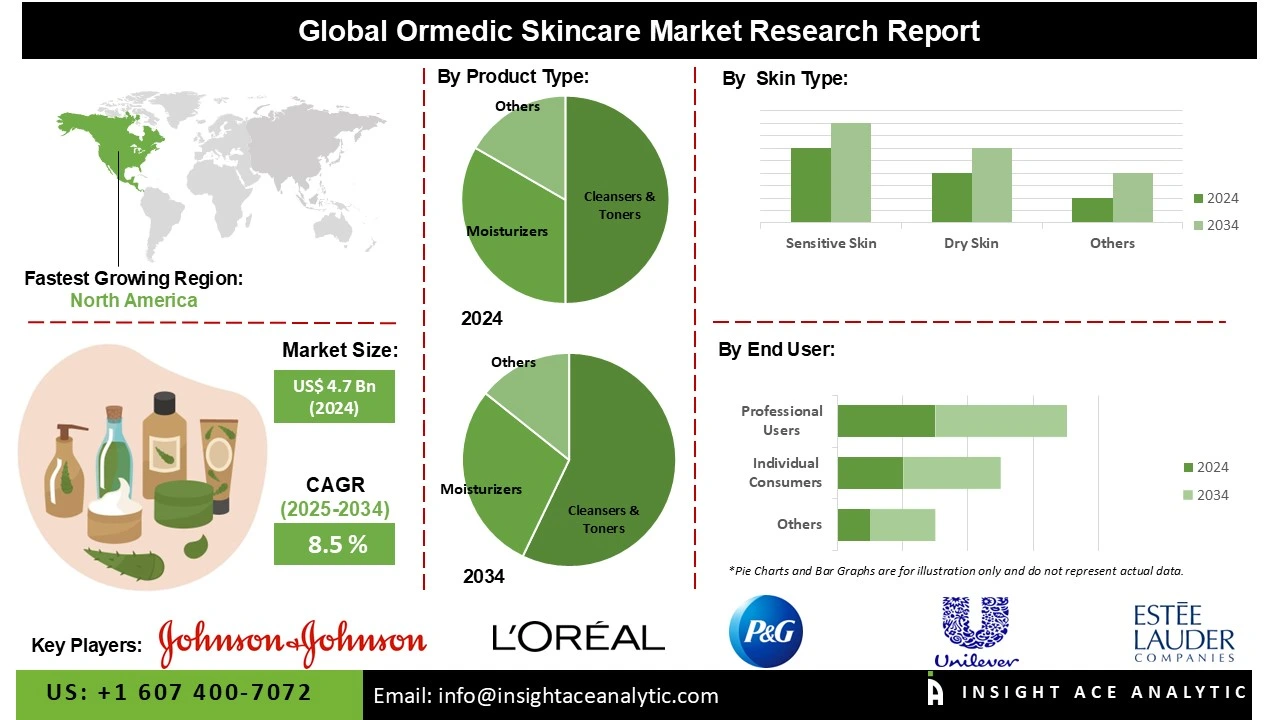

Global Ormedic Skincare Market Size is valued at US$ 4.7 Bn in 2024 and is predicted to reach US$ 10.3 Bn by the year 2034 at an 8.5% CAGR during the forecast period for 2025-2034.

Ormedic Skincare Market Size, Share & Trends Analysis Distribution by Product Type (Sunscreens, Cleansers & Toners, Acne Treatment Products, Moisturizers, Body Care, and Anti-ageing Products), Skin Type (Dry Skin, Sensitive Skin, Combination Skin, Oily and Acne-prone Skin, Ageing Skin, and Hyper-pigmented Skin), End User (Professional Users, Individual Consumers, and Commercial Buyers), Distribution Channel (Offline Retail, Online Retail, and Professional Channels), and Segment Forecasts, 2025-2034.

“Ormedic” skincare describes a type of formulation that brings together organic ingredients and clinically influenced skincare science. The idea behind this approach is to strike a balance between plant-based components and actives that have research or dermatological support, with the aim of helping the skin maintain or return to a healthy, stable state. These products tend to rely on gentle, non-irritating ingredients and usually prioritise barrier support and overall skin well-being rather than dramatic, fast-acting results.

They are often linked with clean-beauty values, including reduced use of synthetic additives and a stronger focus on safety, effectiveness and environmental responsibility. As a concept, Ormedic skincare mirrors broader movements in the industry that favour formulations combining natural elements with evidence-based science.

Recent trends within this segment show a clear emphasis on barrier repair, microbiome support and the use of milder, cleaner ingredients that merge botanical extracts with proven actives. There is also growing interest in biotechnology, such as lab-engineered peptides and fermented ingredients, which offer consistency, sustainability and high purity. At the same time, many brands are moving toward eco-friendly packaging, waterless or low-waste formats and simplified “skinimalist” routines centred around multifunctional products. Adaptogenic plants, Ayurvedic herbs and more holistic wellness-driven ideas are also shaping new formulations. Current product releases reflect these developments, with an increasing number of microbiome-supportive creams, barrier-focused moisturisers and biotech-enhanced serums aimed at calming, strengthening and balancing the skin while remaining aligned with clean-beauty principles.

The increasing global consumer awareness of eco-friendly skincare products and effective dermatological treatments is driving the rapid growth of the ormedic skincare industry. Another major factor is the growing knowledge of the advantages of natural and organic products. The demand for skincare products devoid of harsh chemicals, parabens, sulfates, and artificial perfumes is rising. Additionally, the expansion of e-commerce and online retail platforms has increased the market reach of Ormedic Skincare brands. Since these products are now easily accessible to consumers, market growth has increased even more. Furthermore, innovative formulations that blend nature and contemporary technology are being developed by skincare manufacturers. As a result, a variety of skin care solutions have emerged to address issues such as acne, anti-aging, hyperpigmentation, and skin irritation.

Some of the Key Players in Ormedic Skincare Market:

· Estée Lauder CompaniWes

· L’Oréal Group

· Johnson & Johnson

· Beiersdorf AG

· Murad

· Procter & Gamble (P&G)

· Shiseido Co., Ltd.

· Amorepacific Corporation

· Unilever

· Coty Inc.

· Kiehl’s

· Paula’s Choice

· Neutrogena

· Olay

· Dr. Dennis Gross Skincare

· Emerging List of Companies:

o Codex Labs

o Tata Harper

o Drunk Elephant

o True Botanicals

o Herbivore Botanicals

o Glow Recipe

o One Love Organics

o Henua Organics

o Dr. Hauschka

o MÁDARA Cosmetics

o OSEA Malibu

o Cocokind

o Dr. Alkaitis

o Weleda

o Earth Harbor

o Melvita

o Others

The ormedic skincare market is segmented by product type, skin type, end user, and distribution channel. By product type, the market is segmented into sunscreens, cleansers & toners, acne treatment products, moisturizers, body care, and anti-ageing products. By skin type, the market is segmented into dry skin, sensitive skin, combination skin, oily and acne-prone skin, ageing skin, and hyper-pigmented skin. By end user, the market is segmented into professional users, individual consumers, and commercial buyers. By distribution channel, the market is segmented into offline retail, online retail, and professional channels.

The cleansers & toners category dominated the market for ormedic skincare in 2024. The use of cleansers and toners in daily skin care is common because they remove makeup and prepare the skin for other products. Natural, gentle products without SLS that contain calming ingredients like chamomile or aloe vera are becoming more and more popular, especially among those with acne or sensitive skin.

The sensitive skin category dominated the market for ormedic skincare in 2024. Customers are specifically looking for gentle, hypoallergenic solutions with organic ingredients like calendula, chamomile, and aloe vera that will soothe sensitive skin. This has consequently promoted the use of mild cleansers, toners, and moisturizers that are suitable for this skin type.

North America was the market leader for ormedic skincare in 2024. Because of its wealthy and knowledgeable customer base, it remains the largest market for Ormedic skincare products. A new generation of organic, chemical-free, and medical-grade cosmetics has emerged in response to the growing need for sustainable beauty and dermatological needs. Additionally, laws governing the safety of the items used as well as other marketing claims have propelled the market's growth in this sector.

Over the course of the projection period, the Asia Pacific ormedic skincare market is expected to develop at the fastest rate. With nations like South Korea, Japan, and China setting trends and being acknowledged as global pioneers in beauty advancements, this area occupies a unique position in the ormedic skincare market. Due to the strain this places on research and development, certain new hybrid formulations like fermented organic formulations with dermatological actives are adopted quickly. Another factor driving customer demand for biodegradable packaging or products verified to have not undergone animal testing is sustainability.

Ormedic Skincare Market by Product Type-

· Sunscreens

· Cleansers & Toners

· Acne Treatment Products

· Moisturizers

· Body Care

· Anti-ageing Products

Ormedic Skincare Market by Skin Type -

· Dry Skin

· Sensitive Skin

· Combination Skin

· Oily and Acne-prone Skin

· Ageing Skin

· Hyper-pigmented Skin

Ormedic Skincare Market by End User-

· Professional Users

· Individual Consumers

· Commercial Buyers

Ormedic Skincare Market by Distribution Channel-

· Offline Retail

· Online Retail

· Professional Channels

Ormedic Skincare Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.