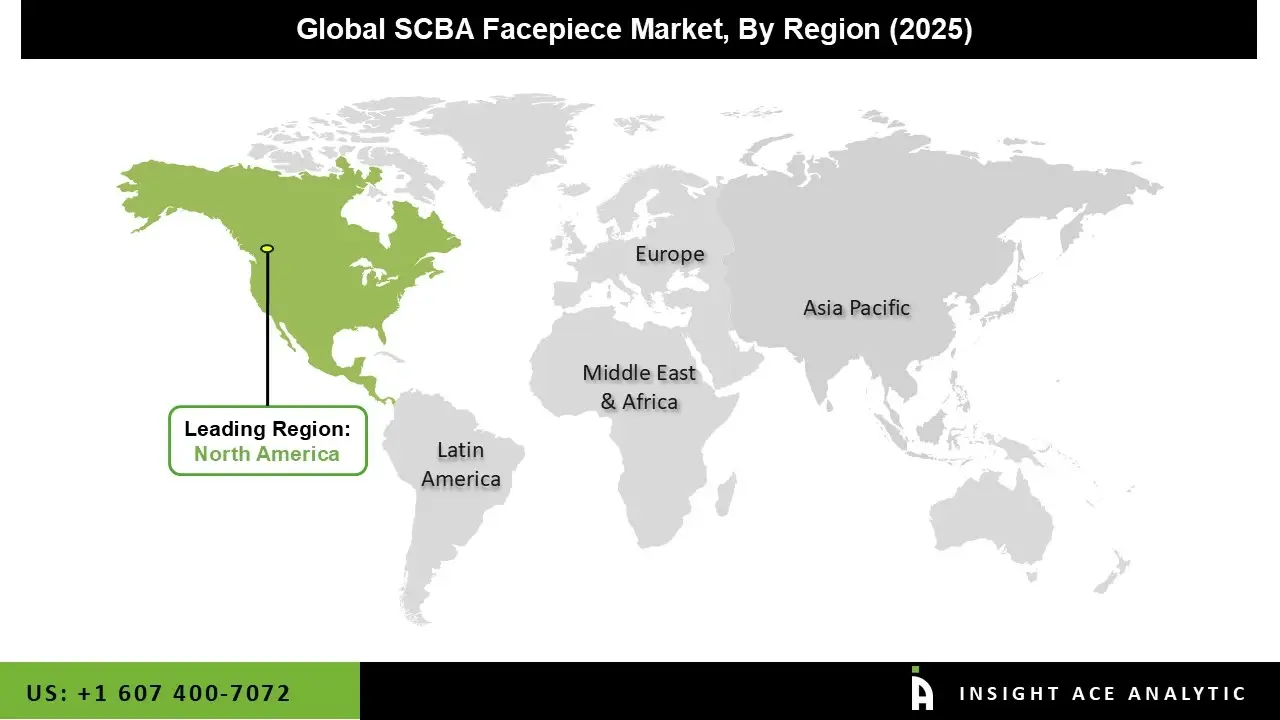

The SCBA Facepieces market was dominated by the North America region in 2024. The demand for SCBA facepieces for usage in hazardous work situations is rising as a result of this region's notable expansion in infrastructure development and construction. Additionally, this region is funding research and development projects to create a lighter, more sophisticated SCBA facepiece that provides wearer protection. This is anticipated to fuel the market's expansion in the area.

Furthermore, in the SCBA facepiece market, there are a number of well-established companies that are well-known in the area. These companies contribute to the market's expansion by providing a variety of SCBA products and having a robust distribution network. Moreover, the market for SCBA facepieces is rising as a result of the expansion of the firefighting sector in North America.

In March 2025, Honeywell International established a strategic alliance with Interspiro to jointly develop improved connectivity features and next-generation SCBA facepieces.

| Report Attribute | Specifications | |

| Growth Rate CAGR | CAGR of 5.0% from 2025 to 2034 | |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2024 to 2034 | |

| Historic Year | 2021 to 2024 | |

| Forecast Year | 2025-2034 | |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends | |

| Segments Covered | Material, Facepiece Type, End-use, and By Region | |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa | |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia | |

| Competitive Landscape | 3M Company, MSA Safety Incorporated, Avon Protection plc, Sundström Safety AB, Honeywell International, Inc., Interspiro AB, Shigematsu Works Co., Ltd., Drägerwerk AG & Co. KGaA, Scott Safety, and Duram Mask. | |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. | |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Silicone

• Rubber

• Polycarbonate (Lens)

• Full-Face Mask

• Half-Face Mask

• Industrial

• Firefighting

• Law Enforcement & Hazmat Teams

• Military & Defense

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.